PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851507

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851507

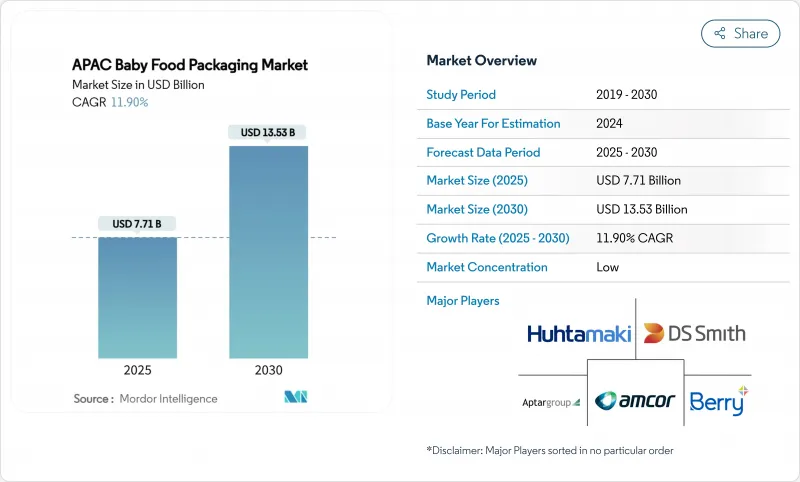

APAC Baby Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The APAC Baby Food Packaging Market size is estimated at USD 7.71 billion in 2025, and is expected to reach USD 13.53 billion by 2030, at a CAGR of 11.90% during the forecast period (2025-2030).

This expansion reflects the region's demographic momentum, strong urbanization and the growing preference for premium infant nutrition. Rising birth registrations during China's Year of the Dragon lifted super-premium infant formula sales by 44.3%, while H&H Group captured 15.6% share of that price tier. Material innovation is another growth catalyst. Plastic retained 46.7% revenue share in 2024, yet bioplastics are climbing fastest at 18.4% CAGR, supported by NatureWorks' USD 600 million Ingeo PLA complex in Thailand scheduled for 2025. Convenience-led pouches already hold 33% share and are growing at 15.9% CAGR, reshaping packaging line investments and retail shelf layouts. Geographic concentration remains evident as China commands 35% share, while India is registering the quickest 14% CAGR through 2030. E-commerce sales of baby food packaging accelerate at 19.4% CAGR, forcing a pivot toward shipping-robust, lighter formats that minimize breakage and dimensional weight.

APAC Baby Food Packaging Market Trends and Insights

Growing demand for packaged baby food and infant formula

China's infant formula segment stayed resilient in 2024 as foreign brands logged 8% sales growth, with the super-premium tier securing 37% share. Parents in urban APAC favor products that guarantee safety, extended shelf life and superior nutrition, prompting demand for multi-layer barrier films and premium finishes. Generational wealth transfer brings millennial purchasing power that privileges convenience and perceived quality over homemade alternatives. Urban-rural divides remain, yet metropolitan centers have become high-density demand clusters.

Rising dual-income urban households

Households with two earners value packaging that supports hectic routines. Spouted pouches enable on-the-go feeding, easy resealability and reduced mess, aligning with parental expectations. Affluence in South Korea and Singapore accelerates adoption of premium, portion-controlled packs, while Vietnam and Indonesia are beginning to mirror the trend as female labor participation rises. Brands are therefore prioritizing ergonomic shapes, soft-touch laminates and quick-open closures suitable for one-hand use.

Stringent bans on single-use plastics

India mandates 30% recycled content by 2025 in many rigid categories, forcing accelerated R&D and qualification cycles. Producers face added costs for certified PCR resin and tighter specifications on migration and odor. Parallel measures in Singapore and Indonesia add complexity for multinational supply chains that must juggle differing compliance deadlines.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of organised retail and e-commerce

- Brand-led shift toward convenience pouch formats

- Volatility in food-grade resin pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic dominated the APAC baby food packaging market in 2024 with 46.7% revenue share. Bioplastics, however, are charting an 18.4% CAGR to 2030, supported by Thailand's pro-investment regime and multinational brand pledges on carbon neutrality. The APAC baby food packaging market size for bioplastics is expected to grow the fastest as capacity from NatureWorks and SKC reduces cost differentials with petro-based polymers. Government subsidies in Thailand and Vietnam lower capital thresholds, while improved processability allows bio-based PLA and PBAT films to match heat resistance and sealing integrity of conventional flexibles.

Price sensitivity still limits uptake in several emerging economies, yet premium and organic baby food brands are using compostable packs as a brand story. Glass maintains relevance in luxury gifting, yet its weight and fragility reduce competitiveness in e-commerce. Metal can demand is retreating in favor of lighter barrier laminates. Paperboard, often coupled with bio-barrier coatings, retains a niche for premium secondary packs.

Pouches held 33% share of the APAC baby food packaging market in 2024. They are forecast to expand at 15.9% CAGR, propelled by spouted designs that support independent toddler feeding. The APAC baby food packaging market size for pouches is therefore widening more quickly than rigid formats. Bottles stay important for ready-to-drink formula, but SIG and Tetra systems now compete with mono-material flexibles that claim lower carbon footprints. Metal cans are losing shelf appeal due to weight penalties and are being displaced in club stores by stand-up pouches with fitments that offer similar barrier levels.

Manufacturers appreciate the logistics benefits of pouches, which reduce inbound freight volumes and warehouse space. Retailers gain faced-up shelf density and improved sell-through as consumers embrace the lighter format. Sachets remain a cost-effective option in Indonesia and the Philippines, where single-use affordability trumps sustainability concerns. Jars persist for premium organic purees but are trending toward lightweight PET rather than glass.

APAC Baby Food Packaging Market Report is Segmented by Material (Plastic, Paperboard, Metal, Glass, Bioplastics), Package Type (Bottles, Metal Cans, Cartons, and More), Product (Dried Baby Food, Liquid Milk Formula, Powder Milk Formula and More), Age Group (0-6 Months, 6-12 Months, 1-2 Years, 2-3 Years), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores and More), and Geography.

List of Companies Covered in this Report:

- Amcor PLC

- Huhtamaki Oyj

- Berry Global Inc.

- Aptar Group Inc.

- Winpak Ltd.

- Tetra Laval

- Constantia Flexibles

- Uflex Ltd.

- DS Smith Plc

- Ball Corporation

- Mondi Group

- SIG Combibloc

- Sealed Air Corp.

- Toyo Seikan Group

- Sonoco Products Co.

- Gualapack SpA

- ProAmpac LLC

- Takigawa Corporation

- Visy Industries

- Nihon Yamamura Glass Co.

- Shenzhen Beauty Star Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for packaged baby food and infant formula

- 4.2.2 Rising dual-income urban households

- 4.2.3 Expansion of organised retail and e-commerce

- 4.2.4 Brand-led shift toward convenience pouch formats

- 4.2.5 Government subsidies for bio-based packaging lines

- 4.2.6 OEM investment in in-house flexible converting capacity

- 4.3 Market Restraints

- 4.3.1 Stringent bans on single-use plastics

- 4.3.2 Volatility in food-grade resin pricing

- 4.3.3 Cultural preference for home-cooked baby food

- 4.3.4 Recycling-infrastructure gaps across emerging SE-Asian economies

- 4.4 Sustainability Trends

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.1.5 Bioplastics

- 5.2 By Package Type

- 5.2.1 Bottles

- 5.2.2 Metal Cans

- 5.2.3 Cartons

- 5.2.4 Jars

- 5.2.5 Others

- 5.3 By Product

- 5.3.1 Dried Baby Food

- 5.3.2 Liquid Milk Formula

- 5.3.3 Powder Milk Formula

- 5.3.4 Snacks and Finger Foods

- 5.3.5 Others

- 5.4 By Age Group

- 5.4.1 0-6 Months

- 5.4.2 6-12 Months

- 5.4.3 1-2 Years

- 5.4.4 2-3 Years

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets / Hypermarkets

- 5.5.2 Convenience Stores

- 5.5.3 Pharmacies and Drugstores

- 5.5.4 Online Retail

- 5.5.5 Others

- 5.6 By Country

- 5.6.1 China

- 5.6.2 India

- 5.6.3 Japan

- 5.6.4 South Korea

- 5.6.5 Indonesia

- 5.6.6 Thailand

- 5.6.7 Malaysia

- 5.6.8 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 Huhtamaki Oyj

- 6.4.3 Berry Global Inc.

- 6.4.4 Aptar Group Inc.

- 6.4.5 Winpak Ltd.

- 6.4.6 Tetra Laval

- 6.4.7 Constantia Flexibles

- 6.4.8 Uflex Ltd.

- 6.4.9 DS Smith Plc

- 6.4.10 Ball Corporation

- 6.4.11 Mondi Group

- 6.4.12 SIG Combibloc

- 6.4.13 Sealed Air Corp.

- 6.4.14 Toyo Seikan Group

- 6.4.15 Sonoco Products Co.

- 6.4.16 Gualapack SpA

- 6.4.17 ProAmpac LLC

- 6.4.18 Takigawa Corporation

- 6.4.19 Visy Industries

- 6.4.20 Nihon Yamamura Glass Co.

- 6.4.21 Shenzhen Beauty Star Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment