PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851512

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851512

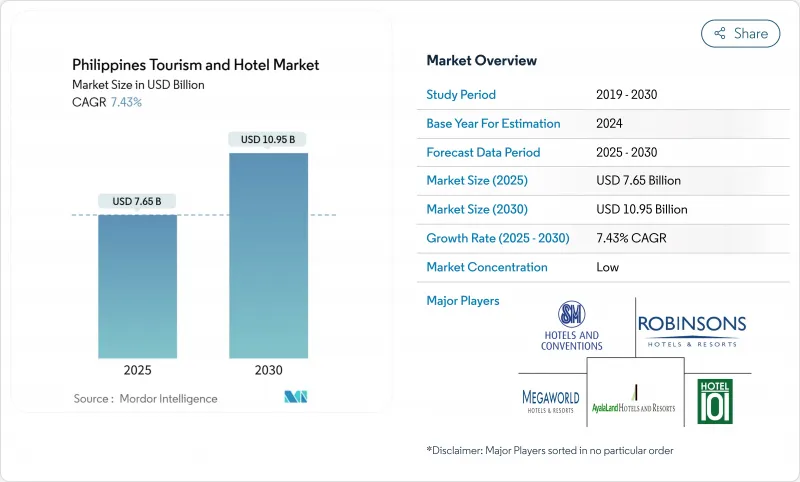

Philippines Hospitality - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Philippines hospitality market size is USD 7.65 billion in 2025 and is forecast to reach USD 10.95 billion by 2030, advancing at a 7.43% CAGR.

Consistent government investment in airports, roads, and tourism promotion drives the upward trajectory, while tax-back incentives and simplified visa rules broaden the visitor base. Diversified accommodation pipelines, a pronounced shift toward digitally enabled direct bookings, and the growing appeal of secondary destinations reinforce the sector's resilience. Demand from the Meetings, Incentives, Conventions, and Exhibitions (MICE) segment accelerates, and domestic "holiday-economics" policies create an all-season travel pattern that reduces cyclicality across the Philippines hospitality market. Rising sustainability standards and asset-light development strategies further influence competitive positioning within the Philippines hospitality market, opening niches for brands that combine technology adoption with strong local partnerships. The market's momentum builds on the Department of Tourism's achievement of employing 6.21 million Filipinos in 2023, representing the highest tourism industry share to GDP in 24 years.

Philippines Hospitality Market Trends and Insights

Government Tourism Campaigns and Infrastructure Investments

The USD 1.7 billion airport modernization program upgraded 22 airports in 2024 and earmarked PHP 7.7 billion for an additional 15 facilities in 2025, improving regional accessibility and dispersing visitor flows. The National Tourism Development Plan 2023-2028 targets 456,000 hotel rooms by 2028 and forecasts 11.5 million international arrivals, necessitating 120,463 additional rooms to keep pace with the Philippines' hospitality market. Mega-projects such as the PHP 735.6 billion New Manila International Airport will host up to 200 million passengers annually, underpinning long-run growth for the Philippines' hospitality market.

Expanded International Air Connectivity

New direct links from Clark, Cebu, and Kalibo shorten travel times and diversify entry points. Clark International Airport alone plans 13 new domestic and international routes to serve 4 million passengers in 2024, boosting hotel occupancy outside Metro Manila. Upgrades to Ninoy Aquino International Airport's air-traffic-management system also unlock previously capped capacity, encouraging carriers to mount more flights into the Philippines hospitality market.

High Vulnerability to Natural Disasters

Situated in the Pacific Ring of Fire, the country regularly endures typhoons and earthquakes, prompting hotels to allocate larger safety budgets and raise insurance premiums. Boracay's closure and rehabilitation showed how environmental pressures can disrupt operations but also spur sustainable redesigns, creating both risks and learning curves for the Philippines hospitality market.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Domestic Travel Demand

- Surge in MICE and Business Travel

- Insufficient Infrastructure in Secondary Destinations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hotels retained a 48.21% share of the Philippines hospitality market in 2024. Serviced apartments and condotels, benefiting from longer-stay demand, are forecast to grow at 9.62% CAGR, outpacing overall expansion. The Philippines hospitality market size for extended-stay lodging is projected to climb alongside the Digital Nomad Visa rollout. DoubleDragon's Hotel101 condotel platform, which surpassed 1 million app users, illustrates how asset-light models can secure rapid nationwide footprints. At the same time, resorts strengthen domestic positioning by integrating eco-tourism elements in Palawan and Mindanao parks.

Local and international brands share the 158-property pipeline worth PHP 250 billion, signaling a balanced competitive mix. Budget lodges and hostels ride on affordable domestic "staycations," while high-end island resorts compete on exclusive experiences and sustainability credentials. This diversified supply makes the Philippines' hospitality market agile and responsive to a wide spectrum of traveler profiles.

Leisure retained 72.31% of 2024 revenue, but MICE bookings are advancing at 9.97% CAGR and represent the fastest-moving demand pool within the Philippines hospitality market. Convention-center build-outs in Clark, Davao, and Cebu nurture geographic spread, allowing the country to vie with Singapore and Bangkok for regional congresses. As a result, the Philippines hospitality market size tied to business travel is set for pronounced gains.

VFR travel remains a stabilizing pillar, buoyed by enhanced air links for the Filipino diaspora. Government gastronomy roadmaps and heritage festivals continue to enrich leisure itineraries. These combined streams create a balanced demand mix that cushions operators from single-segment shocks and underpins average daily rate (ADR) growth across the Philippines hospitality market.

Philippines Hospitality Market is Segmented by Accommodation Type (Hotels, Resorts, Serviced Apartments and Condotels, Hostels and Budget Lodges), by Purpose of Visit (Leisure and Holiday, Business and MICE, and VFR), by Tourist Type (Domestic, International), and Booking Channel (Online Travel Agencies, Direct, Offline Travel Agencies), by Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- SM Hotels and Conventions Corp.

- Robinsons Hotels & Resorts

- AyalaLand Hotels & Resorts Corp.

- Megaworld Hotels & Resorts

- DoubleDragon (HOTEL 101)

- Travellers Intl Hotel Group (Newport World)

- Okada Manila

- City of Dreams Manila

- Jpark Island Resort & Waterpark

- Shangri-La Hotels & Resorts (PH)

- Marriott International (PH)

- Hilton Worldwide (PH)

- IHG Hotels & Resorts (PH)

- Accor Hotels (PH)

- Red Planet Hotels (PH)

- The Ascott Ltd (PH)

- Filinvest Hospitality

- Discovery Hospitality Corp.

- Cebu Landmasters Hospitality

- Berjaya Hotels (PH)*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government tourism campaigns and infrastructure investments

- 4.2.2 Expanded international air connectivity

- 4.2.3 Growth in domestic travel demand

- 4.2.4 Surge in MICE and business travel

- 4.2.5 Rising interest in eco- and adventure tourism

- 4.2.6 Visa facilitation and tax-refund programs

- 4.3 Market Restraints

- 4.3.1 High vulnerability to natural disasters

- 4.3.2 Insufficient infrastructure in secondary destinations

- 4.3.3 Skilled labor shortages in hospitality

- 4.3.4 Overcrowding and environmental degradation at hotspots

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Accommodation Type

- 5.1.1 Hotels

- 5.1.2 Resorts

- 5.1.3 Serviced Apartments and Condotels

- 5.1.4 Hostels and Budget Lodges

- 5.2 By Purpose of Visit

- 5.2.1 Leisure and Holiday

- 5.2.2 Business and MICE

- 5.2.3 VFR (Visiting Friends and Relatives)

- 5.3 By Tourist Type

- 5.3.1 Domestic

- 5.3.2 International

- 5.4 By Booking Channel

- 5.4.1 Online Travel Agencies (OTAs)

- 5.4.2 Direct (Brand.com / Call / Walk-in)

- 5.4.3 Offline Travel Agencies

- 5.5 By Region (Philippines)

- 5.5.1 National Capital Region (NCR)

- 5.5.2 Luzon (ex-NCR)

- 5.5.3 Visayas

- 5.5.4 Mindanao

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SM Hotels and Conventions Corp.

- 6.4.2 Robinsons Hotels & Resorts

- 6.4.3 AyalaLand Hotels & Resorts Corp.

- 6.4.4 Megaworld Hotels & Resorts

- 6.4.5 DoubleDragon (HOTEL 101)

- 6.4.6 Travellers Intl Hotel Group (Newport World)

- 6.4.7 Okada Manila

- 6.4.8 City of Dreams Manila

- 6.4.9 Jpark Island Resort & Waterpark

- 6.4.10 Shangri-La Hotels & Resorts (PH)

- 6.4.11 Marriott International (PH)

- 6.4.12 Hilton Worldwide (PH)

- 6.4.13 IHG Hotels & Resorts (PH)

- 6.4.14 Accor Hotels (PH)

- 6.4.15 Red Planet Hotels (PH)

- 6.4.16 The Ascott Ltd (PH)

- 6.4.17 Filinvest Hospitality

- 6.4.18 Discovery Hospitality Corp.

- 6.4.19 Cebu Landmasters Hospitality

- 6.4.20 Berjaya Hotels (PH)*

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment