PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851514

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851514

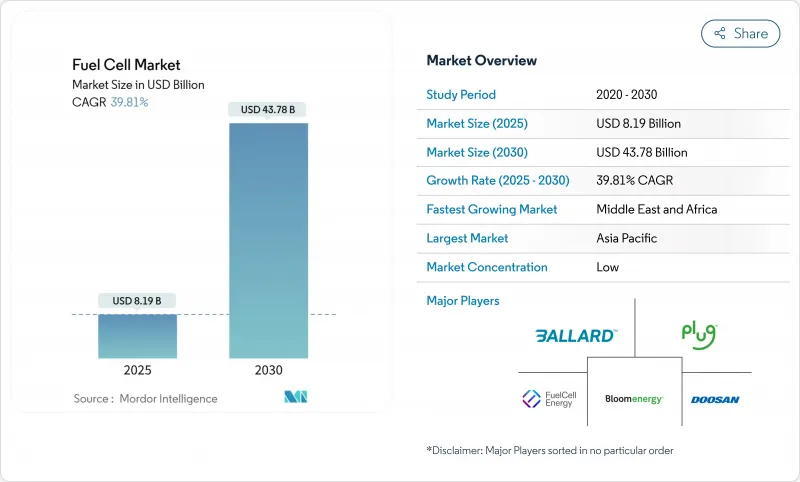

Fuel Cell - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Fuel Cell Market size is estimated at USD 8.19 billion in 2025, and is expected to reach USD 43.78 billion by 2030, at a CAGR of 39.81% during the forecast period (2025-2030).

Expansion is rooted in surging demand from transportation, data centers, and utility-scale applications, each benefiting from cleaner-energy policy mandates. Falling costs of green and blue hydrogen, rapid roll-outs of hydrogen refueling corridors in Asia-Pacific, and accelerating investment from heavy-duty truck makers together widen commercial pathways. Innovation momentum is shifting toward solid oxide fuel cells that serve stationary loads, while polymer electrolyte membrane fuel cells continue to dominate cars, buses, and forklifts. Growing interest from maritime operators and utilities further broadens the addressable base of the fuel cell market, even as supply-chain risks around platinum group metals and hydrogen infrastructure gaps temper near-term growth.

Global Fuel Cell Market Trends and Insights

Falling Costs of Green & Blue Hydrogen Generation

Green hydrogen production costs are set to decline by up to 60% by 2030 as electrolyzer manufacturing scales and renewable power prices fall.Policy incentives such as the U.S. Clean Hydrogen Production Tax Credit of up to USD 3.00/kg and the EU Renewable Energy Directive's 42% renewable-hydrogen quota for industry underpin investment pipelines. A seven-fold jump in projects reaching final investment decision between 2020 and 2024 reflects deepening capital flows. As hydrogen fuel typically represents nearly half of a fuel cell's total cost of ownership, cheaper molecules directly widen adoption. Developers in the fuel cell market anticipate that sub-USD 2/kg hydrogen will trigger parity with diesel in long-haul fleets.

Automaker Commitments to FCEVs in Asia-Pacific

Toyota, Hyundai, and Honda have collectively pledged multi-billion-dollar roadmaps for hydrogen mobility, including supply contracts for 45,000 FCEVs over the next two years. China targets 1 million fuel-cell vehicles and 2,000 stations by 2035, while South Korea links hydrogen trucks to its national smart-grid plan. Automakers' aligned production schedules, joint ventures with energy firms, and station co-investment compress scale-up timelines. Their demand signals cascade along the fuel cell market through stack suppliers, compressor makers, and refueling integrators.

Scarcity of Hydrogen Refueling Infrastructure Outside JP & KR

Network density remains insufficient outside the mature corridors of Japan and South Korea. Germany leads Europe with about 170 public hydrogen stations, yet coverage still trails the needs of regional trucking routes. In the U.S., only California offers a cohesive buildout plan, and pump prices of USD 12-15/kg deter fleet wide roll-outs. Infrastructure delays slow fleet conversion, stretching payback periods for early adopters and reducing overall volumes in the fuel cell market.

Other drivers and restraints analyzed in the detailed report include:

- Government Zero-Emission Mandates in Heavy-Duty Transport (NA & EU)

- Demand for Long-Duration Backup Power in Data Centers

- PGM & Nickel Price Volatility Inflating Stack Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The vehicular segment generated 80.9% of global revenue in 2024, confirming its central role within the fuel cell market. Commercial trucks, city buses, and light-duty cars rely on PEMFC architecture that delivers fast refueling and long range. Recent wholesale of 235 hydrogen trucks, coupled with bulk orders for European fuel-cell buses, signals maturing demand curves. The total cost gap versus diesel narrows as hydrogen prices fall and maintenance savings accrue.

Stationary deployments for data centers, telecom towers, and hospitals capture the remaining 19.1% share, yet post sharp growth. Hyperscale operators trial multi-megawatt installations that displace diesel gensets. These early wins suggest that the fuel cell market will balance more evenly between mobile and stationary uses after 2030 as uptime and emission credentials prove out.

PEMFC retained a 70.4% share in 2024, underpinned by passenger cars and material-handling fleets. Its low operating temperature suits frequent starts and stops, which lifts utilization rates in urban duty cycles. Stack lifetime improvements and membrane recycling programs further cement PEMFC economics.

SOFC, however, is the fastest climber with a forecast 51.1% CAGR to 2030. Electrical efficiencies near 60% and flexible fuel inputs empower utilities and data-center customers to run on pipeline gas today and hydrogen tomorrow. Bloom Energy's multi-megawatt orders underscore this inflection. As a result, the fuel cell market size for SOFC systems is expected to pass USD 20 billion by 2035, reflecting a mix of base-load replacements and microgrid applications. Alkaline, phosphoric acid, and molten carbonate fuel cells address specific industrial niches, completing the technology spectrum.

The Fuel Cell Market Report is Segmented by Application (Vehicular and Non-Vehicular), Technology (Polymer Electrolyte Membrane Fuel Cell, Solid Oxide Fuel Cell, Alkaline Fuel Cell, and Others), Fuel Type (Hydrogen, Natural Gas, Ammonia, and Others), End-User Industry (Transportation, Utilities, Commercial and Industrial, and Others), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific held a 57.8% share of the fuel cell market in 2024. Japan's strategic roadmap subsidizes fuel-cell cars and residential micro-CHP units, while South Korea bundles hydrogen with smart-city initiatives. China's target of 1 million FCEVs and 2,000 stations by 2035 signals a scale unmatched elsewhere. Local governments fund electrolyzers and provide toll exemptions that cut fleet operating costs. Established automotive groups embed fuel cells across trucks, SUVs, and forklifts, locking in component demand for regional suppliers.

North America ranked second, propelled by policy tailwinds in the United States. The Clean Hydrogen Production Tax Credit and seven Regional Hydrogen Hubs mobilize billions toward electrolysis, storage, and downstream projects. California's Advanced Clean Trucks rule anchors early demand in medium- and heavy-duty fleets, while Canadian provinces support hydrogen buses. Data-center operators in Texas, Illinois, and Virginia are contracting multi-megawatt SOFC plants to bolster grid reliability, adding depth to the regional fuel cell market.

Europe leverages its Fit-for-55 climate package to stimulate fuel-cell adoption in trucks, rail, and maritime. Updated CO2 standards require a 90% cut in heavy-duty vehicle emissions by 2040, making hydrogen propulsion a credible path. Germany's 170-plus public stations lead continental coverage. The European Hydrogen Bank and Innovation Fund align bidders with grant finance, derisking scale-up for electrolyzer and stack plants. Cross-border pipeline upgrades from Spain to France pave the infrastructure for future green-hydrogen flows.

The Middle East & Africa offers the fastest growth outlook at a forecast 41.2% CAGR. Ample solar and wind resources enable competitive green-hydrogen export hubs. Egypt, the United Arab Emirates, and Saudi Arabia each map multi-gigawatt electrolyzer parks tied to ammonia production for shipping customers. Existing natural-gas pipelines and port infrastructure provide a ready platform for conversion to hydrogen blends. African economies eye local fuel-cell microgrids that stabilize weak grids and displace diesel gensets, signalling a fresh demand wave.

- Ballard Power Systems Inc.

- Plug Power Inc.

- FuelCell Energy Inc.

- Bloom Energy Corporation

- Doosan Fuel Cell Co., Ltd.

- Cummins Inc. (Hydrogenics)

- Toshiba Energy Systems & Solutions Corp.

- Panasonic Corporation

- Horizon Fuel Cell Technologies Pte. Ltd.

- Intelligent Energy Ltd.

- Nuvera Fuel Cells, LLC

- SFC Energy AG

- Mitsubishi Power Ltd.

- Hyundai Mobis Co., Ltd.

- Toyota Motor Corporation

- Nikola Corporation

- Ceres Power Holdings plc

- Ballard Motive Solutions Ltd.

- PowerCell Sweden AB

- AFC Energy plc

- Advent Technologies Holdings Inc.

- Gencell Ltd.

- Proton Motor Power Systems plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Recent Trends & Developments

- 4.3 Market Drivers

- 4.3.1 Falling Costs of Green & Blue Hydrogen Generation

- 4.3.2 Automaker Commitments to FCEVs in Asia-Pacific

- 4.3.3 Government Zero-Emission Mandates in Heavy-Duty Transport (NA & EU)

- 4.3.4 Demand for Long-Duration Backup Power in Data Centers

- 4.3.5 Maritime Decarbonization Targets Accelerating Fuel Cell Adoption

- 4.3.6 Corporate Net-Zero Investment into On-Site Distributed Generation

- 4.4 Market Restraints

- 4.4.1 Scarcity of Hydrogen Refueling Infrastructure Outside JP & KR

- 4.4.2 PGM & Nickel Price Volatility Inflating Stack Costs

- 4.4.3 SOFC Performance Degradation in Maritime High-Sulfur Environments

- 4.4.4 Certification Gaps in US Building Codes Slowing Stationary Installations

- 4.5 Supply-Chain Analysis

- 4.6 Regulatory Outlook

- 4.7 Technological Outlook

- 4.8 Porte's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products & Services

- 4.8.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Application

- 5.1.1 Vehicular (Passenger Cars, Buses & Coaches, Trucks, Material Handling Equipment, Rail, Marine Vessels)

- 5.1.2 Non-Vehicular (Stationary Power, Portable Power, Micro-Combined Heat & Power)

- 5.2 By Technology

- 5.2.1 Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2 Solid Oxide Fuel Cell (SOFC)

- 5.2.3 Alkaline Fuel Cell (AFC)

- 5.2.4 Others [Phosphoric Acid Fuel Cell (PAFC), Molten Carbonate Fuel Cell (MCFC), Direct Methanol Fuel Cell (DMFC)]

- 5.3 By Fuel Type

- 5.3.1 Hydrogen

- 5.3.2 Natural Gas/Methane

- 5.3.3 Ammonia

- 5.3.4 Others (Methanol, Biogas)

- 5.4 By End-User Industry

- 5.4.1 Transportation

- 5.4.2 Utilities

- 5.4.3 Commercial and Industrial

- 5.4.4 Others (Defense, Residential)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Nordic Countries

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Malaysia

- 5.5.3.6 Thailand

- 5.5.3.7 Indonesia

- 5.5.3.8 Vietnam

- 5.5.3.9 Australia

- 5.5.3.10 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Ballard Power Systems Inc.

- 6.4.2 Plug Power Inc.

- 6.4.3 FuelCell Energy Inc.

- 6.4.4 Bloom Energy Corporation

- 6.4.5 Doosan Fuel Cell Co., Ltd.

- 6.4.6 Cummins Inc. (Hydrogenics)

- 6.4.7 Toshiba Energy Systems & Solutions Corp.

- 6.4.8 Panasonic Corporation

- 6.4.9 Horizon Fuel Cell Technologies Pte. Ltd.

- 6.4.10 Intelligent Energy Ltd.

- 6.4.11 Nuvera Fuel Cells, LLC

- 6.4.12 SFC Energy AG

- 6.4.13 Mitsubishi Power Ltd.

- 6.4.14 Hyundai Mobis Co., Ltd.

- 6.4.15 Toyota Motor Corporation

- 6.4.16 Nikola Corporation

- 6.4.17 Ceres Power Holdings plc

- 6.4.18 Ballard Motive Solutions Ltd.

- 6.4.19 PowerCell Sweden AB

- 6.4.20 AFC Energy plc

- 6.4.21 Advent Technologies Holdings Inc.

- 6.4.22 Gencell Ltd.

- 6.4.23 Proton Motor Power Systems plc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment