PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851519

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851519

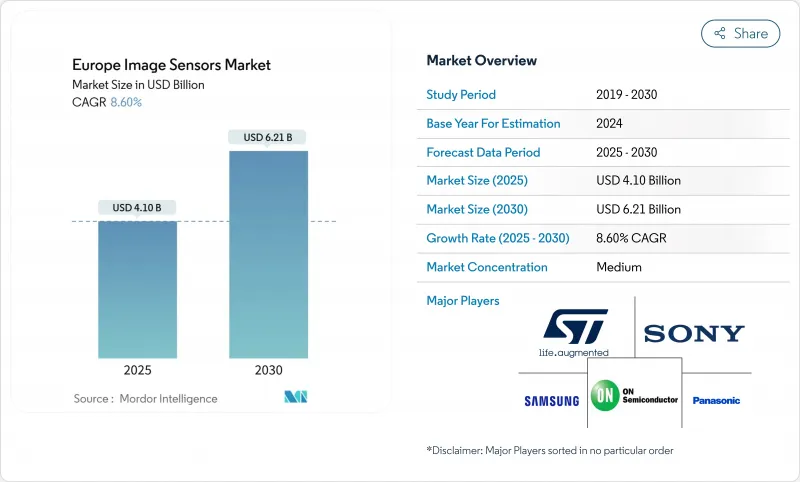

Europe Image Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe image sensors market stands at USD 4.1 billion in 2025 and is projected to reach USD 6.21 billion by 2030, reflecting an 8.66% CAGR.

Pent-up automotive safety demand, smart-phone camera innovation and EU semiconductor re-shoring policies combine to move value creation from consumer electronics toward high-reliability automotive and industrial niches. Wafer-level optics stacked CMOS imaging sensor (CIS) architectures and quantum-dot materials increase performance ceilings while keeping form factors slim. Regional players leverage proximity to automakers and industrial OEMs to validate functional-safety requirements faster than distant suppliers can. At the same time, export-control uncertainty around lithography tools and high European energy prices temper near-term capacity expansion, pushing firms to prioritize premium segments where technical leadership outweighs cost.

Europe Image Sensors Market Trends and Insights

Multi-camera smartphone race >200 MP

European brands escalate sensor resolution beyond 200 MP to counter Asian rivals. Pixel-binning improves low-light results without ballooning file sizes, while wafer-level optics keeps camera bumps in check. OmniVision's 0.56 µm pixels prove technical feasibility and highlight thermal-management trade-offs. Device makers now value European packaging specialists that co-design optics, DSP and AI pipelines in tight form factors. Adoption is set to widen from 2026 as algorithms mature and cost curves bend.

Euro NCAP AEB front-camera mandate

Euro NCAP's updated star-rating system makes forward-facing cameras compulsory for Automatic Emergency Braking across new models launched from 2026. The rule extends to cyclist and pedestrian detection, increasing sensor resolution and dynamic-range targets. OnSemi's Hyperlux family delivers 150 dB HDR tuned for glare-filled road scenes, lowering validation time for German and Italian OEMs. European tier-1 suppliers benefit from geographical proximity to test tracks and regulatory bodies, shortening loop times between prototype and series production.

High EU energy and clean-room utility costs

Electricity and ultra-pure water bills in Europe sit 30-50% above Asian averages. Carbon-neutrality pledges force fabs to pre-pay for renewable power contracts and HVAC upgrades. STMicroelectronics' roadmap to reach carbon neutrality by 2027 exemplifies the capital drag. Smaller foundries lacking volume to offset these overheads either exit or pivot to fab-lite models. Europe image sensors market players see near-term margin squeeze yet gain reputational leverage with ESG-focused buyers.

Other drivers and restraints analyzed in the detailed report include:

- Wafer-level optics and stacked CIS migration

- AI-enabled industrial machine-vision grants

- Limited 300 mm CIS-grade capacity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

CMOS sensors captured 86.30% of Europe image sensors market share in 2024 on the back of lower power draw and logic integration. Global-shutter variants, vital for motion-heavy automotive and robotics tasks, are pacing at 9.30% CAGR and will command a larger slice of the Europe image sensors market by 2030. Rolling-shutter CMOS stays relevant for price-sensitive phones and laptops, while CCD retreats into scientific niches where ultra-low noise still matters.

European firms exploit close ties with automakers to co-design ASIL-B qualified global-shutter parts, gaining early design-wins for Euro NCAP 2026 models. Wafer-level optics and deep-trench isolation raise quantum efficiency without inflating die size. Consequently, Europe image sensors market size for global-shutter devices is projected to climb steadily, lifting regional revenue resilience even if consumer cycles soften.

The 25-64 MP class led revenue with 28.44% share in 2024, balancing file-size economy and computational workload. However, >200 MP parts rise at 12.33% CAGR, fuelled by flagship phones that tout lossless digital zoom and 8K video crops. Europe image sensors market size for these ultra-resolution devices will expand fastest in 2025-2030 as pixel-binning algorithms mature.

Packaging advances that align wafer-level optics with sub-µm pixels curb lens aberration, letting European module makers enter premium handset SKUs. The Europe image sensors market observes OEMs procuring specialty glass and IR filters domestically to hedge against Asian supply shocks. Entry-level handsets still rely on <=8 MP chips, keeping a floor under high-volume rolling-shutter production.

The Europe Image Sensors Market is Segmented by Type (CMOS, CCD), Resolution (<= 8 MP, 9 - 24 MP and More), Spectrum (Visible (RGB), Near-Infrared (NIR) and More), Shutter Technology, End-User Industry (Consumer Electronics, Healthcare, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- STMicroelectronics

- Sony Corporation

- Samsung Electronics Co., Ltd

- On Semiconductor

- OmniVision Technologies

- BAE Systems

- Toshiba Electronic Devices and Storage

- Nikon Corp.

- Panasonic Corp.

- SK Hynix

- Canon Inc.

- AMS-Osram AG

- Teledyne FLIR

- Hamamatsu Photonics

- PixArt Imaging Inc.

- Tower Semiconductor

- Gpixel NV

- Himax Technologies

- GalaxyCore Inc.

- Teledyne e2v

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Multi-camera smartphone race beyond 200 MP

- 4.2.2 Euro NCAP front-camera mandate (AEB)

- 4.2.3 Wafer-level optics and stacked CIS migration

- 4.2.4 AI-enabled industrial machine-vision grants

- 4.2.5 Disposable chip-on-tip medical endoscopy

- 4.2.6 EU smart-city surveillance tenders

- 4.3 Market Restraints

- 4.3.1 High EU energy and clean-room utility costs

- 4.3.2 Limited 300 mm CIS-grade capacity

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 CMOS

- 5.1.2 CCD

- 5.2 By Resolution

- 5.2.1 8 MP

- 5.2.2 924 MP

- 5.2.3 2564 MP

- 5.2.4 65200 MP

- 5.2.5 > 200 MP

- 5.3 By Spectrum

- 5.3.1 Visible (RGB)

- 5.3.2 Near-Infrared (NIR)

- 5.3.3 Short-Wave IR (SWIR)

- 5.3.4 Ultraviolet (UV)

- 5.3.5 Thermal / LWIR

- 5.4 By Shutter Technology

- 5.4.1 Rolling-Shutter CMOS

- 5.4.2 Global-Shutter CMOS

- 5.5 By End-User Industry

- 5.5.1 Consumer Electronics

- 5.5.2 Healthcare

- 5.5.3 Industrial

- 5.5.4 Security and Surveillance

- 5.5.5 Automotive and Transportation

- 5.5.6 Aerospace and Defense

- 5.5.7 Other End-user Industries

- 5.6 By Country

- 5.6.1 United Kingdom

- 5.6.2 Germany

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 STMicroelectronics

- 6.4.2 Sony Corporation

- 6.4.3 Samsung Electronics Co., Ltd

- 6.4.4 On Semiconductor

- 6.4.5 OmniVision Technologies

- 6.4.6 BAE Systems

- 6.4.7 Toshiba Electronic Devices and Storage

- 6.4.8 Nikon Corp.

- 6.4.9 Panasonic Corp.

- 6.4.10 SK Hynix

- 6.4.11 Canon Inc.

- 6.4.12 AMS-Osram AG

- 6.4.13 Teledyne FLIR

- 6.4.14 Hamamatsu Photonics

- 6.4.15 PixArt Imaging Inc.

- 6.4.16 Tower Semiconductor

- 6.4.17 Gpixel NV

- 6.4.18 Himax Technologies

- 6.4.19 GalaxyCore Inc.

- 6.4.20 Teledyne e2v

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment