PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851524

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851524

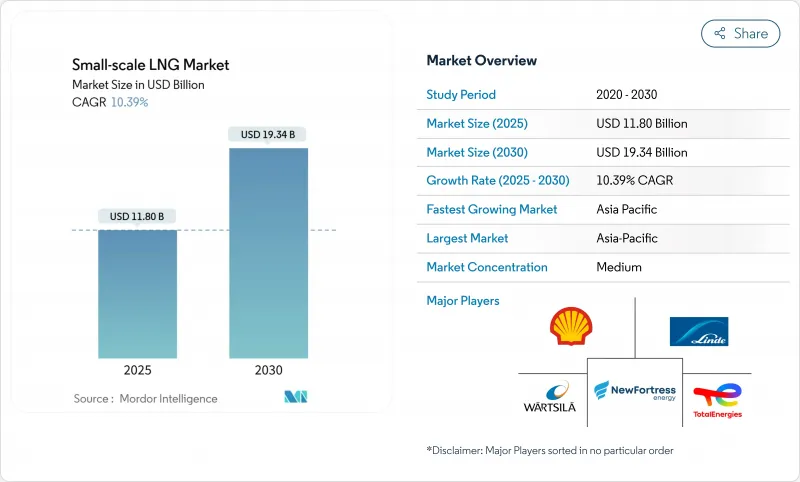

Small-scale LNG - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Small-scale LNG Market size is estimated at USD 11.80 billion in 2025, and is expected to reach USD 19.34 billion by 2030, at a CAGR of 10.39% during the forecast period (2025-2030).

Demand is propelled by industrial and remote communities that are switching from oil and diesel to natural gas, while developers monetize stranded gas and deploy prefabricated plants that shorten construction schedules. Liquefaction technologies optimized for capacities below 1 MTPA, the widening use of LNG in heavy-duty transport, and regulatory incentives in major economies underpin robust capital formation. Competition is intensifying as global energy majors and agile specialists race to secure prime assets, form strategic alliances, and embed proprietary technology platforms across the value chain. Heightened geopolitical uncertainty and the pivot to short-term contracting have raised spot-price volatility, yet continued LNG adoption across power, marine, and trucking segments points to sustained growth opportunities.

Global Small-scale LNG Market Trends and Insights

Tightening IMO & FuelEU Maritime Sulphur Caps Accelerating Marine LNG Bunkering Adoption

New sulphur and greenhouse-gas limits set by the IMO and the FuelEU Maritime package are encouraging vessel operators to adopt LNG to avoid rising carbon compliance costs. The EU Emissions Trading System now prices CO2 from large ships calling at EU ports, and the FuelEU rule requires a 2% cut in carbon intensity by 2025, a target that LNG-fueled ships can meet through 2034 thanks to life-cycle emissions between 76.3-92.3 gCO2e/MJ. Global bunkering demand reached 12.9 million t in 2023, supported by a fleet of 56 LNG bunker vessels by end-2024. Shipowners are responding with record dual-fuel new-build orders and retrofits, driving investments in shore-side loading arms, cryogenic hoses, and safety protocols across European ports.

Rapid Build-Out of Modular Liquefaction Plants for Remote Mining & Off-Grid Power

Factory-fabricated liquefiers mounted on skids or barges are lowering entry barriers in regions where pipeline grids are sparse. Baker Hughes notes rising orders for aeroderivative turbine trains and electric-motor drives that shrink footprints and allow site work to overlap with module fabrication. Indonesia's pilot program showed that supplying remote diesel-fired power plants with LNG can cut levelized generation costs by 55-60% and still yield delivered prices of 10.35-11.28 USD/MMBtu. The modular approach is equally attractive to African miners seeking to monetize flare gas, yielding shorter payback horizons relative to diesel imports.

Sparse ISO-Tank Back-Haul Logistics in Sub-Saharan Africa

Nigeria's 150 tcf of proven gas reserves remain underutilized as ISO-tank fleets face poor road links and minimal two-way trade flows. A lack of return cargo forces operators to reposition empty containers, inflating per-trip costs and eroding the competitiveness of the small-scale LNG market in landlocked states. Regional energy agencies highlight the need for multimodal corridors and harmonized customs procedures before LNG can displace biomass in residential and small commercial segments.

Other drivers and restraints analyzed in the detailed report include:

- Heavy-Duty Truck Fleet Shift to LNG in China's "Blue Corridor" Program

- Caribbean & Central-American Micro-Grid Conversions to LNG-to-Power

- High Boil-Off & Re-Liquefaction Costs Below 0.05 MTPA Plants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Liquefaction terminals generated 62.5% of 2024 revenue, reflecting their pivotal role in gas monetization where pipelines are absent. This portion of the small-scale LNG market size is supported by simplified SMR process trains that balance capital cost and energy efficiency. Developers in the United States alone plan to lift combined micro-LNG capacity to 2.3 million gallons per day. The small-scale LNG market share held by liquefaction facilities is expected to decline slightly as regasification assets grow faster, yet absolute throughput will rise given new off-grid demand from mines and rural utilities.

A parallel wave of floating storage and regasification units is reshaping import options for emerging buyers. FSRUs require USD 300 million and 1-3 years to commission, far below onshore alternatives, and are forecast to post a 14% CAGR through 2030. Innovations such as shallow-draft hulls and articulated tug barges allow access to rivers and near-shore anchorages once deemed unreachable. Developers pair these units with power barges or modular combined-cycle plants, unlocking incremental offtake in Africa, South Asia, and the Caribbean.

Road-based delivery held 52.5% of 2024 revenue thanks to its ability to reach sites beyond pipeline grids. Stabilis Solutions alone has moved more than 420 million gallons via 43,000 truckloads, demonstrating the resilience of this "virtual pipeline" model. Cost competitiveness stems from modular cryogenic pumps, standard ISO-tank interfaces, and GPS-linked fleet scheduling tools that optimize turnaround times.

Bunkering exhibits the sharpest growth at a 14.5% CAGR, propelled by low-sulphur marine rules that favor LNG-dual-fuel ships. LNG is now available in 198 ports, and the bunker fleet stands at 56 specialized vessels-both numbers are poised to multiply as more than 1,200 LNG-capable ships could sail by 2028. Supply chains increasingly blend truck-to-ship, ship-to-ship, and pipeline-to-ship delivery methods to match port layouts and vessel schedules.

The Small-Scale LNG Market Report is Segmented by Type (Liquefaction Terminal and Regasification Terminal), Mode of Supply (Truck, Transshipment and Bunkering, Pipeline and Rail, and ISO Container), Application (Transportation, Power Generation, and Others), End-User (Utilities and IPPs, Oil and Gas Upstream Operators, and Others), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific generated 47.5% of global revenue in 2024 and is forecast to maintain the highest 16% CAGR through 2030. Regional import capacity rose from 15.27 mtpa in 2022 to an expected 23 mtpa by 2025. China remains the linchpin, importing 78.64 MT of LNG in 2024, while aggressively rolling out "Blue Corridor" refueling nodes. Indonesia corroborates the model by demonstrating that small-scale LNG can undercut high-speed diesel by up to 60%, opening avenues for hundreds of island grids.

Europe accounted for roughly 25% of market value, driven by stringent carbon rules and diversification from Russian gas. The continent hosts 28 large-scale import terminals and 8 small-scale facilities totaling 227 bcm of regas capacity, equivalent to 40% of 2024 demand. The Nordic cluster deploys the most advanced environmental tendering in maritime transport, and ports such as Rotterdam, Zeebrugge, and Klaipeda anchor regional bunkering networks. The EU's share of LNG in overall gas supply has more than doubled since 2021, translating into stable base-load for flexible mobile terminals.

North America contributed roughly 20% of revenue, with the United States as the technology leader and largest exporter. US LNG export capacity has tripled since 2018 and will nearly double again by 2030 on sanctioned projects. The local small-scale LNG market climbed from 499 million gallons in 2018 toward 1.9 billion gallons by 2030, propelled by shale gas abundance, tax credits, and accelerating adoption of LNG as truck and rail fuel. Canadian and Mexican developers also explore modular plants to connect remote mines and industrial parks.

The remainder of demand is split among Latin America, the Middle East, and Africa. Latin America's growth centers on Brazil, Chile, and the Dominican Republic, where floating import solutions allow fast ramp-up of LNG-to-power projects. The Middle East uses small-scale LNG mainly for remote oilfield operations and island tourism complexes, leveraging abundant gas feedstock. Africa remains the least penetrated region, constrained by logistics gaps, yet Nigeria and Mozambique present sizable upside if transport bottlenecks ease.

- Linde plc

- Wartsila Oyj Abp

- Baker Hughes Co.

- Honeywell UOP

- Chart Industries Inc.

- Black & Veatch

- New Fortress Energy LLC

- Shell plc

- TotalEnergies SE

- Eni SpA

- PJSC Gazprom

- Novatek PJSC

- Gasum Oy

- Engie SA

- Anthony Veder Group NV

- Stolt-Nielsen Gas Ltd

- Eagle LNG Partners

- Guanghui Energy Co.

- Equinor ASA

- Pavilion Energy Pte Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tightening IMO & FuelEU Maritime Sulphur Caps Accelerating Marine LNG Bunkering Adoption (Europe)

- 4.2.2 Rapid Build-out of Modular Liquefaction Plants for Remote Mining & Off-Grid Power (Asia-Pacific)

- 4.2.3 Heavy-Duty Truck Fleet Shift to LNG in China's "Blue Corridor" Program

- 4.2.4 Caribbean & Central-American Micro-grid Conversions to LNG-to-Power

- 4.2.5 Tax Incentives for Small-Scale LNG Equipment under US Inflation Reduction Act

- 4.2.6 Nordic LNG Bus & Ferry Subsidy Schemes Driving Demand for Bunkering

- 4.3 Market Restraints

- 4.3.1 Sparse ISO-Tank Back-haul Logistics in Sub-Saharan Africa

- 4.3.2 High Boil-Off & Re-liquefaction Costs Below 0.05 MTPA Plants

- 4.3.3 Fragmented Permitting Framework for Mobile Liquefiers in Brazil

- 4.3.4 Russia-Ukraine Conflict Raising Geopolitical Risk Premium on Spot LNG

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Liquefaction Terminal (Micro, Mini, and Small)

- 5.1.2 Regasification Terminal (Onshore and Offshore FSRU)

- 5.2 By Mode of Supply

- 5.2.1 Truck

- 5.2.2 Pipeline and Rail

- 5.2.3 Transshipment and Bunkering (Ship-to-ship and Shore-to-ship)

- 5.2.4 ISO Container

- 5.3 By Application

- 5.3.1 Transportation (Road and Marine Bunkering)

- 5.3.2 Industrial Feedstock

- 5.3.3 Power Generation

- 5.3.4 Other Applications

- 5.4 By End-User

- 5.4.1 Utilities and Independent Power Producers (IPPs)

- 5.4.2 Oil nd Gas Upstream Operators

- 5.4.3 Manufacturing Industries

- 5.4.4 Commercial and Municipal

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Nordic Countries

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Malaysia

- 5.5.3.6 Thailand

- 5.5.3.7 Indonesia

- 5.5.3.8 Vietnam

- 5.5.3.9 Australia

- 5.5.3.10 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Qatar

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Linde plc

- 6.4.2 Wartsila Oyj Abp

- 6.4.3 Baker Hughes Co.

- 6.4.4 Honeywell UOP

- 6.4.5 Chart Industries Inc.

- 6.4.6 Black & Veatch

- 6.4.7 New Fortress Energy LLC

- 6.4.8 Shell plc

- 6.4.9 TotalEnergies SE

- 6.4.10 Eni SpA

- 6.4.11 PJSC Gazprom

- 6.4.12 Novatek PJSC

- 6.4.13 Gasum Oy

- 6.4.14 Engie SA

- 6.4.15 Anthony Veder Group NV

- 6.4.16 Stolt-Nielsen Gas Ltd

- 6.4.17 Eagle LNG Partners

- 6.4.18 Guanghui Energy Co.

- 6.4.19 Equinor ASA

- 6.4.20 Pavilion Energy Pte Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment