PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851529

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851529

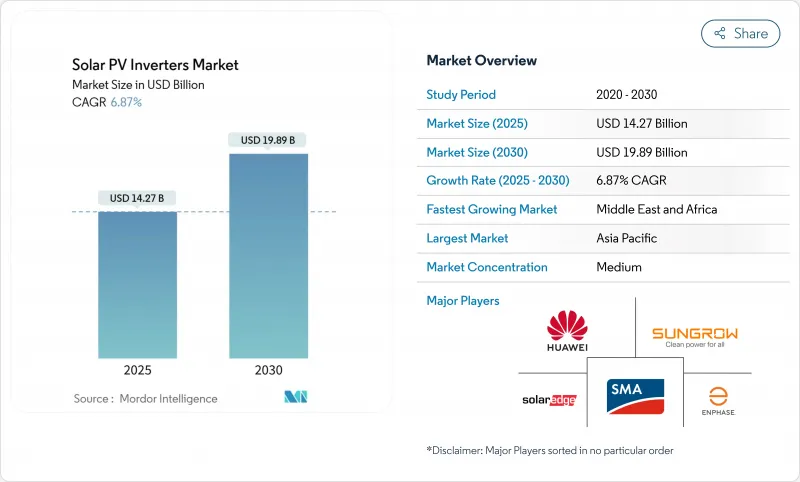

Solar PV Inverters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Solar PV Inverters Market size is estimated at USD 14.27 billion in 2025, and is expected to reach USD 19.89 billion by 2030, at a CAGR of 6.87% during the forecast period (2025-2030).

The market's expansion is underpinned by a move from simple DC-to-AC conversion toward smart, grid-forming solutions that safeguard power quality and unlock new revenue streams for owners. Asia-Pacific anchors global demand, yet the Middle East is now the fastest-growing territory as large utility projects intersect with grid-modernization agendas. Robust replacement cycles in Japan, rooftop mandates in India, and higher-voltage designs across the United States and Europe amplify near-term unit volumes, while persistent SiC/IGBT shortages and rising curtailment in China temper the pace of expansion. Despite those headwinds, premium pricing for advanced grid-support functions keeps aggregate revenue upward in the solar PV inverter market .

Global Solar PV Inverters Market Trends and Insights

Rapid adoption of high-voltage 1 500 V string inverters in utility-scale projects (US, Spain)

Utility developers increasingly specify 1,500 V-and pilot 2,000 V-DC architectures to lower balance-of-system costs and boost power density. GE Vernova's 2,000 V platform showcases a 30% output gain that decreases levelized energy costs. This voltage migration renders 1,000 V arrays economically obsolete on new-build sites and spurs retrofit projects, especially where land and grid headroom allow bigger block sizes. Heightened semiconductor demand follows, tightening the supply of SiC devices and elevating the strategic importance of thermal design expertise among leading brands.

Mandatory rooftop-solar mandates in India's commercial buildings boosting <=100 kW inverter demand

India's policy obliges new and existing commercial structures to install rooftop arrays, driving the sustained need for <=100 kW inverters. Record additions of 4 GW in fiscal 2024 signal the scale of the opportunity . Domestic manufacturers benefit from import-substitution targets embedded in the country's 110 GW cell-and-module build-out by 2026, reinforcing the local value chain. While implementation gaps remain across several states, standardized installation practices create a template for broader residential uptake.

Persistent shortages & price volatility of high-current SiC / IGBT power modules

SiC wafer supply tightness continues to constrain high-efficiency inverters and amplify bill-of-material costs. Wolfspeed's financial distress heightens risk perceptions, whereas Infineon's switch to cost-effective 200 mm SiC wafers signals relief from 2026 onward . European and North American producers, dependent on advanced semiconductors for grid-forming functionality, experience sharper margin compression than vertically integrated Chinese peers able to fall back on silicon alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Aggressive replacement cycle of inverters installed during Japan's 2012-2016 FIT boom

- Integration of advanced grid-support functions lifting ASPs in Europe

- Rising curtailment in China's northwest dampening central-inverter orders

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Central units retained a 55% revenue lead in 2024, yet microinverters are forecast to grow at an 8.1% CAGR as module-level electronics move beyond the early-adopter niche. Enphase shipped more than 6.5 million domestic microinverters in 2025, satisfying US localization criteria and underlining the segment's commercial scale . The solar PV inverter market rewards firms that combine ASIC design, wireless data, and thermal engineering in a miniature footprint. Central architectures now confront flattish demand in China due to curtailment but remain anchored in utility projects elsewhere, especially where plant-level controls and competitive capex remain priorities.

Competitive intensity is pronounced in microelectronics; barriers arise from firmware sophistication and safety certifications rather than raw hardware cost. Consequently, low-price entrants struggle to keep pace with rapid feature rollouts such as rapid shutdown and battery interface modes. Despite robust volume growth, microinverters are not likely to eclipse string platforms before the next decade, keeping the solar PV inverter market diversified by architecture.

Utility plants captured 63% of 2024 shipments, reflecting large project pipelines locked under long-term PPAs. Even so, residential systems should expand by 7.6% annually as grid services and net-billing frameworks enhance household economics. India's Pradhan Mantri Surya Ghar program targets 30 GW of rooftop arrays by March 2027, while Australia's battery add-on trend lifts attachment rates. Commercial rooftops ride India's rooftop mandate wave but face cautious finance terms in other regions that stretch payback timelines.

Prosumers increasingly value bidirectional capability and island-mode resilience, prompting inverter OEMs to integrate battery control logic. The resulting ASP uplift compensates for slower macro installation growth, supporting aggregate revenue progression inside the solar PV inverter market. Utility developers, meanwhile, focus on 1,500 V and 2,000 V platforms, coupling them with STATCOM-like functionalities to meet stricter grid-code compliance.

The Solar PV Inverter Market Report is Segmented by Inverter Type (Central Inverters, String Inverters, Micro Inverters, and Hybrid/Battery-Ready Inverters), Phase (Single-Phase and Three-Phase), Connection Type (On-Grid and Off-Grid), Application (Residential, Commercial and Industrial, and Utility-Scale), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific generated 55% of 2024 shipments, underpinned by China's vertically integrated supply chain and India's policy-driven rooftop push. While China's new market-based tariff regime may slow greenfield installations, volume resilience stems from retrofits that embed storage and higher-voltage strings. India's manufacturing capacity, set to reach 110 GW by 2026, tightens domestic procurement loops and shields the local solar PV inverter market from import volatility, although regional disparities in regulatory execution temper immediate gains.

The Middle East, clocking the quickest 9.4% CAGR through 2030, aligns gigawatt-scale projects with economic diversification blueprints. Harsh desert conditions drive demand for high-derating-temperature designs, opening niches for European OEMs specializing in sealed cubicle solutions. Grid-reinforcement efforts in Saudi Arabia and the United Arab Emirates elevate low-voltage ride-through and reactive-power management specifications, pressing vendors to certify products against stricter utility benchmarks.

North America and Europe operate in a mature install base where replacement and retrofit cycles dominate incremental demand. The US Inflation Reduction Act's domestic content credits accelerate localized production, with Texas, South Carolina, and Arizona facilities targeting annual output well above 30 GW by 2026. Europe's renewable penetration surpassing 50% in markets such as Germany and Spain raises the value of grid-forming features, allowing vendors to pass through higher ASPs even as new-build volumes plateau.

- Huawei Technologies Co., Ltd.

- Sungrow Power Supply Co., Ltd.

- SMA Solar Technology AG

- SolarEdge Technologies Inc.

- Enphase Energy Inc.

- FIMER SpA

- Delta Electronics, Inc.

- Growatt New Energy Technology Co., Ltd.

- Ginlong (Solis) Technologies

- TMEIC Corporation

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Siemens AG

- Eaton Corporation plc

- Hitachi Energy Ltd.

- Omron Corporation

- Power Electronics Espana S.L.

- Chint Power Systems Co., Ltd.

- GoodWe Technologies Co., Ltd.

- GE Vernova

- Canadian Solar Inc. (CSI Solar)

- Toshiba Mitsubishi-Electric Industrial Systems Corp. (TMEIC)

- Kepco KPS (South Korea)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of high-voltage 1 500 V string inverters in utility-scale projects (US, Spain)

- 4.2.2 Mandatory rooftop-solar mandates in India's commercial buildings boosting ?100 kW inverter demand

- 4.2.3 Aggressive replacement cycle of inverters installed during Japan's 2012-2016 FIT boom

- 4.2.4 Integration of advanced grid-support functions lifting ASPs in Europe

- 4.2.5 Growth of hybrid PV-storage solutions driving bidirectional inverters in Australia

- 4.2.6 Localization incentives in Brazil encouraging domestic manufacture of central inverters

- 4.3 Market Restraints

- 4.3.1 Persistent shortages & price volatility of high-current SiC / IGBT power modules

- 4.3.2 Rising curtailment in China's northwest dampening central-inverter orders

- 4.3.3 Fragmented US interconnection codes inflating certification costs

- 4.3.4 Fire-safety concerns on rooftop DC circuits slowing microinverter uptake in Germany

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Inverter Type

- 5.1.1 Central Inverters

- 5.1.2 String Inverters

- 5.1.3 Microinverters

- 5.1.4 Hybrid/Battery-Ready Inverters

- 5.2 By Phase

- 5.2.1 Single-Phase

- 5.2.2 Three-Phase

- 5.3 By Connection Type

- 5.3.1 On-Grid

- 5.3.2 Off-Grid

- 5.4 By Application

- 5.4.1 Residential

- 5.4.2 Commercial and Industrial

- 5.4.3 Utility-Scale

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Nordic Countries

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Malaysia

- 5.5.3.6 Thailand

- 5.5.3.7 Indonesia

- 5.5.3.8 Vietnam

- 5.5.3.9 Australia

- 5.5.3.10 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Huawei Technologies Co., Ltd.

- 6.4.2 Sungrow Power Supply Co., Ltd.

- 6.4.3 SMA Solar Technology AG

- 6.4.4 SolarEdge Technologies Inc.

- 6.4.5 Enphase Energy Inc.

- 6.4.6 FIMER SpA

- 6.4.7 Delta Electronics, Inc.

- 6.4.8 Growatt New Energy Technology Co., Ltd.

- 6.4.9 Ginlong (Solis) Technologies

- 6.4.10 TMEIC Corporation

- 6.4.11 Mitsubishi Electric Corporation

- 6.4.12 Schneider Electric SE

- 6.4.13 Siemens AG

- 6.4.14 Eaton Corporation plc

- 6.4.15 Hitachi Energy Ltd.

- 6.4.16 Omron Corporation

- 6.4.17 Power Electronics Espana S.L.

- 6.4.18 Chint Power Systems Co., Ltd.

- 6.4.19 GoodWe Technologies Co., Ltd.

- 6.4.20 GE Vernova

- 6.4.21 Canadian Solar Inc. (CSI Solar)

- 6.4.22 Toshiba Mitsubishi-Electric Industrial Systems Corp. (TMEIC)

- 6.4.23 Kepco KPS (South Korea)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment