PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851561

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851561

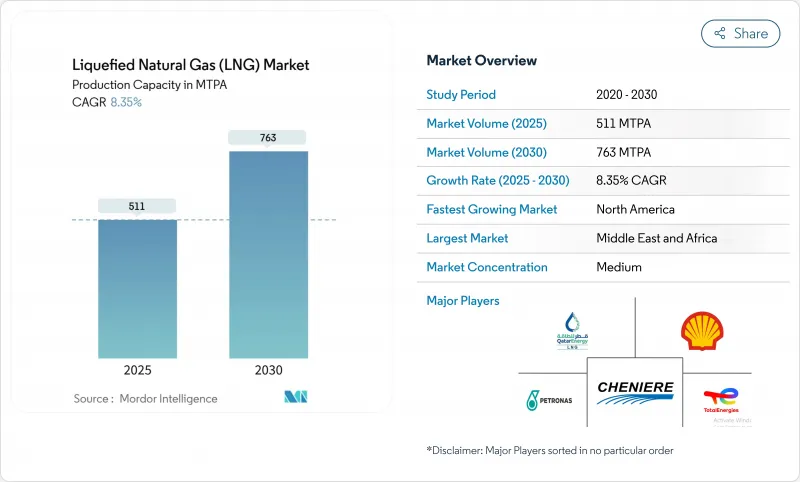

Liquefied Natural Gas (LNG) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Liquefied Natural Gas Market size in terms of production capacity is expected to grow from 511 MTPA in 2025 to 763 MTPA by 2030, at a CAGR of 8.35% during the forecast period (2025-2030).

Energy-security goals and decarbonization mandates are steering governments and utilities toward LNG as a transitional fuel, while the rapid adoption of floating LNG technology broadens supply options and unlocks previously stranded offshore resources. North American export terminals enjoy low-cost feedgas from the Permian Basin, marine shipping is pivoting to LNG for sulfur-cap compliance, and electrification plus carbon-capture upgrades are advancing operational sustainability. Technology-driven cost management and flexible contract structures are reshaping trade patterns, yet prolonged EPC inflation and the rise of renewable hydrogen remain watchpoints for the liquefied natural gas market.

Global Liquefied Natural Gas (LNG) Market Trends and Insights

Surge in Asia-Pacific Gas-to-Power Projects Seeking Midstream LNG Offtake Agreements

Asia-Pacific utilities are adding over 100 bcm of new regasification capacity, and India plans to lift gas consumption 60% by 2030. National decarbonization targets are accelerating coal-to-gas switching and prompting integrated contracts that link LNG supply directly to power-purchase deals. This tight coupling lowers financing risk, improves project bankability, and reinforces long-run demand for the liquefied natural gas market.

Rapid Uptake of LNG as Marine Bunker Fuel Following IMO-2020 Sulfur Cap in Europe

The global LNG-fueled fleet grew 33% in 2024 to 638 vessels and is expected to exceed 1,200 ships by 2028. Container lines represent 60% of LNG-propelled deadweight tonnage, driving accelerated bunker-infrastructure rollout in 198 ports. The liquefied natural gas market is picking up additional momentum from bio-LNG initiatives that extend compliance into future emissions-control regimes.

Prolonged FID Delays Owing to EPC-Cost Inflation & Module Fabrication Bottlenecks

Just 14.8 MTPA of capacity reached FID in 2024, down sharply amid 20-30% cost jumps and labor shortages. Modular construction is gaining favor despite higher equipment prices, yet delays could open a supply gap in 2027-2029, inducing volatility across the liquefied natural gas market.

Other drivers and restraints analyzed in the detailed report include:

- Permian Basin Associated Gas Output Unlocks Low-Cost Feedgas for U.S. Gulf-Coast Export Terminals

- Floating LNG Technology Unlocking Stranded Offshore Gas Fields in Africa

- Competitiveness of Renewable Hydrogen Eroding Long-Term LNG Contract Appetite in Northeast Asia

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Liquefaction plants held 43% of 2024 revenues, the highest within the liquefied natural gas market. Capacity boosts in Qatar, the United States, and Australia underpin a forecast 11.1% CAGR to 2030. Electrified compressors and carbon capture trim emissions and sharpen competitive edges for integrated majors.

The segment's ecosystem now includes 904 LNG carriers, many fitted with low-methane-slip engines that curb greenhouse-gas intensity. FSRUs are accelerating import growth, especially in Europe, adding 77 MMtpy of regas capacity since 2021 and validating modular deployment for the liquefied natural gas market.

Power generation retained 38% of demand in 2024 and is expanding through integrated LNG-to-power projects in Asia. These setups consolidate terminal, storage, and generation assets, lowering credit risk and deepening the liquefied natural gas market footprint.

Marine bunkering is poised for a 14% CAGR, the fastest among applications. Fleet counts, port bunkering networks, and bio-LNG pilots signal durable growth, positioning shipping as a dynamic contributor to the liquefied natural gas market.

The Liquefied Natural Gas (LNG) Market Report is Segmented by Infrastructure Type (LNG Liquefaction Plants, LNG Regasification Facilities, and LNG Shipping Fleet), End-Use Application (Power Generation, Industrial and Manufacturing, and Others), Scale (Large-Scale, Mid-Scale, and Small-Scale), Location (Onshore and Offshore), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

The Middle East & Africa held 28% of the 2024 market. Qatar's North Field build-out from 77 MTPA to 126 MTPA by 2027 cements regional leadership and improves routing flexibility between Europe and Asia. New UAE and Mauritanian ventures add depth, though tanker insurance costs through Hormuz remain an operational concern for the liquefied natural gas market.

North America is set for a 10.5% CAGR through 2030 thanks to abundant shale gas and 13.3 MTPA of export trains entering service in 2025. Canada's Kitimat start-up and Henry-Hub-linked contracts amplify buyer interest, although temporary permitting pauses temper mid-decade FID outlooks.

Asia-Pacific remains the largest import center, with China purchasing 78.64 million t in 2024. First-time importers in the Philippines and Vietnam broaden the customer base, while small-scale LNG distribution gains traction for archipelagic supply. Renewable energy growth and hydrogen pilots in Japan and South Korea inject longer-term uncertainty into regional consumption.

Europe expanded regas capacity by 44% since 2021, installing multiple FSRUs to replace Russian pipeline volumes. Seasonal demand spikes sustain premium pricing, and impending EU methane rules will intensify supply-chain monitoring across the liquefied natural gas market.

- QatarEnergy LNG (Qatargas)

- Shell plc

- Cheniere Energy Inc.

- TotalEnergies SE

- Petronas

- Novatek

- Chevron Corporation

- Exxon Mobil Corporation

- Woodside Energy Group

- Equinor ASA

- Sempra Infrastructure

- Venture Global LNG

- ENI SpA

- KOGAS

- Mitsui O.S.K. Lines

- Golar LNG

- BW LNG

- Technip Energies

- Bechtel Corporation

- Fluor Corporation

- KBR Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Asia-Pacific Gas-to-Power Projects Seeking Midstream LNG Offtake Agreements

- 4.2.2 Rapid Uptake of LNG as Marine Bunker Fuel Following IMO-2020 Sulfur Cap in Europe

- 4.2.3 Permian Basin Associated Gas Output Unlocks Low-Cost Feed-gas for U.S. Gulf-Coast Export Terminals

- 4.2.4 Floating LNG Technology Unlocking Stranded Offshore Gas Fields in Africa

- 4.2.5 China's Coal-to-Gas Switching Policies for Industrial Boilers Driving Spot LNG Imports

- 4.2.6 Growing Demand from Energy-Intensive Data Centres for Firm Low-Carbon Supply in OECD Markets

- 4.3 Market Restraints

- 4.3.1 Prolonged FID Delays Owing to EPC-Cost Inflation & Module Fabrication Bottlenecks

- 4.3.2 Competitiveness of Renewable Hydrogen Eroding Long-Term LNG Contract Appetite in N.E. Asia

- 4.3.3 Regulatory Moratoria on New LNG Export Permits in U.S. & Canada

- 4.3.4 Geopolitical Risk at Key Chokepoints (Hormuz, Suez) Escalating LNG Shipping Insurance Costs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Infrastructure Type

- 5.1.1 LNG Liquefaction Plants [Onshore Liquefaction, Floating LNG (FLNG), Mid-Scale (1-5 mtpa), and Small-Scale (<1 mtpa)]

- 5.1.2 LNG Regasification Facilities [Onshore Import Terminals, and Floating Storage & Regasification Units (FSRU)]

- 5.1.3 LNG Shipping Fleet [LNG Carriers by Containment (Moss and Membrane), Carrier Size (Q-Max, Q-Flex and Standard), LNG Bunkering Vessels]

- 5.2 By End-Use Application

- 5.2.1 Power Generation

- 5.2.2 Industrial and Manufacturing

- 5.2.3 Residential and Commercial

- 5.2.4 Transportation (Marine Bunkering, Heavy-Duty Road Transport and Rail)

- 5.3 By Scale

- 5.3.1 Large-Scale (Above 5 mtpa)

- 5.3.2 Mid-Scale (1 to 5 mtpa)

- 5.3.3 Small-Scale (Below 1 mtpa)

- 5.4 By Location

- 5.4.1 Onshore

- 5.4.2 Offshore (FLNG and FSRU)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Nordic Countries

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN Countries

- 5.5.3.6 Australia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Egypt

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 QatarEnergy LNG (Qatargas)

- 6.4.2 Shell plc

- 6.4.3 Cheniere Energy Inc.

- 6.4.4 TotalEnergies SE

- 6.4.5 Petronas

- 6.4.6 Novatek

- 6.4.7 Chevron Corporation

- 6.4.8 Exxon Mobil Corporation

- 6.4.9 Woodside Energy Group

- 6.4.10 Equinor ASA

- 6.4.11 Sempra Infrastructure

- 6.4.12 Venture Global LNG

- 6.4.13 ENI SpA

- 6.4.14 KOGAS

- 6.4.15 Mitsui O.S.K. Lines

- 6.4.16 Golar LNG

- 6.4.17 BW LNG

- 6.4.18 Technip Energies

- 6.4.19 Bechtel Corporation

- 6.4.20 Fluor Corporation

- 6.4.21 KBR Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment