PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910427

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910427

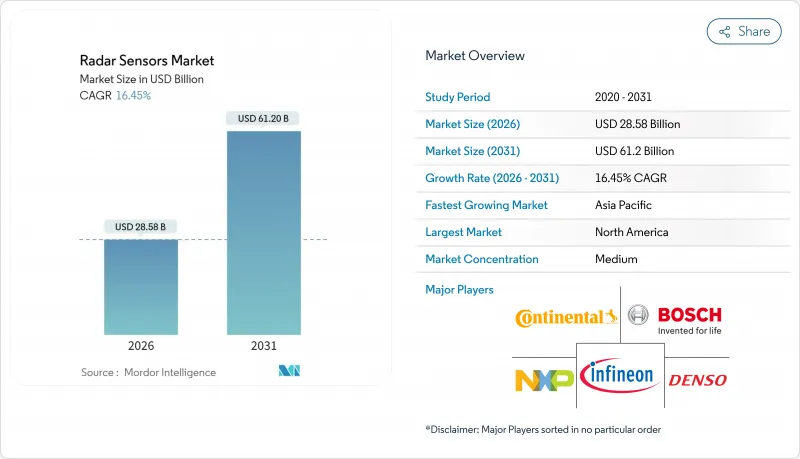

Radar Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The radar sensor market is expected to grow from USD 24.54 billion in 2025 to USD 28.58 billion in 2026 and is forecast to reach USD 61.2 billion by 2031 at 16.45% CAGR over 2026-2031.

The rapid scaling reflects the technology's migration from exclusive defense use to high-volume automotive safety, industrial automation, drone mapping, and smart infrastructure programs. Adoption is propelled by safety regulations such as the European Union General Safety Regulation, which mandates automatic emergency braking using 77-81 GHz radar in new vehicles. Supply-side catalysts include affordable millimeter-wave chipsets and gallium-nitride power devices that enhance range resolution while lowering size, weight, and power requirements. Robust military modernization in Asia-Pacific, expanding 5G-enabled road projects in Europe, and climate-resilient weather radar networks worldwide deepen addressable demand. Near-term challenges center on below-10 GHz spectrum congestion, calibration expenses for imaging arrays, and gallium supply risks stemming from China's 98% production dominance.

Global Radar Sensors Market Trends and Insights

Increasing adoption of 77-81 GHz radars in automotive safety systems

Regulators and automakers endorse 77-81 GHz because it delivers longer detection ranges and sharper angular resolution than legacy 24 GHz devices. Continental's ARS640 exceeds 300 m range and enables object classification fit for Level 2+ autonomy. China's Ministry of Industry and Information Technology halted new 24 GHz radar approvals in 2022, compelling local OEMs to shift frequency bands. Bosch extended the band to motorcycles, equipping KTM bikes with 210 m range radar for adaptive cruise and blind-spot warning. These developments reinforce steady sensor penetration across vehicle classes, underpinning radar sensor market growth.

Surging demand for compact imaging radars in drone-based terrain mapping

Multirotor drones use lightweight synthetic-aperture radars to generate sub-meter elevation models even in vegetation or cloud cover where optical payloads fail. Research shows 72.73% of mining exploration missions now favor multirotor over helicopter platforms, cutting survey cost by 60% while improving spatial granularity. The U.S. Geological Survey's mobile radar observatory captures rainfall-runoff data minutes after wildfires, supporting emergency response. Such proof points fuel R&D investment in higher-bandwidth chipsets and on-board processing, broadening the radar sensor market.

Spectrum allocation constraints in sub-10 GHz bands

Radar developers compete with telecom and satellite operators for scarce sub-10 GHz slots. The U.S. Department of Defense runs more than 120 radars below 3 GHz, limiting civilian spectrum re-farm potential. The FCC recently tightened 24 GHz out-of-band limits to satisfy global rulings, forcing design changes. Certification queues can stretch nine months, delaying product launches and curbing near-term radar sensor market adoption.

Other drivers and restraints analyzed in the detailed report include:

- Rising military spend on AESA radars in Asia-Pacific

- Growing need for mm-wave sensors in industrial robot collision avoidance

- High calibration & maintenance cost of imaging radar arrays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-imaging devices represented 70.35% of 2025 revenue, illustrating entrenched use in parking assistance and basic adaptive cruise. Imaging solutions, however, are forecast to post an 18.12% CAGR through 2031 as Level 2+ autonomy proliferates. NXP and sinPro's 48-channel entry-level 4D unit reaches 1-degree azimuth and 2,000 point clouds per frame, signaling democratization of high-resolution perception. Imaging capability lets automated brakes distinguish pedestrians from roadside signs, pushing OEM fitment beyond luxury trims. The radar sensor market size for imaging-enabled modules is projected to reach USD 19.76 billion by 2031, capturing escalating software-defined vehicle budgets. Conversely, the cost-optimized non-imaging category retains dominance in delivery robots, forklift collision alerts, and rainfall estimation where identification finesse is less critical. Manufacturers bundle simple FMCW dies with antenna-in-package designs to lower bill-of-material cost and sustain the wider radar sensor market.

Competitive roadmaps now combine embedded signal processors with edge AI acceleration to shrink latency. Continental's ARS640 integrates neural network filtering to classify vulnerable road users in real time, raising functional safety metrics. On the materials side, silicon germanium front-ends challenge GaAs incumbents, promising sub-USD 10 die price at high volumes. This cost curve supports incremental imaging upgrades in mid-segment cars and paves the way for radar sensor market penetration in scooters and micro-mobility.

The 77-81 GHz tier held 42.55% 2025 revenue due to a sweet spot between path loss and antenna aperture, enabling 250 m automotive detection while remaining cost-effective. Regulatory harmonization in Europe, China, and North America cut certification complexity and boosted the radar sensor market. STMicroelectronics' 77 GHz transceiver sustains performance in snow or dirt, validating use in harsh roadside units. Above 94 GHz, ultra-wideband channels achieve sub-centimeter resolution prized in pavement crack monitoring and medical micro-Doppler imaging. With a 21.25% CAGR, >=94 GHz shipments are set to more than triple by 2031 as wafer-scale GaN power amplifiers mature.

Spectrum below 10 GHz faces saturation, pushing developers to migrate upward. China no longer approves new 24 GHz automotive radars, accelerating global pivot. Short-range 60 GHz gear excels in cabin sensing, occupancy detection, and gesture control; Texas Instruments' single-chip radar improves child presence alert accuracy to 98% without cameras. Blended multi-band architectures deploy 24 GHz corners, 77 GHz front units, and 60 GHz interiors, expanding the radar sensor market across multiple tiers.

The Radar Sensor Market is Segmented by Type (Imaging Radar, Non-Imaging Radar), Frequency Band (More Than 10 GHz, 24 GHz ISM Band, and More), Range (Short-Range Radar Sensor, Medium-Range Radar Sensor, and More), Technology (Pulsed Radar, Phased-Array / AESA Radar, and More), End-User and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the largest regional contributor in 2024, supported by advanced driver-assistance deployment and sizable defense upgrades. Gallium supply risk, however, threatens USD 602 billion of U.S. economic output, pushing policymakers to localize GaN epitaxy and recycle scrap csis.org. The United States also grapples with certification delays that slow civilian rollouts, while Canada scales automotive radar test facilities and Mexico benefits from near-shoring Tier-1 production lines.

Europe posts the highest forward CAGR due to unified safety laws and expansive smart-road investments. The EU's AEB mandate ensures uniform sensor installation across vehicle classes, while national road agencies deploy radar for congestion analytics. smartmicro UK surpassed 1,000 roadside units, illustrating integrator momentum smartmicro.com. Supply-chain reshoring counters semiconductor scarcity, and 5G corridors embed radar hand-in-hand with V2X beacons.

Asia-Pacific leads defense and weather spending. Japan's AN/SPY-7 roll-out and South Korea's L-SAM II project typify high-budget programs driving domestic GaN foundry growth. China's policy shift away from 24 GHz automotive radar accelerates migration to 77 GHz across local OEM plants. India's USD 50 million weather radar order demonstrates public-sector appetite for precision meteorology. Collectively, these initiatives expand the radar sensor market beyond consumer mobility.

- Robert Bosch GmbH

- Continental AG

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Denso Corporation

- Hella GmbH and Co. KGaA

- Veoneer Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Analog Devices Inc.

- Renesas Electronics Corporation

- Aptiv PLC

- ZF Friedrichshafen AG

- Valeo SA

- Hitachi Astemo Ltd.

- Smart Microwave Sensors GmbH

- InnoSenT GmbH

- Baumer Group

- Banner Engineering Corp.

- Lockheed Martin Corporation

- Raytheon Technologies Corp.

- Northrop Grumman Corp.

- Thales Group

- Honeywell International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of 77-81 GHz Radars in Automotive Safety Systems

- 4.2.2 Surging Demand for Compact Imaging Radars in Drone-based Terrain Mapping

- 4.2.3 Rising Military Spend on Active Electronically Scanned Array (AESA) Radars in Asia-Pacific

- 4.2.4 Growing Need for mm-Wave Sensors in Industrial Robot Collision Avoidance

- 4.2.5 Infrastructure Push for Smart Highways and Traffic-Monitoring Radars in Europe

- 4.2.6 Climate-change-driven Uptake of Doppler Weather Radars in Coastal Regions

- 4.3 Market Restraints

- 4.3.1 Spectrum Allocation Constraints in Sub-10 GHz Bands

- 4.3.2 High Calibration and Maintenance Cost of Imaging Radar Arrays

- 4.3.3 Thermal Management Challenges in High-power mm-Wave Chipsets

- 4.3.4 Data-privacy Concerns Over 3-D People-tracking Radars in Retail

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Threat of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Imaging Radar

- 5.1.2 Non-Imaging Radar

- 5.2 By Frequency Band

- 5.2.1 Less than 10 GHz (HF/UHF/L-Band)

- 5.2.2 24 GHz ISM Band

- 5.2.3 60-64 GHz

- 5.2.4 77-81 GHz

- 5.2.5 94 GHz and Above

- 5.3 By Range

- 5.3.1 Short-range Radar Sensor (less than 30 m)

- 5.3.2 Medium-range Radar Sensor (30-150 m)

- 5.3.3 Long-range Radar Sensor ( greater than 150 m)

- 5.4 By Technology

- 5.4.1 Pulsed Radar

- 5.4.2 Frequency-Modulated Continuous-Wave (FMCW) Radar

- 5.4.3 Phased-Array / AESA Radar

- 5.4.4 Digital Modulation and MIMO Radar

- 5.5 By End-User

- 5.5.1 Automotive

- 5.5.2 Aerospace and Defense

- 5.5.3 Security and Surveillance (Fixed and Mobile)

- 5.5.4 Industrial Automation and Robotics

- 5.5.5 Environment and Weather Monitoring

- 5.5.6 Traffic Monitoring and Smart Infrastructure

- 5.5.7 Healthcare and Assisted-Living

- 5.5.8 Other End-Users

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 Israel

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 United Arab Emirates

- 5.6.4.4 Turkey

- 5.6.4.5 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Egypt

- 5.6.5.3 Rest of Africa

- 5.6.6 South America

- 5.6.6.1 Brazil

- 5.6.6.2 Argentina

- 5.6.6.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, Funding, Partnerships)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 Infineon Technologies AG

- 6.4.4 NXP Semiconductors N.V.

- 6.4.5 Denso Corporation

- 6.4.6 Hella GmbH and Co. KGaA

- 6.4.7 Veoneer Inc.

- 6.4.8 STMicroelectronics N.V.

- 6.4.9 Texas Instruments Incorporated

- 6.4.10 Analog Devices Inc.

- 6.4.11 Renesas Electronics Corporation

- 6.4.12 Aptiv PLC

- 6.4.13 ZF Friedrichshafen AG

- 6.4.14 Valeo SA

- 6.4.15 Hitachi Astemo Ltd.

- 6.4.16 Smart Microwave Sensors GmbH

- 6.4.17 InnoSenT GmbH

- 6.4.18 Baumer Group

- 6.4.19 Banner Engineering Corp.

- 6.4.20 Lockheed Martin Corporation

- 6.4.21 Raytheon Technologies Corp.

- 6.4.22 Northrop Grumman Corp.

- 6.4.23 Thales Group

- 6.4.24 Honeywell International Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment