PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851600

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851600

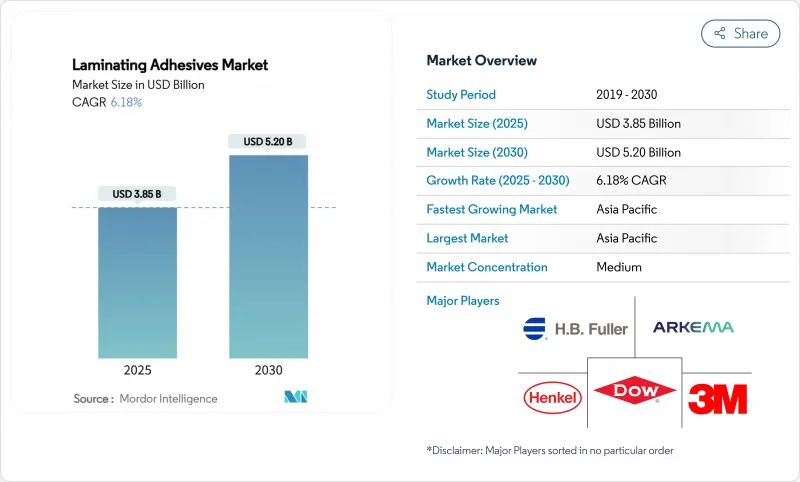

Laminating Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The laminating adhesives market size is valued at USD 3.85 billion in 2025 and is forecast to reach USD 5.20 billion by 2030, advancing at a 6.18% CAGR during the period.

Sustained demand for flexible packaging in food, pharmaceuticals and e-commerce parcels, alongside tightening chemical regulations, underpins this steady expansion. Brand owners now specify solvent-free or water-borne solutions to lower volatile organic compound (VOC) emissions, driving accelerated adoption of advanced polyurethane (PUR) and acrylic chemistries. Accelerating Asia-Pacific industrialization, robust medical device output in North America and stringent circular-economy rules in Europe collectively shape product development priorities. Competitive advantage hinges on vertical integration, regulatory fluency and the ability to scale bio-based raw materials that meet cost and performance targets.

Global Laminating Adhesives Market Trends and Insights

Robust Growth in Flexible Food Packaging

Flexible packaging's 3.2% annual expansion toward a projected USD 341.6 billion by 2028 continues to lift demand for migration-resistant laminating adhesives that comply with FDA 21 CFR Part 175 and China's GB 4806.15-2024 national food-contact adhesive standard. Converter requirements for precise thermal activation profiles ensure seal integrity during high-retort processes while preventing flavor transfer across multilayer structures. Leading suppliers differentiate through low-monomer PUR grades that fall beneath EU diisocyanate thresholds, shortening compliance lead times. Global food brands increasingly mandate quantitative migration testing, favoring vendors with in-house analytics and global regulatory dossiers. The laminating adhesives market capitalizes on this shift by scaling solvent-less lines that cut energy use and elevate workplace safety.

Surge in Medical Flexible Pouches & IV-Bag Laminations

Cast-extruded films deliver crystal clarity vital for IV-bag visual inspection, whereas blown-film laminates boost puncture resistance for pharmaceutical pouches. ISO 10993 biocompatibility testing poses high barriers, restricting new entrants and reinforcing premium pricing for validated grades. Wearable medical devices drive innovation in skin-friendly adhesives that balance adhesion and painless removal. Regulatory bodies demand sterilization stability across gamma, e-beam and ethylene oxide processes, pushing R&D toward chemistries that retain mechanical strength post-sterilization. North American producers leverage GMP facilities and track-record documentation to secure long-term hospital contracts.

VOC & PFAS Regulatory Tightening on Legacy Solvents

The US EPA's 40 CFR Part 59 sets stringent VOC ceilings for industrial adhesives, forcing reformulation of long-standing solvent products. California's listing of vinyl acetate under Proposition 65 effective December 2025 increases labeling and reformulation costs across the region. Concurrently, EU rules cap total PFAS to 250 ppb in food packaging by August 2026, catalyzing rapid migration toward PFAS-free chemistries. Compliance expenditures and re-qualification testing stretch R&D budgets, disproportionately affecting smaller converters and accelerating consolidation within the laminating adhesives market.

Other drivers and restraints analyzed in the detailed report include:

- E-Commerce Parcel Boom Demanding High-Performance Mailer Laminates

- Brand-Owner Push for Mono-Material Recycle-Ready Laminates

- Cost-Inflation of Bio-Based Polyols Limiting Green Transition

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solvent-borne products retained a 45.65% share of the laminating adhesives market in 2024, reflecting versatile adhesion and entrenched converter familiarity. The segment expands modestly, yet regulatory clampdowns on VOCs spur processors to reassess energy-intensive drying tunnels. Solvent-less grades are therefore registering a vigorous 7.64% CAGR toward 2030 as converters adopt high-speed tandem lines that eliminate ovens and curb energy bills by up to 40%. Water-borne dispersions occupy an intermediary niche, easing the learning curve for firms transitioning away from solvents while offering environmental benefits. Emerging UV- and electron-beam-curable systems target niche applications requiring instant green-strength and low migration.

Processing economics underpin this migration. Reactive PUR hot-melts supply the handling simplicity of hot-melts and the final strength of thermosets, making them prime candidates on duplex and triplex laminators. Microwave-triggered light-activated adhesives demonstrated by Hebrew University researchers hint at next-generation cure mechanisms that could enable on-demand recycling. Suppliers with broad technology portfolios gain strategic leverage by supporting converters through phased equipment upgrades while guaranteeing consistent performance across packaging, industrial and transportation end uses.

The Laminating Adhesives Market Report is Segmented by Type (Solvent-Borne, Water-Borne, and More), Resin Chemistry (Polyurethane, Acrylic, and More), Application (Packaging, Industrial Laminations, and More), and Geography (Asia-Pacific, North America, South America, Europe, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 49.02% of laminating adhesives market share in 2024 and is forecast to grow at a 7.09% CAGR through 2030. China's USD 1.6 billion acrylic acid investment leveraging propane feedstock underlines cost-innovation synergies. India's growing middle class and infrastructure projects, coupled with Henkel's Loctite facility expansion in Maharashtra, anchor regional capacity. Japan and South Korea contribute high-precision formulations for electronics and EV battery modules, benefiting from tight supply chains and robust IP protections.

North America leverages advanced R&D ecosystems and stringent regulatory oversight that accelerate sustainable-formulation breakthroughs. The region's leading role in medical device and pharmaceutical manufacturing drives specialized adhesive demand aligned with FDA requirements. Canada's restriction on polycyclic aromatic hydrocarbon (PAH) sealants highlights the continent's regulatory influence on global suppliers. Mexico's cost-competitive plants support NAFTA supply chains in automotive interiors and consumer packaging.

Europe continues to shape global standards. The EU's escalating recycled-content mandates steer converter investments toward recyclable PUR and acrylic systems. Germany's engineering base fosters continuous process improvements, while France and Italy retain sizable converting clusters that rely on solvent-less upgrades. South America and Middle East & Africa, though smaller today, display above-average growth as infrastructure and consumer markets expand. Saint-Gobain's USD 1.025 billion FOSROC deal underscores rising interest in these regions' construction and industrial segments.

- 3M

- Arkema (Bostik)

- Ashland

- BASF

- Chemline India

- Coim Group

- Covestro

- DIC Corporation

- Dow

- Evonik

- Flint Group

- H.B. Fuller

- Henkel AG & Co. KGaA

- hubergroup

- INX International Coatings & Adhesives Co.

- LD Davis

- Paramelt

- SAPICI

- Sika AG

- Sun Chemical

- Toyochem

- Toyo-Morton

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust growth in flexible food packaging

- 4.2.2 Surge in medical flexible pouches & IV-bag laminations

- 4.2.3 E-commerce parcel boom demanding high-performance mailer laminates

- 4.2.4 Adoption of solvent-free PUR systems in high-speed tandem lines

- 4.2.5 Brand-owner push for mono-material recycle-ready laminates

- 4.3 Market Restraints

- 4.3.1 VOC & PFAS regulatory tightening on legacy solvents

- 4.3.2 Cost-inflation of bio-based polyols limiting green transition

- 4.3.3 Thermal-budget limits with heat-sensitive sustainable films

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Solvent-borne

- 5.1.2 Water-borne

- 5.1.3 Solvent-less

- 5.1.4 Other Types (UV/EB-curable)

- 5.2 By Resin Chemistry

- 5.2.1 Polyurethane

- 5.2.2 Acrylic

- 5.2.3 Epoxy

- 5.2.4 Other Resin Chemistries (EVA, Polyolefin, Nitrile)

- 5.3 By Application

- 5.3.1 Packaging

- 5.3.1.1 Food

- 5.3.1.2 Medical

- 5.3.1.3 Other Packaging

- 5.3.2 Industrial Laminations

- 5.3.3 Transportation

- 5.3.4 Other Applications (Textiles, Graphics)

- 5.3.1 Packaging

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 South America

- 5.4.3.1 Brazil

- 5.4.3.2 Argentina

- 5.4.3.3 Rest of South America

- 5.4.4 Europe

- 5.4.4.1 Germany

- 5.4.4.2 United Kingdom

- 5.4.4.3 Italy

- 5.4.4.4 France

- 5.4.4.5 Rest of Europe

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema (Bostik)

- 6.4.3 Ashland

- 6.4.4 BASF

- 6.4.5 Chemline India

- 6.4.6 Coim Group

- 6.4.7 Covestro

- 6.4.8 DIC Corporation

- 6.4.9 Dow

- 6.4.10 Evonik

- 6.4.11 Flint Group

- 6.4.12 H.B. Fuller

- 6.4.13 Henkel AG & Co. KGaA

- 6.4.14 hubergroup

- 6.4.15 INX International Coatings & Adhesives Co.

- 6.4.16 LD Davis

- 6.4.17 Paramelt

- 6.4.18 SAPICI

- 6.4.19 Sika AG

- 6.4.20 Sun Chemical

- 6.4.21 Toyochem

- 6.4.22 Toyo-Morton

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment