PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851612

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851612

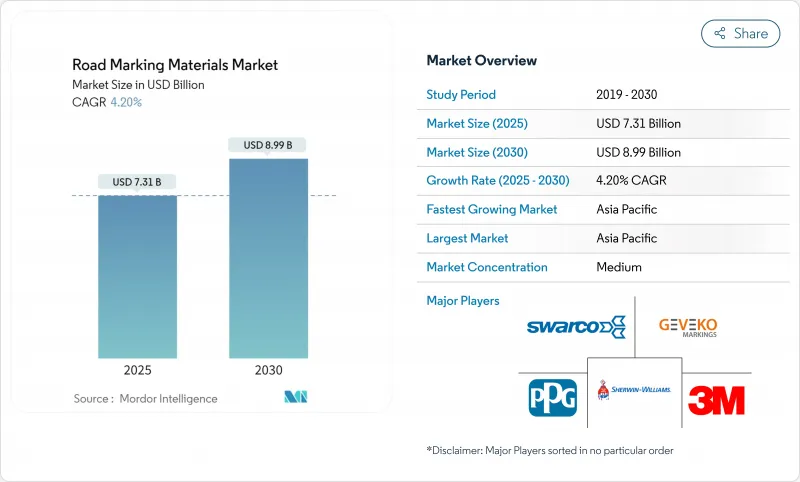

Road Marking Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Road Marking Materials Market size is estimated at USD 7.31 billion in 2025, and is expected to reach USD 8.99 billion by 2030, at a CAGR of 4.2% during the forecast period (2025-2030).

The steady expansion is supported by surging infrastructure outlays, tightening safety mandates and rapid product innovation. Asia-Pacific remains the principal demand engine yet spending programs in North America and Europe sustain a broad global opportunity set. Material selection is evolving polymer systems are eroding the dominance of legacy paints, and machine-readable markings designed for autonomous vehicles are moving from pilot trials toward commercial roll-out. Environmental regulations now shape R&D priorities, pushing manufacturers toward low-VOC chemistries and recycled raw materials while retaining high visibility and durability. Competitive intensity is moderate, with established players relying on targeted acquisitions and technology licensing to protect share across high-growth regions.

Global Road Marking Materials Market Trends and Insights

Rising Road Network Expansion in Developing Economies

Government-funded Road building drives much of the incremental demand in the road marking materials market. India's transport blueprint earmarks USD 268.4 billion to add 30,600 km of new highways by 2032, with a wider goal of 200,000 km by 2037. Mega-projects of this scale require high-performance striping able to survive heavy axle loads, monsoon floods and desert heat. Similar funding surges across Southeast Asia and the Middle East channel multi-year volumes to suppliers capable of fast logistics and field technical support. Cross-border corridors also stimulate regional coordination on marking standards, nurturing opportunities for premium retro-reflective and thermoplastic lines that align with growing autonomous-vehicle readiness targets.

Escalating Global Road Safety & Visibility Regulations

Regulators continue to strengthen visibility criteria. The European Union Road Federation recommends 150 mm-wide lines with defined retro-reflection thresholds, while the US Federal Highway Administration enforces minimum retro-reflective values for centerlines and edgelines. Construction zones face even stricter orange marking rules that must remain conspicuous to LiDAR sensors. Parallel environmental statutes cap VOC content at 150 g/L in the United States, compelling manufacturers to migrate toward water-borne or high-solids chemistries. The combined safety-plus-sustainability pressure rewards suppliers with differentiated resin systems and advanced glass bead solutions that maintain night-time brightness without exceeding emission ceilings.

Stringent VOC & Micro-Plastic Emission Norms

The latest US amendments to aerosol-coating rules and Canada's 2023 VOC statute compel continuous reformulation, adding R&D cost and elongating regulatory approvals. Europe's forthcoming micro-plastic directive identifies traffic paint abrasion as an emergent pollutant, prompting calls for particulate-shedding life-cycle audits. While studies suggest road markings contribute below 0.07% of total microplastics, compliance pathways-such as encapsulated bead systems and accelerated wear testing-divert capital from new-product marketing toward documentation and certification.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Urbanization Boosting Vehicle-Density Management

- Machine-Readable Retro-Reflective Markings for AVs

- Petrochemical & Titanium Dioxide Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paints continue to anchor demand thanks to 61.72% share in 2024, especially in lower-traffic provincial roads where agencies prioritize first-cost savings. However, polymer systems are capturing incremental budgets, booking a 4.61% CAGR on the strength of methyl-methacrylate and durable pre-formed tapes. Water-borne acrylics see rising specification because they satisfy EPA's 150 g/L VOC cap without sacrificing drying speed. Conversely, solvent-rich chlorinated rubber paints retreat in North America and Europe under emission scrutiny, yet retain beachhead demand in hot, humid equatorial projects that require rapid moisture resistance.

Thermoplastic-by far the largest polymer sub-class-wins where life-cycle cost is scrutinized. Pourable MMA technologies, curing at ambient temperatures, now permit night-time application even in 0 °C conditions, avoiding costly lane closures. The outlook suggests polymer formulations will approach half of the road marking materials market by the mid-2030s if durability targets continue to tighten.

The Road Marking Materials Market Report is Segmented by Material Type (Polymer-Based Markings Including Thermoplastics, Cold Plastics, Pre-Formed Adhesive Tapes, Raised Pavement Markers; Paint-Based Markings Including Solvent-Based, Water-Based), Application (Road Markings, Car Park Markings, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 4.96% CAGR remains unchallenged through 2030. China's continuing freeway additions and India's 10% hike in highway budgets support multi-year procurement cycles. The climatic breadth-from Himalayan freeze zones to Thar Desert heat-incentivizes material diversification. North America, while mature, channels stimulus-funded resurfacing cash into compliant low-VOC lines and AV-ready patterns. EPA enforcement and Canada's 2023 VOC rules demand dual-formulation inventories for cross-border suppliers. Europe's micro-plastic debate pushes recyclate-rich paints and cradle-to-grave product passports; the region also advances AV lane trials in Germany and the Netherlands. Latin America and the Middle East post mid-single-digit growth anchored in urban ring-road builds and World Cup-driven stadium precinct upgrades, respectively.

- 3M

- Automark Industries Pvt. Ltd.

- Aximum

- BASF

- Berlac AG

- Crown USA, LLC

- Dow

- Geveko Markings

- Ingevity

- KANSAI HELIOS Slovenia Ltd.

- Kataline

- Kelly Bros

- NIPPON PAINT (M) SDN. BHD.

- PPG Industries, Inc.

- SealMaster

- SWARCO

- TATU Markings

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising road-network expansion in developing economies

- 4.2.2 Escalating global road-safety & visibility regulations

- 4.2.3 Rapid urbanisation boosting vehicle-density management

- 4.2.4 Machine-readable retro-reflective markings for AVs

- 4.2.5 Photoluminescent / solar-charged line-markings

- 4.3 Market Restraints

- 4.3.1 Stringent VOC & micro-plastic emission norms

- 4.3.2 Petrochemical & Titanium dioxide price volatility

- 4.3.3 Accelerated wear in extreme-climate zones

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Polymer-based Markings

- 5.1.1.1 Thermoplastics

- 5.1.1.2 Cold Plastics

- 5.1.1.3 Pre-formed Adhesive Tapes

- 5.1.1.4 Raised Pavement Markers

- 5.1.2 Paint-based Markings

- 5.1.2.1 Solvent-based

- 5.1.2.2 Water-based

- 5.1.1 Polymer-based Markings

- 5.2 By Application

- 5.2.1 Road Markings (Road and Highways)

- 5.2.2 Car Park Markings

- 5.2.3 Factory and Warehouse Markings

- 5.2.4 Airport Markings

- 5.2.5 Other Markings (Sports, Leisure, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Automark Industries Pvt. Ltd.

- 6.4.3 Aximum

- 6.4.4 BASF

- 6.4.5 Berlac AG

- 6.4.6 Crown USA, LLC

- 6.4.7 Dow

- 6.4.8 Geveko Markings

- 6.4.9 Ingevity

- 6.4.10 KANSAI HELIOS Slovenia Ltd.

- 6.4.11 Kataline

- 6.4.12 Kelly Bros

- 6.4.13 NIPPON PAINT (M) SDN. BHD.

- 6.4.14 PPG Industries, Inc.

- 6.4.15 SealMaster

- 6.4.16 SWARCO

- 6.4.17 TATU Markings

- 6.4.18 The Sherwin-Williams Company

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment