PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851623

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851623

China Electric Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

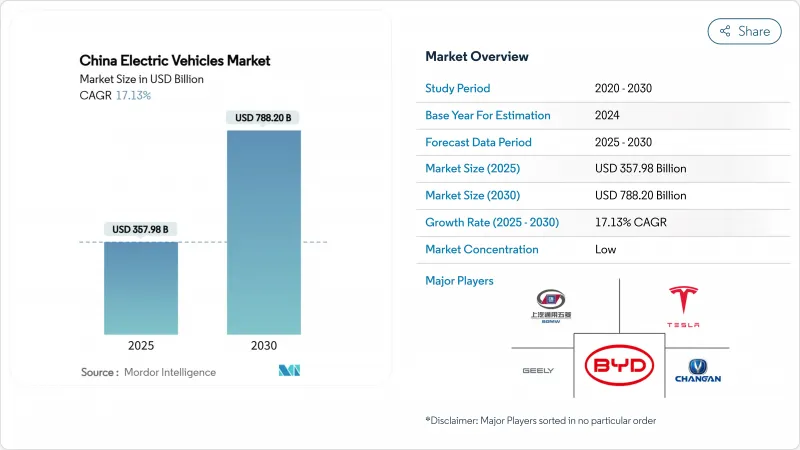

The China Electric Vehicles Market size is estimated at USD 357.98 billion in 2025, and is expected to reach USD 788.20 billion by 2030, at a CAGR of 17.13% during the forecast period (2025-2030).

Battery cost parity, a nationwide charging and battery-swap build-out, and tier-2/3 city PHEV momentum reinforce volume expansion. Automakers are also accelerating vertical integration and battery chemistry innovation to secure falling margins amid price wars. Infrastructure investment and cost-competitive LFP batteries position the Chinese electric vehicle market for further penetration into price-sensitive rural segments.

China Electric Vehicles Market Trends and Insights

Extended NEV Purchase-Tax Exemptions to 2027

Tax-free status worth USD 1,390-4,175 per vehicle cushions the post-subsidy transition and keeps entry-level pricing competitive. Tier-2/3 customers react strongly to this saving, and one-third of 2024 NEV sales leveraged the exemption plus trade-in incentives. Predictable policy horizons let automakers schedule capacity ramps and mid-cycle refreshes, particularly for mid-market crossovers driving the volume of China's electric vehicles.

Nationwide Fast-Charging & Battery-Swap Corridor Build-Out

Public charging points rose drastically over the past few years, while CATL and Sinopec are placing 500 battery-swap stations capable of two-minute exchanges. Highway coverage now spans 60% of service areas, and 57% of chargers remain clustered within 15 cities, signalling headroom in western provinces. The twin-track infrastructure strategy addresses commuter top-up needs and fleet uptime demands, underpinning confidence in the Chinese electric vehicle market.

Phase-Out of Central Subsidies Slowing Upgrade Cycles

The December 2022 subsidy sunset trimmed purchase incentives by RMB 1,670-2,780, elevating price sensitivity in mid-market sedans. Automakers countered with rebates and regional trade-in schemes, yet replacement intervals lengthened. As battery input costs drop, reliance on direct subsidies is expected to fade, restoring natural replacement rhythms within the Chinese electric vehicle market.

Other drivers and restraints analyzed in the detailed report include:

- PHEV Surge in Tier-2/3 Cities on Fuel-Savings Appeal

- Municipal E-Freight Quotas Boosting Electric LCV Demand

- Lithium-Carbonate Price & Export-Control Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery electric vehicles led 2024 deliveries with a 58.36% share, anchoring the China electric vehicle market size for that year. Plug-in hybrids, however, are forecast to post a 21.47% CAGR to 2030, narrowing the gap as infrastructure diffuses inland. Dual-fuel flexibility makes PHEVs the preferred bridge tech for drivers facing sparse chargers.

Continued BEV cost erosion keeps fully electric models appealing in subcompacts and taxi fleets, yet PHEV growth in family SUVs and rural sedans diversifies the powertrain mix. Manufacturers, therefore, hedge across architectures, while solid-state programs target the post-2030 premium BEV wave.

Passenger cars captured 88.25% of China's electric vehicle market share in 2024, but light commercial vans are rising on an 18.71% CAGR trajectory. Municipal zero-emission quotas, hub-and-spoke logistics, and battery-swap economics make electric LCVs a reliable fleet asset.

SUVs show 15.21% CAGR as consumers trade up for cabin space, and bus operators refresh diesel fleets under local low-emission mandates. Commercial adoption reinforces battery demand curves and broadens China's electric vehicle market size beyond private mobility.

The China Electric Vehicle Market Report is Segmented by Drivetrain Type (Battery Electric Vehicles, Plug-In Hybrid Electric Vehicles, and More), Vehicle Type (Passenger Cars [Hatchback and More] and Commercial Vehicles [Light Commercial Vehicles and More]), Battery Chemistry (LFP, NCM/NMC, and More), and Price Band (Less Than USD 10, 000 and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- BYD Company Ltd

- SAIC-GM-Wuling

- Tesla Inc.

- Geely Auto Group

- Changan Automobile

- Great Wall Motors

- BAIC Motor Corp.

- SAIC Motor Corp. Ltd.

- Dongfeng Motor Corp.

- FAW Group

- GAC Aion

- NIO Inc.

- Xpeng Motors

- Li Auto

- Leapmotor

- Hozon Auto (Neta)

- Zeekr Intelligent Tech.

- Seres Group

- Jiangling Motors Corp.

- JAC Motors

- Chery Automobile

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Extended NEV Purchase-Tax Exemptions to 2027

- 4.1.2 Nationwide Fast-Charging & Battery-Swap Corridor Build-Out

- 4.1.3 PHEV Surge in Tier-2/3 Cities on Fuel-Savings Appeal

- 4.1.4 Municipal E-Freight Quotas Boosting Electric LCV Demand

- 4.1.5 V2G Pilot Tariffs Enabling Vehicle-Grid Revenue Streams

- 4.1.6 LFP-Driven Cost Parity With Sub-Compact ICE Cars

- 4.2 Market Restraints

- 4.2.1 Phase-Out of Central Subsidies Slowing Upgrade Cycles

- 4.2.2 Lithium-Carbonate Price & Export-Control Volatility

- 4.2.3 Provincial Caps on Low-Utilisation Public Chargers

- 4.2.4 Rising NEV Quality Issues (JD Power IQS) Denting Loyalty

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Battery-Chemistry Trends

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2024-2030)

- 5.1 By Drivetrain Type

- 5.1.1 Battery Electric Vehicles

- 5.1.2 Plug-in Hybrid Electric Vehicles

- 5.1.3 Fuel-cell Electric Vehicles

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.1.1 Hatchback

- 5.2.1.2 Sedan

- 5.2.1.3 SUV

- 5.2.1.4 MPV

- 5.2.2 Commercial Vehicles

- 5.2.2.1 Light Commercial Vehicles

- 5.2.2.2 Buses & Coaches

- 5.2.2.3 Medium & Heavy Trucks

- 5.2.1 Passenger Cars

- 5.3 By Battery Chemistry

- 5.3.1 LFP

- 5.3.2 NCM/NMC

- 5.3.3 NCA

- 5.3.4 Others

- 5.4 By Price Band

- 5.4.1 Less than USD 10,000

- 5.4.2 USD 10,000 - 20,000

- 5.4.3 USD 20,000 - 30,000

- 5.4.4 USD 30,000 - 50,000

- 5.4.5 Over USD 50,000

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.3.1 BYD Company Ltd

- 6.3.2 SAIC-GM-Wuling

- 6.3.3 Tesla Inc.

- 6.3.4 Geely Auto Group

- 6.3.5 Changan Automobile

- 6.3.6 Great Wall Motors

- 6.3.7 BAIC Motor Corp.

- 6.3.8 SAIC Motor Corp. Ltd.

- 6.3.9 Dongfeng Motor Corp.

- 6.3.10 FAW Group

- 6.3.11 GAC Aion

- 6.3.12 NIO Inc.

- 6.3.13 Xpeng Motors

- 6.3.14 Li Auto

- 6.3.15 Leapmotor

- 6.3.16 Hozon Auto (Neta)

- 6.3.17 Zeekr Intelligent Tech.

- 6.3.18 Seres Group

- 6.3.19 Jiangling Motors Corp.

- 6.3.20 JAC Motors

- 6.3.21 Chery Automobile

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment