PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851707

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851707

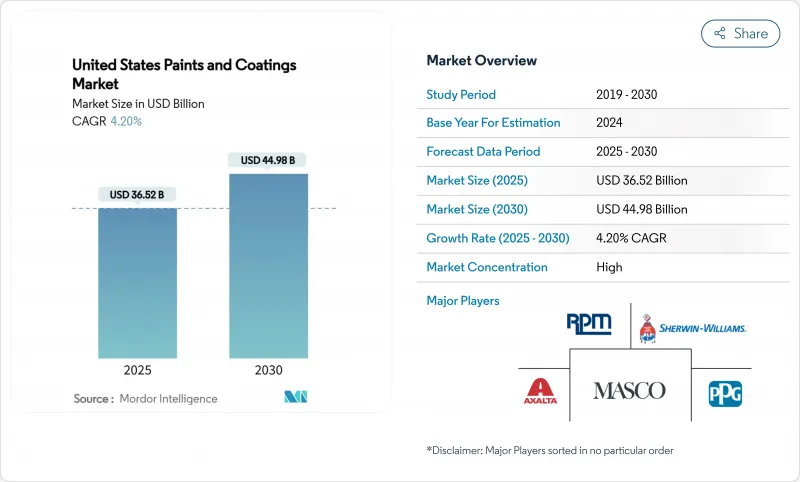

United States Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States Paints And Coatings Market size is estimated at USD 36.52 billion in 2025, and is expected to reach USD 44.98 billion by 2030, at a CAGR of 4.20% during the forecast period (2025-2030).

The current expansion rests on the sustained strength of architectural repaint activity, the sharp pivot toward waterborne formulations, and a federal infrastructure wave lifting volumes of protective products. Underlying demand is reinforced by population migration to the Sun Belt, manufacturing reshoring in the Southeast, and a steady rise in e-commerce paint sales. Producers also benefit from near-term pricing power as volatile titanium-dioxide costs and tight labor conditions make price increases stick. Competitive intensity, however, is heightening as private-equity backed consolidators apply a buy-and-build playbook while large incumbents prune portfolios to favor higher-margin industrial niches.

United States Paints And Coatings Market Trends and Insights

Federal Infrastructure Investment and Jobs Act

The IIJA has funded more than 40,000 bridge and roadway projects, lifting highway and street spending by 36% since its adoption. High-performance epoxy, polyaspartic, and zinc-rich primers benefit because DOT specifications prioritize corrosion protection over lowest-bid paint systems. Specifications for NSF-certified linings in water projects are expanding alongside a 62% federal outlay jump in drinking-water infrastructure. Transportation construction is projected to climb another 8% in 2025, creating a visible two-year order pipeline for protective-coatings applicators. Inflation is absorbing a portion of allocated funds, tempering volume upside, yet price-mix remains positive as agencies specify longer-life systems. Labor availability is the main gating factor, prolonging project schedules and stretching consumption over more calendar quarters.

Home Remodeling Boom

Residential repaint volumes have offset softness in new-build housing thanks to a "lock-in" effect that encourages owners with sub-3% mortgages to renovate rather than relocate. Sherwin-Williams reported high-single-digit growth in repaint categories through 2024. Millennials forming first-time households and baby boomers retrofitting aging homes underpin sustained gallonage. Digital color tools and next-day delivery have expanded the addressable DIY audience, while pro painters use mobile ordering to cut store trips. Remodel demand is inherently discretionary, yet demographic fundamentals and an aging housing stock provide resilience through economic cycles.

Volatile TiO2 Pricing

TiO2 constitutes up to 50% of a white architectural coating's raw-material cost, exposing formulators. Margins compressed during the 2024 summer spike, prompting Nippon Paint and others to announce up to 9% price rises for 2025 contracts. Larger players hedge through multi-year supply deals and pigment-extension technology, while smaller producers risk inventory losses. R&D is intensifying around opacity-optimized resin systems and nanoparticle dispersions that lower TiO2 loading without sacrificing hide, yet widespread commercial scale is still three to four years away.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Powder and UV-Curable Coatings

- Manufacturing Reshoring

- Shortage of Skilled Industrial Painters

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic chemistries generated the largest slice of 2024 revenue at 35% because they balance hardness and flexibility across both wall paints and maintenance finishes. End-users appreciate low-temperature film formation and odor reduction in next-generation waterborne acrylics. The polyurethane cohort is advancing at a 5.10% CAGR as automakers and floor-coating specifiers adopt two-component water-borne versions that rival solvent-borne durability. Formulators capitalize on aliphatic isocyanate advances that resist yellowing under harsh UV. Alkyds are losing share yet still serve quick-dry metal primers and cost-sensitive contractor markets. Polyester resins are carving powder-coating niches on fencing and HVAC panels. Specialty hybrid systems fetch higher margins, allowing mid-size producers to defend pricing against bulk commodity acrylic suppliers. Over the forecast horizon, the US paints and coatings market will see polyurethane chip away at acrylic leadership in industrial and automotive uses, although acrylic will stay dominant in consumer and builder channels.

Water-borne systems held 67% of 2024 sales, reflecting regulatory and consumer momentum. Continuous advances in rheology modifiers and coalescent-free binders have closed historical performance gaps versus solvent alternatives, driving above-trend growth as the US paints and coatings market shifts toward greener options. Powder technology is gaining share in appliances, metal furniture, and automotive wheels thanks to zero-VOC credentials and reclaimable overspray. Solvent-borne platforms remain essential in select heavy-duty and marine settings where cure conditions are severe, but successive air-quality rules will keep eroding their share. Hybrid powder-liquid lines are emerging in job-coat shops that need color flexibility and high film build capabilities. Collectively, these shifts are reshaping the technology mix and fueling investment in cure-energy modeling, powder spray robots, and LED-UV lamp systems.

The United States Paints and Coatings Market Report Segments the Industry by Resin Type (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, and Other Resin Types), Technology (Water-Borne, Solvent-Borne, Powder Coating, and UV Technology), Distribution Channel (Company-Owned Stores, Independent Paint Dealers, and More), and End-User Industry (Architectural, Automotive, Wood, Protective Coatings, General Industrial, and More).

List of Companies Covered in this Report:

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- BASF

- Beckers Group

- Benjamin Moore & Co.

- Carboline

- Diamond Vogel

- Dunn-Edwards Corporation

- Hempel A/S

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- Parker Hannifin

- PPG Industries, Inc.

- RPM International Inc.

- Rust-Oleum Corporation

- Sika AG

- The Sherwin-Williams Company

- Tnemec

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Federal Infrastructure Investment and Jobs Act Catalyzing Bridge and Highway Coatings Demand

- 4.2.2 Home Remodeling Boom Elevating DIY Architectural Paint Volumes

- 4.2.3 Shift to Powder and UV-Curable Coatings to Meet U.S. Air-Emission Standards

- 4.2.4 Manufacturing Reshoring Spurring Industrial Coatings Demand in U.S. Southeast

- 4.2.5 Growth in the Automotive Sector

- 4.3 Market Restraints

- 4.3.1 Volatile TiO2 Pricing Compressing Producer Margins

- 4.3.2 Shortage of Skilled Industrial Painters Delaying Project Completions

- 4.3.3 Freight-Cost Inflation Disrupting Paint-Retailer Inventory Cycles

- 4.3.4 Shift to PVC and Composite Siding Reducing Exterior Paint Consumption

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Industry Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Polyester

- 5.1.6 Other Resin Types

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV technology

- 5.3 By Distribution Channel

- 5.3.1 Company-Owned Stores

- 5.3.2 Independent Paint Dealers

- 5.3.3 Big-Box Retailers and Home Centers

- 5.3.4 Direct to Industrial OEM

- 5.3.5 E-Commerce

- 5.4 By End-user Industry

- 5.4.1 Architectural

- 5.4.2 Automotive

- 5.4.3 Wood

- 5.4.4 Protective Coatings

- 5.4.5 General Industrial

- 5.4.6 Transportation

- 5.4.7 Packaging

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems, LLC

- 6.4.3 BASF

- 6.4.4 Beckers Group

- 6.4.5 Benjamin Moore & Co.

- 6.4.6 Carboline

- 6.4.7 Diamond Vogel

- 6.4.8 Dunn-Edwards Corporation

- 6.4.9 Hempel A/S

- 6.4.10 Masco Corporation

- 6.4.11 Nippon Paint Holdings Co., Ltd.

- 6.4.12 Parker Hannifin

- 6.4.13 PPG Industries, Inc.

- 6.4.14 RPM International Inc.

- 6.4.15 Rust-Oleum Corporation

- 6.4.16 Sika AG

- 6.4.17 The Sherwin-Williams Company

- 6.4.18 Tnemec

- 6.4.19 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Self-Healing Protective Coatings for Offshore Wind Infrastructure