PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851754

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851754

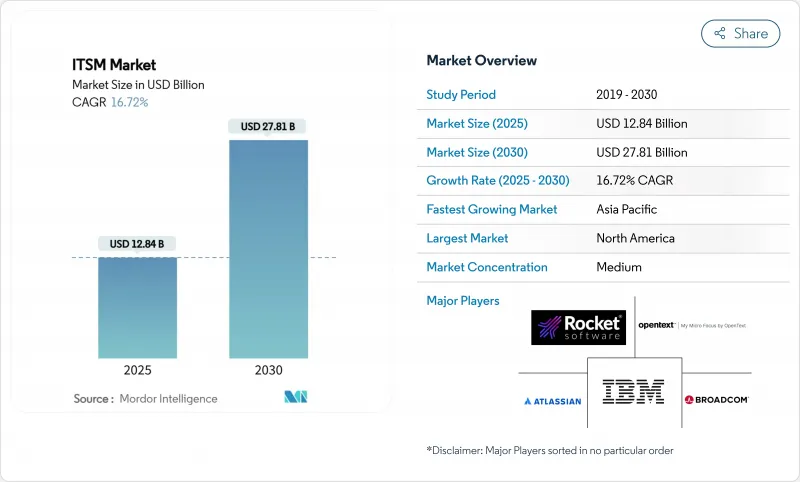

ITSM - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The IT service management market was valued at USD 12.84 billion in 2025 and is forecast to grow to USD 27.81 billion by 2030, reflecting a 16.72% CAGR.

The acceleration stems from three forces: rapid enterprise adoption of AI-driven automation, the migration to cloud-native architectures, and the need for unified management across hybrid and multicloud estates. Enterprises are also embracing low-code orchestration to offset skills shortages, while FinOps and GreenOps reporting embed sustainability and cost-control metrics directly into IT workflows. Edge-computing and 5G onboarding further expands the scope of the IT service management market as distributed devices require real-time support.

Global ITSM Market Trends and Insights

Shift to Cloud-Native ITSM Platforms

Cloud-native adoption removes the USD 40,000 annual maintenance burden linked to legacy systems, freeing budgets for innovation. Strategic alliances with hyperscalers enable elastic compute for AI features, driving 19% year-over-year subscription growth in Q1 2025. Migrating manufacturers cut support times from 30 minutes to 6 minutes, highlighting productivity gains. Early adopters gain cost and speed advantages, making cloud-native capability a baseline requirement across the IT service management market.

AI-Driven Service Automation and AIOps Integration

ServiceNow recorded 150% quarter-over-quarter growth in AI deals and surpassed 1,000 AI customers in 2025 ServiceNow. AIOps shortens mean time to resolution by up to 60%, reducing ticket backlogs. IBM's generative AI revenue reached USD 6 billion in 2025, underscoring enterprise appetite for autonomous operations.Vendors embedding conversational interfaces further democratize access, altering buyer expectations and sharpening competitive differentiation.

Legacy Migration Complexity and High Switching Cost

Enterprises devote USD 40,000 annually per legacy system and lose 17 hours a week to maintenance tasks.Security vulnerabilities heighten risk, yet phased migrations that safeguard data deliver up to 277% ROI post-transition. The expense forms a barrier, preserving incumbent vendor positions, but organizations that modernize enjoy significant efficiency gains.

Other drivers and restraints analyzed in the detailed report include:

- Unified Management for Hybrid/Multicloud Estates

- Low-Code/No-Code Orchestration Enabling Citizen ITSM

- Shortage of Skilled ITSM and ITOM Professionals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployments accounted for 64.8% of the IT service management market in 2024 and are projected to grow at 18.3% CAGR to 2030. Organizations select cloud to access AI functions and manage global operations without capital outlays. On-premise remains essential for data-sovereign environments such as defense. Real-world cases such as Microsoft migrating internal ServiceNow instances to Azure show cloud's role in scaling innovation.

Cloud also aligns with multicloud realities because it offers pre-built integrations. ServiceNow's strategic collaboration with AWS covers AI-powered applications across diverse industries and illustrates the momentum. Consequently, cloud is becoming the default path to modern IT service management market capabilities.

Service Desk and Incident Management retained 35.3% share in 2024 as the foundational gateway to IT support. Configuration and Asset Management, fueled by asset discovery needs, will expand at 17.9% CAGR. A combined platform approach that unifies discovery, dependency mapping, and incident workflows changes budget priorities. The IT service management market size for Configuration and Asset Management is forecast to double between 2025 and 2030.

AI further elevates every application. ServiceNow's AI Agent Orchestrator demonstrates multiple autonomous agents collaborating on ticket resolution to cut manual toil. Change, Release, Network, and Database Management segments climb steadily because DevOps and hybrid architectures demand integrated visibility.

IT Service Management Market Report is Segmented by Deployment (Cloud, On-Premises), Application (Service Desk and Incident Management, Configuration and Asset Management, and More), End-User Industry (BFSI, Manufacturing, IT and Telecommunications, and More), Enterprise Size (Large Enterprises, Smes), Service Type (Solutions, Services), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains leadership with 37.2% of 2024 revenue and an entrenched install base among enterprises and the public sector. Recent federal contracts surpass USD 1 million each, underscoring continued platform upgrades. Regional focus is shifting from first-time deployments toward advanced AI and cross-domain observability.

Asia-Pacific is the fastest-growing region. Managed services demand surged 32% in 2025 as companies outsource ITSM to stay agile. Chinese manufacturers and banks digitize operations at scale, while Japan's Mitsubishi UFJ Bank recorded 2,200 hours saved annually through its 2025 ServiceNow rollout. India's domestic demand strengthens alongside its global outsourcing leadership.

Europe, South America, Middle East, and Africa illustrate diverse opportunities. European enterprises need ITSM solutions that respect stringent data-protection laws and upcoming AI governance frameworks. Sustainability reporting brightens prospects for FinOps and GreenOps modules. Latin American adoption accelerates through cloud uptake, whereas GCC states invest in ITSM for smart-city initiatives. African telco and government segments form an early-stage but promising arena for affordable, cloud-based platforms.

- ServiceNow Inc.

- IBM Corporation

- BMC Software Inc.

- Atlassian Corporation PLC

- Broadcom Inc. (CA Technologies)

- Micro Focus International PLC

- Ivanti Inc.

- Freshworks Inc.

- ASG Technologies Group Inc.

- Axios Systems

- ManageEngine (Zoho Corp.)

- SolarWinds Corp.

- EasyVista SA

- USU Software AG

- SysAid Technologies Ltd.

- Cherwell (Ivanti)

- TOPdesk BV

- Hornbill Service Management Ltd.

- SymphonyAI Summit

- 4me Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift to cloud-native ITSM platforms

- 4.2.2 AI-driven service automation and AIOps integration

- 4.2.3 Unified management for hybrid / multicloud estates

- 4.2.4 Low-code / no-code orchestration enabling citizen ITSM

- 4.2.5 FinOps and GreenOps reporting embedded in ITSM

- 4.2.6 Edge-computing and 5G operations onboarding to ITSM

- 4.3 Market Restraints

- 4.3.1 Legacy migration complexity and high switching cost

- 4.3.2 Shortage of skilled ITSM and ITOM professionals

- 4.3.3 Emerging AI-governance and data-residency regulations

- 4.3.4 Rising observability-data costs causing tool sprawl

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By Application

- 5.2.1 Service Desk and Incident Management

- 5.2.2 Configuration and Asset Management

- 5.2.3 Change and Release Management

- 5.2.4 Network and Database Management

- 5.2.5 Others

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Manufacturing

- 5.3.3 Government and Education

- 5.3.4 IT and Telecommunications

- 5.3.5 Retail and E-commerce

- 5.3.6 Healthcare

- 5.3.7 Travel and Hospitality

- 5.3.8 Other Industries

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Mid-size Enterprises (SME)

- 5.5 By Service Type

- 5.5.1 Solutions (Platform/Software)

- 5.5.2 Services (Implementation, Managed, Training)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Southeast Asia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.5.2.5 Egypt

- 5.6.5.2.6 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ServiceNow Inc.

- 6.4.2 IBM Corporation

- 6.4.3 BMC Software Inc.

- 6.4.4 Atlassian Corporation PLC

- 6.4.5 Broadcom Inc. (CA Technologies)

- 6.4.6 Micro Focus International PLC

- 6.4.7 Ivanti Inc.

- 6.4.8 Freshworks Inc.

- 6.4.9 ASG Technologies Group Inc.

- 6.4.10 Axios Systems

- 6.4.11 ManageEngine (Zoho Corp.)

- 6.4.12 SolarWinds Corp.

- 6.4.13 EasyVista SA

- 6.4.14 USU Software AG

- 6.4.15 SysAid Technologies Ltd.

- 6.4.16 Cherwell (Ivanti)

- 6.4.17 TOPdesk BV

- 6.4.18 Hornbill Service Management Ltd.

- 6.4.19 SymphonyAI Summit

- 6.4.20 4me Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment