PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851816

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851816

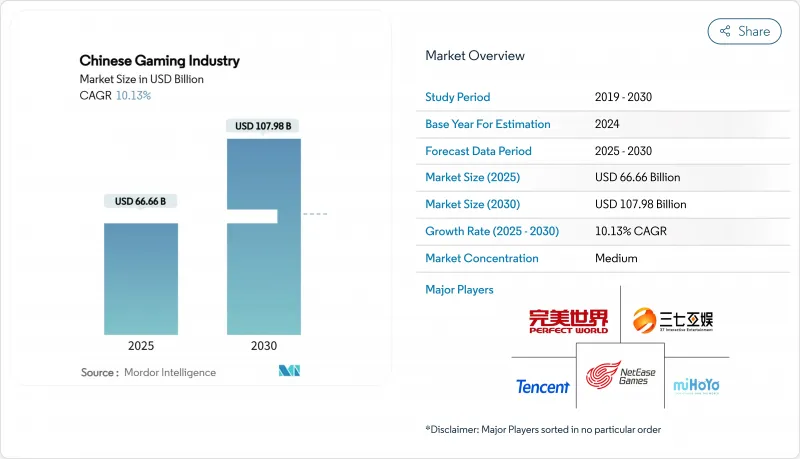

Chinese Gaming Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Chinese gaming market size is estimated at USD 66.66 billion in 2025 and is on course to reach USD 107.98 billion by 2030, advancing at a 10.13% CAGR over 2025-2030.

Strong domestic demand, rising 5G penetration and steady regulatory relaxation underpin the expansion. Mobile titles dominate spending, yet console releases are accelerating as consumers seek premium, story-driven experiences. Digital yuan pilots lower payment friction and open fresh monetization routes, while local studios leverage Chinese mythology to build globally resonant intellectual property. Esports sponsorships, especially from fast-moving consumer-goods brands, deepen engagement and diversify revenue. Meanwhile, international sales grow in double digits as leading publishers launch culturally adapted content abroad.

Chinese Gaming Industry Market Trends and Insights

5G rollout boosting low-latency play

China finished 2024 with more than 800 million 5G connections, representing 45% of all mobile lines. Ultra-low latency now supports competitive shooters and real-time multiplayer titles that previously required PC-grade networks. Operators project that 5G will add USD 260 billion to national GDP by 2030, widening disposable-income pools for game spending. The anticipated quadrupling of mobile data traffic further encourages developers to introduce console-quality graphics on smartphones. Cloud-rendering partnerships, such as miHoYo's investment in Well-Link Technologies, help overcome device limits and broaden the addressable user base.

Esports sponsorship surge

The domestic esports scene moved into mainstream advertising portfolios after Edward Gaming generated USD 690,000 from Valorant weapon skins alone Esports Advocate. Brands targeting affluent Gen-Z consumers view tournament streams as cost-effective media with high conversion. China's dedicated VALORANT Champions Tour league, launched in 2024 with ten partner teams, underlines institutional support Esports Insider. Winning the 2024 world championship elevated local teams' profile internationally, drawing fresh sponsors from beverages, apparel and personal electronics.

Quota-based content approvals

The National Press and Publication Administration restricts monthly license grants, pushing back release calendars for both domestic and foreign developers. Sudden halts in late 2023 unsettled publisher confidence and disclosed the need for clearer timelines. Foreign studios now depend on local partners to adjust plotlines, rename characters and reveal loot-box odds. The uncertainty trims about 1.6 percentage points from the growth trajectory of the Chinese gaming market.

Other drivers and restraints analyzed in the detailed report include:

- Digital Yuan in micro-payments

- Cultural IP exports driving overseas adoption

- Cloud-service GPU shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mobile software generated CNY 238.2 billion (USD 32.7 billion) in 2024, equal to 68% of the Chinese gaming market size. Affordable 5G plans, wide handset ownership and curated app stores keep engagement high, while live-operations tailored to national holidays extend play cycles. Nonetheless, user-acquisition costs continue to rise, prompting studios to experiment with cross-play ecosystems that blend mobile, PC and console access. Console revenues remain smaller but are projected to move at a 14% CAGR through 2030, the fastest of any platform category. Relaxed hardware import duties and cloud streaming lower entry barriers, and households with growing disposable incomes view consoles as shared entertainment centers. The diverging trends suggest that consoles will whittle down mobile's dominance, yet the Chinese gaming market will stay mobile-first through the decade.

Growth in console adoption is reshaping content strategies. Premium launches now receive simultaneous PC ports to maximize audience, and publishers bundle exclusive skins to reward early adopters. Cloud-based trials let undecided players sample high-fidelity experiences without upfront hardware costs, supporting broader conversion funnels. Retailers in Shanghai and Guangzhou report higher foot traffic for next-generation devices during shopping festivals, confirming a gradual but steady shift toward living-room play.

Free-to-play titles held 54% of the Chinese gaming market share in 2024 as evergreen hits refined season-pass and cosmetic-item rotations. Yet policymakers' scrutiny of gacha mechanics and a maturing audience's appetite for complete experiences encourage alternative billing formats. Subscription passes bundle legacy libraries with day-one releases and offer cross-device cloud saves, delivering perceived value against unpredictable micro-transaction spend. Market estimates signal a mid-twenties CAGR for subscription revenue, well above overall sector growth, positioning it as a credible challenger to ad-supported and free-to-play models.

Publishers also revisit buy-to-play pricing, especially for story-driven action adventures that showcase domestic folklore. Integration with the digital yuan reduces payment friction and supports tiered pricing for deluxe editions, making premium content accessible to a wider income spectrum. Smaller teams experimenting with one-off price tags benefit from predictable cash flow, while larger firms fold subscription perks into loyalty ecosystems spanning video, music and social communities.

The Chinese Gaming Market is Segmented by Platform (Cloud Gaming, Games, Console Games, Mobile Games and More), Revenue Model (Free-To-Play (F2P), Pay-To-Play / Premium and More), Genre (Action/Adventure, Shooter & Battle Royale and More) and Player Age Group (<18 Years, 18-35 Years and More). The Market Forecasts are Provided in Terms of Value (USD)

List of Companies Covered in this Report:

- Tencent Holdings Ltd.

- NetEase Inc.

- Shanghai miHoYo Network Technology Co. Ltd.

- Perfect World Co. Ltd.

- 37 Interactive Entertainment

- Lilith Games

- Kingsoft Corporation (Seasun)

- Giant Network Group Co. Ltd.

- Beijing Kunlun Tech Co. Ltd.

- Shanda Games

- Yoozoo Games

- FunPlus International

- TapTap (XD Inc.)

- CMGE Technology Group Ltd.

- iDreamSky Technology Holdings

- G-bits Network Technology

- Shanghai Moonton Technology

- Nuverse (ByteDance)

- Bilibili Inc.

- NetDragon Websoft Holdings

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Expansion of 5G Infrastructure Enabling Low-Latency Mobile Gaming

- 4.2.2 Escalating Esports Sponsorship Spending by Chinese Consumer-Goods Brands

- 4.2.3 Government-Backed Digital Yuan Pilots Powering In-Game Micro-Payments

- 4.2.4 Tier-3 and Below City Broadband Roll-outs Unlocking New Gamer Cohorts

- 4.2.5 Cross-Border IP Licensing Deals Boosting AAA Title Imports

- 4.3 Market Restraints

- 4.3.1 Quota-Based Content Censorship Causing Launch Delays for Foreign Titles

- 4.3.2 Cloud-Service GPU Shortages During Peak Seasons

- 4.3.3 Intensifying Talent Poaching Driving Up Game-Engineer Salaries

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Gaming Platform

- 5.1.1 Mobile Games

- 5.1.2 PC Games (Downloaded/Box and Browser)

- 5.1.3 Console Games

- 5.1.4 Cloud Gaming

- 5.1.5 VR/AR Gaming

- 5.2 By Revenue Model

- 5.2.1 Free-to-Play (F2P)

- 5.2.2 Pay-to-Play / Premium

- 5.2.3 Subscription and Game-Pass

- 5.3 By Genre

- 5.3.1 Action/Adventure

- 5.3.2 Shooter and Battle Royale

- 5.3.3 Role-Playing (RPG/MMORPG)

- 5.3.4 Sports and Racing

- 5.3.5 Others

- 5.4 By Player Age Group

- 5.4.1 <18 Years

- 5.4.2 18-35 Years

- 5.4.3 36-50 Years

- 5.4.4 >50 Years

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Tencent Holdings Ltd.

- 6.3.2 NetEase Inc.

- 6.3.3 Shanghai miHoYo Network Technology Co. Ltd.

- 6.3.4 Perfect World Co. Ltd.

- 6.3.5 37 Interactive Entertainment

- 6.3.6 Lilith Games

- 6.3.7 Kingsoft Corporation (Seasun)

- 6.3.8 Giant Network Group Co. Ltd.

- 6.3.9 Beijing Kunlun Tech Co. Ltd.

- 6.3.10 Shanda Games

- 6.3.11 Yoozoo Games

- 6.3.12 FunPlus International

- 6.3.13 TapTap (XD Inc.)

- 6.3.14 CMGE Technology Group Ltd.

- 6.3.15 iDreamSky Technology Holdings

- 6.3.16 G-bits Network Technology

- 6.3.17 Shanghai Moonton Technology

- 6.3.18 Nuverse (ByteDance)

- 6.3.19 Bilibili Inc.

- 6.3.20 NetDragon Websoft Holdings

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment