PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851837

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851837

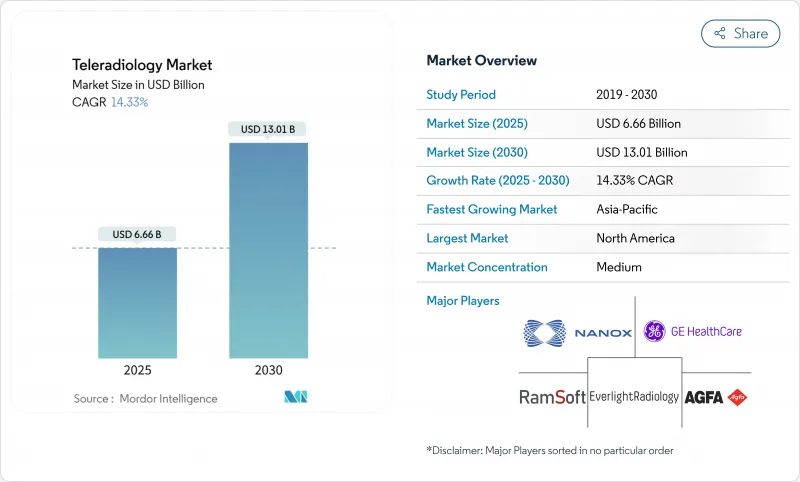

Teleradiology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Teleradiology Market size is estimated at USD 6.66 billion in 2025, and is expected to reach USD 13.01 billion by 2030, at a CAGR of 14.33% during the forecast period (2025-2030).

The surge aligns with widening radiologist shortages, rapid broadband expansion, and cloud-first imaging platforms that convert once-optional remote reading into a core clinical utility. Workforce gaps-expected to leave the United Kingdom 40% short of radiologists by 2028-mirror similar deficits across OECD members and keep remote diagnostics in permanent demand. At the same time, radiology volumes continue to climb as aging populations require more cross-sectional imaging, driving health systems toward outsourced overnight coverage and subspecialty reads. AI-enabled triage and zero-footprint viewers reduce turnaround time and capital outlays, attracting providers seeking flexible growth. Consolidation is accelerating: ONRAD's January 2025 purchase of Direct Radiology created a scaled platform serving 550 sites and signalled to investors that teleradiology has moved from a fragmented service to a strategic infrastructure layer.

Global Teleradiology Market Trends and Insights

Shortage of Radiologists in OECD Countries

Demand for imaging is climbing 27% over three decades, yet radiologist headcount growth is flat, leaving hospitals without round-the-clock coverage, especially in neurology, musculoskeletal, and cardiothoracic subspecialties. Remote reading fills both geographic and temporal gaps, supports emergency departments, and appeals to younger physicians who prioritize flexible schedules. Rural and underserved regions, in particular, rely on remote diagnostics because running an in-house radiology department is cost-prohibitive. The structural nature of the shortage ensures long-term demand for teleradiology services.

Rising Global Diagnostic-Imaging Volumes

Projected 2055 modality growth-CT 25.1%, nuclear medicine 26.9%, X-ray 17.8%, ultrasound 17.3%, MRI 16.9%-adds pressure on health systems already grappling with staffing constraints. Chronic diseases, aging demographics, and expanded screening initiatives drive the volume uptick. Teleradiology allows facilities to absorb workload spikes without proportional payroll growth and ensures subspecialists interpret complex cases without patients travelling to tertiary centers.

Cyber-Security & Data-Sovereignty Concerns

In 2024, 88% of healthcare entities reported a breach, affecting 106 million Americans. Legacy PACS lack modern safeguards, and ransomware has caused downtimes exceeding a month and losses above USD 63 million. Strict frameworks such as GDPR elevate compliance costs for cross-border reads, prompting buyers to vet vendor security posture rigorously and favor partners offering cyber-insurance and sovereign-cloud deployment options.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of 5G & Satellite Broadband Connectivity

- AI-Enabled Work-List Triage Boosting Reading Capacity

- Multi-State Licensure and Credentialing Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software solutions generated 40.54% of 2024 revenue, a position underpinned by subscription models that cut capital outlays and provide automatic upgrades. These cloud platforms integrate AI modules, zero-footprint viewers, and vendor-neutral archives that clinicians can reach on any device. GE HealthCare's Genesis portfolio exemplifies this move toward elastic infrastructure that synchronizes multisite workflows. Hardware, representing on-premise servers, high-resolution workstations, and network equipment, is set to post the briskest 15.23% CAGR as 5G gateways and edge devices proliferate and as rural hospitals add satellite receivers to link with metropolitan reading hubs. Service contracts keep expanding as outsourcing becomes mainstream, but the teleradiology market size for services scales steadily rather than explosively because buyers blend vendor assistance with in-house IT teams.

The software wave creates cost savings near 30% by eliminating data-center maintenance and unlocking pay-as-you-go scalability. Vendors differentiate by embedding AI orchestration that routes studies based on priority and subspecialty, reducing idle time and failed handoffs. Hybrid cloud-edge designs ensure image pre-processing happens locally, then the study transfers securely to public clouds for AI inference, an architecture that satisfies privacy obligations while preserving bandwidth. As a result, facilities across mid-income countries can spin up full-featured imaging solutions without multimillion-dollar infrastructure, widening the addressable teleradiology market.

The Teleradiology Market Report is Segmented by Component (Hardware, Software, Services), Imaging Technique (X-Ray, Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, Nuclear Imaging, and More), End User (Hospitals, Diagnostic Imaging Centers, Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 38.83% revenue in 2024 on the back of Medicare coverage, robust fiber networks, and established malpractice frameworks that reassure buyers. However, looming 3-4% Medicare fee cuts in 2025 pressure hospital margins, prompting administrators to accelerate cost-saving remote reads. Private equity remains active: RadNet's USD 103 million iCAD acquisition augmented its AI breast-imaging toolkit, reinforcing scale advantages. Canada and Mexico adopt cross-border teleradiology for night coverage, leveraging bilingual radiologists to smooth regional workflow.

Asia-Pacific is forecast for a 16.16% CAGR, the highest worldwide. Government programs in China and India subsidize PACS rollouts and broadband to primary health centers, while middle-class growth fuels demand for high-resolution MRI and CT. Investments in AI for MedTech are projected to hit USD 250 million by 2028, and companies such as RamSoft have planted regional hubs to serve multilingual clients. Australia's I-Med Radiology Network, valued near USD 2 billion, showcases investor appetite for regional consolidation.

Europe maintains steady momentum as 84% of EU members already employ teleradiology in some form. Yet data-sovereignty rules and union resistance temper velocity. The United Kingdom's Hexarad-backed by EUR 13 million in growth funding-adds over 200 radiologists to its roster, illustrating how platform plays can thrive even in regulated environments. Germany's outpatient clinics show positive attitudes, with 79.2% of referring physicians rating remote reading favorably, pointing to unmet demand in rural districts.

- GE Healthcare

- Koninklijke Philips

- Siemens Healthineers

- Agfa-Gevaert

- FUJIFILM

- Everlight Radiology

- Virtual Radiologic (vRad / Mednax)

- ONRAD Inc.

- Teleradiology Solutions

- Nanox Imaging (USARAD)

- 4ways Healthcare

- Ram Soft

- Carestream Health

- StatRad (NucleusHealth)

- Telemedicine Clinic (Unilabs)

- Vision Radiology

- Doctor-Net Inc.

- Ambra Health

- Sectra

- RadNet Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shortage of Radiologists in OECD Countries

- 4.2.2 Rising Global Diagnostic-Imaging Volumes

- 4.2.3 Expansion of 5G & Satellite Broadband Connectivity

- 4.2.4 AI-Enabled Work-List Triage Boosting Reading Capacity

- 4.2.5 Overnight "Follow-The-Sun" Service Outsourcing

- 4.2.6 Cloud-Native Zero-Footprint Viewers Reducing CAPEX

- 4.3 Market Restraints

- 4.3.1 Cyber-Security & Data-Sovereignty Concerns

- 4.3.2 Multi-State Licensure and Credentialing Hurdles

- 4.3.3 Satellite-Link Latency in Remote Areas

- 4.3.4 Organized Radiologist-Union Pushback in Europe

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Imaging Technique

- 5.2.1 X-ray

- 5.2.2 Computed Tomography (CT)

- 5.2.3 Magnetic Resonance Imaging (MRI)

- 5.2.4 Ultrasound

- 5.2.5 Nuclear Imaging

- 5.2.6 Mammography

- 5.2.7 Other Techniques

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Diagnostic Imaging Centers

- 5.3.3 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 GE HealthCare

- 6.3.2 Koninklijke Philips N.V.

- 6.3.3 Siemens Healthineers

- 6.3.4 Agfa-Gevaert Group

- 6.3.5 Fujifilm Holdings

- 6.3.6 Everlight Radiology

- 6.3.7 Virtual Radiologic (vRad / Mednax)

- 6.3.8 ONRAD Inc.

- 6.3.9 Teleradiology Solutions

- 6.3.10 Nanox Imaging (USARAD)

- 6.3.11 4ways Healthcare Ltd

- 6.3.12 RamSoft Inc.

- 6.3.13 Carestream Health

- 6.3.14 StatRad (NucleusHealth)

- 6.3.15 Telemedicine Clinic (Unilabs)

- 6.3.16 Vision Radiology

- 6.3.17 Doctor-Net Inc.

- 6.3.18 Ambra Health

- 6.3.19 Sectra AB

- 6.3.20 RadNet Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment