PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910629

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910629

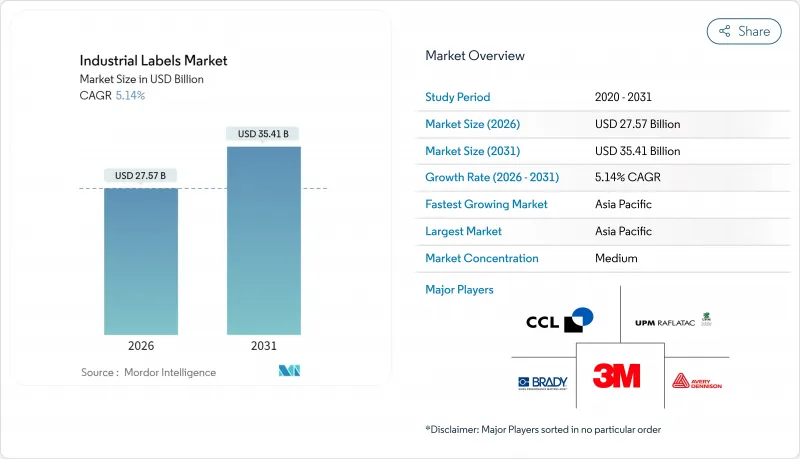

Industrial Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The industrial labels market was valued at USD 26.22 billion in 2025 and estimated to grow from USD 27.57 billion in 2026 to reach USD 35.41 billion by 2031, at a CAGR of 5.14% during the forecast period (2026-2031).

This growth momentum underscores sustained demand for reliable product identification, traceability, and safety communication as regulations tighten and digital manufacturing expands. New compliance mandates, rapid e-commerce fulfillment, and accelerating adoption of digital and smart printing technologies are reshaping cost structures and competitive strategies across converters, raw-material suppliers, and equipment manufacturers. The industrial labels market benefits from rising investment in factory automation and logistics visibility, yet pricing volatility for polymers and adhesives and stricter VOC limits continue to pressure margins. Overall, the sector demonstrates a balanced mix of mature end-use demand and emerging innovation pockets that collectively support mid-single-digit growth over the next five years.

Global Industrial Labels Market Trends and Insights

Rising demand from food and beverage compliance labelling

Manufacturers face imminent January 2026 enforcement of the FDA Food Traceability Rule, forcing adoption of labels capable of carrying 2D codes and serialized Traceability Lot Codes.Uniform compliance dates set for new food labeling rules in 2028 heighten the need for print systems that flex with evolving data fields. Demand is rising for durable, weather-resistant substrates that stay legible across cold chains. The push toward 2D barcodes is increasing printer resolution requirements, and early retail pilots with RFID-embedded bakery labels illustrate how compliance intersects with supply-chain optimization. As brands retrofit lines, the industrial labels market records a surge in high-specification food-grade products.

Accelerating e-commerce and logistics labelling growth

Automated fulfillment centers are scaling variable-data labels that originate in ERP systems and travel through robotics-driven warehouses, aligning with a 9.98% CAGR in logistics labeling. Walmart's expanded RFID directive compels upstream suppliers to embed encoded inlays at item level. Real-time location sensing printed BLE labels show how IoT-ready tags are replacing passive barcodes to meet AI-powered inventory algorithms. APAC's booming cross-border e-commerce further accelerates industrial labels market demand for machine-readable, error-free identification.

Volatile raw-material and adhesive pricing

Downward swings in polyvinyl alcohol costs, interspersed with freight surcharges, hamper profit planning in Asia-Pacific converting hubs. Contract renegotiations become frequent as adhesive feedstocks and silicone liners move sharply with oil and energy markets. Q4 2024 sourcing reports flag erratic availability of specialty coatings, prompting converters to hold buffer inventories that erode working capital. Combined, these shocks slightly temper overall industrial labels market expansion despite healthy demand.

Other drivers and restraints analyzed in the detailed report include:

- Rapid adoption of digital and hybrid printing technologies

- Regulatory mandates for traceability and safety

- Stringent environmental regulations on plastics and VOCs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polymer labels retained 51.98% industrial labels market share in 2025 due to superior chemical resistance, yet paper-based eco substrates are set to outpace with a 9.38% CAGR, lifting their slice of industrial labels market size through 2031. Automotive, agrochemical, and lubricants applications still rely on PP and PET films for abrasion resistance, while hybrid laminates combine metal and polymer layers for extreme environments.

Sustainability imperatives are catalyzing rapid material substitution. Carbon-action paper lines and hemp-fiber label stocks demonstrate measurable footprint reductions. Fruit-waste and nut-shell papers repurpose agricultural by-products, appealing to premium food brands. Early adopters differentiate by reporting cradle-to-gate emissions in quotations, a first in the industrial labels market.

Pressure-sensitive constructions led with 43.05% industrial labels market share in 2025 on the strength of fast, flexible application lines across FMCG and pharma plants. Concurrently, in-mold and heat-transfer labels present an 8.78% CAGR as blow-molders and injection molders integrate decoration into primary forming.

Linerless technology illustrates dual gains in productivity and sustainability, providing 80% more labels per roll and reducing downtime. OptiCut WashOff linerless labels detach cleanly in recycling baths, aiding closed-loop PET systems. Robotics-ready applicators further integrate these mechanisms into Industry 4.0 lines, enhancing industrial labels market adoption.

The Industrial Labels Market Report is Segmented by Raw Material (Polymer/Plastic, Metal, and More), Mechanism (Pressure-Sensitive, Glue-Applied, and More), Product Type (Warning/Security, Asset Tags, and More), Printing Technology (Analog, Digital, Hybrid, Screen), Identification Technology (Barcode, RFID, and More), End-User Industry (Food/Beverage, Electronics, and More), and Geography. Market Forecasts in Value (USD).

Geography Analysis

Asia-Pacific dominated with 38.10% industrial labels market share in 2025 and is projected to compound at 8.52% through 2031 thanks to expanding electronics, automotive, and e-commerce hubs. China and India spearhead capacity additions, while ASEAN incentives attract near-shoring. Government Industry 4.0 programs accelerate smart-label adoption inside new greenfield plants, cementing the region's pivotal role in global industrial labels market growth.

North America benefits from entrenched regulatory frameworks and big-box retail mandates. Avery Dennison's Queretaro RFID plant underscores Mexico's ascent as a low-cost supply partner for U.S. converters Averydennison. Canadian VOC controls and the U.S. emphasis on supply-chain security keep label demand resilient across consumer and strategic industries, reinforcing regional industrial labels market stability.

Europe exhibits mature demand moderated by strict eco-design and waste directives. Recyclable label innovations enjoy early adoption as brand owners align with European Green Deal goals. Germany's automation leadership sustains high-spec production tools, while UK regulatory divergence post-Brexit prompts multi-language, multi-format label strategies. Emerging clusters in the Middle East & Africa and South America show variable trajectories but remain attractive for converters seeking first-mover gains in developing industrial labels markets.

- Avery Dennison Corporation

- CCL Industries Inc.

- 3M Company

- Brady Corporation

- UPM Raflatac

- DuPont de Nemours Inc.

- Brook + Whittle Ltd

- Multi-Color Corporation

- Fuji Seal International

- Honeywell International Inc.

- SATO Holdings Corporation

- Zebra Technologies Corporation

- Lintec Corporation

- TSC Auto ID Technology

- Checkpoint Systems Inc.

- DIC Corporation

- Skanem Group

- Weber Packaging Solutions

- Resource Label Group

- Smartrac Technology GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from food and beverage compliance labelling

- 4.2.2 Accelerating e-commerce and logistics labelling growth

- 4.2.3 Rapid adoption of digital and hybrid printing technologies

- 4.2.4 Regulatory mandates for traceability and safety

- 4.2.5 Industry 4.0 integration of smart labels and IoT

- 4.2.6 Hybrid printing enabling mass-customisation

- 4.3 Market Restraints

- 4.3.1 Volatile raw-material and adhesive pricing

- 4.3.2 Stringent environmental regulations on plastics and VOCs

- 4.3.3 Skilled-labour shortage in digital colour management

- 4.3.4 Supply-chain disruptions for specialty inks and liners

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Raw Material

- 5.1.1 Polymer / Plastic Labels

- 5.1.2 Metal Labels

- 5.1.3 Paper-based Eco Substrates

- 5.1.4 Hybrid Laminates and Others

- 5.2 By Mechanism

- 5.2.1 Pressure-Sensitive Labeling

- 5.2.2 Glue-Applied Labeling

- 5.2.3 Shrink-Sleeve Labeling

- 5.2.4 In-Mold and Heat-Transfer Labeling

- 5.2.5 Liner-less Labeling

- 5.3 By Product Type

- 5.3.1 Warning / Security Labels

- 5.3.2 Asset and Inventory Tags

- 5.3.3 Branding and Promotional Labels

- 5.3.4 Weather-proof and Durable Labels

- 5.3.5 Track-and-Trace (Smart / RFID) Labels

- 5.4 By Printing Technology

- 5.4.1 Analog Printing

- 5.4.2 Digital Printing

- 5.4.3 Hybrid Printing

- 5.4.4 Screen Printing

- 5.5 By Identification Technology

- 5.5.1 Barcode

- 5.5.2 RFID

- 5.5.3 NFC

- 5.5.4 QR and 2-D Codes

- 5.5.5 Other Identification Technology

- 5.6 By End-user Industry

- 5.6.1 Food and Beverage

- 5.6.2 Electronics and Electricals

- 5.6.3 Automotive and Transportation

- 5.6.4 Healthcare and Pharmaceuticals

- 5.6.5 Chemicals and Hazardous Goods

- 5.6.6 Construction and Heavy Equipment

- 5.6.7 Logistics and Warehousing

- 5.6.8 Other End-user Industry

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 South Korea

- 5.7.3.5 Australia and New Zealand

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East and Africa

- 5.7.4.1 Middle East

- 5.7.4.1.1 United Arab Emirates

- 5.7.4.1.2 Saudi Arabia

- 5.7.4.1.3 Turkey

- 5.7.4.1.4 Rest of Middle East

- 5.7.4.2 Africa

- 5.7.4.2.1 South Africa

- 5.7.4.2.2 Nigeria

- 5.7.4.2.3 Egypt

- 5.7.4.2.4 Rest of Africa

- 5.7.4.1 Middle East

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Avery Dennison Corporation

- 6.4.2 CCL Industries Inc.

- 6.4.3 3M Company

- 6.4.4 Brady Corporation

- 6.4.5 UPM Raflatac

- 6.4.6 DuPont de Nemours Inc.

- 6.4.7 Brook + Whittle Ltd

- 6.4.8 Multi-Color Corporation

- 6.4.9 Fuji Seal International

- 6.4.10 Honeywell International Inc.

- 6.4.11 SATO Holdings Corporation

- 6.4.12 Zebra Technologies Corporation

- 6.4.13 Lintec Corporation

- 6.4.14 TSC Auto ID Technology

- 6.4.15 Checkpoint Systems Inc.

- 6.4.16 DIC Corporation

- 6.4.17 Skanem Group

- 6.4.18 Weber Packaging Solutions

- 6.4.19 Resource Label Group

- 6.4.20 Smartrac Technology GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment