PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910637

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910637

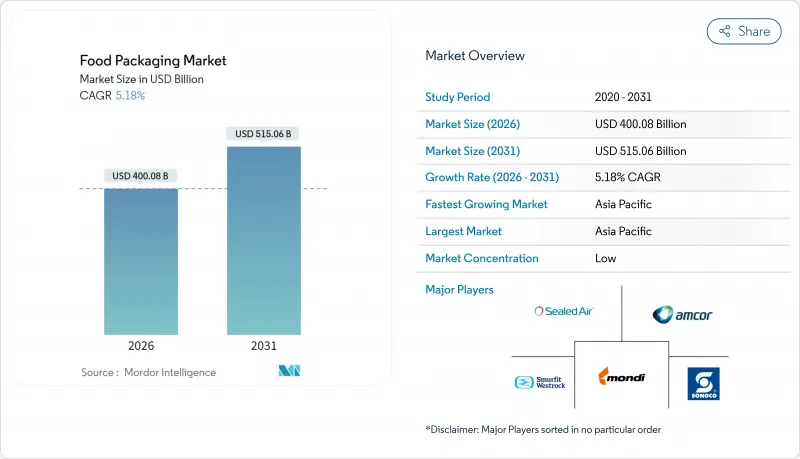

Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The food packaging market size in 2026 is estimated at USD 400.08 billion, growing from 2025 value of USD 380.38 billion with 2031 projections showing USD 515.06 billion, growing at 5.18% CAGR over 2026-2031.

Expansion rests on rapid urbanisation in Asia-Pacific, stronger regulatory attention to recycled content across North America and Europe, and the steady shift among global brand owners toward material-efficient flexible formats. Manufacturers also benefit from investments in cold-chain infrastructure that widen retail reach for chilled and frozen foods, while premiumisation trends revitalise glass demand and encourage adoption of high-barrier technologies able to support clean-label claims. On the supply side, direct customer relationships remain the dominant route to market; however, e-commerce logistics specialists are accelerating uptake of indirect channels that serve small and mid-size food processors. Merger activity among the leading converters is reshaping competitive boundaries by pooling R&D, recycling assets and global distribution footprints.

Global Food Packaging Market Trends and Insights

Accelerated Urban Convenience Retail Growth Across Asia Driving Demand for Single-Serve Packs

Rapid migration to metropolitan areas in China, India and Southeast Asia is shortening shopping cycles and increasing demand for portion-controlled food packs. Convenience stores now reach dense inner-city districts where refrigeration space is limited, rewarding brands that supply lightweight single-serve options able to deliver freshness and curb food waste. Younger working consumers also prize portability, prompting processors to redesign legacy SKUs into resealable pouches or thermoformed cups that command premium price points. The push for on-the-go formats reinforces the food packaging market's shift toward barrier-enhanced flexibles and thin-gauge rigid plastics that meet shelf-life targets. Investments in small-footprint filling lines have fallen by as much as 18% per unit since 2024, lowering barriers for regional co-packers and accelerating format diversification.

Legislative Push for Post-Consumer Recycled Content in North American Food Packaging

State-level mandates such as California's SB 54 and Maine's recycled-content quota are tightening supply of food-grade PCR, raising resin premiums to 15-20% above virgin PET in peak quarters. Brand owners are therefore signing multiyear offtake agreements with recyclers and co-investing in sorting capacity to lock in feedstock security. Equipment suppliers report a 26% rise in orders for extrusion and filtration systems that can process higher PCR ratios without compromising clarity. The legislation also spurs label redesigns that highlight recycled content, resonating with consumers who increasingly equate PCR usage with brand responsibility. EPR fees ranging from USD 192 per ton for glass to USD 423 per ton for plastics are being internalised into long-term cost models, accelerating adoption of mono-material flexible laminates compatible with curbside recycling.

EU Single-Use Plastic Directive Raising Compliance Costs for Multilayer Flexible Structures

The European Packaging and Packaging Waste Regulation mandates all consumer packs sold after 2028 achieve demonstrable recyclability, imposing steep redesign expenses on converters that rely on PET-PE or PA-PE laminates. Transitioning to mono-material polypropylene or polyethylene structures raises raw-material cost by up to 14% because of barrier-coating upgrades and compatibility tests with existing seal jaws. Sorting facilities must also integrate near-infra-red sensors capable of distinguishing new laminates, an investment smaller municipalities struggle to justify. Manufacturers that cannot amortise the redesign across global volumes are at risk of ceding EU shelf space to larger peers with deeper R&D pipelines.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Expansion of Direct-to-Consumer Meal-Kit Services in Europe Requiring Customisable Temperature-Stable Packaging

- Surge in Demand for Ready-to-Eat Seafood in Japan Fuelling Adoption of High-Barrier Retort Pouches

- Volatility in Recycled Resin Pricing Undermining Cost Competitiveness of Sustainable Formats

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics generated the highest revenue, holding 58.55% of food packaging market share in 2025 owing to versatility and cost advantages. In value terms, the food packaging market size for plastics is projected to advance at 4.92% CAGR beyond 2026 as bio-circular polypropylene and chemically recycled PET enter commercial scale. Glass, although occupying a smaller base, will grow 7.12% annually, propelled by premium beverages and sauces that leverage infinite recyclability claims.

Growth in paperboard aligns with e-commerce and corrugated shipping demand, while metals sustain niche roles in canned meals through lightweighting innovation. Across all materials, regulatory incentives for recyclability and the emergence of deposit-return systems are influencing brand selections. Material substitution decisions increasingly weigh carbon footprints alongside cost, nudging processors toward mono-material architectures compatible with region-specific recycling streams.

Flexible solutions captured 56.10% of the overall market in 2025 and will progress at a 6.18% CAGR through 2031. Stand-up pouches, flow wraps and pillow bags reduce shipping weight by up to 70% versus comparable rigid options, supporting retailer sustainability targets. As a result, the food packaging market size for flexible formats is expected to reach USD 307.2 billion within the forecast window.

Rigid plastics, glass jars and metal cans remain indispensable where product integrity and tamper evidence are paramount. Converters are stretching rigid relevance by deploying in-mould label technologies that supply 360-degree graphics without post-application steps. Future format selection will pivot on mechanical recyclability, infrastructure readiness and brand-specific storytelling goals.

The Food Packaging Market Report is Segmented by Material Type (Plastics, Paper, Metal, Glass), Format (Rigid, Flexible), Product Type (Cans, Bottles, and More), Technology (MAP, Vacuum, Hot-Fill, and More), Distribution Channel (Direct, Indirect), Application (Dairy, Meat, Produce, Bakery, Seafood, Ready Meals, Frozen), and Geography (North America, Europe, Asia-Pacific, MEA, South America). Market Forecasts in Value (USD).

Geography Analysis

Asia-Pacific generated 40.85% of global revenue in 2025 and is expected to expand at an 8.22% CAGR through 2031, propelled by rising incomes, cold-chain expansion and a surge in organised retail. China's scale provides significant pull for polymer suppliers, while India's government incentives for food parks are spurring domestic demand for carton, pouch and rigid PET formats. Japan and South Korea focus on premiumisation and recyclable glass, whereas Southeast Asian nations rapidly adopt lightweight flexibles to counter rising freight costs. Region-wide, the food packaging market size is forecast to surpass USD 245.8 billion by 2031, reflecting both export-oriented agri-food growth and domestic consumption upgrades.

North America ranks second in value, sustained by mature packaged food categories and leadership in PCR regulation. The United States is at the forefront of plant-based material trials and chemical recycling pilots that promise scalable circularity. Canada supports sector development with tax credits for recycling infrastructure, and Mexico capitalises on proximity to US retailers by attracting joint-venture converters along the border. EPR schemes, live in four states and pending in several others, incentivise mono-material design and recyclability labelling. Collectively, these policies underpin a steady mid-single-digit CAGR despite high base consumption.

Europe's market is shaped by stringent ecological rules under the PPWR. Germany, the United Kingdom and France dominate volume; Italy leads in design innovation for compostable trays. Eastern European production clusters are attracting investments from Western converters seeking cost efficiencies. Despite regulatory burdens, Europe remains a knowledge hub for deposit-return systems, influencing policy in Latin America and Africa. While growth lags Asia, the continent secures value through premium sustainable packs and high adoption of digital watermarking for waste-sorting.

- Amcor PLC

- Tetra Pak International S.A.

- Smurfit WestRock

- Ball Corporation

- Mondi Group

- Crown Holdings Inc.

- Sealed Air Corporation

- Sonoco Products Company

- International Paper Company

- Huhtamaki Oyj

- Graham Packaging Company Inc.

- Anchor Packaging Inc.

- Schur Flexibles Group

- ProAmpac LLC

- Constantia Flexibles

- Uflex Ltd.

- Stora Enso Oyj

- Clondalkin Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Urban Convenience Retail Growth Across Asia Driving Demand for Single-Serve Packs

- 4.2.2 Legislative Push for Post-Consumer Recycled (PCR) Content in North American Food Packaging

- 4.2.3 Rapid Expansion of Direct-to-Consumer Meal-Kit Services in Europe Requiring Customizable Temperature-Stable Packaging

- 4.2.4 Surge in Demand for Ready-to-Eat Seafood in Japan Fuelling Adoption of High-Barrier Retort Pouches

- 4.2.5 Cold-Chain Infrastructure Build-out in Sub-Saharan Africa Unlocking Growth for Aseptic Cartons

- 4.2.6 Digital Printing Adoption for Short-Run SKUs Enabling Brand Differentiation in Latin America

- 4.3 Market Restraints

- 4.3.1 EU Single-Use Plastic Directive Raising Compliance Costs for Multilayer Flexible Structures

- 4.3.2 Volatility in Recycled Resin Pricing Undermining Cost Competitiveness of Sustainable Formats

- 4.3.3 Limited Industrial Composting Infrastructure in APAC Hindering Uptake of Compostable Films

- 4.3.4 Migration-Safety Concerns Restricting Use of Recycled Paperboard in High-Fat Food Applications

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastics

- 5.1.1.1 PET

- 5.1.1.2 PE (HDPE and LDPE)

- 5.1.1.3 PP

- 5.1.1.4 Other Plastics

- 5.1.2 Paper and Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.1.1 Plastics

- 5.2 By Packaging Format

- 5.2.1 Rigid

- 5.2.2 Flexible

- 5.3 By Product Type

- 5.3.1 Cans

- 5.3.2 Bottles and Jars

- 5.3.3 Pouches

- 5.3.4 Corrugated Boxes

- 5.3.5 Other Product Type

- 5.4 By Technology

- 5.4.1 Modified Atmosphere Packaging (MAP)

- 5.4.2 Vacuum Packaging

- 5.4.3 Hot-Fill

- 5.4.4 High-Pressure Processing (HPP)

- 5.4.5 Aseptic

- 5.4.6 Retort

- 5.5 By Distribution Channel

- 5.5.1 Direct Sales

- 5.5.2 Indirect Sales

- 5.6 By Application

- 5.6.1 Dairy Products

- 5.6.2 Poultry and Meat Products

- 5.6.3 Fruits and Vegetables

- 5.6.4 Bakery and Confectionery

- 5.6.5 Seafood

- 5.6.6 Ready Meals and Convenience Food

- 5.6.7 Frozen Food

- 5.6.8 Other Application

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 South Korea

- 5.7.3.5 Australia and New Zealand

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East and Africa

- 5.7.4.1 Middle East

- 5.7.4.1.1 United Arab Emirates

- 5.7.4.1.2 Saudi Arabia

- 5.7.4.1.3 Turkey

- 5.7.4.1.4 Rest of Middle East

- 5.7.4.2 Africa

- 5.7.4.2.1 South Africa

- 5.7.4.2.2 Nigeria

- 5.7.4.2.3 Egypt

- 5.7.4.2.4 Rest of Africa

- 5.7.4.1 Middle East

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 Tetra Pak International S.A.

- 6.4.3 Smurfit WestRock

- 6.4.4 Ball Corporation

- 6.4.5 Mondi Group

- 6.4.6 Crown Holdings Inc.

- 6.4.7 Sealed Air Corporation

- 6.4.8 Sonoco Products Company

- 6.4.9 International Paper Company

- 6.4.10 Huhtamaki Oyj

- 6.4.11 Graham Packaging Company Inc.

- 6.4.12 Anchor Packaging Inc.

- 6.4.13 Schur Flexibles Group

- 6.4.14 ProAmpac LLC

- 6.4.15 Constantia Flexibles

- 6.4.16 Uflex Ltd.

- 6.4.17 Stora Enso Oyj

- 6.4.18 Clondalkin Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment