PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851899

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851899

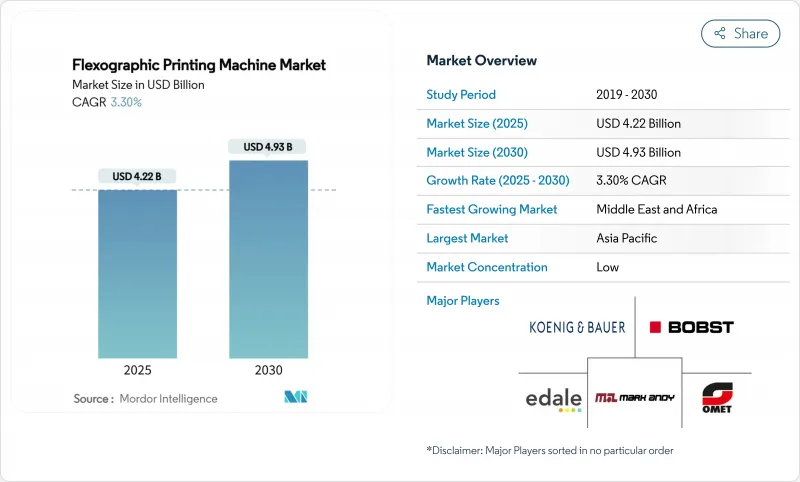

Flexographic Printing Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The flexographic printing machine market size stands at USD 4.22 billion in 2025 and is on track to reach USD 4.93 billion by 2030, reflecting a steady 3.3% CAGR.

Investment priorities now revolve around automation, hybrid press capabilities, and compliance with tightening sustainability rules rather than simple capacity expansion. E-commerce-related short runs, water-based ink mandates, and digital-twin maintenance platforms are reshaping procurement criteria across converters. Suppliers that marry fast changeovers with low-VOC performance are gaining share, while regional subsidy programs, most notably China's 2026 "Green Press" policy, are altering the competitive map. At the same time, mergers such as XSYS-MacDermid and INX-C&A illustrate how plate-making and ink specialists are consolidating to cut lead times and navigate PFAS restrictions.

Global Flexographic Printing Machine Market Trends and Insights

Cost-effective short-run packaging capability

Flexographic press builders have slashed setup times, taking profitable minimum runs from 5,000 m to close to 500 m. Shorter cycles mean brands with seasonal or regional SKUs can deploy custom graphics without prohibitive costs. MacDermid's LUX ITP plates now leave the plate room in eight hours, down from two days, which removes a key bottleneck for converters targeting next-day art changes. Together, faster plates and rapid changeovers allow flexography to reclaim work that once defaulted to digital presses. Converters are therefore investing in mid-range modular lines that balance speed with flexibility, underpinning equipment demand across the flexographic printing machine market.

Surge in food-grade sustainable flexible packaging

European and North American regulations are eliminating PFAS while demanding full recyclability. Saica Flex plans a 100% recyclable portfolio by 2030 with 5% PCR content, showcasing the pressure on converters to prove circularity. INX's GelFlex EB inks remove lamination layers, cutting total pack weight yet maintaining barrier integrity inxinternational.com. Inline barrier-coating partnerships, such as Solenis-Heidelberg, further reduce secondary processes. As converters race to certify new chemistries before the EU's August 2026 PFAS cap, demand crescendos for presses that can run water-based or EB curing inks at competitive speeds benefiting the flexographic printing machine market.

Cap-ex intensive multi-color CI presses

A fully optioned 1,300 mm CI line can command USD 4 million, well above modular alternatives. As a result, even global accounts deferred orders in 2024, cutting Bobst CI bookings by 24%. Mid-market converters hesitate to finance premium presses when average run lengths are shrinking, slowing replacement cycles in the flexographic printing machine market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid corrugated capacity additions in e-commerce fulfillment

- Mandates on water-based low-VOC inks

- Skilled press-operator shortage in Europe and Japan

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paper and paperboard led the flexographic printing machine market with 45.56% share in 2024, buoyed by retail e-commerce cartons and recycled kraft liners. Converters rely on paper's easy recyclability to satisfy brand mandates, while improved coatings are extending shelf life for ambient foods. Plastic films, however, chart the fastest 6.57% CAGR as mono-material laminates and PCR blends solve circularity and barrier needs.

The substitution battle intensifies as INX's EB inks allow film structures to drop a lamination layer, cutting gauge without compromising barrier. UFlex's new PET resin capacity in Egypt reflects global resin self-sufficiency moves to shorten supply chains. Overall, paper converters expand corrugator fleets, whereas film suppliers chase high-barrier pouches together sustaining equipment demand across the flexographic printing machine market size for substrate-specific presses.

In-line/modular systems held 39.34% revenue share in 2024 thanks to affordable acquisition costs and nimble job changes traits favored by private-label food and indie cosmetics. Central-impression presses, though capital-heavy, are gaining fastest at 5.45% CAGR, propelled by brand demands for tight color-to-color register on shrink sleeves and wide web snacks.

Hybrid designs blur former lines: Uteco's OnyxOMNIA stitches inkjet heads onto an eight-color flexo deck, delivering 400 m/min while enabling variable data . As CI OEMs roll out automatic plate cylinders and digital-twin diagnostics, converters with 24/6 shifts migrate upscale, driving the flexographic printing machine market toward higher-spec platforms.

Flexographic Printing Machine Market is Segmented by Material (Paper and Paperboard, Plastic Films, Corrugated Board, and More), Press Type (Central-Impression (CI), Stack, and In-Line / Modular), End-User Industry (Food and Beverage, Pharmaceutical and Healthcare, and More), Automation Level (Conventional, and Smart / IoT-Enabled), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 40.56% of global revenues in 2024, aided by China's capacity expansions and subsidy-driven equipment renewals that favor CI presses meeting "green, intelligent" criteria. Japan's high labor costs accelerate adoption of robotic material handling, while South Korean and ASEAN converters invest in flexible packaging lines to serve regional snack and personal-care brands.

Middle East & Africa is the fastest-growing territory at 6.14% CAGR. Population growth, cold-chain improvements, and rising FMCG penetration spur new flexible packaging plants, drawing investments like UFlex's PET chip facility in Egypt which anchors local resin supply. Gulf States are also piloting water-based ink retrofits to meet circular-economy targets.

North America and Europe, though mature, remain technology pacesetters as PFAS and VOC regulations tighten. The EU's 25 ppb PFAS ceiling effective August 2026 forces converters to overhaul barrier coatings. North American printers face similar pressure from state-level solvent rules, driving upgrades to enclosed-chamber doctor-blade systems and heat-set air management. Consequently, replacement demand keeps the flexographic printing machine market dynamic despite slower macro-volume growth in these regions.

- Bobst Group SA

- Windmoller and Holscher KG

- Koenig and Bauer AG

- Mark Andy Inc.

- Uteco Group

- Heidelberger Druckmaschinen AG

- OMET Srl

- MPS Systems BV

- Nilpeter A/S

- Gallus Ferd. Ruesch AG

- Soma Engineering

- PCMC (Barry-Wehmiller)

- Star Flex International

- Orient Sogyo Co. Ltd.

- Taiyo Kikai Ltd.

- Comexi Group

- Rotatek SA

- Wolverine Flexographic LLC

- Zhejiang Weigang Machinery

- Edale Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cost-effective short-run packaging capability

- 4.2.2 Surge in food-grade sustainable flexible packaging

- 4.2.3 Rapid corrugated capacity additions in e-commerce fulfilment

- 4.2.4 Mandates on water-based low-VOC inks in North America and EU

- 4.2.5 Converting-line digital twin and AI predictive-maintenance adoption

- 4.2.6 China 2026 Green Press subsidy for CI-flexo equipment

- 4.3 Market Restraints

- 4.3.1 Cap-ex intensive multi-colour CI presses

- 4.3.2 Skilled press-operator shortage in Europe and Japan

- 4.3.3 Plate-making lead-time bottlenecks for ultra-short runs

- 4.3.4 Tightening PFAS restrictions on barrier coating compatibility

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Paper and Paperboard

- 5.1.2 Plastic Films

- 5.1.3 Metallic Films and Foils

- 5.1.4 Corrugated Board

- 5.1.5 Others Material (Bioplastics, Laminates)

- 5.2 By Press Type

- 5.2.1 Central-Impression (CI)

- 5.2.2 Stack

- 5.2.3 In-Line / Modular

- 5.3 By End-User Industry

- 5.3.1 Food and Beverage

- 5.3.2 Pharmaceutical and Healthcare

- 5.3.3 Personal-Care and Cosmetics

- 5.3.4 Consumer Electronics

- 5.3.5 Logistics and E-commerce

- 5.3.6 Other End-user Industry

- 5.4 By Automation Level

- 5.4.1 Conventional

- 5.4.2 Smart / IoT-Enabled

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 Italy

- 5.5.2.4 United Kingdom

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Kenya

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bobst Group SA

- 6.4.2 Windmoller and Holscher KG

- 6.4.3 Koenig and Bauer AG

- 6.4.4 Mark Andy Inc.

- 6.4.5 Uteco Group

- 6.4.6 Heidelberger Druckmaschinen AG

- 6.4.7 OMET Srl

- 6.4.8 MPS Systems BV

- 6.4.9 Nilpeter A/S

- 6.4.10 Gallus Ferd. Ruesch AG

- 6.4.11 Soma Engineering

- 6.4.12 PCMC (Barry-Wehmiller)

- 6.4.13 Star Flex International

- 6.4.14 Orient Sogyo Co. Ltd.

- 6.4.15 Taiyo Kikai Ltd.

- 6.4.16 Comexi Group

- 6.4.17 Rotatek SA

- 6.4.18 Wolverine Flexographic LLC

- 6.4.19 Zhejiang Weigang Machinery

- 6.4.20 Edale Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment