PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851900

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851900

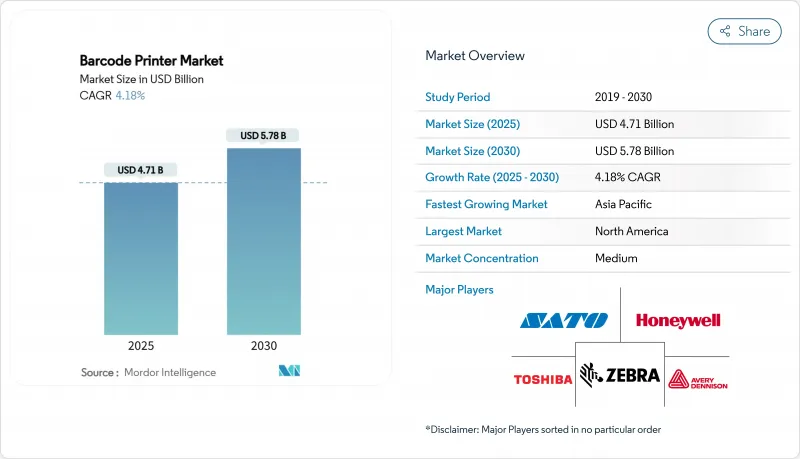

Barcode Printer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The barcode printer market size is valued at USD 4.71 billion in 2025 and is forecast to reach USD 5.78 billion by 2030, advancing at a 4.18% CAGR.

This growth reflects steady corporate investment in automation and supply chain digitization that keeps demand resilient even as the sector enters a more mature phase. Expanding traceability mandates in healthcare and food, the acceleration of omnichannel retail, and the need for serialized production data inside smart factories all sustain procurement budgets. Thermal transfer technology continues to anchor the barcode printer market because it supports durable labels for compliance-critical environments, yet direct thermal printers are gaining ground because users prefer their lower consumable costs and simplified workflows. Industrial printers remain the workhorse of global manufacturing sites, but mobile units are now the clear growth engine as last-mile delivery networks and field service organizations pursue real-time labeling. Competitive intensity is rising as Chinese manufacturers scale up and challenge incumbents on price, forcing established brands to double down on software integration and specialized service offerings.

Global Barcode Printer Market Trends and Insights

Omnichannel retail and e-commerce logistics boom

Retailers that manage unified inventories across multiple channels need labels printed in real time at fulfillment sites to cope with seasonal demand swings. American Eagle Outfitters lifted carton reading accuracy to 99% after installing image-based solutions in its 1.65 million sq ft Pennsylvania distribution center, illustrating how higher scan rates feed back into precise print requirements. Blue Sky Distribution recorded 100% order accuracy and an 80% jump in fulfillment efficiency once it synchronized on-demand printing with routing software, which cut single-day delivery errors as orders rose 70%. Retailers now deploy mobile printers on picking carts to remove stationary bottlenecks, enhancing flexibility on warehouse floors. Demand for cloud oversight is also rising so that IT teams can manage firmware and security patches remotely. These needs push the barcode printer market toward devices that are wireless, rugged, and serviceable through centralized dashboards.

Industry 4.0-driven smart factories adopting AIDC

Smart factories rely on automated identification and data capture to link production assets directly with ERP and MES platforms. Zebra's FS42 fixed scanner integrates neural processing to inspect codes and feed AI models that flag defects on the line. When barcode printers relay serial numbers to plant networks, they enable predictive maintenance programs that rely on component IDs. Brady Corporation observed that automated data entry based on printed codes can eliminate up to 90% of manual typing errors while increasing lifting efficiency by 40%. Manufacturers therefore specify printers that support industrial protocols, edge computing, and high-volume throughput. The result is sustained hardware refresh cycles despite the broader slowdown in capital expenditure across sectors.

Supply volatility and price swings for thermal printheads

Tariffs and rising input prices pushed thermal paper costs up by double digits in 2024. Printhead fabrication is concentrated among a handful of specialist plants in East Asia, and replacement heads wear 25-50% faster in direct thermal modes than in thermal transfer settings. OEMs must stock larger buffers, elevating working capital needs and pushing end-user prices higher. Some projects have slipped because buyers wait for component costs to normalize. Longer term, manufacturers are evaluating multi-supplier strategies, yet the capital barrier keeps supply diversity modest.

Other drivers and restraints analyzed in the detailed report include:

- Cold-chain traceability demand in healthcare and food

- Mobile and wearable barcode printers enhancing field productivity

- Migration toward QR / RFID reducing basic barcode demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial printers produced the highest revenue in 2024 by securing 57.1% of the barcode printer market. These devices deliver wide media widths, steel chassis, and duty cycles that exceed 24-hour operation, which manufacturers and logistics hubs value for uptime. SATO's CL4NX Plus prints at 14 ips while tracking head wear in firmware, ensuring predictive part replacement. Nonetheless, mobile units record a 6.2% CAGR to 2030 as gig-economy couriers, field engineers, and in-store pickers seek lightweight devices that roam with workers. The barcode printer market size for mobile models is projected to expand from USD 1.02 billion in 2025 to USD 1.39 billion by 2030, indicating that portability is redefining customer expectations. Desktop printers keep traction among small firms because they blend acceptable duty cycles with modest capex. Hybrid designs that mount industrial engines on cart platforms may blur product lines, suggesting future segmentation will hinge on workflow rather than form factor.

In volume terms, industrial printers still ship the largest absolute unit count because multi-line factories employ fleets for work-in-process tickets. However, price aggression by Chinese OEMs is compressing margins in the mid-tier. Mobile printer ASPs have proven more resilient because buyers prioritize battery life, wireless security, and drop resistance. Over the forecast, industrial SKU turnover will center on connectivity upgrades-Ethernet, Bluetooth 5, and WPA3-while mobile SKUs will compete on weight reductions and antimicrobial casings for healthcare. The coexistence of entrenched industrial demand with agile mobile adoption underscores how the barcode printer market can grow even as one segment matures.

Barcode Printer Market is Segmented by Product Type (Desktop Printers, Mobile Printers, Industrial Printers), Printing Technology (Thermal Transfer, Direct Thermal, Laser, Inkjet, Others), End-User Industry (Manufacturing, Retail, Transportation and Logistics, Healthcare, Other End-User Industries), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 31.7% of the barcode printer market in 2024. Federal procurement, such as the United States Postal Service's refresh of thousands of Zebra devices, anchors hardware volumes. Drug supply chain laws also oblige hospitals and pharmacies to invest in printers that handle GS1 DataMatrix media. Canada's retail modernization and Mexico's maquiladora exports further reinforce regional demand. The barcode printer market size for North America is estimated at USD 1.49 billion in 2025 and will edge toward USD 1.81 billion by 2030. Users in the region typically prioritize total cost of ownership, driving adoption of remote fleet management suites that schedule firmware updates without site visits.

Asia-Pacific is the fastest-expanding arena with a 4.9% CAGR to 2030. China and India keep building new factories for consumer electronics and apparel, each requiring inline labeling for export. Gainscha operates over 40,000 sqm of manufacturing space and holds 50 thermal patents, underscoring indigenous capability gains. HPRT reports distribution in more than 80 countries, reflecting the global reach of Chinese brands. Japan advances Industry 4.0 integration in automotive plants, while Southeast Asia wins near-shoring that moves labeling equipment demand southward. The barcode printer market size in Asia-Pacific is projected at USD 1.33 billion in 2025 and should exceed USD 1.69 billion by 2030.

- Zebra Technologies Corporation

- Sato Holdings Corporation

- Honeywell International Inc.

- Toshiba Tec Corporation

- Avery Dennison Corporation

- Seiko Epson Corporation

- TSC Auto ID Technology Co. Ltd.

- Brother Industries Ltd.

- Postek Electronics Co. Ltd.

- Primera Technology Inc.

- Bixolon Co. Ltd.

- Citizen Systems Japan Co. Ltd.

- Godex International Co. Ltd.

- Wasp Barcode Technologies

- Cab Produkttechnik GmbH and Co KG

- Printronix Auto ID Inc.

- Gainscha Technology Group Ltd.

- Domino Printing Sciences plc

- IDPRT (Xiamen Hanin Co. Ltd.)

- Datamax

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Omnichannel retail and e-commerce logistics boom

- 4.2.2 Industry 4.0-driven smart factories adopting AIDC

- 4.2.3 Cold-chain traceability demand in healthcare and food

- 4.2.4 Mobile and wearable barcode printer

- 4.2.5 Cloud-native remote print management and security

- 4.2.6 Adoption of linerless labeling for ESG compliance

- 4.3 Market Restraints

- 4.3.1 Supply volatility and price swings for thermal printheads

- 4.3.2 Migration toward QR/RFID reducing basic barcode demand

- 4.3.3 Tightening e-waste directives inflating lifecycle costs

- 4.3.4 Shift to direct-part marking and laser etching in harsh industrial use

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitute Products

- 4.8 Assessment of the Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Desktop Printers

- 5.1.2 Mobile Printers

- 5.1.3 Industrial Printers

- 5.2 By Printing Technology

- 5.2.1 Thermal Transfer

- 5.2.2 Direct Thermal

- 5.2.3 Laser

- 5.2.4 Inkjet

- 5.2.5 Others

- 5.3 By End-user Industry

- 5.3.1 Manufacturing

- 5.3.1.1 Automotive

- 5.3.1.2 Electronics

- 5.3.1.3 Food and Beverage

- 5.3.1.4 Others

- 5.3.2 Retail

- 5.3.3 Transportation and Logistics

- 5.3.4 Healthcare

- 5.3.5 Other End-user Industries

- 5.3.1 Manufacturing

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 GCC

- 5.4.5.1.2 Turkey

- 5.4.5.1.3 Israel

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Kenya

- 5.4.5.2.4 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Zebra Technologies Corporation

- 6.4.2 Sato Holdings Corporation

- 6.4.3 Honeywell International Inc.

- 6.4.4 Toshiba Tec Corporation

- 6.4.5 Avery Dennison Corporation

- 6.4.6 Seiko Epson Corporation

- 6.4.7 TSC Auto ID Technology Co. Ltd.

- 6.4.8 Brother Industries Ltd.

- 6.4.9 Postek Electronics Co. Ltd.

- 6.4.10 Primera Technology Inc.

- 6.4.11 Bixolon Co. Ltd.

- 6.4.12 Citizen Systems Japan Co. Ltd.

- 6.4.13 Godex International Co. Ltd.

- 6.4.14 Wasp Barcode Technologies

- 6.4.15 Cab Produkttechnik GmbH and Co KG

- 6.4.16 Printronix Auto ID Inc.

- 6.4.17 Gainscha Technology Group Ltd.

- 6.4.18 Domino Printing Sciences plc

- 6.4.19 IDPRT (Xiamen Hanin Co. Ltd.)

- 6.4.20 Datamax

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment