PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851915

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851915

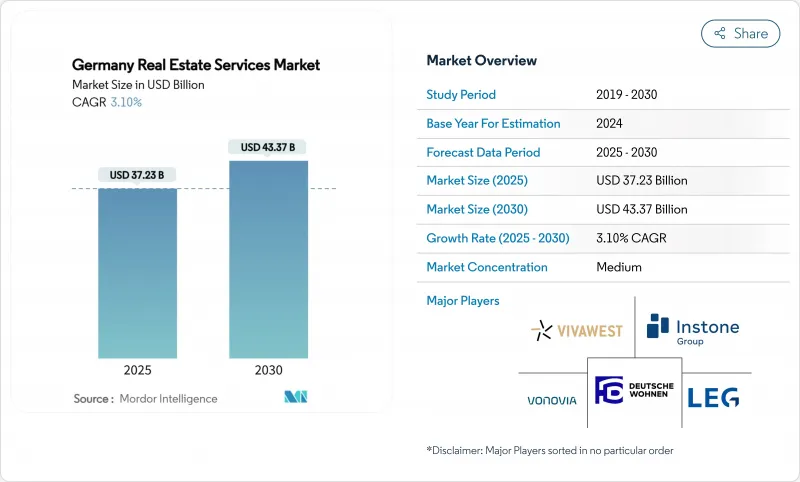

Germany Real Estate Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Germany real estate services market stands at USD 37.23 billion in 2025 and is set to reach USD 43.37 billion by 2030, advancing at a 3.10% CAGR.

Recent growth is powered by institutional capital rotation into ESG-compliant assets, steady demand for project management linked to mandatory energy-efficiency upgrades, and rapid digitalization of property workflows. Brokerage fee reforms and lingering affordability pressures have tempered transaction-led revenues, yet recurring income from property and facility management continues to underpin sector resilience. Competitive conditions remain moderate as large, full-service providers leverage scale, while PropTech entrants press for share through data-rich, software-enabled offerings. Policy tools such as degressive depreciation allowances for new housing and expanded infrastructure quotas for regulated investors signal sustained government support and will likely reinforce medium-term service demand.

Germany Real Estate Services Market Trends and Insights

Institutional Demand for Outsourced Facility and Property Management

Hospitals and public agencies are moving non-core real-estate operations to specialist providers to manage complexity and regulatory risk. Fresenius Helios illustrates the shift by prioritizing external expertise for energy management and digital building systems, securing predictable cost structures and compliance benefits. Municipal authorities, facing budget pressure, adopt similar strategies, creating long-term contracts that stabilize revenues for facility managers. As outsourcing scales, providers broaden technical depth, from HVAC optimization to smart-sensor maintenance, to meet performance guarantees. This driver will keep recurring income streams buoyant across the Germany real estate services market as public and healthcare assets grow.

Expansion of ESG Reporting Mandates Boosting Valuation and Advisory Volumes

Disclosure rules now require granular data on carbon intensity and social impact, prompting insurers holding 13.1% of portfolios in real estate to seek deeper due diligence services. Advisory firms equipped with climate-risk analytics gain share because investors must substantiate acquisitions against evolving taxonomy criteria. Valuers incorporate flood, heat-stress, and green-capex metrics, positioning ESG-savvy practices for premium pricing. Enhanced reporting complexity raises entry barriers, cementing the advantage of firms with established sustainability credentials. Rising regulatory clarity should accelerate assessment demand over the next two years.

Prolonged Weakness in Residential Transactions Due to Affordability Pressures

Higher interest rates and construction costs have sidelined first-time buyers, shrinking deal volumes and elongating sales cycles. Broking firms now split commissions equally with buyers under the 2020 reform, reducing gross margins just as transaction counts fall. Knock-on effects hit mortgage advisory, conveyancing, and ancillary valuation work. Recovery requires interest-rate stability and expanded housing supply, making this headwind likely to persist through 2027. Service providers are diversifying toward rental-focused and asset-management income to offset the mismatch.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Retrofit Project Management Under Energy-Efficiency Targets

- Greater Pension-Fund Capital Deployment into Core Assets

- Tight Labor Market for Skilled FM Technicians and Asset Managers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Residential services contributed 56.1% of 2024 revenues, led by multi-family rental demand, yet commercial contracts are expanding fastest at a 3.56% CAGR to 2030. Logistics growth rides e-commerce fulfillment needs, while core offices in Frankfurt and Munich attract ESG-compliant capital seeking stable yields. Data-center square footage is forecast to double by 2030, driving high-margin facility-management and power-quality advisory work. Conversely, single-family brokerage lags as affordability weighs on first-time buyers, though ADU reforms may add incremental listings over the long run.

Market participants diversify by pairing residential management platforms with specialized commercial advisory teams to capture the full asset lifecycle. ESG retrofits, particularly in older offices, spur bundled project-management and valuation mandates. Residential providers deploy tech-enabled solutions such as virtual property inspections to trim costs and sustain margins amid slower sales. Meanwhile, the Germany real estate services market continues to allocate more capital to warehousing and data-center clusters, where long-lease tenures stabilize income and offset cyclical swings in retail and hospitality assets.

The Germany Real Estate Services Market Report is Segmented by Property Type (Residential, Commercial), by Service (Brokerage Services, Property Management Services, Valuation Services and More), by Client Type (Individuals/Households, Corporates & SMEs and More), and by City (Berlin, Munich, Frankfurt, Hamburg, Rest of Germany). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Vonovia SE

- Deutsche Wohnen

- LEG Immobilien SE

- Instone Group

- Vivawest Wohnen GmbH

- Gewobag Wohnungsbau AG

- SAGA Hamburg

- Bundesanstalt fur Immobilienaufgaben

- STRABAG Property & Facility Services GmbH

- HEID Valuation

- GESOBAU AG

- CBRE GmbH (Germany)

- Jones Lang LaSalle SE (Germany)

- Savills Deutschland GmbH

- BNP Paribas Real Estate Germany

- Colliers International Deutschland GmbH

- Cushman & Wakefield Germany

- Drees & Sommer SE

- Engel & Volkers AG

- Patrizia SE

- Scout24 AG (ImmobilienScout24)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Institutional demand for outsourced facility and property management in public and healthcare sectors

- 4.2.2 Expansion of ESG reporting mandates boosting valuation and advisory volumes

- 4.2.3 ADU-friendly zoning reforms accelerating small-unit residential brokerage activity

- 4.2.4 Rising demand for retrofit project management under national energy-efficiency targets

- 4.2.5 Increased capital deployment from pension funds into core office and logistics assets

- 4.2.6 Digital transformation across real estate portfolios driving software-enabled service uptake

- 4.3 Market Restraints

- 4.3.1 Prolonged weakness in residential transaction volumes due to affordability pressures

- 4.3.2 Tight labour market for skilled FM technicians and asset managers

- 4.3.3 Lengthy permitting cycles dampening project advisory pipelines

- 4.3.4 Commission compression from consumer protection and brokerage fee reforms

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Insights into Real Estate Tech and Startups Active in the Real Estate Services Segment

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD bn)

- 5.1 By Property Type

- 5.1.1 Residential

- 5.1.1.1 Single-Family

- 5.1.1.2 Multi-Family

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Logistics

- 5.1.2.4 Others

- 5.1.1 Residential

- 5.2 By Service

- 5.2.1 Brokerage Services

- 5.2.2 Property Management Services

- 5.2.3 Valuation Services

- 5.2.4 Others

- 5.3 By Client Type

- 5.3.1 Individuals / Households

- 5.3.2 Corporates & SMEs

- 5.3.3 Others

- 5.4 By City

- 5.4.1 Berlin

- 5.4.2 Munich

- 5.4.3 Frankfurt

- 5.4.4 Hamburg

- 5.4.5 Rest of Germany

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Vonovia SE

- 6.3.2 Deutsche Wohnen

- 6.3.3 LEG Immobilien SE

- 6.3.4 Instone Group

- 6.3.5 Vivawest Wohnen GmbH

- 6.3.6 Gewobag Wohnungsbau AG

- 6.3.7 SAGA Hamburg

- 6.3.8 Bundesanstalt fur Immobilienaufgaben

- 6.3.9 STRABAG Property & Facility Services GmbH

- 6.3.10 HEID Valuation

- 6.3.11 GESOBAU AG

- 6.3.12 CBRE GmbH (Germany)

- 6.3.13 Jones Lang LaSalle SE (Germany)

- 6.3.14 Savills Deutschland GmbH

- 6.3.15 BNP Paribas Real Estate Germany

- 6.3.16 Colliers International Deutschland GmbH

- 6.3.17 Cushman & Wakefield Germany

- 6.3.18 Drees & Sommer SE

- 6.3.19 Engel & Volkers AG

- 6.3.20 Patrizia SE

- 6.3.21 Scout24 AG (ImmobilienScout24)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment