PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851928

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851928

Millet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

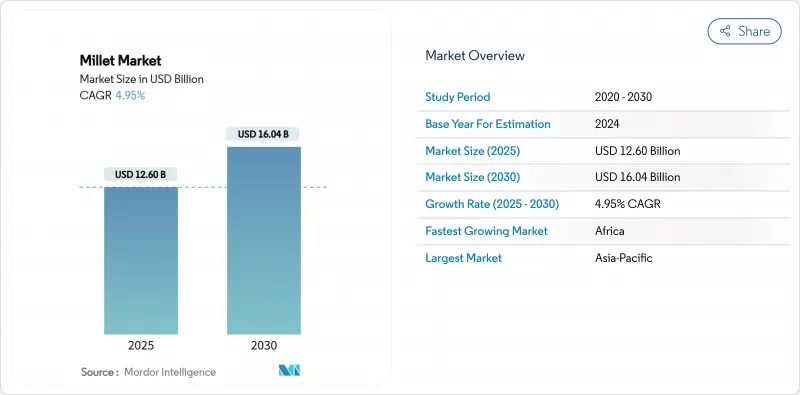

The Millet market size is estimated at USD 12.60 billion in 2025 and is projected to reach USD 16.04 billion by 2030, at a CAGR of 4.95% during the forecast period.

The climb reflects a decisive industry pivot toward climate-resilient crops as water scarcity, erratic monsoons, and rising temperatures undermine traditional cereals. Demand also benefits from millet's 70% lower irrigation requirement versus rice, its proven capacity to survive on just 200-400 mm of rainfall, and its widening role in functional foods that command price premiums of 40-60% over commodity grains. Processing investments from conglomerates such as ITC Limited and policy interventions like India's Public Distribution System inclusion have accelerated acreage expansion, while forward contracts and futures listings improve price discovery for risk-averse growers.

Global Millet Market Trends and Insights

Climate Resilient Crop Advantage

Millet's capacity to produce dependable yields on marginal land turns the crop into a strategic hedge against heat and drought shocks. Varieties withstand 200-400 mm of annual rainfall, while rice demands roughly 1,200 mm. Breakthrough "resurrection millet" lines even rehydrate embolized xylem tissue after complete desiccation, a trait that safeguards yield when competing cereals lose 30-50% of output under drought. As climate volatility intensifies, governments incorporate millet into food-security strategies, and growers extend cultivation onto fallow, rain-fed acreage, enlarging the millet market.

Surge in Functional Food and Beverage Formulation

The functional food boom elevates millet from a subsistence staple to a premium ingredient. Nutritional analyses show 60-70% carbohydrates and up to 12.1% protein alongside high calcium and magnesium densities. Meta-analysis across 19 trials reveals millet consumption cuts fasting blood glucose by 11.8% and post-prandial glucose by 15.1%, legitimizing disease-management claims for finished products. Pearl millet flour now substitutes up to 20% of wheat in gluten-free breads without sensory penalties, sustaining the premium segment's double-digit growth. These findings encourage processors to introduce high-margin snacks, cereals, and beverages that further enlarge the millet market.

Limited Mechanization and Yield Gap

Mechanized planting and harvesting reach barely 15% of millet acreage in Africa versus 80% for wheat in high-income markets. Tiny seeds clog conventional drills, and diverse landraces complicate equipment calibration. Field yields average 800-1,200 kg/ha compared with research-station ceilings near 3,000 kg/ha, locking producers into labor-intensive regimes that undercut price competitiveness. Absent affordable implements, the yield gap persists and slows millet market growth despite robust demand signals.

Other drivers and restraints analyzed in the detailed report include:

- Government Millet Missions and Subsidies

- Growing Demand in Gluten-Free Commodity Trading

- Infrastructure Deficit in Post-Harvest Handling

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Millet Market Report is Segmented by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Asia-Pacific retained 46.1% of the millet market share in 2024, with India contributing substantial production volumes and generating notable export earnings, both of which directly fuel regional processing demand. Government minimum-support prices, integration into public ration shops, and aggressive export targets underpin the region's entrenched leadership. China remains a vital consumption base for feed and liquor applications, yet its urbanizing dietary shift limits incremental growth, nudging Asia-Pacific toward a mature phase of the millet market.

Africa is on course for a 5.2% CAGR through 2030, the quickest climb among all continents. Niger, Nigeria, and Mali collectively harvested a significant share in 2024, equal to roughly one-third of global pearl millet output. National food-security agendas and climate adaptation policies incentivize acreage expansion, while corridor-wide processing investments improve value capture. Niger's edible-grain exports of millet already represent a meaningful portion of the country's total foreign earnings, and France absorbs a large share of that volume, signaling a budding Europe-Africa supply chain.

North America and Europe together form a niche but lucrative node within the millet market. Trials in the inland Pacific Northwest report proso millet varieties such as Plateau and Sunup outperforming earlier cultivars in iron, zinc, and antioxidant concentrations while delivering yields exceeding 2.5 metric tons per hectare. European buyers emphasize organic certification, sustainable sourcing, and traceable supply chains, attributes that justify price premiums sufficient to offset higher labor and compliance costs. Consequently, these high-income markets contribute disproportionate value relative to volume, thereby magnifying the overall millet market size.

- Market Overview

- Market Drivers

- Market Restraints

- Value/Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTLE Analysis

- List of Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Climate Resilient Crop Advantage

- 4.2.2 Surge in Functional Food and Beverage Formulation

- 4.2.3 Government Millet Missions and Subsidies

- 4.2.4 Growing Demand in Gluten-Free Commodity Trading

- 4.2.5 Accelerated Research and Development in Stress-Tolerant Varieties

- 4.2.6 Carbon-Credit Potential for Dryland Farmers

- 4.3 Market Restraints

- 4.3.1 Limited Mechanization and Yield Gap

- 4.3.2 Volatile Global Commodity Pricing

- 4.3.3 Infrastructure Deficit in Post-Harvest Handling

- 4.3.4 Competition from High-Productivity Cereals

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 Italy

- 5.1.2.3 United Kingdom

- 5.1.2.4 Russia

- 5.1.2.5 France

- 5.1.3 Asia-Pacific

- 5.1.3.1 China

- 5.1.3.2 India

- 5.1.3.3 Japan

- 5.1.3.4 Australia

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Argentina

- 5.1.4.3 Peru

- 5.1.5 Middle East

- 5.1.5.1 Saudi Arabia

- 5.1.5.2 United Arab Emirates

- 5.1.5.3 Turkey

- 5.1.6 Africa

- 5.1.6.1 Nigeria

- 5.1.6.2 Niger

- 5.1.6.3 Mali

- 5.1.1 North America

6 Competitive Landscape

- 6.1 List of Stakeholders

7 Market Opportunities and Future Outlook