PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851934

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851934

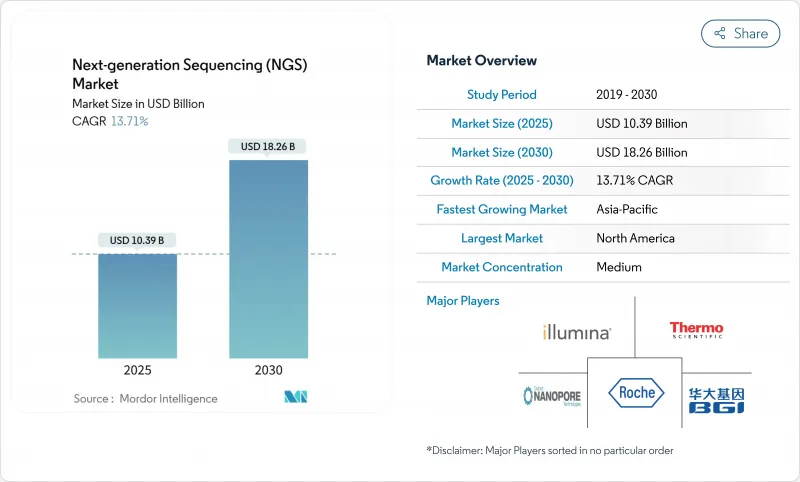

Next-generation Sequencing (NGS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Next Generation Sequencing market size generated around USD 10.39 billion in 2025 and is forecast to reach nearly USD 18.26 billion by 2030, reflecting a compound annual growth rate (CAGR) of 13.7% during 2025-2030.

This expansion signals the shift from a technology-centric phase to wide clinical deployment as sequencing costs approach USD 100 per genome, lowering the affordability barrier for health-system adoption. Reagents and consumables remain the main revenue engine, while the entrance of Element Biosciences, Ultima Genomics and other challengers is expanding platform choice and encouraging price competition. Oncology retains priority, but population-scale genomics, pharmacogenomics and rare-disease diagnostics are broadening demand. Imminent FDA rules on Laboratory Developed Tests (LDTs) promise clearer quality standards, yet they also increase compliance workloads that smaller laboratories must manage.

Global Next-generation Sequencing (NGS) Market Trends and Insights

Accelerating Adoption of Precision Medicine and Companion Diagnostics Across Oncology and Rare Disease Care Pathways

Oncology crossed a milestone in 2023 when clinical sequencing volumes surpassed research use, confirming hospital confidence that genomic data can guide drug selection and reduce avoidable treatments. The United States NGS oncology segment alone touched USD 3 billion in 2023 and is tracking toward USD 4 billion by 2025, illustrating health-system appetite for broader panel tests. FDA approval of comprehensive assays such as TruSight Oncology Comprehensive widens payer acceptance and accelerates lab conversion from single-gene to multi-gene panels. Combined with EHR integration pilots that deliver pharmacogenomic alerts at the point of care, clinicians now view sequencing as a routine rather than rare test. The next generation sequencing market consequently gains recurring throughput as treatment guidelines reference genomic signatures.

Continuous Decline in Cost Per Genome Driven by Higher-Throughput Chemistries and Innovative Instrument Technologies

Chemistry miniaturization, optics upgrades and base-calling algorithms have pushed the cost per human genome below USD 200 on Illumina's NovaSeq X system and toward USD 100 on emerging competitors. Providers in oncology and neonatology can now justify sequencing over multi-step legacy assays because price no longer overwhelms diagnostic savings. Falling consumable costs also encourage academic core facilities to expand instrument fleets, driving additional reagent demand that sustains the next generation sequencing market. Continued advancements in flow-cell reusability and kit multiplexing are expected to shave another 20%-30% from per-sample expense within two years, compressing payback periods for capital equipment.

Fragmented Global Regulatory Landscape for Clinical NGS Validation

The FDA final rule classifying most LDTs as medical devices introduces phased compliance through 2028 and compels clinical labs to submit premarket reviews or pivot to FDA-cleared kits. While the policy aims to harmonize quality, legal challenges from laboratory associations create uncertainty over timelines. Laboratories must budget for validation studies and potential system upgrades, temporarily slowing capital orders. Outside the United States, divergent requirements among China's NMPA, the EU's IVDR and Japan's PMDA force vendors to localize documentation, adding expense and lengthening product launches in the next generation sequencing market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion Of Population-Scale Genomics Programs Supported by Governments and Private Consortia Worldwide

- Increasing Utilization of NGS In Pharmaceutical Drug Discovery and Biomarker Identification Workflows

- Data-Privacy-Driven Restrictions on Cross-Border Genomic Data Transfer

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Targeted resequencing held 38.1% revenue in 2024, reinforcing its role as the workhorse for actionable cancer and germline panels that can be completed within forty-eight hours. Its focused scope reduces data-analysis burden and aligns with reimbursement codes, making it the entry point for most hospital labs in the next generation sequencing market. Whole exome sequencing is gaining as costs fall, recording a 14.2% CAGR to 2030 and serving as the first-line test with 45% diagnostic yield for rare diseases. RNA sequencing continues to proliferate in hematologic malignancies where fusion detection guides targeted therapy. Meanwhile, whole genome sequencing adoption remains modest yet rising because population projects increasingly demand full-coverage data. As AI-driven annotation accelerates, the next generation sequencing market size for WGS is forecast to outpace the overall market after 2028.

Instruments optimized for exome or genome throughput now integrate on-box secondary analysis, reducing the need for separate servers and making end-to-end turnaround more predictable. Laboratories switching from exome to genome workflows often retain existing extraction and library kits, cushioning transition costs. Vendors counterbalance cannibalization risk by offering upgrade paths that re-use flow-cell cartridges across multiple run modes. Consequently, the next generation sequencing market benefits from stickier consumable demand even as run formats diversify.

Reagents and consumables captured 69.9% of the next generation sequencing market share in 2024, underscoring the razor-and-blade model that underpins vendor profitability. Their dominant position reflects the monthly restocking cycle of flow cells, enzymes and capture probes in clinical labs that push 90% run capacity utilization. Although instruments represent a smaller base, innovations like Illumina's single-flow-cell NovaSeq X upgrade are expanding throughput while shrinking floor space. Instrument revenue thus posts a 14.4% CAGR to 2030, reinforced by leasing models that bundle reagents into multi-year contracts and cushion capital budgets.

Service providers-ranging from academic core facilities to commercial reference labs-continue to absorb complex bioinformatics workloads. Demand for data interpretation, particularly around mosaic variants and structural rearrangements, is driving a double-digit expansion in outsourced analysis. As artificial intelligence automates primary base-calling, vendors increasingly differentiate services through tertiary analytics and clinical reporting. That development anchors additional layers of recurring revenue and helps defend margins as reagent prices fall across the next generation sequencing market.

The Next Generation Sequencing (NGS) Market Report is Segmented by Type of Sequencing (Whole Genome Sequencing, and More), Product Type (Instruments, and More), Application (Drug Discovery and Personalized Medicine, and More), End User (Hospitals and Healthcare Institutions, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 41.9% revenue in 2024 on the back of advanced clinical reimbursement and venture funding for sequencing start-ups. The United States market expansion is reinforced by CMS coverage decisions that reimburse large somatic panels, while the phased LDT rule is expected to standardize quality and gradually accelerate payer confidence. Major academic medical centers leverage NIH grants for population-health genomics, ensuring a steady flow of instrument upgrades and consumables within the next generation sequencing market.

Asia-Pacific registers the fastest 14.2% CAGR through 2030, led by China's National Genomics Data Center and domestic innovators such as BGI. Local manufacturing incentives and large oncology incidence create favorable economics for home-grown sequencers that often undercut import prices. Japan and South Korea integrate sequencing into national cancer screening programs, while India scales pilot newborn-screening projects, widening reagent consumption. Regional regulatory reforms that streamline import licensing further accelerate technology transfer and platform penetration.

Europe maintains a significant share, supported by Horizon Europe funding and coordinated rare-disease networks. Nevertheless, GDPR data-localization constraints inflate operating costs; laboratories invest in federated analytics that comply with cross-border rules. The Middle East and Africa, though smaller, observe double-digit growth paced by precision-medicine hubs in the Gulf Cooperation Council and by Africa-based pathogen-genomics surveillance consortia that acquired fleet sequencers during the COVID-19 response. Overall, geographic diversification cushions currency risk and underpins long-term resilience of the next generation sequencing market.

- Illumina

- Thermo Fisher Scientific

- BGI Genomics Co. Ltd.

- Roche

- Oxford Nanopore Technologies Plc

- Pacific Bioscience

- QIAGEN

- Agilent Technologies

- Bio-Rad Laboratories

- PerkinElmer

- Eurofins

- Macrogen

- CD Genomics Inc.

- Genapsys Inc.

- 10x Genomics Inc.

- Twist Bioscience Corp.

- Guardant Health

- Fulgent Genetics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating Adoption of Precision Medicine and Companion Diagnostics Across Oncology and Rare Disease Care Pathways

- 4.2.2 Continuous Decline in Cost Per Genome Driven by Higher-Throughput Chemistries and Innovative Instrument Technologies

- 4.2.3 Expansion Of Population-Scale Genomics Programs Supported by Governments and Private Consortia Worldwide

- 4.2.4 Increasing Utilization of NGS In Pharmaceutical Drug Discovery and Biomarker Identification Workflows

- 4.2.5 Clinical-practice Guidelines (e.g., NCCN, ACMG) Increasingly Endorsing NGS Tests, Bolstering Payer Reimbursement

- 4.2.6 Integration of AI-enabled Bioinformatics Pipelines that Streamline Large-scale Data Analysis and Interpretation

- 4.3 Market Restraints

- 4.3.1 Fragmented Global Regulatory Landscape for Clinical NGS Validation

- 4.3.2 Data-Privacy-Driven Restrictions on Cross-Border Genomic Data Transfer

- 4.3.3 High Capital Outlay for Long-Read & Spatial Sequencing Platforms

- 4.3.4 Shortage of Bioinformatics Talent for Clinical Grade Interpretation

- 4.4 Regulatory Outlook

- 4.5 Technological Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type of Sequencing

- 5.1.1 Whole Genome Sequencing

- 5.1.2 Targeted Resequencing

- 5.1.3 Whole Exome Sequencing

- 5.1.4 RNA Sequencing

- 5.1.5 CHIP Sequencing

- 5.1.6 De Novo Sequencing

- 5.1.7 Methyl Sequencing

- 5.2 By Product Type

- 5.2.1 Instruments

- 5.2.2 Reagents and Consumables

- 5.2.3 Services

- 5.3 By Application

- 5.3.1 Drug Discovery and Personalized Medicine

- 5.3.2 Genetic Screening

- 5.3.3 Diagnostics

- 5.3.4 Agriculture and Animal Research

- 5.3.5 Other Applications (Epigenomics, Metagenomics, Transcriptomics)

- 5.4 By End User

- 5.4.1 Hospitals and Healthcare Institutions

- 5.4.2 Academics

- 5.4.3 Pharmaceuticals and Biotechnology Companies

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle-East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Illumina Inc.

- 6.4.2 Thermo Fisher Scientific Inc.

- 6.4.3 BGI Genomics Co. Ltd.

- 6.4.4 F. Hoffmann-La Roche Ltd.

- 6.4.5 Oxford Nanopore Technologies Plc

- 6.4.6 Pacific Biosciences of California Inc.

- 6.4.7 Qiagen N.V.

- 6.4.8 Agilent Technologies Inc.

- 6.4.9 Bio-Rad Laboratories Inc.

- 6.4.10 PerkinElmer Inc.

- 6.4.11 Eurofins Scientific SE

- 6.4.12 Macrogen Inc.

- 6.4.13 CD Genomics Inc.

- 6.4.14 Genapsys Inc.

- 6.4.15 10x Genomics Inc.

- 6.4.16 Twist Bioscience Corp.

- 6.4.17 Guardant Health Inc.

- 6.4.18 Fulgent Genetics Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment