PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851936

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851936

Stevia - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

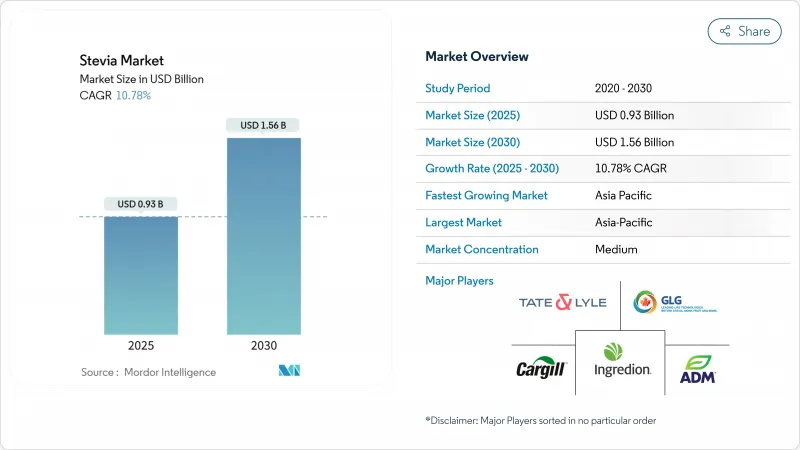

The Stevia market size, valued at USD 0.93 billion in 2025, is anticipated to grow significantly, reaching USD 1.56 billion by 2030, with a strong CAGR of 10.78%.

This growth is driven by increasing regulatory support, including FDA GRAS notices for rebaudioside M and enzyme-modified glycosides, which ensure product safety and encourage wider adoption. Rising health concerns about sugar consumption, coupled with the growing prevalence of obesity and diabetes, are pushing manufacturers to adopt plant-based alternatives, making Stevia a key solution for sugar reduction. The Asia-Pacific region remains a leader in Stevia cultivation and processing due to its scale and expertise. However, challenges such as tariff policies and scrutiny over labor practices are prompting buyers to explore alternative sourcing options. Additionally, advancements in bioconversion and precision fermentation technologies are reducing production costs and improving the taste profile of Stevia, enabling its use in a wider range of applications.

Global Stevia Market Trends and Insights

Shift in consumer preference toward natural and plant-based sweeteners

Consumer preference for natural alternatives to artificial sweeteners is driving stevia's dominance in the sweetener market, especially in developed markets where clean-label demands and ingredient transparency influence purchases. Regulatory advancements, like the FDA's GRAS approvals for steviol glycosides in May 2025, enhance trust by confirming safety and versatility . Institutional buyers, including foodservice operators and manufacturers, are also adopting stevia to meet the demand for health-conscious, sustainable products. Stevia's consistent and resilient demand positions it as a key growth driver in the sweetener market and a vital part of the industry's evolution.

Boosting the market growth surge in new product launches featuring stevia

Manufacturers are driving product innovation by utilizing stevia's versatility in beverages, dairy, and baked goods while addressing taste challenges. For example, Cargill and DSM-Firmenich's EverSweet line uses precision fermentation to create sugar-like Reb M and Reb D molecules without aftertaste. In 2024, the European Union approved fermentation-based stevia products, enabling broader launches in the region. Improved manufacturing processes are also lowering costs, making stevia a viable alternative to artificial sweeteners. Beverage leaders like Coca-Cola are investing in zero-sugar formulations, supported by better taste profiles, regulatory backing, and cost efficiencies, fostering innovation across food categories.

Volatility in stevia leaf prices due to agricultural factors

Stevia producers face challenges from volatile agricultural commodity prices, unpredictable weather, and geopolitical events, which disrupt supply chains and complicate price forecasts. Concentrated production in specific regions increases risks from localized disruptions, worsened by climate change. Geopolitical tensions, such as US Customs seizing Chinese stevia extracts over forced labor concerns, highlight vulnerabilities. Tariffs on imports from China and India are driving manufacturers to diversify sourcing, raising short-term costs but boosting domestic production. Splenda's USD 50 million Florida facility, launched in March 2023, aims to reduce reliance on international markets. Companies are adopting vertical integration and exploring precision fermentation to strengthen supply chains and ensure a sustainable stevia market.

Other drivers and restraints analyzed in the detailed report include:

- Expanding use of stevia in pharmaceuticals and nutraceuticals

- Advancements in stevia extraction and processing technologies

- Stringent regulatory requirements and lengthy approval processes sweeteners

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, powder stevia holds a 95.34% market share, establishing itself as the preferred choice in food and beverage manufacturing. Its dominance is due to stability, long shelf life, and compatibility with production processes. The powder format is favored for its handling ease, precise dosing, and cost-effective production, making it ideal for large-scale applications. Research from the University of Hohenheim highlights its versatility, with usage levels of 160-700 mg/kg in beverages and 500-1000 mg/kg in dairy desserts . Its moisture resistance and thermal stability make it suitable for baking, where liquid formats may compromise quality.

Liquid stevia is emerging as the fastest-growing format segment, with a projected CAGR of 12.58% from 2025 to 2030. This growth is driven by technological advancements that have addressed previous challenges related to solubility and taste. The rising demand for zero-sugar beverages, which require complete dissolution and precise sweetness control, is a significant factor fueling the liquid format's adoption. Industry leaders like Coca-Cola are actively working on improving rebaudioside M solubility through innovative compositions and spray-dried formulations. Additionally, Ingredion's Clean Taste Solubility Solution showcases advancements in liquid stevia applications, enhancing both taste and functionality to meet the evolving needs of beverage manufacturers.

The Stevia Market Report is Segmented by Format (Powder and Liquid), Ingredient Type (Organic and Conventional), Application (Bakery, Confectionery, Beverages, Dairy, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, the Asia-Pacific region holds a 31.43% share of the global stevia market and is projected to grow at a 12.20% CAGR from 2025 to 2030. Growth is driven by established cultivation and rising consumption in China, India, and Japan. The Indian Chemical Council highlights the region's seamless supply chain from cultivation to manufacturing. However, China's leading position faces regulatory challenges from US Customs over forced labor allegations, prompting manufacturers to reconsider sourcing. Meanwhile, India's growing stevia sector, supported by government initiatives, offers an alternative. Innovation, such as nanotechnology for stevioside accumulation, further strengthens the region's position.

North America, with established regulations and consumer acceptance, faces slower growth due to market saturation in the traditional food and beverage sectors. Tate & Lyle's partnership with Manus highlights supply chain advancements in stevia Reb M production. European markets are shifting toward premium stevia applications, driven by demand for clean-label and reduced-sugar products. Developers are addressing taste challenges with flavor-masking techniques and novel blends for dairy, beverages, and bakery products.

South America, the origin of stevia, combines cultivation expertise with emerging processing capabilities. However, macroeconomic volatility and infrastructure issues limit scalability. Producers focus on artisanal farming and sustainable sourcing, with global buyers prioritizing traceability and ESG benchmarks. Paraguay remains a hub for traditional leaf cultivation, appealing to brands seeking authenticity. In the Middle East and Africa, health awareness and regulatory support are growing, though local production is limited. Saudi Arabia and the UAE's 50% excise tax on sugar-sweetened beverages promotes stevia adoption .

- Cargill, Incorporated

- Ingredion Incorporated

- Tate & Lyle PLC

- Archer Daniels Midland Company

- GLG Life Tech Corporation

- Morita Kagaku Kogyo Co. Ltd

- Pyure Brands LLC

- Sunwin Stevia International, Inc.

- Evolva Holding SA

- Wisdom Natural Brands (SweetLeaf)

- SweeGen Inc.

- Arzeda Corp.

- Guilin Layn Natural Ingredients Corp.

- Zhucheng Haotian Pharma Co. Ltd

- Steviva Brands Inc.

- Xinghua GL Stevia Co., Ltd

- Ganzhou Julong High-Tech Industrial Co. Ltd

- Shandong Huaxian Stevia Co., Ltd.

- Jining Aoxing Stevia Products Co., Ltd.

- The Real Stevia Company AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift in consumer preference toward natural and plant-based sweeteners

- 4.2.2 Boosting the market growth surge in new product launches featuring stevia

- 4.2.3 Expanding use in pharmaceuticals and nutraceuticals

- 4.2.4 Advancements in extraction and processing technologies

- 4.2.5 Increasing prevalence of diabetes and obesity worldwide

- 4.2.6 Growing use in functional and fortified foods

- 4.3 Market Restraints

- 4.3.1 Volatility in prices due to agricultural factors

- 4.3.2 Stringent regulatory requirements and lengthy approval processes sweeteners

- 4.3.3 Supply chain disruptions affecting product availability

- 4.3.4 High production costs compared to traditional sweeteners.

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Format

- 5.1.1 Powder

- 5.1.2 Liquid

- 5.2 By Ingredient Type

- 5.2.1 Organic

- 5.2.2 Conventional

- 5.3 By Application

- 5.3.1 Bakery

- 5.3.2 Confectionery

- 5.3.3 Beverages

- 5.3.4 Dairy

- 5.3.5 Table-top Sweeteners

- 5.3.6 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Netherlands

- 5.4.2.6 Poland

- 5.4.2.7 Belgium

- 5.4.2.8 Sweden

- 5.4.2.9 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Indonesia

- 5.4.3.6 South Korea

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cargill, Incorporated

- 6.4.2 Ingredion Incorporated

- 6.4.3 Tate & Lyle PLC

- 6.4.4 Archer Daniels Midland Company

- 6.4.5 GLG Life Tech Corporation

- 6.4.6 Morita Kagaku Kogyo Co. Ltd

- 6.4.7 Pyure Brands LLC

- 6.4.8 Sunwin Stevia International, Inc.

- 6.4.9 Evolva Holding SA

- 6.4.10 Wisdom Natural Brands (SweetLeaf)

- 6.4.11 SweeGen Inc.

- 6.4.12 Arzeda Corp.

- 6.4.13 Guilin Layn Natural Ingredients Corp.

- 6.4.14 Zhucheng Haotian Pharma Co. Ltd

- 6.4.15 Steviva Brands Inc.

- 6.4.16 Xinghua GL Stevia Co., Ltd

- 6.4.17 Ganzhou Julong High-Tech Industrial Co. Ltd

- 6.4.18 Shandong Huaxian Stevia Co., Ltd.

- 6.4.19 Jining Aoxing Stevia Products Co., Ltd.

- 6.4.20 The Real Stevia Company AB

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK