PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851946

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851946

Viral Vector And Plasmid DNA Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

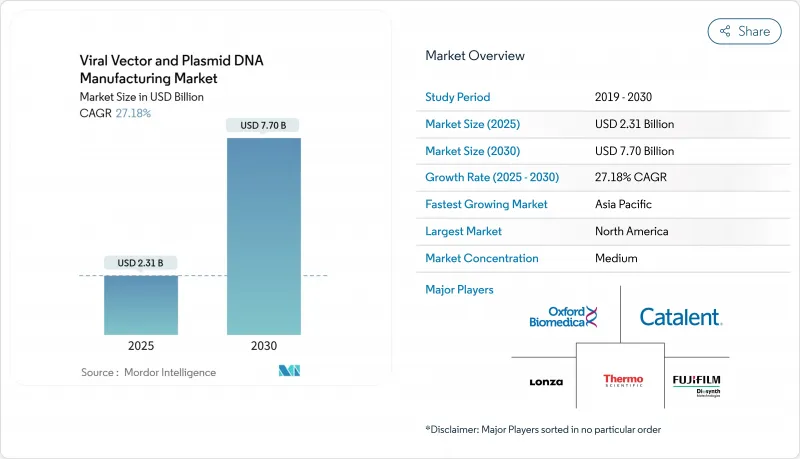

The viral vectors and plasmid DNA manufacturing market size stands at USD 2.31 billion in 2025 and is forecast to reach USD 7.70 billion by 2030, expanding at a 27.18% CAGR.

Demand accelerates as more gene therapies win regulatory approvals, personalized medicine becomes routine, and production technologies mature enough for commercial scale. Supply remains tight because global GMP capacity lags sharply behind the clinical pipeline, pushing sponsors toward specialized CDMOs and spurring wave after wave of facility expansions and acquisitions. Viral vectors continue to dominate shipments, yet non-viral approaches gain traction as developers try to curb cost, simplify scale-up, and limit immunogenicity. North America retains leadership in approvals and spend, but Asia-Pacific attracts the next tranche of factories as governments fund local biologics hubs and innovators chase lower operating outlays.

Global Viral Vector And Plasmid DNA Manufacturing Market Trends and Insights

Rising Incidence of Genetic and Chronic Diseases

More patients receive precise diagnoses for rare genetic disorders and chronic conditions, and many of those indications now have either approved or late-stage gene therapies in view. Recently cleared products such as Zevaskyn and Kebilidi show that authorities are willing to green-light advanced treatments for historically intractable illnesses, driving steady vector demand. The epidemiological transition toward older populations amplifies chronic disease prevalence, creating a durable pool of candidates for one-time gene replacement. Rare-disease incentives, including streamlined reviews and market exclusivity, further fortify the outlook. Combined, these factors add material volume to the viral vectors and plasmid DNA manufacturing market.

Growing Pipeline of Gene and Cell Therapies

More than 2,000 gene-therapy programs now populate global registries, with adeno-associated viruses (AAV) still the most common payload. The FDA's Platform Technology Designation for Sarepta's rAAVrh74 template encourages reuse of well-characterized vectors, cutting both cost and timeline. Drug makers have followed with bricks-and-mortar commitments such as Novartis' EUR 40 million EU vector plant, ensuring slots for late-stage assets . Developers that secure capacity early can move rapidly from Phase II data to launch. The steady clinical queue therefore locks in multi-year production visibility and underpins expansion across the viral vectors and plasmid DNA manufacturing market.

High Manufacturing and Capital Costs

A single gene-therapy course can cost USD 1 million, and viral vector inputs often consume up to 40% of that bill. While Brazil showed a path to USD 35,000 CAR-T pricing through local production, most health systems struggle to pay at scale. Outcome-based contracts help spread risk, but smaller biotech firms still face heavy upfront investment to secure slots or build plants. Automation and standardized platforms promise relief, yet they require multimillion-dollar capital outlays that only deep-pocketed sponsors can afford. These costs temper penetration of the viral vectors and plasmid DNA manufacturing market, especially in lower-income regions.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Adoption of Viral Vectors in Vaccines and Novel Modalities

- Technological Advancements in Scalable Vector Production Platforms

- Limited Global GMP Production Capacity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Viral vectors accounted for 55.45% of the viral vectors and plasmid DNA manufacturing market in 2024, supported by well-established regulatory precedents and strong transfection efficiency. Non-viral vectors deliver the fastest 29.65% CAGR through 2030, propelled by lipid nanoparticles, polymer conjugates, and electroporation systems that bypass immunity hurdles. Plasmid DNA remains the backbone for both categories, serving as the starting template for viral assembly and as the therapeutic construct in direct injection approaches.

The viral vectors and plasmid DNA manufacturing market size for viral vectors is projected to widen further as newly approved products such as Casgevy and Elevidys transition to commercial scale. AAV and lentiviral lines dominate oncology and rare-disease pipelines thanks to durable expression and tissue tropism. Yet manufacturing complexity keeps cost high, motivating drug sponsors to trial scalable non-viral carriers. Lipid nanoparticle expertise gained in mRNA COVID-19 vaccines can be leveraged for plasmid and siRNA delivery, helping non-viral methods chip away at share. Partnerships between nanoparticle specialists and legacy biologics CDMOs have already started to expand total factory utilization, indicating that both modalities will coexist within the viral vectors and plasmid DNA manufacturing market.

The Viral Vector and Plasmid DNA Manufacturing Market Report is Segmented by Product Type (Plasmid DNA, Viral Vector, and Non-Viral Vector), Application (Cancer, Genetic Disorders, Infectious Diseases, Ophthalmic Disorders and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 42.56% of 2024 revenue, sustained by FDA leadership, large venture funding pools, and a deep clinical-trial ecosystem. Major transactions like Lonza's USD 1.2 billion takeover of a Vacaville plant and Charles River's purchase of Vigene Biosciences illustrate the region's appetite for vertical integration. Skilled labor shortages and raw-material chokepoints do persist, but concerted workforce programs and reshoring incentives aim to close gaps. Overall, the viral vectors and plasmid DNA manufacturing market still finds its highest pricing and most reliable regulatory pathway in the United States.

Asia-Pacific shows the strongest 28.65% CAGR outlook as multinational firms and domestic champions build new suites in China, South Korea, India, and Australia. VectorBuilder's USD 500 million Guangzhou campus and WuXi Biologics' continual expansions reflect Beijing's emphasis on localizing critical modalities, while India's Bharat Biotech commits USD 75 million to its inaugural CGT plant. Regional authorities streamline approvals and offer tax credits, bringing down cost per liter and widening patient access. These moves rapidly enlarge the viral vectors and plasmid DNA manufacturing market in the region and diversify global supply lines.

Europe retains a mature yet evolving position. EMA guidelines give predictable review timelines, and cross-border consortia channel Horizon Europe funds into advanced-therapy infrastructure. Novartis' EUR 40 million Slovenian vector expansion underscores corporate confidence despite reimbursement variations across member states. Post-Brexit, the United Kingdom pursues parallel regulatory schemes to stay attractive for trials and manufacturing. Latin America and Middle East/Africa trail in absolute terms, but Brazil's cost-effectiveness breakthroughs and Gulf sovereign investment vehicles hint at fresh capacity additions. Collectively, geographical diversification spreads risk and adds resilience to the viral vectors and plasmid DNA manufacturing market.

- Lonza Group

- Thermo Fisher Scientific, Inc. (Viral Vector Services)

- Catalent

- Oxford Biomedica

- FUJIFILM

- Wuxi Advanced Therapies

- Aldevron (Danaher)

- AGC Biologics

- SIRION Biotech

- Cell & Gene Therapy Catapult

- FinVector

- Cognate BioServices (Cobra Biologics)

- MassBiologics

- Merck KGaA (MilliporeSigma)

- UniQure

- Charles River

- Takara Bio USA (CDMO Services)

- Yposkesi

- VGXI (GeneOne Life Science)

- Genezen

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Genetic and Chronic Diseases

- 4.2.2 Growing Pipeline of Gene and Cell Therapies

- 4.2.3 Expanding Adoption of Viral Vectors in Vaccines And Novel Modalities

- 4.2.4 Increasing Outsourcing To Specialized CDMOs

- 4.2.5 Technological Advancements in Scalable Vector Production Platforms

- 4.2.6 Supportive Regulatory and Funding Environment For Advanced Therapies

- 4.3 Market Restraints

- 4.3.1 High Manufacturing and Capital Costs

- 4.3.2 Limited Global GMP Production Capacity

- 4.3.3 Complex and Evolving Regulatory Requirements

- 4.3.4 Supply Chain Dependence on Specialized Raw Materials

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers / Consumers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitute Products

- 4.5.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Plasmid DNA

- 5.1.2 Viral Vector

- 5.1.3 Non-Viral Vector

- 5.2 By Application

- 5.2.1 Cancer

- 5.2.2 Genetic Disorders

- 5.2.3 Infectious Diseases

- 5.2.4 Ophthalmic Disorders

- 5.2.5 Neurological Disorders

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Lonza Group

- 6.3.2 Thermo Fisher Scientific, Inc. (Viral Vector Services)

- 6.3.3 Catalent Inc.

- 6.3.4 Oxford Biomedica

- 6.3.5 Fujifilm Diosynth Biotechnologies

- 6.3.6 Wuxi Advanced Therapies

- 6.3.7 Aldevron (Danaher)

- 6.3.8 AGC Biologics

- 6.3.9 SIRION Biotech

- 6.3.10 Cell & Gene Therapy Catapult

- 6.3.11 FinVector

- 6.3.12 Cognate BioServices (Cobra Biologics)

- 6.3.13 MassBiologics

- 6.3.14 Merck KGaA (MilliporeSigma)

- 6.3.15 UniQure NV

- 6.3.16 Charles River Laboratories

- 6.3.17 Takara Bio USA (CDMO Services)

- 6.3.18 Yposkesi

- 6.3.19 VGXI (GeneOne Life Science)

- 6.3.20 Genezen

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment