PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906960

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906960

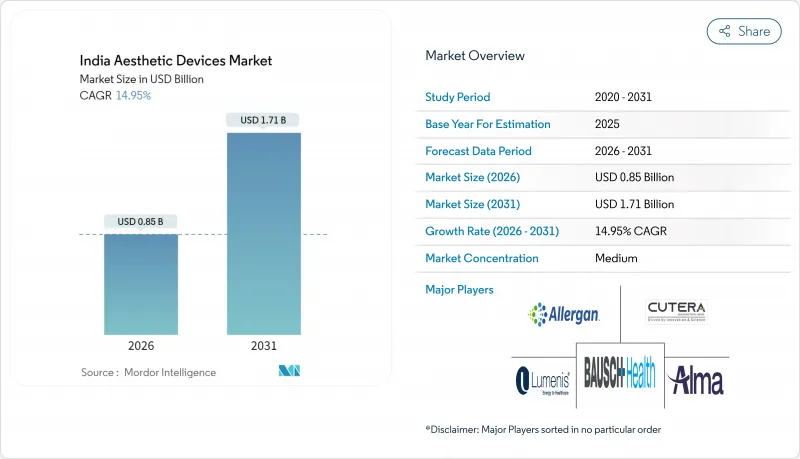

India Aesthetic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India Aesthetic Devices Market is expected to grow from USD 0.74 billion in 2025 to USD 0.85 billion in 2026 and is forecast to reach USD 1.71 billion by 2031 at 14.95% CAGR over 2026-2031.

Strong demand stems from rising disposable incomes, medical-tourism inflows, and policy incentives that cut import reliance and boost local output. Energy-based systems dominate procedure rooms, clinics adopt AI for treatment planning, and government production subsidies attract fresh capital into manufacturing hubs. Metro consumers drive early adoption, but tier-2 cities now show rapid uptake as awareness grows and financing options improve. Device makers see opportunity in customizable platforms that bundle multiple modalities, while providers leverage social media to normalize aesthetic care among men and women alike. Partnerships between global OEMs and Indian contract manufacturers shorten supply chains, reinforcing a shift from import-heavy distribution to mixed domestic production models.

India Aesthetic Devices Market Trends and Insights

Increasing Awareness Regarding Aesthetic Procedures

Urban consumers view cosmetic enhancement as routine wellness rather than vanity, a perception shift amplified by celebrity endorsements and social-media narratives. India now ranks second in rhinoplasty volume and third in liposuction counts worldwide, giving clinics deeper case experience that feeds further acceptance. Male demand grows for gynecomastia correction and hair restoration, broadening the gender mix once skewed toward female clientele. Consultation numbers surge in tier-2 cities yet infrastructure gaps still limit procedural throughput outside metros. Training institutes respond by running short intensive programs, which in turn seed new clinics in smaller urban clusters.

Rising Disposable Income & Medical Tourism

Domestic purchasing power also rises, with the luxury beauty segment signaling readiness to pay for non-reimbursed procedures. Competitive pack ages price aesthetic treatments 60-80% below Western benchmarks, a gap large enough to offset travel costs for foreign clients. The National Capital Region treated 1,851 foreign organ-transplant patients in 2023, underscoring India's perceived clinical competence. This dual domestic-international demand profile encourages providers to invest in advanced multimodal platforms that broaden menu offerings.

High Cost of Aesthetic Procedures & Devices

Energy-based systems priced between INR 15-50 lakh (USD 17.1 to 57 thousands) challenge smaller clinics that serve emerging-city catchments, limiting device penetration outside metros. Insurance rarely pays for cosmetic indications, forcing self-pay models that strain middle-income budgets. Import duties inflate landed costs, though early PLI outputs are starting to close the price gap on select RF handpieces. Portable units help some practitioners enter the market, yet power ratings and duty cycles of such devices often restrict them to entry-level services. Financing schemes bundled by OEMs relieve upfront burdens but extend break-even horizons if patient volumes plateau in nascent geographies.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Technological Advancements

- Government PLI Scheme Spurring Domestic Manufacturing

- Shortage of Trained Practitioners Beyond Tier-1 Cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Energy-based equipment generated 47.44% of India aesthetic devices market size in 2025 and will stay in the lead as radiofrequency systems post an 17.65% CAGR to 2031. Laser platforms still anchor hair-removal menus and high-fluence pigment correction, while ultrasound systems gain appeal for non-surgical fat disruption in mid-section treatments. Multi-modal consoles that mate RF with pulsed light or HIFEM lure clinics seeking one head-unit for multiple indications, reducing real-estate footprints inside compact procedure rooms.

Indian manufacturers now co-design handpieces sized for local ergonomics, substituting imported optics with domestically sourced fiber bundles to hit 30-40% lower BOM costs. AI dashboards visualize impedance curves and skin-temperature data, guiding operators to micro-adjust dwell times for Fitzpatrick IV-V skin types common across India. Disposable tip revenues create annuity streams for OEMs, while predictive-maintenance alerts cut unscheduled downtime, boosting device uptime contractual guarantees above 96% for premier providers. Clinics market zero-downtime fractional resurfacing sessions framed around festival seasons when patient volumes spike.

The India Aesthetic Devices Market Report is Segmented by Type of Device (Energy-Based Aesthetic Device, Non-Energy-Based Aesthetic Device), Application (Skin Resurfacing & Tightening, Body Contouring & Cellulite Reduction, and More), End User (Hospitals, and More), and Region (North India, West India, South India, East India, Central India, North-East India). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Allergan Aesthetics (AbbVie Inc.)

- Alma Lasers (Sisram Medical)

- Bausch Health (Solta Medical)

- BTL

- Cutera

- Zimmer Biomet

- Lumenis

- Venus Concept

- 7e Wellness

- Cynosure (Hologic Inc.)

- Candela Medical

- InMode Ltd.

- Merz Pharma

- Fotona d.o.o.

- Candela Medical

- Lutronic

- Stryker

- Iridex Corp.

- Invasix Aesthetic Solutions

- Quanta System S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Awareness Regarding Aesthetic Procedures

- 4.2.2 Rising Disposable Income & Medical Tourism

- 4.2.3 Rapid Technological Advancements

- 4.2.4 Aging Population & Focus on Anti-Aging

- 4.2.5 Government PLI Scheme Spurring Domestic Manufacturing

- 4.2.6 AI-Driven Personalized Treatment Protocols

- 4.3 Market Restraints

- 4.3.1 High Cost of Aesthetic Procedures & Devices

- 4.3.2 Social Stigma & Ethical Concerns

- 4.3.3 Regulatory Ambiguity Under CDSCO Classifications

- 4.3.4 Shortage of Trained Practitioners Beyond Tier-1 Cities

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Type of Device

- 5.1.1 Energy-based Aesthetic Device

- 5.1.1.1 Laser-based Aesthetic Device

- 5.1.1.2 Radiofrequency-based Aesthetic Device

- 5.1.1.3 Light-based Aesthetic Device

- 5.1.1.4 Ultrasound Aesthetic Device

- 5.1.1.5 Other Energy-based Aesthetic Devices

- 5.1.2 Non-energy-based Aesthetic Device

- 5.1.2.1 Botulinum Toxin

- 5.1.2.2 Dermal Fillers & Threads

- 5.1.2.3 Microdermabrasion

- 5.1.2.4 Implants

- 5.1.2.5 Other Non-energy-based Aesthetic Devices

- 5.1.1 Energy-based Aesthetic Device

- 5.2 By Application

- 5.2.1 Skin Resurfacing & Tightening

- 5.2.2 Body Contouring & Cellulite Reduction

- 5.2.3 Facial Aesthetic Procedures

- 5.2.4 Hair Removal

- 5.2.5 Breast Augmentation

- 5.2.6 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Clinics & Beauty Centers

- 5.3.3 Home Care Settings

- 5.4 By Region

- 5.4.1 North India

- 5.4.2 West India

- 5.4.3 South India

- 5.4.4 East India

- 5.4.5 Central India

- 5.4.6 North-East India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Allergan Aesthetics (AbbVie Inc.)

- 6.3.2 Alma Lasers (Sisram Medical)

- 6.3.3 Bausch Health (Solta Medical)

- 6.3.4 BTL Aesthetics

- 6.3.5 Cutera Inc.

- 6.3.6 Zimmer Biomet

- 6.3.7 Lumenis Ltd.

- 6.3.8 Venus Concept India

- 6.3.9 7e Wellness

- 6.3.10 Cynosure (Hologic Inc.)

- 6.3.11 Candela Medical

- 6.3.12 InMode Ltd.

- 6.3.13 Merz Pharma GmbH & Co. KGaA

- 6.3.14 Fotona d.o.o.

- 6.3.15 Syneron Medical Ltd.

- 6.3.16 Lutronic Corporation

- 6.3.17 Stryker Corporation

- 6.3.18 Iridex Corp.

- 6.3.19 Invasix Aesthetic Solutions

- 6.3.20 Quanta System S.p.A.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment