PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851970

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851970

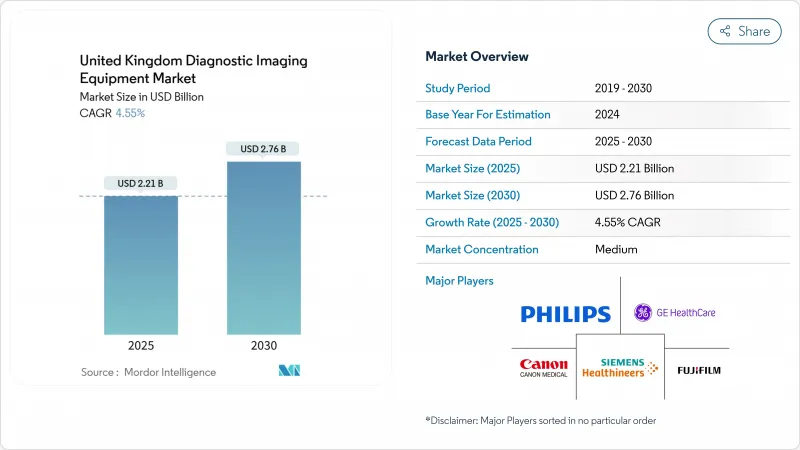

United Kingdom Diagnostic Imaging Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United Kingdom Diagnostic Imaging Equipment Market size is estimated at USD 2.21 billion in 2025, and is expected to reach USD 2.76 billion by 2030, at a CAGR of 4.55% during the forecast period (2025-2030).

Stable growth rests on NHS capital injections, notably the USD 29 billion modernization fund that underwrites rapid scanner replacement and the roll-out of 160 Community Diagnostic Centres, each configured for high-throughput MRI, CT, and ultrasound workflows. An aging population, chronic disease prevalence, and guideline-driven screening programs combine to lift annual imaging volumes well above the 45 million procedures conducted in 2024, locking in structural demand. Brexit-related supply chain friction simultaneously spurs on-shore manufacturing such as Siemens Healthineers' GBP 250 million Oxford MRI plant, curbing import risk and anchoring next-generation R&D. Technology adoption tilts toward AI-enabled scanners and managed-equipment-service (MES) contracts that accelerate refresh cycles while easing up-front capital strain. Workforce shortages, with 30% radiologist vacancies, amplify interest in workflow automation that maintains throughput without proportional staff additions.

United Kingdom Diagnostic Imaging Equipment Market Trends and Insights

Rising Prevalence of Chronic Diseases

Escalating cardiovascular, oncologic, and metabolic disorders fuel multi-modality imaging demand, with chronic cases now accounting for the fastest-growing share of the 47 million NHS scans projected for 2025. Cancer screening expansions extend imaging intensity across diagnosis, staging, and surveillance stages, further tightening scanner utilization. Diabetes-related vascular assessments and musculoskeletal degeneration in an older workforce add to modality-agnostic volume growth. NICE guidelines increasingly favor imaging over invasive procedures, reinforcing reliance on CT angiography and MRI arthrography. The cumulative effect is a higher lifetime scan count per patient, anchoring durable revenue across modalities.

Growing Adoption of Advanced Imaging Technologies

Teaching hospitals spearhead procurement of AI-augmented CT, MRI, and X-ray systems that compress exam times and slash repeats, thereby freeing scarce staff capacity. NICE approved four AI fracture-detection tools in 2024, signposting regulatory acceptance and accelerating hospital tender requirements for embedded analytics. Digital breast tomosynthesis outperforms 2-D mammography in cancer pick-up rates, prompting nationwide upgrade roadmaps. Low-helium 1.5 T MRI platforms, such as MAGNETOM Flow, cut running costs by up to 30%, satisfying both budgetary and sustainability mandates. Synthetic-CT algorithms reduce radiation dose while safeguarding image fidelity, helping providers meet IR(ME)R 2024 thresholds and regulations.

High Equipment & Procedure Costs

MRI suite build-outs exceed GBP 2 million once shielding and HVAC upgrades are counted, a figure that eclipses annual capital envelopes for many community hospitals. Service contracts add another 10% of purchase price each year, locking trusts into steep overheads for the full operational life. Reimbursement tariffs lag real costs for advanced modalities, disincentivizing early adoption despite clinical gains. Aging assets-57% of CT scanners are now older than five years-raise maintenance outlays and unplanned downtime, dampening throughput and revenue. Collectively, these cost pressures slow the pace at which smaller facilities can join modernization programs.

Other drivers and restraints analyzed in the detailed report include:

- Government Capital Funding to Modernise NHS Imaging Fleet

- Managed-Equipment-Service (MES) Model Shortening Replacement Cycles

- Radiographer Shortages Limiting Scanner Throughput

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

X-ray retained 34.12% of United Kingdom diagnostic imaging equipment market share in 2024, owing to low ownership costs, ubiquitous clinical indications, and minimal facility prerequisites. The segment enjoys near-universal deployment across emergency rooms, outpatient clinics, and community diagnostic centres. Digital radiography upgrades replace aging CR suites, boosting detector sensitivity and cutting radiation by up to 40%. Mobile DR units enable bedside imaging, supporting infection-control protocols and reducing patient transport time. Nevertheless, flat growth expectations reflect saturation and reimbursement ceilings.

MRI exhibits the fastest 5.97% CAGR, extending the United Kingdom diagnostic imaging equipment market by expanding use cases such as prostate multiparametric scans, liver iron quantification, and fetal imaging. High-field 3 T and emerging 7 T platforms capture neurology and orthopaedics subspecialties that demand high-resolution soft-tissue contrast. The helium-light MAGNETOM Flow and GE HealthCare's new ultra-premium 1.5 T gradient system limit operational expense, widening the addressable buyer base. Hybrid PET-MR holds niche appeal for oncology research centres but benefits from pooled academic-industry funding. CT, ultrasound, nuclear imaging, fluoroscopy, and mammography remain critical but record mid-single-digit growth, largely tied to replacement rather than net-new installs.

Fixed rooms delivered 80.84% of the United Kingdom diagnostic imaging equipment market size in 2024, reflecting entrenched hospital demand for high-throughput CT, MRI, and interventional labs. Large teaching hospitals invest in multi-room suites with shared control areas and integrated RIS/PACS, achieving capacity utilisation above 85%. Shielded bunkers and gantry weight constraints keep these systems firmly site-bound. Warranty extensions and modular upgrades prolong asset life, yet fleet renewal cycles shorten under MES arrangements.

Conversely, mobile and hand-held platforms record a 6.12% CAGR, riding the decentralisation wave that places diagnostics closer to patients. Community Diagnostic Centres rely on trailer-based CT and MRI units that rotate through rural catchment areas, delivering 40-scan daily capacity without bricks-and-mortar spend. Butterfly Network's GBP 1,699 handheld ultrasound compresses a traditional USD 50,000 cart into a smartphone-sized probe, unlocking point-of-care adoption across 21 trusts. Portable C-arms and mini-fluoroscopy systems support day-case surgical hubs, further dispersing imaging capacity. Growth hinges on clinician training and reimbursement alignment, both advancing via NHS digital accreditation pathways.

The United Kingdom Diagnostic Imaging Equipment Market Report is Segmented by Modality (MRI, Computed Tomography, Ultrasound, X-Ray, Nuclear Imaging, Fluoroscopy, Mammography), Portability (Fixed Systems, Mobile and Hand-Held Systems), Application (Cardiology, Oncology, Neurology, Orthopedics, and More), and End-User (Hospitals, Diagnostic Imaging Centres, Other End-Users). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Siemens Healthineers

- GE Healthcare

- Koninklijke Philips

- Canon

- Fujifilm Holdings Corp.

- Carestream Health

- Hologic

- Shimadzu

- Esaote

- MR Solutions

- Samsung Medison Co. Ltd.

- United Imaging Healthcare Co. Ltd.

- Mindray Medical Intl. Ltd.

- Butterfly Network Inc.

- Medray Imaging Systems Ltd.

- Xograph Healthcare Ltd.

- Intelligent Ultrasound Group plc

- Agfa-Gevaert

- Ziehm Imaging

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Chronic Diseases

- 4.2.2 Growing Adoption of Advanced Imaging Technologies

- 4.2.3 Government Capital Funding to Modernise NHS Imaging Fleet

- 4.2.4 Managed-Equipment-Service (MES) Model Shortening Replacement Cycles

- 4.2.5 AI-Enabled Workflow Tools Boosting Utilisation Rates

- 4.2.6 Hand-Held Ultrasound Uptake in Primary/Community Settings

- 4.3 Market Restraints

- 4.3.1 High Equipment & Procedure Costs

- 4.3.2 Radiation-Dose Compliance and Image-Quality Regulations

- 4.3.3 Brexit-Linked Installation & Spare-Parts Delays

- 4.3.4 Shortage of Radiographers Limiting Scanner Throughput

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Modality

- 5.1.1 MRI

- 5.1.1.1 High-field (>1.5 T)

- 5.1.1.2 Low-field (<=1.5 T)

- 5.1.2 Computed Tomography

- 5.1.2.1 High-slice (>64)

- 5.1.2.2 Mid-slice (16-64)

- 5.1.2.3 Low-slice (<16)

- 5.1.2.4 Cone-Beam CT

- 5.1.3 Ultrasound

- 5.1.3.1 Diagnostic (2D)

- 5.1.3.2 Diagnostic (3D/4D)

- 5.1.3.3 Hand-held/Portable

- 5.1.4 X-Ray

- 5.1.4.1 Digital Radiography

- 5.1.4.2 Analog Radiography

- 5.1.4.3 Mobile DR

- 5.1.5 Nuclear Imaging

- 5.1.5.1 PET

- 5.1.5.2 SPECT

- 5.1.5.3 Hybrid (PET-CT / PET-MR)

- 5.1.6 Fluoroscopy

- 5.1.6.1 Fixed C-arm

- 5.1.6.2 Mobile C-arm

- 5.1.7 Mammography

- 5.1.7.1 Digital 2D

- 5.1.7.2 3D Tomosynthesis

- 5.1.1 MRI

- 5.2 By Portability

- 5.2.1 Fixed Systems

- 5.2.2 Mobile and Hand-held Systems

- 5.3 By Application

- 5.3.1 Cardiology

- 5.3.2 Oncology

- 5.3.3 Neurology

- 5.3.4 Orthopedics

- 5.3.5 Gastroenterology

- 5.3.6 Gynecology

- 5.3.7 Other Applications

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Imaging Centres

- 5.4.3 Other End-users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Siemens Healthineers

- 6.3.2 GE Healthcare

- 6.3.3 Koninklijke Philips N.V.

- 6.3.4 Canon Medical Systems Corporation

- 6.3.5 Fujifilm Holdings Corp.

- 6.3.6 Carestream Health Inc.

- 6.3.7 Hologic Inc.

- 6.3.8 Shimadzu Corp.

- 6.3.9 Esaote SpA

- 6.3.10 MR Solutions Ltd.

- 6.3.11 Samsung Medison Co. Ltd.

- 6.3.12 United Imaging Healthcare Co. Ltd.

- 6.3.13 Mindray Medical Intl. Ltd.

- 6.3.14 Butterfly Network Inc.

- 6.3.15 Medray Imaging Systems Ltd.

- 6.3.16 Xograph Healthcare Ltd.

- 6.3.17 Intelligent Ultrasound Group plc

- 6.3.18 Agfa-Gevaert NV

- 6.3.19 Ziehm Imaging GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment