PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851989

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851989

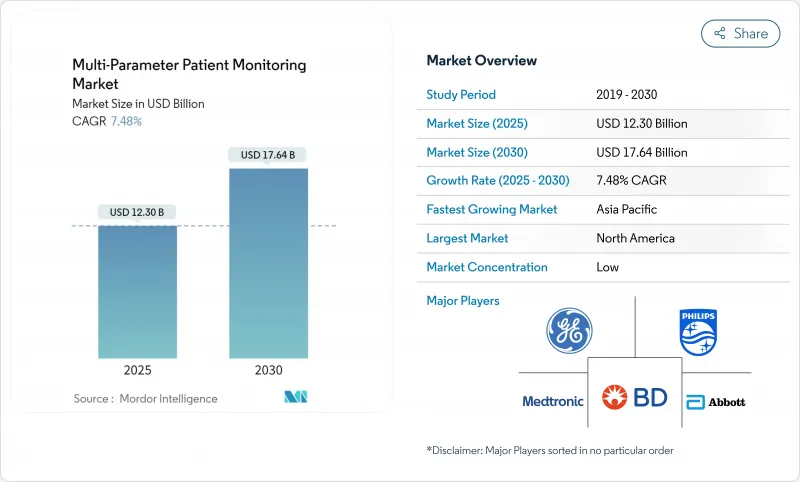

Multi-Parameter Patient Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The patient monitoring systems market size stood at USD 12.30 billion in 2025 and is forecast to reach USD 17.64 billion by 2030, advancing at a 7.84% CAGR.

Within this growth arc, clinical priorities have shifted toward mobility, interoperability and data-driven decision support, accelerating the transition from fixed bedside units to portable, wearable and AI-enabled platforms. Hospital staffing shortages, higher patient acuity and chronic-disease prevalence continue to elevate demand for continuous surveillance, while reimbursement expansion in the United States and Europe sustains investment in remote care. Semiconductor supply tightness has pushed manufacturers to redesign hardware around power-efficient architectures, and energy-harvesting wearables are beginning to remove battery-related limitations. Strategic alliances-such as GE HealthCare's multi-year imaging and monitoring partnership with Sutter Health-illustrate how large providers are standardizing on platform ecosystems that embed predictive analytics into routine workflows.

Global Multi-Parameter Patient Monitoring Market Trends and Insights

Rising Prevalence of Chronic Diseases Requiring Continuous Vital-Sign Surveillance

More than 537 million adults live with diabetes and cardiovascular diseases remain the leading global cause of death. Continuous glucose monitors, such as Dexcom G7 cleared by FDA in 2024, deliver 8% mean absolute relative difference accuracy over an extended 15-day sensor life. Integrated solutions linking Abbott glucose sensors with Medtronic insulin pumps are lowering hypoglycemic events by 40%. Multimorbidity among older adults intensifies demand for multi-parameter platforms capable of flagging subtle deterioration far earlier than spot-check routines.

Accelerated Adoption of Remote Patient Monitoring Post-COVID-19

Clinician uptake of remote patient monitoring climbed above 80% in 2024 as telehealth reimbursement parity removed geographic barriers in the United States. India's eSanjeevani network has delivered more than 340 million consultations since launch, confirming scalability in resource-constrained settings. RPM programs have reduced readmissions for chronic conditions and supported home-based transition pathways such as Masimo's donation of Stork Smart Home Baby Monitors to 50,000 families.

Reimbursement Expansion for Home Telemetry in the U.S. & EU

The 2025 Medicare Physician Fee Schedule maintains CPT 99453-99458, paying up to USD 47.87 per 20-minute interactive RPM session when FDA-cleared devices transmit at least 16 readings every 30 days. Germany's Digital Healthcare Act similarly supports digital therapeutics, accelerating commercial adoption of connected monitors. Private payers such as Cigna now deem RPM medically necessary for COPD, diabetes and heart-failure management.

Other drivers and restraints analyzed in the detailed report include:

- Hospital Capacity Constraints Driving Demand for Portable Multi-Parameter Monitors

- High Capital Cost for High-Acuity Bedside Systems

- Cyber-Security & Interoperability Concerns in Networked Monitors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Portable/handheld systems accounted for 34.72% of 2024 demand, favored for their compact footprint in emergency, perioperative and step-down settings where floor space is constrained. Wearable and remote devices, boosted by organic-photovoltaic harvesters that reach 16.18% energy-conversion efficiency, are projected to post the fastest 8.56% CAGR to 2030. Pandemic-era care models validated the clinical safety of untethered vitals capture, prompting providers to place portability ahead of feature depth when refreshing fleets. Hardware redesigns also mitigate semiconductor shortages by using lower-power chipsets, extending service life and easing maintenance schedules.

SurePulse Medical's wireless newborn monitor demonstrates how NICU-grade accuracy is now delivered without traditional cables, reducing caregiver workload and improving skin integrity in fragile infants. Fixed bedside consoles still dominate intensive and perioperative care because they aggregate multi-parameter streams and integrate with hospital alarm middleware. Yet vendors are embedding Bluetooth Low Energy radios into those consoles so data can mirror to clinician tablets, smoothing migration toward fully wireless ecosystems. Hospitals that standardize on a single operating system for both portable and fixed units also gain cybersecurity uniformity, an increasingly important buying criterion. As a result, product roadmaps across leading brands show converging design languages that prioritize modular sensor ports, cloud compatibility and subscription-based analytics.

Adults held 53.20% share in 2024, reflecting the broad need for routine vitals collection in medical, surgical and telemetry wards. The geriatric cohort is expanding at a 9.67% CAGR as populations age and multimorbidity heightens surveillance requirements across cardiac, metabolic and respiratory domains. Frailty scores used by hospitalists reinforce the business case for continuous monitors that detect subtle deterioration earlier than nurse rounding. Remote monitoring also allows long-term-care facilities to escalate patients before crises, reducing avoidable transfers to overcrowded emergency departments.

At the opposite end of the spectrum, neonatology has become a high-value niche where touchless optical systems monitor movement and heart rate without adhesives that can damage preterm skin. Pediatric centers deploy stretchable, skin-interfacing biosensors that flex with growth and activity to capture cardiac and respiratory data painlessly. Adolescents benefit from cloud-linked asthma and diabetes wearables that feed clinician dashboards as well as parental smartphone apps, fostering adherence. Together, these age-tailored innovations extend the patient monitoring systems market beyond traditional acute-care silos into schools, homes and rehabilitation venues.

The Patient Monitoring Systems Market Report is Segmented by Device Type (Portable/Handheld Monitors, Wearable/Remote Monitors, and More), Patient Age Group (Neonatal, Pediatric, and More), End User (Hospitals & Intensive Care Units, Ambulatory Surgery Centers, and More), Application (Cardiology, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD), Based On Availability.

Geography Analysis

North America retained 42.23% share in 2024, underpinned by Medicare RPM coverage and enterprise-wide rollouts such as Sutter Health's seven-year partnership with GE HealthCare across 300 facilities.

Asia-Pacific is forecast to register a 10.93% CAGR, buoyed by India's Ayushman Bharat Digital Mission issuing 568 million health IDs and by China's commitment to WHO-aligned digital-health standards. Regional suppliers are tailoring cost-efficient monitors for fast-growing mid-tier hospitals.

Europe continues steady adoption as the Medical Device Regulation enforces post-market surveillance, while Germany's DiGA fast-track reimburses connected therapies. Southern and Eastern Europe leverage EU structural funds to modernize monitoring infrastructure.

South America shows potential with Brazilian firms such as BR HomMed expanding tele-ICU models that bridge rural access gaps. In the Middle East and Africa, Gulf states are investing aggressively in e-ICU hubs that centralize surveillance for satellite hospitals.

- GE Healthcare

- Koninklijke Philips

- Nihon Kohden

- Mindray

- Dragerwerk

- Medtronic

- Siemens Healthineers

- Masimo

- ICU Medical

- Baxter

- Smiths Group plc (Smiths Medical)

- OSI Systems, Inc. (Spacelabs Healthcare)

- Schiller

- Contec Medical Systems

- BPL

- Edan Instruments, Inc.

- Fukuda Denshi Co., Ltd.

- Abbott Laboratories

- General Meditech, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of chronic diseases requiring continuous vital-sign surveillance

- 4.2.2 Accelerated adoption of remote patient monitoring post-COVID-19

- 4.2.3 Hospital capacity constraints driving demand for portable multi-parameter monitors

- 4.2.4 Reimbursement expansion for home telemetry in the U.S. & EU

- 4.2.5 AI-enabled predictive analytics embedded in next-gen monitors (under-reported)

- 4.2.6 Battery-less energy-harvesting wearables lowering TCO (under-reported)

- 4.3 Market Restraints

- 4.3.1 High capital cost for high-acuity bedside systems

- 4.3.2 Cyber-security & interoperability concerns in networked monitors

- 4.3.3 Shortage of trained biomedical engineers in LMIC hospitals (under-reported)

- 4.3.4 Supply-chain fragility for critical semiconductors (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Device Type (Value)

- 5.1.1 Portable / Handheld Monitors

- 5.1.2 Wearable / Remote Monitors

- 5.1.3 Fixed

- 5.1.4 Wireless Integrated Monitors

- 5.2 By Patient Age Group (Value)

- 5.2.1 Neonatal

- 5.2.2 Pediatric

- 5.2.3 Adult

- 5.2.4 Geriatric

- 5.3 By End User (Value)

- 5.3.1 Hospitals & Intensive Care Units

- 5.3.2 Ambulatory Surgery Centers

- 5.3.3 Specialty Clinics

- 5.3.4 Homecare Settings

- 5.3.5 Emergency Medical Services

- 5.4 By Application (Value)

- 5.4.1 Cardiology

- 5.4.2 Neurology

- 5.4.3 Respiratory

- 5.4.4 Fetal & Neonatal

- 5.4.5 Temperature Monitoring

- 5.4.6 Other Applications

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 GE HealthCare

- 6.3.2 Philips Healthcare

- 6.3.3 Nihon Kohden Corporation

- 6.3.4 Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- 6.3.5 Dragerwerk AG & Co. KGaA

- 6.3.6 Medtronic plc

- 6.3.7 Siemens Healthineers AG

- 6.3.8 Masimo Corporation

- 6.3.9 ICU Medical, Inc.

- 6.3.10 Baxter International Inc.

- 6.3.11 Smiths Group plc (Smiths Medical)

- 6.3.12 OSI Systems, Inc. (Spacelabs Healthcare)

- 6.3.13 Schiller AG

- 6.3.14 Contec Medical Systems Co., Ltd.

- 6.3.15 BPL Medical Technologies

- 6.3.16 Edan Instruments, Inc.

- 6.3.17 Fukuda Denshi Co., Ltd.

- 6.3.18 Abbott Laboratories

- 6.3.19 General Meditech, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment