PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907277

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907277

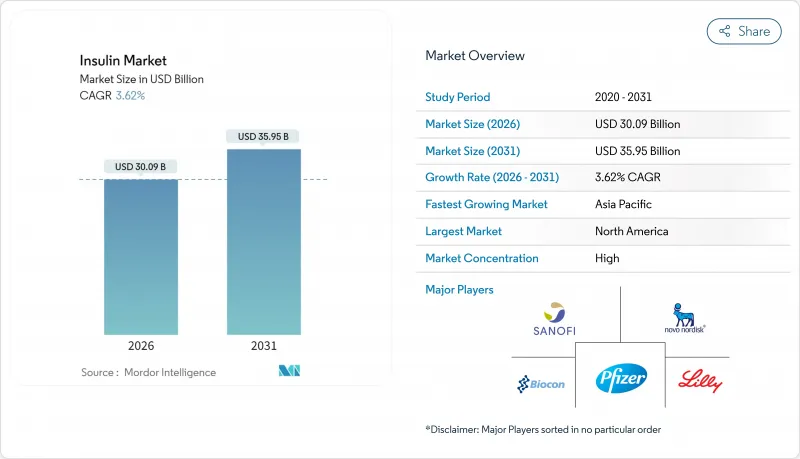

Insulin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The insulin market is expected to grow from USD 29.04 billion in 2025 to USD 30.09 billion in 2026 and is forecast to reach USD 35.95 billion by 2031 at 3.62% CAGR over 2026-2031.

Demand is anchored by the steady rise in diabetes prevalence, expanding reimbursement coverage, and continuous innovation in long-acting and non-invasive formulations. At the same time, widening access to biosimilars is tempering price growth, while next-generation delivery systems are expanding prescriber and patient options. Competition from incretin-based therapies is siphoning demand at the margin, yet manufacturers are counter-balancing through weekly basal products, glucose-responsive platforms, and large-scale capacity expansions. Collectively, these forces point to a maturing yet resilient insulin market characterized by incremental volume gains, richer product mix, and heightened technology content.

Global Insulin Market Trends and Insights

Increasing Diabetes Prevalence

Global diabetes prevalence is projected to rise from 536.6 million in 2021 to 783.2 million by 2045, a 46% surge that sustains baseline demand for insulin therapies. China alone reported 233 million cases in 2023 with prevalence approaching 15.9%, underscoring the scale of unmet need. Urbanization, aging, and rising BMI collectively widen the insulin-dependent population, especially in emerging markets where disease progression increasingly mirrors that of high-income countries. High BMI already accounts for over half of Type 2 diabetes-related disability-adjusted life years, signaling continued reliance on pharmacologic glucose control. The clinical transition from oral antidiabetics to basal-bolus regimens ensures insulin volume growth even as alternative therapies capture early-stage patients.

Growing Government Awareness Programs

National campaigns are accelerating diagnosis and therapy initiation. China's National Volume-Based Procurement centralized insulin bidding, cutting prices while boosting treatment uptake across public hospitals. India's biosimilar insulin adoption initiatives similarly demonstrate how policy can close affordability gaps by favoring interchangeable products with proven equivalence. The WHO pre-qualification pathway is widening the pool of quality-assured insulin options, giving low- and middle-income countries a validated procurement channel. Such programs create virtuous cycles: earlier detection raises prescribing volumes, which then reinforce economies of scale and further price erosion, broadening patient access.

Stringent Regulatory Approval Processes

Complex, high-cost approval pathways delay market entry for novel and biosimilar insulins. The U.S. FDA's 2024 complete response letter on insulin icodec highlighted manufacturing validation gaps that can stall even late-stage assets. Biosimilar developers must still undertake extensive comparative clinical programs costing over USD 100 million per molecule, a hurdle disproportionate to smaller firms. The WHO's global pre-qualification demands additional bioequivalence data across diverse populations, further stretching timelines. As a result, market power remains concentrated among incumbents able to navigate multi-jurisdictional quality requirements, limiting price competition and patient choice in the near term.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Reimbursement Coverage

- Technological Advancements in Insulin Delivery

- Therapeutic Shift Toward Incretin-Based Drugs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Long-acting analogs held 45.92% of insulin market share in 2025, serving as the backbone of basal therapy across diabetes types. Continued penetration of once-weekly options promises to strengthen the category's patient convenience appeal. Rapid-acting and premix segments face modest price competition from the first FDA-approved biosimilars Merilog and Kirsty, broadening access for the 8.4 million U.S. insulin users. Meanwhile, ultra-rapid inhalable formulations are projected to lead growth at a 5.18% CAGR through 2031, driven by user preference for needle-free dosing. Pipeline programs exploring dual-protraction chemistry could eventually trim injection frequency to monthly intervals, enhancing adherence and positioning basal products for sustained relevance despite competitive pressures.

In tandem, glucose-responsive research is advancing towards "smart" insulin that modulates bioactivity in real time, holding the potential to all but eliminate hypoglycemia events. Biosimilar activity remains most intense in Europe, where streamlined tender systems reward suppliers that raise manufacturing efficiency. Such competition, coupled with device upgrades, is steadily shifting value creation from molecule differentiation toward combined formulation-device ecosystems.

The Insulin Market Report is Segmented by Product Type (Rapid-Acting, Long-Acting, Combination/Premix, Biosimilar, Other), Application (Type 1 Diabetes, Type 2 Diabetes), Delivery Device (Pens, Pump Reservoirs, Vials & Syringes, Jet/Patch/Inhalers), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America sustained a 41.78% share of global revenue in 2025, benefiting from robust insurance coverage and early adoption of premium analogs. The USD 35 Medicare copay ceiling, however, is narrowing manufacturers' pricing latitude, compelling operational efficiencies and differentiated value propositions. U.S. capacity expansions-Novo Nordisk's USD 4.1 billion North Carolina plant and Eli Lilly's USD 9 billion Indiana complex-underline long-term confidence despite nearer-term biosimilar and GLP-1 competition. Canada, meanwhile, is phasing out animal-sourced products in favor of modern analogs, underscoring North America's pivot to high-purity recombinant supply.

Europe remains a mature yet dynamic market where biosimilar penetration and value-based purchasing foster disciplined price trajectories. After biosimilar entry, average insulin glargine prices declined more than 20% across 28 countries, illustrating payers' negotiation leverage. Weekly basal approvals such as Awiqli (icodec) and expanded CE markings for AID systems position the region as an early proving ground for next-generation therapies. Still, supply chain hiccups-Fiasp PumpCart shortages in 2025-expose vulnerabilities in specialized cartridge formats and highlight the need for diversified manufacturing nodes. Prospective regulatory streamlining for biosimilars could shorten development cycles and raise competitive intensity post-2026.

Asia-Pacific is the fastest-growing geography at a 4.43% CAGR through 2031, propelled by escalating diabetes incidence, urban lifestyle shifts, and policy-driven affordability gains. China's Volume-Based Procurement has cut insulin prices by as much as 48% in nationwide tenders, expanding access to millions of new users. India is leveraging domestic biosimilar capacity to cover rural districts previously underserved by analog products. Multinational firms are pairing local fill-finish alliances with greenfield builds, as evidenced by Sanofi's Beijing complex and Novo Nordisk's Tianjin expansion, to anchor supply close to growth clusters. Cold-chain infrastructure gaps and regional reimbursement disparity remain challenges, yet they also create openings for logistics specialists and telehealth platforms.

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- Biocon Biologics

- Wockhardt

- Pfizer

- Tonghua Dongbao

- Gan & Lee Pharmaceutical

- Julphar

- Sedico Pharmaceutical

- Ypsomed

- Insulet

- Medtronic Plc (MiniMed)

- Terumo Corp.

- Becton Dickinson & Co.

- Adocia SA

- Bioton SA

- Hikma Pharmaceuticals

- Novo Nordisk Pharmatech

- Jiangsu Wanbang Biopharma

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Diabetes Prevalence

- 4.2.2 Growing Government Awareness Programs

- 4.2.3 Expansion of Reimbursement Coverage

- 4.2.4 Technological Advancements in Insulin Delivery

- 4.2.5 Rising Adoption of Biosimilar Insulin

- 4.2.6 Emerging Demand In Tier-2 Urban Centers

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Approval Processes

- 4.3.2 Price Control Policies and Competitive Tenders

- 4.3.3 Supply Chain Vulnerabilities in Cold Chain Logistics

- 4.3.4 Therapeutic Shift Toward Incretin-Based Drugs

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Rapid-Acting Insulin

- 5.1.1.1 Insulin Lispro

- 5.1.1.2 Insulin Aspart

- 5.1.1.3 Insulin Glulisine

- 5.1.1.4 Technosphere Insulin

- 5.1.2 Long-Acting Insulin

- 5.1.2.1 Insulin Detemir

- 5.1.2.2 Insulin Glargine (Originator)

- 5.1.2.3 Insulin Glargine-Yfgn (Biosimilar)

- 5.1.2.4 Insulin Degludec

- 5.1.3 Combination / Premix Insulin

- 5.1.3.1 NPH/Regular

- 5.1.3.2 Protamine/Lispro

- 5.1.3.3 Protamine/Aspart

- 5.1.4 Biosimilar Insulin (Cross-Cutting)

- 5.1.5 Other Product Types

- 5.1.1 Rapid-Acting Insulin

- 5.2 By Application

- 5.2.1 Type 1 Diabetes

- 5.2.2 Type 2 Diabetes

- 5.3 By Delivery Device

- 5.3.1 Pens

- 5.3.2 Pump Reservoirs

- 5.3.3 Vials & Syringes

- 5.3.4 Jet / Patch / Inhalers

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Novo Nordisk A/S

- 6.3.2 Eli Lilly And Company

- 6.3.3 Sanofi

- 6.3.4 Biocon Biologics

- 6.3.5 Wockhardt

- 6.3.6 Pfizer Inc.

- 6.3.7 Tonghua Dongbao

- 6.3.8 Gan & Lee Pharmaceutical

- 6.3.9 Julphar

- 6.3.10 Sedico Pharmaceutical

- 6.3.11 Ypsomed AG

- 6.3.12 Insulet Corporation

- 6.3.13 Medtronic Plc (MiniMed)

- 6.3.14 Terumo Corp.

- 6.3.15 Becton Dickinson & Co.

- 6.3.16 Adocia SA

- 6.3.17 Bioton SA

- 6.3.18 Hikma Pharmaceuticals

- 6.3.19 Novo Nordisk Pharmatech

- 6.3.20 Jiangsu Wanbang Biopharma

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment