PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852030

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852030

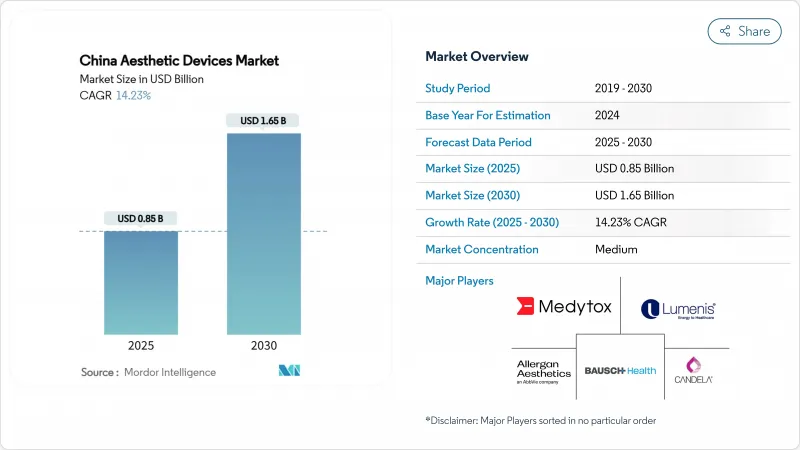

China Aesthetic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China Aesthetic Devices Market size is estimated at USD 0.85 billion in 2025, and is expected to reach USD 1.65 billion by 2030, at a CAGR of 14.23% during the forecast period (2025-2030).

Sustained consumer demand, rapid product innovation, and favorable regulatory initiatives underpin this trajectory. Energy-based technologies keep the category dynamic by offering non-invasive solutions that match risk-averse preferences, while social commerce funnels a growing stream of first-time patients into clinics and home-use channels. Rising urban incomes and heightened appearance awareness sustain premium price segments, even as local manufacturers close performance gaps with international brands. Government support for domestic innovation, combined with accelerated approval pathways, ensures a steady pipeline of advanced devices that sharpen competitive intensity.

China Aesthetic Devices Market Trends and Insights

Rising Prevalence of Obesity and Weight-Related Concerns

Adult obesity rates have risen each year, with tier-one cities displaying the steepest growth. Non-invasive fat reduction methods such as radiofrequency lipolysis and cryolipolysis offer surgery-free alternatives that resonate with preventive-health positioning. Disposable-income growth intensifies willingness to pay for body sculpting treatments, now framed as health investments rather than luxury indulgences. Pipeline innovations reinforce momentum; for example, Raziel Therapeutics' RZL-012 injectable is in Phase 3 trials and targets a 2027 mainland launch, blending pharmaceutical and device capabilities. Government wellness campaigns that emphasize healthy weight further bolster demand for medically supervised contouring.

Growing Popularity of Minimally Invasive Cosmetic Treatments

"Light medical beauty" continues to dominate consumer preferences as 91% of surveyed patients maintained or increased spending in 2024. Gradual enhancement aligns with cultural aesthetics that favor subtle improvements over dramatic change. Platforms such as Little Red Book amplify peer reviews and treatment diaries, accelerating mainstream acceptance. AI-enabled diagnostic tools, including VISIA systems, personalize device protocols and improve outcomes. Streamlined NMPA pathways for minimally invasive tools lower entry barriers for new modalities that reduce downtime and adverse events, driving faster replacement cycles within clinics.

Concerns Over Adverse Events and Patient Safety

Expanded use across diverse operator skill levels heightens complication risk and media scrutiny. Scientific studies report cases such as subcutaneous fat atrophy after injectables in Asian patients with thinner adipose layers, underscoring the need for population-specific dosing. NMPA has tightened post-market surveillance, obliging manufacturers to submit periodic safety updates and incident analyses. Clinics invest in certified training programs to safeguard reputations. Home-use device makers now integrate skin-type sensors and auto-shutoff features to mitigate misuse, yet liability concerns temper adoption speed.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated Innovation in Energy-Based Device Technologies

- Social Commerce and Live-Streaming Driving Patient Acquisition

- Proliferation of Counterfeit and Unregulated Devices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Energy-based equipment led with 43.01% share of China aesthetic devices market in 2024, reflecting its ability to address multiple indications through non-invasive means. Radiofrequency devices are forecast to register an 18.45% CAGR through 2030, aided by AI-guided temperature modulation that ensures consistent dermal heating without epidermal damage. Laser systems remain indispensable for hair removal and tattoo clearance, while ultrasound expands into abdominal lipolysis segments. Cost-effective local brands further democratize access by pricing 25-30% below foreign equivalents without compromising core safety standards. In contrast, non-energy options such as dermal rollers grow at a single-digit pace as consumers gravitate toward solutions promising longer-lasting collagen remodeling. Regulatory classification as Class III medical devices imposes stringent manufacturing controls, raising barriers for newcomers but elevating quality perception across the China aesthetic devices market.

Second-generation RF platforms combine microneedles, ultrasound imaging, and impedance sensing within one chassis, allowing physicians to tailor protocols in minutes. Clinics appreciate reduced capital expenditure associated with multi-modality systems, influencing purchasing cycles every 24-36 months instead of 48 months previously. Domestic champions pursue export licenses for Southeast Asia, leveraging economies of scale realized at home. Meanwhile, importers reposition premium devices as foundational technologies for advanced combination protocols, preserving higher margins in top-tier urban clinics.

The China Aesthetic Devices Market Report is Segmented by Device Type (Energy-Based Aesthetic Device, Non-Energy-Based Aesthetic Device), Application (Skin Resurfacing & Tightening, Body Contouring & Cellulite Reduction, Facial Aesthetic Procedures, Hair Removal, Breast Augmentation, Other Applications), End User (Hospitals, Clinics & Beauty Centers, Home Settings). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Sisram Medical

- Lumenis

- Candela Medical

- AbbVie (Allergan Aesthetics)

- Bloomage Biotechnology

- Shanghai Fosun Pharma (Aesthetic)

- Cutera

- Bausch Health

- Merz Pharma

- Medytox

- Sinclair Pharma

- Beijing Sincoheren Tech

- Shenzhen GSD Bio-Tech

- PZLASER

- Oriental Laser

- Huadong Medicine (Aesthetics)

- Guangzhou Wuhan Aimeike

- Weifang Huamei Electronics

- Jiangsu Fengdeng Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Obesity and Weight-Related Concerns

- 4.2.2 Growing Popularity of Minimally Invasive Cosmetic Treatments

- 4.2.3 Accelerated Innovation in Energy-Based Device Technologies

- 4.2.4 Increased Spending Power Among Millennials and Gen Z

- 4.2.5 Social Commerce and Live-Streaming Driving Patient Acquisition

- 4.2.6 Early-Access Regulatory Pilots in Hainan and Greater Bay Area (GBA)

- 4.3 Market Restraints

- 4.3.1 Concerns Over Adverse Events and Patient Safety

- 4.3.2 Absence of Insurance Reimbursement for Cosmetic Procedures

- 4.3.3 Price Pressure from Volume-Based Procurement Initiatives

- 4.3.4 Proliferation of Counterfeit and Unregulated Devices

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Type of Device

- 5.1.1 Energy-based Aesthetic Device

- 5.1.1.1 Laser-based Aesthetic Device

- 5.1.1.2 Radiofrequency-based Aesthetic Device

- 5.1.1.3 Light-based Aesthetic Device

- 5.1.1.4 Ultrasound Aesthetic Device

- 5.1.1.5 Other Energy-based Aesthetic Devices

- 5.1.2 Non-energy-based Aesthetic Device

- 5.1.2.1 Botulinum Toxin

- 5.1.2.2 Dermal Fillers & Threads

- 5.1.2.3 Microdermabrasion

- 5.1.2.4 Implants

- 5.1.2.5 Other Non-energy-based Aesthetic Devices

- 5.1.1 Energy-based Aesthetic Device

- 5.2 By Application

- 5.2.1 Skin Resurfacing & Tightening

- 5.2.2 Body Contouring & Cellulite Reduction

- 5.2.3 Facial Aesthetic Procedures

- 5.2.4 Hair Removal

- 5.2.5 Breast Augmentation

- 5.2.6 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Clinics & Beauty Centers

- 5.3.3 Home Settings

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Sisram Medical (Alma Lasers)

- 6.3.2 Lumenis

- 6.3.3 Candela Medical

- 6.3.4 AbbVie (Allergan Aesthetics)

- 6.3.5 Bloomage Biotechnology

- 6.3.6 Shanghai Fosun Pharma (Aesthetic)

- 6.3.7 Cutera

- 6.3.8 Bausch Health Companies Inc.

- 6.3.9 Merz Pharma

- 6.3.10 Medytox

- 6.3.11 Sinclair Pharma

- 6.3.12 Beijing Sincoheren Tech

- 6.3.13 Shenzhen GSD Bio-Tech

- 6.3.14 PZLASER

- 6.3.15 Oriental Laser

- 6.3.16 Huadong Medicine (Aesthetics)

- 6.3.17 Guangzhou Wuhan Aimeike

- 6.3.18 Weifang Huamei Electronics

- 6.3.19 Jiangsu Fengdeng Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment