PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852031

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852031

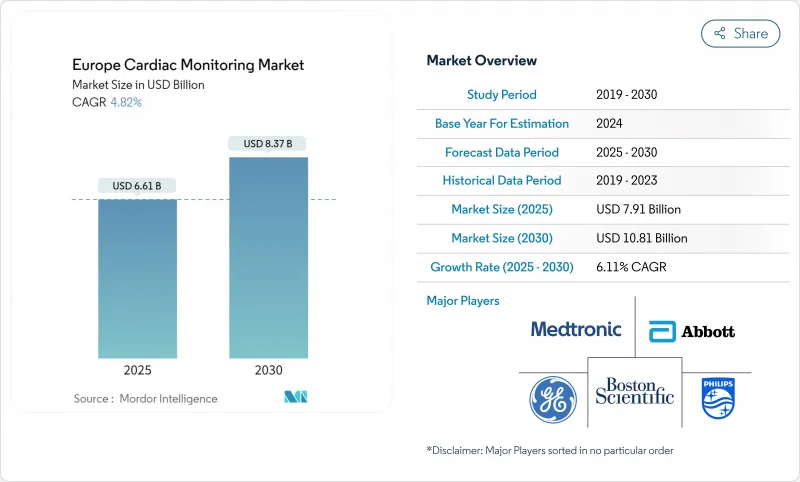

Europe Cardiac Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe cardiac monitoring market generated USD 7.91 billion in 2024 and is forecast to expand at a 6.11% CAGR to reach USD 10.81 billion by 2030.

Underpinning this steady climb are demographic aging, rising cardiovascular disease prevalence, and reimbursement reforms that reward early detection and home-based management. The shift from episodic, in-hospital diagnostics to continuous remote monitoring is accelerating as artificial-intelligence algorithms reduce false alarms, making ambulatory data clinically actionable. Regulatory support-most notably new DRG codes in Germany and France-further de-risks provider adoption, while hospital capacity constraints encourage virtual-ward models. Competitive intensity remains moderate; established implantable-device manufacturers now vie with software-first firms that analyze rhythm data in the cloud. Persistent barriers include EU-MDR compliance costs and GDPR obligations, yet evidence from multicountry tele-heart-failure studies confirms that remote monitoring materially cuts readmissions, sustaining long-term demand.

Europe Cardiac Monitoring Market Trends and Insights

Rising Prevalence of Cardiovascular Diseases Among Europe's Ageing Population

An older cohort now outnumbers youth, and cardiovascular disease already contributes 3.9 million annual deaths, or 45% of all fatalities in the region who.int. Higher rates of atrial fibrillation, heart failure, and complex arrhythmias demand scalable diagnostics that operate outside crowded hospitals. Health-system planners are channeling capital toward chronic-care platforms rather than episodic interventions, cementing cardiac monitoring as critical infrastructure. Germany, France, and Italy face the steepest incidence curves, creating fertile ground for implantable loop recorders and long-life telemetry patches. Continual rhythm surveillance also supports secondary prevention programs that align with European Health Union objectives.

Shift Toward Ambulatory & Remote Cardiac Monitoring Across EU Health Systems

National health services are turning to virtual wards and home-based ECG patches to relieve bed shortages and nursing workloads. Early data from the United Kingdom shows hospital readmission rates falling when patients are fitted with AI-analyzed wearable monitors during discharge transitions nice.org.uk. Similar pilots in Italy and Sweden integrate cloud dashboards directly into electronic patient records, enabling clinicians to adjust therapy before decompensation events. This decentralization synchronizes with broader EU policy that pushes care closer to home, reduces carbon footprints from travel, and elevates patient satisfaction scores.

Stringent EU-MDR Compliance Costs

Certification fees ranging from EUR 5,000 to EUR 500,000 require comprehensive clinical dossiers and post-market surveillance, forcing smaller innovators either to curtail portfolios or seek acquisition by larger incumbents ema.europa.eu. Although the regulation fortifies patient safety, it may delay AI-software updates and prolong time-to-market for novel sensors.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Wearable ECG Devices

- Favourable Reimbursement Updates Under DRG & National Tariff Schedules

- Data-Privacy Concerns Under GDPR Limiting Remote-Monitoring Uptake

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Europe cardiac monitoring market size for ECG devices accounted for 42.23% revenue in 2024, underscoring the modality's status as frontline diagnostics. Mobile telemetry, aided by real-time data transmission and automated triage, is on track for a 6.98% CAGR, reflecting clinician demand for immediate intervention alerts. Implantable loop recorders now offer up to six years of battery life, making them attractive for cryptogenic stroke workups. Holter monitors keep a niche for 24- to 48-hour studies, especially in primary-care settings where quick turnaround matters. Smart wearables bridge consumer lifestyle tracking and clinical-grade accuracy, expanding engagement among younger risk-aware users. AI embedded within these devices mines continuous streams for subtle atrial-fibrillation episodes that traditional snapshots miss, transforming monitoring from reactive to predictive. Regulatory approvals for dual-chamber leadless pacemakers further broaden device options and spur cross-selling opportunities. Taken together, telemetry's growth reorients procurement budgets toward cloud dashboards and subscription analytics rather than standalone hardware.

Following this acceleration, the Europe cardiac monitoring market is witnessing suppliers bundle sensors with longitudinal software licenses. Patch-as-a-service contracts appeal to hospital groups that lack capital for large upfront purchases, while giving manufacturers recurring revenue visibility. Competitive differentiation now hinges on noise-reduction algorithms, patient-friendly adhesives, and interoperability with electronic health records. As academic centers publish outcome data validating lower rehospitalization rates, payer confidence strengthens reimbursement pathways. These combined dynamics cement mobile telemetry's role as the principal growth engine and position the segment to overtake legacy Holter volume by the decade's end.

The Europe Cardiac Monitoring Market Report Segments the Industry Into Device Type (ECG Monitor, Event Recorder and More), B Technology (Conventional (Wired), Wireless & Wearable and More) End-Users (Hospitals & Clinics, Ambulatory Surgical Centers and More), and Country (Germany, United Kingdom, France, Italy, Spain, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Medtronic

- GE HealthCare Technologies Inc.

- Koninklijke Philips

- Abbott Laboratories

- Boston Scientific

- BIOTRONIK

- Nihon Kohden

- Hillrom (Baxter)

- iRhythm Technologies

- AliveCor

- Schiller

- Mindray

- Spacelabs Healthcare (OSI Systems)

- Bittium Corporation

- Withings SA

- Cardiologs Technologies SAS

- LivaNova

- MicroPort

- Lepu Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of cardiovascular diseases among Europe's ageing population

- 4.2.2 Shift toward ambulatory & remote cardiac monitoring across EU health systems

- 4.2.3 Technological advancements in wearable ECG devices

- 4.2.4 Favourable reimbursement updates under DRG & national tariff schedules

- 4.2.5 Integration of AI-driven predictive analytics in Holter data

- 4.2.6 Emergence of tele-cardiology hubs in Central & Eastern Europe

- 4.3 Market Restraints

- 4.3.1 Stringent EU-MDR compliance costs

- 4.3.2 Data-privacy concerns under GDPR limiting remote-monitoring uptake

- 4.3.3 Shortage of trained electrophysiologists in peripheral regions

- 4.3.4 Battery & data-storage limits in long-term implantable recorders

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Buyer Power

- 4.7.2 Supplier Power

- 4.7.3 Threat of Substitutes

- 4.7.4 Threat of New Entrants

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value)

- 5.1.1 ECG Devices

- 5.1.2 Holter Monitors

- 5.1.3 Event Recorders

- 5.1.4 Mobile Cardiac Telemetry

- 5.1.5 Implantable Loop Recorders

- 5.1.6 Smart Wearable Monitors

- 5.2 By End User (Value)

- 5.2.1 Hospitals

- 5.2.2 Cardiac Centres & Clinics

- 5.2.3 Home-Care Settings

- 5.2.4 Ambulatory Surgical Centres

- 5.2.5 Others

- 5.3 By Country (Value)

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 GE HealthCare Technologies Inc.

- 6.3.3 Koninklijke Philips N.V.

- 6.3.4 Abbott Laboratories

- 6.3.5 Boston Scientific Corporation

- 6.3.6 Biotronik SE & Co. KG

- 6.3.7 Nihon Kohden Corporation

- 6.3.8 Hillrom (Baxter)

- 6.3.9 iRhythm Technologies Inc.

- 6.3.10 AliveCor Inc.

- 6.3.11 Schiller AG

- 6.3.12 Mindray Medical International Ltd.

- 6.3.13 Spacelabs Healthcare (OSI Systems)

- 6.3.14 Bittium Corporation

- 6.3.15 Withings SA

- 6.3.16 Cardiologs Technologies SAS

- 6.3.17 LivaNova PLC

- 6.3.18 MicroPort Scientific

- 6.3.19 Lepu Medical Technology

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment