PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852142

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852142

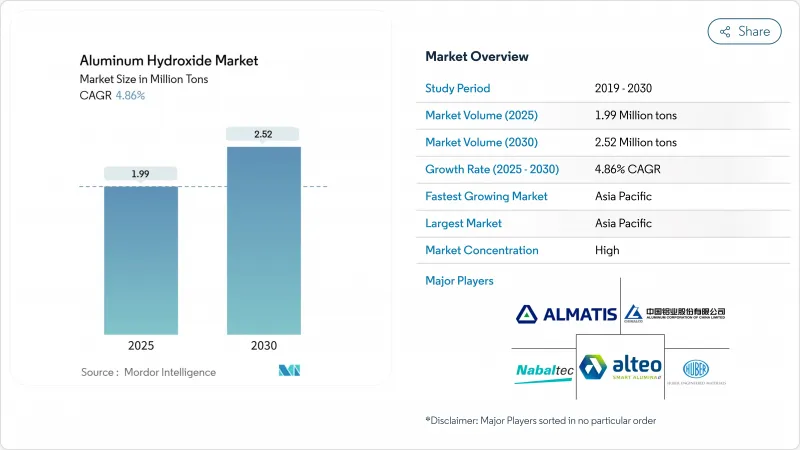

Aluminum Hydroxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aluminum hydroxide market is standing at 1.99 million tons in 2025 and is forecast to reach 2.52 million tons by 2030, registering a 4.86% CAGR.

Strong regulatory focus on fire safety, mounting demand for halogen-free flame retardants, and steady expansion of water-treatment infrastructure are shaping the growth curve. Industrial-grade material dominates current consumption thanks to its balance of purity and cost, while specialty grades tailored for electric-vehicle (EV) batteries signal the next wave of value creation. Producers are also prioritizing energy-efficient processes and recycling solutions in response to rising carbon-reduction mandates. Supply chain fragility linked to bauxite availability remains a watch point, yet sustained downstream investment in construction, automotive, and pharmaceuticals continues to unlock opportunity for both established suppliers and niche innovators across the aluminum hydroxide market.

Global Aluminum Hydroxide Market Trends and Insights

Fire-safety Regulations Driving ATH in Polyolefin Cable Compounds

European Construction Products Regulation and North American UL 94 standards have tightened requirements for low-smoke, halogen-free materials in wiring. Aluminum hydroxide meets these rules by releasing water vapor at 180-200 °C, suppressing flames without toxic by-products. Its share of the European flame-retardant pool has climbed to 38%. Significant uptake is visible in high-rise buildings, tunnels, and rolling stock, where cable safety is mission-critical. The trend has propelled investment in higher-purity grades capable of loading levels of 60% in polyolefins, ensuring electrical performance while meeting stringent smoke density limits. North American infrastructure upgrades, especially in data centers and transit, echo the same compliance logic, reinforcing mid-term demand across the aluminum hydroxide market.

Halogen-free Flame-retardant Demand in EV Battery Enclosures

Soaring EV output places battery fire safety at the center of automotive design priorities. Viscosity-optimized aluminum hydroxide grades now combine thermal conductivity values of 1-3 W/mK with UL 94 V0 ratings, enabling lightweight composite covers that mitigate thermal runaway. China's battery supply chain already deploys these grades at scale, while European and North American gigafactories are testing similar formulations. Automakers value the single-additive approach that delivers both heat dissipation and flame suppression, streamlining compound recipes and reducing reliance on brominated agents. Continued EV penetration underpins a resilient mid-term pull for battery-grade products within the aluminum hydroxide market.

Bauxite-supply Volatility

Indonesia's 2023 export curbs and intermittent mine shutdowns in key regions have tightened alumina feedstock availability. Vertically integrated majors can buffer shortfalls, yet smaller processors with spot contracts face elevated costs and production stoppages. Europe has felt the squeeze most acutely after curtailments at Alcoa's San Ciprian refinery, prompting inventory-driven price spikes. While alternative sourcing from Guinea and Australia offers partial relief, logistics challenges keep raw-material risk at the forefront for the aluminum hydroxide market during the medium term.

Other drivers and restraints analyzed in the detailed report include:

- Rising OTC Antacid Consumption in Ageing Economies

- Rapid Adoption of ATH in Solid-surface Countertops

- Health Concerns on Chronic Aluminum Intake

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial-grade material delivered 64% of total volume in 2024 and continues to outpace other grades at a 5.01% CAGR, underscoring its pivotal role across fire-safety, filler, and water-treatment applications. The aluminum hydroxide market size for industrial grade is projected to widen steadily as construction, wire-and-cable, and polymer compounders specify halogen-free solutions. Particle-size optimization and surface treatments improve dispersion, enabling 40-60% loading ratios in polyolefins without compromising mechanical performance.

Pharmaceutical-grade demand, though smaller in tonnage, benefits from the ageing-population effect and stricter quality norms in antacids and vaccine adjuvants. Purity thresholds above 99.7% and trace-metal limits impose tighter process controls, driving premium pricing. Nano-scale grades remain a niche yet promising frontier. Catalysis and high-performance composites value controlled morphology, and several producers are piloting continuous precipitation routes that can deliver sub-100 nm particles. As EV battery and aerospace markets seek lightweight, thermally stable fillers, these specialties will add incremental value within the aluminum hydroxide market.

The Aluminum Hydroxide Market is Segmented by Product Type (Industrial, Pharmaceutical, and Others), Application (Flame-Retardant and Smoke-Suppressant, Filler and Pigment, and More), End-User Industry (Plastics and Rubber, Pharmaceuticals, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia Pacific anchored 54% of worldwide consumption in 2024 and sustains the swiftest growth with a 5.2% CAGR. China's position as the core manufacturing hub for cable compounds, engineered stone, and lithium-ion batteries drives large-scale offtake. India's infrastructure programs, especially housing and municipal water schemes, add further volume traction. Stricter fire-safety codes for high-rise structures, introduced in 2024, reinforce demand visibility across the aluminum hydroxide market in the region.

North America remains the second-largest buyer, powered by rigorous UL and NFPA standards that favor halogen-free retardants in wire, cable, and building materials. A wave of countertop and flooring renovations underscores the material's dual aesthetic and safety value. Parallel upgrades in water-treatment plants under the U.S. Infrastructure Investment and Jobs Act boost coagulant demand, underpinning a stable mid-term outlook. The region also houses advanced research on high-thermal-conductivity ATH for EV batteries, cementing strategic importance for specialized grades.

Europe upholds a sizeable share, leveraging its environmental regulations to accelerate the transition away from brominated chemicals. Automotive electrification is a distinct demand catalyst as OEMs adopt ATH-rich composites for battery enclosures and onboard wiring. Germany, France, and the United Kingdom are key importers, while Central and Eastern Europe host extrusion and molding capacity that serves pan-European cable markets. The aluminum hydroxide market benefits from the bloc's emphasis on circularity and low-carbon materials, spurring recycling initiatives and green-energy feedstocks in production.

- Akrochem Corporation

- Almatis

- Alteo

- Aluminum Corporation of China Limited

- Hindalco Industries Ltd

- HONGHE CHEMICAL

- Huber Engineered Materials

- KC

- LKAB Minerals

- Martin Marietta Materials

- Nabaltec AG

- Nippon Light Metal Holdings Co., Ltd

- Resonac Holdings Corporation

- Sankyo Chemical Co. Ltd

- Sibelco

- Sumitomo Chemical Co. Ltd

- TOR Minerals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Fire-Safety Regulations Driving ATH in Polyolefin Cable Compounds

- 4.1.2 Halogen-Free Flame-Retardant Demand in EV Battery Enclosures

- 4.1.3 Rising OTC Antacid Consumption in Ageing Economies

- 4.1.4 Rapid Adoption of ATH in Solid-Surface Countertops

- 4.1.5 Water-Treatment Infrastructure Expansion in Emerging Nations

- 4.2 Market Restraints

- 4.2.1 Bauxite-Supply Volatility

- 4.2.2 Health Concerns on Chronic Aluminum Intake

- 4.2.3 High Energy Cost of Precipitated ATH Production

- 4.3 Value Chain Analysis

- 4.4 Porter's Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

5 Market Size and Growth Forecasts ( Volume)

- 5.1 By Product Type

- 5.1.1 Industrial

- 5.1.2 Pharmaceuticals

- 5.1.3 Others (Specialty Nano Grade and Reclaimed / Recycled Grade)

- 5.2 By Application

- 5.2.1 Flame-Retardant and Smoke-Suppressant

- 5.2.2 Filler and Pigment

- 5.2.3 Antacid

- 5.2.4 Water-Treatment Chemicals

- 5.2.5 Catalyst and Others

- 5.3 By End-User Industry

- 5.3.1 Plastics and Rubber

- 5.3.2 Pharmaceuticals

- 5.3.3 Paints, Coatings, Adhesives and Sealants (CASE)

- 5.3.4 Others (Paper and Others)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Akrochem Corporation

- 6.4.2 Almatis

- 6.4.3 Alteo

- 6.4.4 Aluminum Corporation of China Limited

- 6.4.5 Hindalco Industries Ltd

- 6.4.6 HONGHE CHEMICAL

- 6.4.7 Huber Engineered Materials

- 6.4.8 KC

- 6.4.9 LKAB Minerals

- 6.4.10 Martin Marietta Materials

- 6.4.11 Nabaltec AG

- 6.4.12 Nippon Light Metal Holdings Co., Ltd

- 6.4.13 Resonac Holdings Corporation

- 6.4.14 Sankyo Chemical Co. Ltd

- 6.4.15 Sibelco

- 6.4.16 Sumitomo Chemical Co. Ltd

- 6.4.17 TOR Minerals

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Rising Usage in Batteries and Chemicals