PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852144

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852144

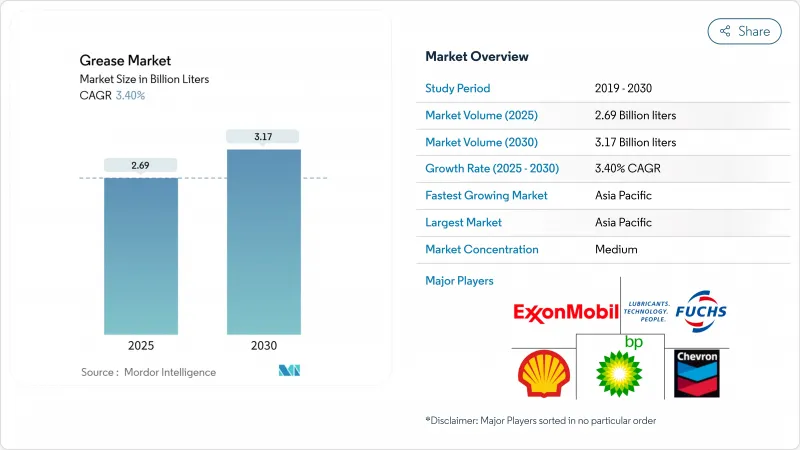

Grease - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Grease Market size is estimated at 2.69 Billion liters in 2025, and is expected to reach 3.17 Billion liters by 2030, at a CAGR of 3.40% during the forecast period (2025-2030).

Volume growth is steady rather than spectacular, yet the change in thickener mix is far more dynamic, with calcium-based products expanding at 9.10% CAGR and starting to chip away at lithium's long-held dominance. Price volatility for lithium carbonate, tightening environmental regulation and the technical needs of electric vehicles (EVs) are simultaneously reshaping buyer priorities and supplier portfolios. Asia Pacific maintains its role as the fulcrum of demand, propelled by construction equipment activity and the world's fastest-growing EV production base. High-temperature and extreme-pressure grades are capturing increasing attention as machinery designs push bearings, gears and seals far beyond traditional service envelopes.

Global Grease Market Trends and Insights

Hygienic Food-Grade Lubrication Uptake in EU & North America Processing Lines

Demand for NSF H1-registered greases is accelerating as processors align with FDA 21 CFR 178.3570 and ISO 21469 standards. Facilities are migrating to "all-H1" programs to eliminate the risk of cross-contamination, and synthetic base fluids are replacing mineral oils to achieve higher temperature resilience-up to 500 °F continuous service-and longer relubrication intervals. The trend is most evident in European bakeries, dairies and beverage plants, where compliance checks have tightened since 2024. Suppliers able to certify both product composition and plant hygiene are winning multi-site contracts that secure recurring volume.

EV e-Powertrain Bearing Shift to Lithium-Complex & Calcium-Sulfonate Greases in APAC

Rapid EV output in China, Korea and India is reshaping formulation requirements. Bearings that once ran at 10,000 rpm now exceed 20,000 rpm, pushing thermal loads beyond 150 °C. Laboratory tests show calcium-sulfonate greases sustaining consistency at dropping points near 600 °F, a 20% margin over lithium-complex alternatives, while also exhibiting lower electrical impedance. OEM specification sheets published in 2024 already list calcium-sulfonate as the default for front-and-rear e-axle bearings in several mass-market models. Grease producers with secure calcium sulfonate supply chains are using this window to lock in multi-year volume contracts.

Lithium Carbonate Cost Volatility Due to Battery-Sector Competition

Lithium carbonate spot prices climbed between 2021 and 2024. Survey data show lithium thickeners dropped from 70% of global output to 60% in two years, and producers now hedge with polyurea or calcium technologies to protect margins. Grease buyers exposed to quarterly price resets have diversified suppliers to mitigate spot shortages. Some automotive lines are pre-approving calcium-sulfonate greases to avoid mid-contract surcharges tied to lithium benchmarks.

Other drivers and restraints analyzed in the detailed report include:

- Offshore Deep-Water Drilling Boosting Water-Resistant Marine Greases

- Construction Equipment Boom in India & ASEAN Driving Extreme-Pressure Greases

- EU REACH Tightening on PFAS & Boron-Nitride Additives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lithium-based products still accounted for 66% of the grease market in 2024, but calcium-based volumes are advancing at a 9.10% CAGR. This realignment is rooted in the dual dynamics of lithium price spikes and superior high-temperature resilience offered by calcium chemistries. Manufacturers are recalibrating reactor lines to flex between lithium and calcium batches, mitigating feedstock risk while preserving customer-approved product codes. Aluminum complex greases retain relevance in marine and paper-mill water-resistance niches. Polyurea grades gain traction in noise-sensitive EV bearing applications where the absence of metal soaps reduces electrical impedance. End users remain cautious about widespread polyurea adoption due to incompatibility with legacy lithium greases, but OEM-filled units present a fast-track pathway to volume growth.

Calcium-sulfonate's acceptance is further boosted by field evidence showing a 30% extension in relubrication intervals on wind turbine main bearings in China. Benchmark testing against lithium-complex rivals confirmed lower oil separation and superior drop-point performance-a critical advantage in turbines operating at nacelle temperatures below -20 °C yet experiencing sun-exposed peaks above 70 °C. Producers emphasize that calcium's natural detergency properties lower additive treat rates, yielding cost savings that partially offset higher sulfonate acid costs. Ultimately, the thickener landscape is fragmenting into multi-chemistry portfolios in which lithium, calcium, aluminum and polyurea each defend distinct performance niches within the grease market.

Mineral-oil greases represented 75% of the grease market share in 2024 and the synthetic grades is forecast to rise at 4.90% CAGR. Polyalphaolefin (PAO) bases dominate the synthetic pool thanks to oxidation stability and broad temperature envelopes. Mobil Aviation Grease SHC 100, qualified from -54 °C to 177 °C, exemplifies the performance advantage recognized by aerospace OEMs. Bio-based oils enjoy legislative tailwinds from EAL mandates and voluntary ESG programs. Vegetable-derived esters blended with antioxidant packages now rival Group III mineral oils on oxidative life in standard ASTM tests.

Mineral-oil greases keep price-sensitive applications such as chassis lubrication and industrial open-gear drives aligned with NLGI-recommended practices. However, the operating temperature swing required by modern high-speed production lines is pushing buyers to spec synthetics or semi-synthetics even in mid-range duty. Suppliers that master complex additive solubility in PAO and ester packages are positioned to capture above-average margins across specialty and food-grade segments of the grease market.

The Grease Market Report Segments the Industry by Thickener (Lithium-Based, Calcium-Based, and More), Product Type (Mineral Oil, Synthetic Oil, and More), Performance Grade (High-Temperature Greases, Low-Temperature and Arctic-Grade Greases, and More), End-User Industry (Automotive and Other Transportation, Power Generation, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia Pacific retained 49% of global volume in 2024 and is expanding at a 4.32% CAGR, twice the pace of Europe. China's manufacturing complex, India's infrastructure surge and Southeast Asia's EV component clustering keep utilization rates high. Shell's decision to triple grease plant capacity in Thailand to 15,000 tonnes per year underscores the region's pull. The region's share of the grease market size is expected to touch 52% by 2030, cementing its structural leadership.

North America holds a significant share of the total volume, supported by robust food processing and a booming renewable power pipeline. Wind farm buildout has lifted demand for synthetics that can last five-year maintenance cycles at hub heights above 100 m. Regulatory emphasis on environmentally acceptable lubricants is pushing marine operators on the Great Lakes and coastal routes to convert cargo-winch points to EAL-certified greases.

Europe holds a significant share of the volume but faces the most stringent regulatory challenges. The PFAS restriction docket has triggered supplier audits across automotive, aerospace and machinery OEMs. Suppliers that demonstrate PFAS-free alternatives without sacrificing reliability are poised to keep share. South America and the Middle East & Africa together contribute a small share of 2024 demand. Low penetration of automatic lubrication systems raises per-unit grease consumption, but capital constraints slow technology upgrades. Service providers with retrofit solutions can leverage the volume imbalance to fast-track growth in these frontier segments of the grease market.

- Ampol Limited

- Axel Christiernsson AB

- BECHEM Lubrication Technology LLC

- BP p.l.c.

- Chevron Corporation

- China Petrochemical Corporation

- DuPont

- ENEOS Corporation

- ETS Oil & Gas Ltd.

- Exxon Mobil Corporation

- FUCHS

- Gazprom

- Gulf Oil International Ltd

- Idemitsu Kosan Co.,Ltd.

- Kluber Lubrication SE

- LUKOIL

- Morris Lubricants

- Orlen Oil

- Penrite Oi

- Petromin

- Petronas Lubricants International

- Saudi Arabian Oil Co.

- Shell Plc

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Hygienic Food-Grade Lubrication Uptake in EU and North-America Processing Lines

- 4.2.2 EV e-Powertrain Bearing Shift to Lithium-Complex and Calcium-Sulfonate Grease

- 4.2.3 Offshore Deep-Water Drilling Boosting Water-Resistant Marine Grease

- 4.2.4 Construction Equipment Boom in India and ASEAN Driving Extreme-Pressure Grease

- 4.2.5 Robust Growth of Investments in the Power Generation Sector

- 4.3 Market Restraints

- 4.3.1 Lithium Carbonate Cost Volatility Due to Battery-Sector Competition

- 4.3.2 EU REACH Tightening on PFAS and Boron-Nitride Additives

- 4.3.3 Low Penetration of Auto-Lubrication Systems in Africa and South America

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Thickener

- 5.1.1 Lithium-based

- 5.1.2 Calcium-based

- 5.1.3 Aluminum-based

- 5.1.4 Polyurea

- 5.1.5 Other Thickeners

- 5.2 By Product type

- 5.2.1 Mineral Oil

- 5.2.2 Synthetic Oil

- 5.2.3 Bio-based Oil

- 5.3 By Performance Grade

- 5.3.1 High-Temperature Grease

- 5.3.2 Low-Temperature and Arctic-Grade Grease

- 5.3.3 Extreme-Pressure and Heavy-Load Grease

- 5.4 By End-user Industry

- 5.4.1 Automotive and Other Transportation

- 5.4.2 Power Generation (Wind, Hydro, Thermal)

- 5.4.3 Heavy Equipment

- 5.4.4 Food and Beverage

- 5.4.5 Metallurgy and Metalworking

- 5.4.6 Chemical Manufacturing

- 5.4.7 Other Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Indonesia

- 5.5.1.6 Malaysia

- 5.5.1.7 Thailand

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Turkey

- 5.5.3.8 Russia

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Ampol Limited

- 6.4.2 Axel Christiernsson AB

- 6.4.3 BECHEM Lubrication Technology LLC

- 6.4.4 BP p.l.c.

- 6.4.5 Chevron Corporation

- 6.4.6 China Petrochemical Corporation

- 6.4.7 DuPont

- 6.4.8 ENEOS Corporation

- 6.4.9 ETS Oil & Gas Ltd.

- 6.4.10 Exxon Mobil Corporation

- 6.4.11 FUCHS

- 6.4.12 Gazprom

- 6.4.13 Gulf Oil International Ltd

- 6.4.14 Idemitsu Kosan Co.,Ltd.

- 6.4.15 Kluber Lubrication SE

- 6.4.16 LUKOIL

- 6.4.17 Morris Lubricants

- 6.4.18 Orlen Oil

- 6.4.19 Penrite Oi

- 6.4.20 Petromin

- 6.4.21 Petronas Lubricants International

- 6.4.22 Saudi Arabian Oil Co.

- 6.4.23 Shell Plc

- 6.4.24 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growing Usage of Polyurea Greases