PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852145

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852145

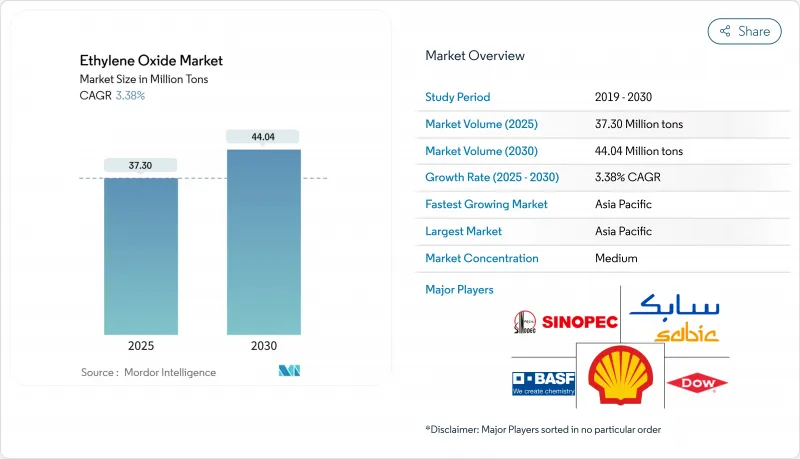

Ethylene Oxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Ethylene Oxide Market size is estimated at 37.30 Million tons in 2025, and is expected to reach 44.04 Million tons by 2030, at a CAGR of 3.38% during the forecast period (2025-2030).

Demand stems from its versatility as a chemical intermediate, with polyester fibers, PET resins, surfactants, ethanolamines, and sterilants underpinning consumption growth. Expansion of polyester-based textiles, wider adoption of PET for lightweight food and beverage packaging, and regulatory-driven investments in medical device sterilization facilities remain the core drivers. Rapid uptake of bio-ethylene feedstock, rising investment in emission-control technology, and the spread of circular-economy initiatives are reshaping sourcing strategies and opening new revenue pools. Competitive dynamics favor vertically integrated producers that can balance feedstock volatility, comply with tightening emission limits, and develop specialty derivatives.

Global Ethylene Oxide Market Trends and Insights

Growing Usage of PET in the Food and Beverage Industry

PET packaging adoption is accelerating because brand owners favor lightweight, recyclable solutions that preserve product integrity. Monoethylene glycol derived from ethylene oxide constitutes nearly 90% of the ethylene glycol pool used for PET polymerization, causing direct pull-through on upstream demand. Large resin producers are backing chemical-recycling platforms that depolymerize post-consumer PET into monomers with yields above 90%, enabling circular supply chains while keeping ethylene oxide volumes steady. Companies such as Dow have earmarked multi-million-metric-ton programs to deliver circular and renewable plastics annually by 2030. These initiatives strengthen long-term demand visibility even as the product mix shifts toward recycled grades.

Increasing Demand for Household and Personal Care Products

Surfactants and detergents formulated with ethoxylates and ethanolamines deliver superior cleaning efficiency, especially in hard-water regions. Consumer preference for eco-friendly ingredients is prompting producers such as Nouryon to certify green ethylene oxide derivatives under the ISCC PLUS scheme. Switching from alkylphenol to fatty-alcohol ethoxylates aligns with forthcoming biodegradability regulations while sustaining performance. Capacity additions in Europe and North America are timed to capture this demand uptick as private-label cleaning brands gain retail shelf space.

Health and Environmental Effects over High Exposure

Ethylene oxide is classified as carcinogenic, prompting the EPA's January 2025 interim decision that cuts worker exposure limits from 0.5 ppm by 2028 down to 0.1 ppm by 2035. Compliance demands costly engineering controls, personal monitoring, and capital upgrades. Some healthcare device makers are accelerating the qualification of alternative sterilization methods, including gamma radiation, vaporized hydrogen peroxide, and nitrogen dioxide. While these substitutes will erode specific volumes, ethylene oxide remains indispensable for heat-sensitive devices with intricate lumens.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Utilization in Medical Device Sterilization

- Growing Demand from Textile and Apparel Industry

- Volatility of Ethylene Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ethylene glycols formed the bedrock of the ethylene oxide market in 2024, capturing 75.57% share as polyester fiber and PET resin output scaled in Asia-Pacific. Price volatility has returned following upstream supply disruptions, pushing Asia-based buyers to secure long-term contracts with integrated producers. In parallel, bio-MEG pilots are gaining traction as brand owners seek lower-carbon packaging options.

Ethanolamines contribute a smaller volume but post the highest 3.69% CAGR to 2030, driven by agrochemicals, gas treatment, and personal-care demand. BASF's Antwerp debottlenecking raised global alkyl ethanolamine capacity by nearly 30% to more than 140,000 t per year, underscoring the segment's strategic value. Rising glyphosate herbicide volumes in Latin America and Asia sustain monoethanolamine pull-through, while triethanolamine sees new opportunities in CO2 capture solvents. Strong downstream diversification shields this derivative class from single-industry cyclicality.

PET resins and polyester fibers absorbed 28.19% of ethylene oxide demand in 2024. The ethylene oxide market size linked to PET is expected to grow steadily as beverage companies transition from glass and metal to lightweight PET bottles. Innovative depolymerization pathways such as dimethyl-carbonate-aided methanolysis enable greater than 90% dimethyl terephthalate yields, opening high-purity recycled PET streams. Over the forecast horizon, virgin demand moderates in developed regions yet expands in fast-growing economies where recycling infrastructure remains nascent.

Sterilization and fumigation ranked as the fastest-growing application at 3.81% CAGR. Approximately 50,000 distinct medical devices rely on ethylene oxide sterilization, preserving thermolabile polymers that cannot withstand gamma or electron-beam radiation. Even with stringent emissions limits, demand persists because alternative modalities often fail to penetrate complex packaging or achieve required sterility assurance levels. Investment in catalytic oxidation units and continuous emissions monitoring allows compliant operations, sustaining growth in this niche.

The Ethylene Oxide Market Report is Segmented by Derivative (Ethylene Glycols, Ethoxylates, Ethanolamines, and More), Application (Polyester Fiber and PET Resins, Surfactants and Detergents, and More), End-User Industry (Automotive, Agrochemicals, Food and Beverage, and More), Feedstock (Petro-Based Ethylene and Bio-Ethylene), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific remained the largest ethylene oxide market in 2024, supplying 51.09% of global demand and expanding at a region-leading 3.82% CAGR to 2030. China anchors capacity additions with BASF's Zhanjiang Verbund complex slated for start-up in 2025. India's production grows alongside local polyester fiber expansion, supported by government manufacturing incentives. Regional governments tighten environmental norms, but integrated complexes with advanced abatement maintain competitiveness.

North America benefits from shale-based ethane economics that yield some of the world's lowest ethylene cash costs. Medical device sterilization concentration elevates domestic consumption, and INEOS's 2024 acquisition of LyondellBasell's Bayport unit consolidates supply in the largest single market. Compliance with EPA emission rules accelerates investment in catalytic scrubbers and real-time monitoring, setting a global technology benchmark.

Europe confronts high energy prices and more stringent CO2 targets, prompting 11 million tons of regional chemical capacity closures during 2023-2024. Collaborations such as the 2024 Clariant-OMV agreement to supply lower-carbon ethylene and ethylene oxide derivatives aim to defend market share against imports. Eastern Europe retains selective competitiveness through access to pipeline gas and established downstream polyester assets.

The Middle East leverages advantaged feedstock at integrated complexes, with Saudi-based producers targeting export markets in Asia. Africa sees limited local production but steady imports for detergent and agrochemical formulations. South America advances bio-ethylene projects in Brazil, positioning the subcontinent as a potential net exporter of low-carbon derivatives over the next decade.

- BASF SE

- China Petrochemical Corporation

- Clariant

- Dow

- Huntsman International LLC

- India Glycols Limited

- Indorama Ventures Public Company Limited

- INEOS

- LOTTE Chemical Corporation

- NIPPON SHOKUBAI CO., LTD.

- Nouryon

- PETRONAS Chemicals Group Berhad

- Reliance Industries Limited

- SABIC

- Sasol Limited

- Shell plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Usage of PET in the Food and Beverage Industry

- 4.2.2 Increasing Demand for Household and Personal Care Products

- 4.2.3 Increasing Utilziation in Medical Device Sterilization

- 4.2.4 Growing Demand from Textile and Apparel Industry

- 4.2.5 Increasing Utilization from the Agriculture Sector

- 4.3 Market Restraints

- 4.3.1 Health and Environmental Effects over High Exposure

- 4.3.2 Volatility of Ethylene Feedstock Prices

- 4.3.3 High Production Cost

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Derivative

- 5.1.1 Ethylene Glycols

- 5.1.1.1 Monoethylene Glycol (MEG)

- 5.1.1.2 Diethylene Glycol (DEG)

- 5.1.1.3 Triethylene Glycol (TEG)

- 5.1.2 Ethoxylates

- 5.1.3 Ethanolamines

- 5.1.4 Glycol Ethers

- 5.1.5 Polyethylene Glycol

- 5.1.6 Other Derivatives

- 5.1.1 Ethylene Glycols

- 5.2 By Application

- 5.2.1 Polyester Fiber and PET Resins

- 5.2.2 Surfactants and Detergents

- 5.2.3 Sterilization and Fumigation

- 5.2.4 Coolant and Antifreeze

- 5.2.5 Pharmaceuticals Excipients

- 5.2.6 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Agrochemicals

- 5.3.3 Food and Beverage

- 5.3.4 Textile

- 5.3.5 Personal Care

- 5.3.6 Pharmaceuticals

- 5.3.7 Detergents

- 5.3.8 Others End user Industries

- 5.4 By Feedstock

- 5.4.1 Petro-based Ethylene

- 5.4.2 Bio-ethylene

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 BASF SE

- 6.4.2 China Petrochemical Corporation

- 6.4.3 Clariant

- 6.4.4 Dow

- 6.4.5 Huntsman International LLC

- 6.4.6 India Glycols Limited

- 6.4.7 Indorama Ventures Public Company Limited

- 6.4.8 INEOS

- 6.4.9 LOTTE Chemical Corporation

- 6.4.10 NIPPON SHOKUBAI CO., LTD.

- 6.4.11 Nouryon

- 6.4.12 PETRONAS Chemicals Group Berhad

- 6.4.13 Reliance Industries Limited

- 6.4.14 SABIC

- 6.4.15 Sasol Limited

- 6.4.16 Shell plc

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Usage of Bio-derived Ethylene over Petro-based Ethylene for Production