PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852146

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852146

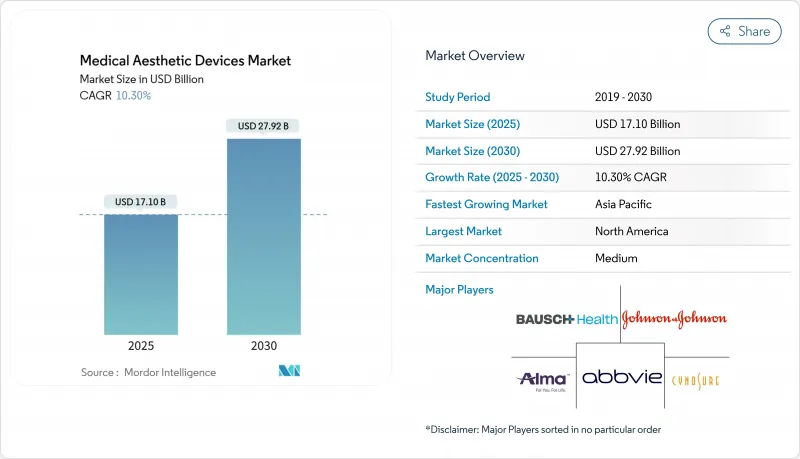

Medical Aesthetic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The medical aesthetic devices market size stands at USD 29.89 billion in 2025 and is projected to reach USD 48.84 billion by 2030, translating into a 10.32% CAGR over the forecast period.

Continuous technology upgrades, rising disposable incomes, and wider consumer acceptance of minimally invasive cosmetic procedures underpin this momentum. Aging populations in developed economies and growing middle classes in emerging regions further amplify procedure volumes, while social-media visibility fuels awareness and demand. Device makers are quickening innovation cycles around energy delivery, AI-guided treatment protocols, and longer-lasting injectables, which together expand the addressable patient pool and shorten recovery times. Consolidation among leading manufacturers is accelerating, enabling broader product portfolios that blend laser, radiofrequency, ultrasound, and injectable solutions under single corporate umbrellas.

Global Medical Aesthetic Devices Market Trends and Insights

Increasing Demand for Minimally Invasive Procedures

Minimally invasive treatments continue to attract patients who value shorter recovery windows and lower risk profiles. U.S. data show that non-surgical options represented 54.9% of all aesthetic sessions in 2024, and 85% of surveyed consumers intend to maintain or boost spending even amid economic uncertainty. Younger adults now seek preventive neurotoxin injections, while male uptake of fillers and lasers keeps rising. Energy-based systems emulate surgical results by precisely targeting tissue layers without general anesthesia. Dermal fillers that retain volume for 12-18 months reinforce repeat-purchase behavior and strengthen provider loyalty. Collectively these factors raise treatment frequency and widen the customer base beyond traditional core segments.

Growing Aging Population and Obesity Rates

The 40-54 age bracket contributed 46.19% of U.S. aesthetic revenues in 2024 and is expanding at 13.9% CAGR as visible aging coincides with high earning power. Upticks in global obesity intensify demand for non-invasive body contouring tools that target stubborn adipose pockets. Injectable biostimulators restore facial fullness lost after weight-management therapeutics, as evidenced in recent Galderma trials that reported 89% patient satisfaction at three-month follow-up. Similar demographic shifts in East Asia, where populations age rapidly yet remain economically active, amplify regional procedure volume. These combined trends create a long-tail demand driver for both facial and body treatments.

High Procedure Costs and Limited Insurance Coverage

Aesthetic interventions are typically paid out-of-pocket, which limits uptake in low-income segments despite falling per-unit device costs. Financing schemes and installment plans are emerging, yet interest rates can deter price-sensitive prospects. Smaller clinics face steep capital requirements when acquiring new laser or body-sculpting platforms, which can cost over USD 150,000 each, concentrating market power among larger chains. Economic downturns heighten deferral of elective treatments, directly suppressing session volumes. Even in medical-tourism destinations, airfare and accommodation add to total spend, challenging affordability thresholds for many candidates.

Other drivers and restraints analyzed in the detailed report include:

- Rising Consumer Awareness and Acceptance of Aesthetic Treatments

- Technological Advancements in Energy-Based and Injectable Devices

- Stringent Regulatory and Safety Compliance Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Energy-based platforms anchored the medical aesthetic devices market with 52.56% revenue share in 2024, underscoring the clinical trust built around lasers, radiofrequency, and ultrasound systems. The medical aesthetic devices market size for energy platforms is projected to remain dominant thanks to constant wavelength tuning and AI-guided protocols that personalize fluence levels for each tissue profile. Sales momentum also benefits from replacement-cycle dynamics as clinics upgrade to multi-modal consoles that combine skin resurfacing, tightening, and fat reduction in one footprint. In parallel, non-energy technologies such as fillers, neurotoxins, and thread lifts are growing faster at 12.67% CAGR, widening the total addressable base. These innovations rely on advanced biomaterials that trigger collagenesis, providing effects that can last 18 months and justify premium pricing. Longer duration means fewer clinic visits for patients and higher revenue per encounter for providers.

Combination therapies that marry fractional lasers with biostimulator injections further enhance outcomes, fostering cross-selling inside single appointments. Fragmentation persists among smaller device categories like microdermabrasion and light-emitting diode masks, yet even these niches attract consumer interest through lower price points and at-home variants. Competition now pivots toward integrated software that logs energy settings, tracks consumable usage, and supports remote diagnostics, helping clinics maximize device uptime. The medical aesthetic devices market will likely see increased collaboration between hardware makers and pharma firms to co-develop synergistic treatment protocols.

Non-surgical approaches maintained 55.87% share of revenue in 2024 and remain attractive for their minimal downtime and reduced risk profiles. The medical aesthetic devices market share for these less invasive modalities is buoyed by broader candidacy across age groups and easier entry points for clinics lacking operating-room infrastructure. Yet surgical procedures are rebounding at 12.98% CAGR because micro-coring, endoscopic lifts, and laser-assisted lipolysis shorten convalescence and deliver longer-lasting results in a single session. Enhanced anesthesia methods reduce post-operative discomfort, while 3-D imaging improves pre-operative planning accuracy.

The line between surgical and non-surgical is blurring, with hybrid protocols that pair targeted fat removal with radiofrequency tightening during one visit. Patients who start with injectables often graduate to surgical lifts as aging progresses, creating lifecycle-long revenue opportunities for full-service practices. Clinics that offer both options retain patients and cross-refer internally, driving higher retention rates. Device makers develop accessories that make operating-room tools compatible with med-spa settings, widening the provider universe able to perform minimally invasive surgical work under local anesthesia.

The Medical Aesthetic Devices Market Report is Segmented by Type of Device (Energy-Based Aesthetic Devices and Non-Energy-Based Aesthetic Devices), Procedure Type (Non-Surgical/Minimally Invasive and Surgical), Application (Skin Resurfacing and Tightening, and More), End User (Hospitals, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 42.45% of revenue in 2024 as high discretionary incomes, a dense network of board-certified practitioners, and rapid product clearances converge. Domestic demand skews toward minimally invasive services, which account for 54.22% of sessions, reflecting patients' preference for outcome-to-downtime efficiency. Federal reimbursement remains limited yet flexible financing models and loyalty plans cushion price sensitivity. Manufacturers tap U.S. innovation hubs to pilot AI-driven energy consoles and long-duration neuromodulators before global rollout, solidifying the region's first-mover status.

Asia-Pacific is forecast to grow at 11.45% CAGR through 2030, moving the needle of the global medical aesthetic devices market. Regulatory reforms in China shorten device approval timelines, while rising middle-class purchasing power makes premium treatments attainable. South Korea's K-beauty influence and Japan's aging demographics boost filler and skin-tightening volumes. Regional medical tourism flows swell as Thailand and Malaysia offer bundled surgery plus recovery packages under internationally accredited clinics, though price competition remains intense.

Europe delivers steady expansion driven by Germany, France, and the United Kingdom, where public perception of aesthetics has shifted from vanity to self-care. Harmonized standards under the Medical Device Regulation support cross-border sales yet add compliance layers that raise entry costs. The Middle East builds luxury aesthetic centers to attract medical tourists, leveraging high disposable incomes and cultural acceptance of cosmetic enhancement. South America remains cost-competitive, with Brazil's skilled surgeons and Colombia's procedural value proposition drawing inbound patients. Emerging African economies are in early adoption phases but present long-term upside as urbanization and internet penetration spread awareness.

- Abbvie (Allergan Aesthetics)

- Alma Lasers

- Bausch Health

- Cutera

- El.En. (Asclepion)

- Cynosure

- Boston Scientific (Lumenis)

- Sciton

- Candela Medical

- Venus Concept

- Johnson & Johnson (Mentor)

- Merz Pharma

- Galderma

- Ipsen

- Inmode

- Sinclair Pharma

- Revance Therapeutics

- Candela Medical

- Hologic

- Zeltiq Aesthetics (Coolsculpting)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Minimally Invasive Procedures

- 4.2.2 Growing Aging Population and Obesity Rates

- 4.2.3 Rising Consumer Awareness and Acceptance of Aesthetic Treatments

- 4.2.4 Technological Advancements in Energy-Based and Injectable Devices

- 4.2.5 Expansion of Medical Tourism Hubs Offering Aesthetic Services

- 4.2.6 Integration of Digital Marketing and Social Media Influencers in Patient Acquisition

- 4.3 Market Restraints

- 4.3.1 High Procedure Costs and Limited Insurance Coverage

- 4.3.2 Stringent Regulatory and Safety Compliance Requirements

- 4.3.3 Workforce Shortages of Skilled Aesthetic Practitioners

- 4.3.4 Environmental Sustainability Concerns around Single-Use Consumables

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers / Consumers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitute Products

- 4.5.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type Of Device

- 5.1.1 Energy-Based Aesthetic Devices

- 5.1.1.1 Laser-Based Aesthetic Devices

- 5.1.1.2 Radiofrequency-Based Aesthetic Devices

- 5.1.1.3 Light-Based Aesthetic Devices

- 5.1.1.4 Ultrasound-Based Aesthetic Devices

- 5.1.2 Non-Energy-Based Aesthetic Devices

- 5.1.2.1 Botulinum Toxin

- 5.1.2.2 Dermal Fillers And Threads

- 5.1.2.3 Microdermabrasion

- 5.1.2.4 Implants

- 5.1.2.5 Other Aesthetic Devices

- 5.1.1 Energy-Based Aesthetic Devices

- 5.2 By Procedure Type

- 5.2.1 Non-Surgical / Minimally Invasive

- 5.2.2 Surgical

- 5.3 By Application

- 5.3.1 Skin Resurfacing And Tightening

- 5.3.2 Body Contouring And Cellulite Reduction

- 5.3.3 Hair Removal

- 5.3.4 Facial Aesthetic Procedures

- 5.3.5 Breast Augmentation

- 5.3.6 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Clinics And Dermatology Offices

- 5.4.3 Medical Spas

- 5.4.4 Home Settings

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Abbvie (Allergan Aesthetics)

- 6.3.2 Alma Lasers (Sisram Med)

- 6.3.3 Bausch Health Companies Inc. (Solta Medical Inc.)

- 6.3.4 Cutera

- 6.3.5 El.En. (Asclepion)

- 6.3.6 Cynosure

- 6.3.7 Boston Scientific (Lumenis)

- 6.3.8 Sciton

- 6.3.9 Candela Medical

- 6.3.10 Venus Concept

- 6.3.11 Johnson & Johnson (Mentor)

- 6.3.12 Merz Pharma

- 6.3.13 Galderma

- 6.3.14 Ipsen

- 6.3.15 Inmode

- 6.3.16 Sinclair Pharma

- 6.3.17 Revance Therapeutics

- 6.3.18 Syneron Medical

- 6.3.19 Hologic

- 6.3.20 Zeltiq Aesthetics (Coolsculpting)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment