PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852169

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852169

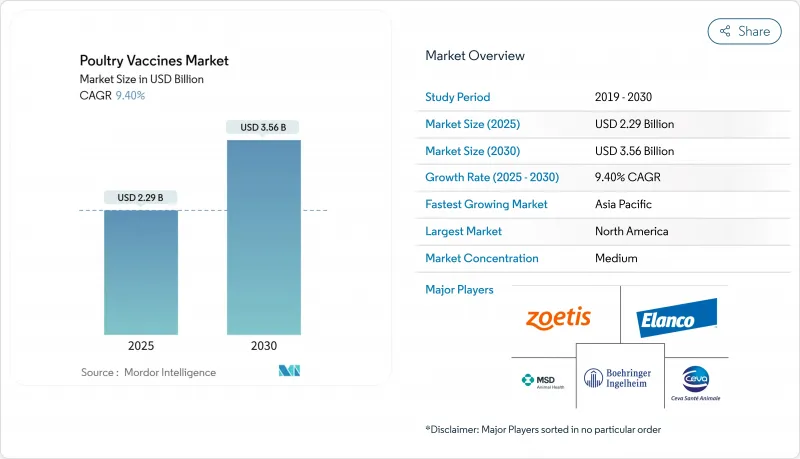

Poultry Vaccines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The poultry vaccine market size reached USD 2.29 Billion in 2025 and is projected to climb to USD 3.56 billion by 2030, reflecting a 9.4% CAGR.

The global poultry vaccine market continues its upward trajectory as regulatory reform converges with disease pressure to redefine producer priorities. A closer examination of the 2024 landscape shows that Infectious Bronchitis vaccines retain a 23.1 % disease-segment share, yet Avian Influenza preparations are poised to accelerate at a 9.4 % CAGR between 2025 and 2030. Every time producers update their biosecurity budgets, they now weigh the indirect cost of regulatory non-compliance against the direct cost of vaccination, a calculation that has begun to favor preventive immunization in most commercial models.

Global Poultry Vaccines Market Trends and Insights

Regulatory Push to Replace Antibiotics with Preventive Vaccination

Mounting antimicrobial-resistance concerns have prompted the US Food & Drug Administration's Center for Veterinary Medicine to intensify pre-approval scrutiny of in-feed drugs while formally encouraging vaccination as an alternative route to compliance . In parallel, the European Medicines Agency is phasing in residue-monitoring protocols that make antibiotic-free certification commercially valuable. Integrated producers are therefore renegotiating feed contracts to reflect lower antibiotic volumes, releasing working capital that is rapidly redeployed into biologics purchasing. The strategic benefit extends to export-oriented operators, who leverage vaccination records to streamline customs clearance and shorten cash-conversion cycles.

Rapid Expansion of Vertically-Integrated Broiler Operations in ASEAN

. South and Southeast Asia's vertically integrated broiler systems are scaling at an estimated 4 %-5 % per year through 2030. The operational insight emerging from the region is that integrators are beginning to specify vaccine serotypes directly in grow-out contracts, thereby transferring some biological-risk responsibility upstream to suppliers. This practice is quietly shifting the balance of power in price discussions from distributors toward international vaccine brands that can guarantee strain-specific supply continuity.

Emergence of Variant IBV Serotypes Undermining Existing Bronchitis Vaccines

Mutation of IBV strains hastens product obsolescence. Manufacturers with agile seed-strain update capabilities are capturing multiyear supply agreements, locking in share before slower rivals can reformulate. Data from regional labs highlight an uptick in cross-protection failures, driving integrators to diversify brand portfolios to de-risk supply continuity. This fragmentation rewards suppliers able to deliver multiplex diagnostics that pinpoint serotype prevalence in near-real time.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Incidences of Poultry and Zoonotic Diseases

- Improvements in Vectored and Combination Vaccinations

- Heightened Regulatory Review of Viral-Vector Vaccines in China

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 23% market share of Infectious Bronchitis vaccines in 2024 underscores their role as table stakes for commercial producers. Variant turnover forces suppliers into more frequent seed-stock updates than for most other poultry diseases. The operational takeaway is that vendors able to synchronize strain updates with integrator production cycles gain negotiating leverage on multiyear supply agreements.

Live attenuated offerings hold 36 % share today, but vector technologies are projected to expand at 9.8 % CAGR through 2030. An emerging pattern shows integrators treating vector vaccines as a hedge against tightening residue regulations, positioning them not only as a health product but also as a compliance instrument.

Breeder-flock vaccination commands 44.8 % of 2024 revenues. Because every vaccinated breeder protects multiple downstream generations, GCC sovereign food-security funds now evaluate vaccine spend in terms of protein-security ROI, effectively bundling biologics purchases into national resilience budgets.

The Poultry Vaccines Market Report Segments the Industry Into Disease Type (Infectious Bronchitis, and More), Technology (Live Attenuated Vaccines, and More), Application (Broiler, and More), Dosage Form (Liquid, and More), Route of Administration (Injectable, and More), End User (Poultry Farms, and More), Distribution Channel (Hospital, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains a 34% market share in 2024. USDA indemnity payouts totaling USD 1.1 billion highlight the fiscal magnitude of HPAI . Insurers have begun to model policy premiums on whether a farm participates in USDA-approved vaccination programs, effectively turning vaccines into quasi-financial instruments that influence coverage costs.

Asia is the fastest-growing region with an 8 % CAGR outlook for 2025-2030. China's historic 73 % avian-influenza vaccination coverage has prompted local labs to develop accelerated viral-evolution monitoring systems. Those surveillance assets double as competitive intelligence, allowing regional manufacturers to iterate vaccines ahead of global peers.

Europe, Latin America, and the Middle East each display distinct triggers for vaccine uptake, from welfare regulations to export-market access requirements. Brazil's export-oriented producers increasingly view vaccination status as a tariff-mitigation tool, whereas GCC buyers fold vaccine clauses directly into long-term feed import contracts to ensure continuity of local protein supplies.

- Zoetis

- Boehringer Ingelheim

- Merck & Co., Inc. (Merck Animal Health/MSD)

- Ceva Sante Animale

- Elanco Animal Health Inc.

- Phibro Animal Health

- HIPRA S.A.

- Huvepharma EAD

- Dechra Pharmaceuticals

- Hester Biosciences Ltd.

- Venkys (India) Ltd.

- Biovac Ltd.

- Indian Immunologicals

- Ringpu Biologicals Co. Ltd.

- Avimex Laboratorios, S.A. de C.V.

- SAN Group

- Nisseiken Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory Push to Replace Antibiotics with Preventive Vaccination in US & EU Poultry Chains

- 4.2.2 Rapid Expansion of Vertically-Integrated Broiler Operations in ASEAN, Driving Bulk Vaccine Contracts

- 4.2.3 Increasing Incidences of Poultry and Zoonotic Diseases

- 4.2.4 Commercial Roll-out of Thermostable Live-Attenuated Vaccines Unlocking Sub-Saharan Demand

- 4.2.5 Improvements in Vectored and Combination Vaccinations

- 4.2.6 GCC Food-Security Funds Accelerating Spend on Comprehensive Breeder Flock Immunization

- 4.3 Market Restraints

- 4.3.1 Use of Counterfeit Products

- 4.3.2 Cold-Chain Expense & Vaccine Hesitancy Among African Smallholders

- 4.3.3 Emergence of Variant IBV Serotypes Undermining Existing Bronchitis Vaccines

- 4.3.4 Heightened Regulatory Review of Viral-Vector Vaccines in China Delaying Product Launches

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Scenario

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Disease Type

- 5.1.1 Infectious Bronchitis

- 5.1.2 Avian Influenza

- 5.1.3 Newcastle Disease

- 5.1.4 Marek's Disease

- 5.1.5 Coccidiosis

- 5.1.6 Egg Drop Syndrome

- 5.1.7 Avian Encephalomyelitis

- 5.1.8 Other Diseases

- 5.2 By Technology

- 5.2.1 Live Attenuated Vaccines

- 5.2.2 Inactivated (Killed) Vaccines

- 5.2.3 Recombinant / Vector Vaccines

- 5.2.4 DNA & Sub-unit Vaccines

- 5.2.5 Other Technologies

- 5.3 By Application

- 5.3.1 Broiler

- 5.3.2 Layer

- 5.3.3 Breeder

- 5.4 By Dosage Form

- 5.4.1 Liquid

- 5.4.2 Freeze-Dried (Lyophilized)

- 5.4.3 Powder

- 5.5 By Route of Administration

- 5.5.1 Injectable

- 5.5.2 Intranasal

- 5.6 By End User

- 5.6.1 Poultry Farms

- 5.6.2 Veterinary Hospitals & Clinics

- 5.6.3 Research Institutes

- 5.7 By Distribution Channel

- 5.7.1 Hospital / Clinic Pharmacy

- 5.7.2 Farm Supply Stores

- 5.7.3 Online & Direct Sales

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 Europe

- 5.8.2.1 Germany

- 5.8.2.2 United Kingdom

- 5.8.2.3 France

- 5.8.2.4 Italy

- 5.8.2.5 Spain

- 5.8.2.6 Rest of Europe

- 5.8.3 Asia-Pacific

- 5.8.3.1 China

- 5.8.3.2 Japan

- 5.8.3.3 India

- 5.8.3.4 South Korea

- 5.8.3.5 Australia

- 5.8.3.6 Rest of Asia-Pacific

- 5.8.4 South America

- 5.8.4.1 Brazil

- 5.8.4.2 Argentina

- 5.8.4.3 Rest of South America

- 5.8.5 Middle East

- 5.8.5.1 GCC

- 5.8.5.2 South Africa

- 5.8.5.3 Rest of Middle East

- 5.8.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Zoetis Inc.

- 6.4.2 Boehringer Ingelheim International GmbH

- 6.4.3 Merck & Co., Inc. (Merck Animal Health/MSD)

- 6.4.4 Ceva Sante Animale

- 6.4.5 Elanco Animal Health Inc.

- 6.4.6 Phibro Animal Health Corporation

- 6.4.7 HIPRA S.A.

- 6.4.8 Huvepharma EAD

- 6.4.9 Dechra Pharmaceuticals PLC

- 6.4.10 Hester Biosciences Ltd.

- 6.4.11 Venkys (India) Ltd.

- 6.4.12 Biovac Ltd.

- 6.4.13 Indian Immunologicals Ltd.

- 6.4.14 Ringpu Biologicals Co. Ltd.

- 6.4.15 Avimex Laboratorios, S.A. de C.V.

- 6.4.16 SAN Group

- 6.4.17 Nisseiken Co. Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment