PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852207

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852207

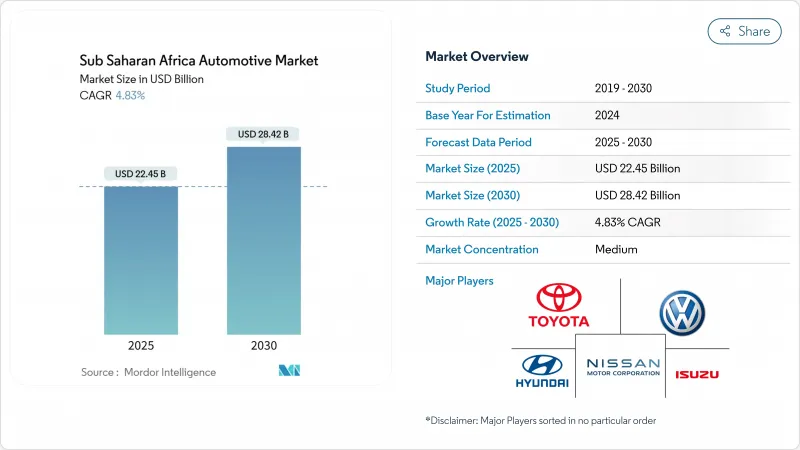

Sub Saharan Africa Automotive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Sub Saharan Africa automotive market size stands at USD 22.45 billion in 2025 and is projected to reach USD 28.42 billion by 2030, expanding at a 4.83% CAGR during the forecast period.

Accelerating urbanization, surging ride-hailing fleets, and government incentives for local assembly collectively sustain momentum despite persistent currency volatility and infrastructure gaps. Electrification initiatives in Ethiopia and South Africa signal a structurally diversifying demand mix, while diesel platforms remain dominant because of established fuel logistics and service networks. Grey-import activity continues to temper authorized-dealer volumes, yet structured fleet financing programs unlock new-vehicle penetration among ride-hailing operators. Strategic OEM partnerships with local assemblers, supported by AfCFTA tariff reductions, reinforce regional supply-chain integration.

Sub Saharan Africa Automotive Market Trends and Insights

Rising Middle-Class Income and Urbanization

An annual 4.1% urban-population uptick shifts purchasing power toward metropolitan nodes where dealer networks, financing options, and aftermarket services coalesce. Middle-income households in Nigeria, Kenya, and Ghana gravitate towards affordable models, intensifying competition between Chinese and Indian OEMs. Compact SUVs and hatchbacks hold favor for maneuverability in congested corridors, whereas peri-urban consumers rely on incoming used stock propelled by rising urban trade-in flows. Lenders follow employment clusters, resulting in cities above 1 million inhabitants offering up to five times more car-loan products than rural districts. Although local-currency depreciation erodes import affordability, wage growth linked to extractive sectors partially offsets price pressure, sustaining demand.

Surge of Ride-Hailing Platforms Accelerating Fleet Renewal

Structured fleet-financing programs from providers such as Moove enable ride-hailing drivers to bypass conventional credit hurdles, lifting multi-year baseline demand for the Sub Saharan Africa automotive market. Ride-hailing vehicles operate 8-12 hours daily, roughly quadrupling private-use utilization, which shortens replacement cycles to 3-4 years. This predictable cadence allows OEMs to align inventory planning with platform procurement schedules, protecting volumes when consumer sentiment dips. Nigeria, Kenya, and South Africa collectively host over 450,000 active ride-hailing drivers in 2025, and platform expansion into secondary cities deepens addressable demand. Government agencies increasingly recognize such fleets as catalysts for formalizing transport services, offering duty rebates on low-emission vehicles deployed for ride-hailing in Ethiopia and Ghana. Resultant fleet growth moderates the risk of limited retail financing reach in many markets.

Dominance of Used-Car Imports

Used vehicles represented 83% of all light-duty vehicle registrations across Sub Saharan Africa in 2024, according to the African Association of Automotive Manufacturers . South African Revenue Service customs data show That 45-60% price gaps between used and new models tilt buyer preference, a disparity magnified whenever local-currency depreciation inflates showroom tags. Projected deregistrations of ICE cars in wealthier economies could add 15 million exportable units annually by 2030, prolonging the region's high-emission fleet unless stricter import-quality rules take hold. UNECE roadworthiness protocols aim to stem sub-standard flows, but uneven enforcement across border posts still dilutes effectiveness.

Other drivers and restraints analyzed in the detailed report include:

- Government CKD/SKD Assembly Incentives

- Infrastructure Upgrades Improving Road Connectivity

- Limited Consumer Credit Access and High Interest Rates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sport-Utility Vehicles accounted for 36.75% of the Sub Saharan Africa automotive market in 2024, underpinned by a versatile ride height suited to mixed-quality roads and a 5.04% CAGR outlook through 2030. Sedans maintain relevance in professional and fleet procurement, yet share erosion persists as consumers migrate to crossover silhouettes. Chinese entrants such as BYD and Chery intensify rivalry by launching locally assembled PHEV SUVs at discounts versus Japanese incumbents, widening adoption among aspirational buyers. Hatchbacks dominate entry-level tiers in Kenya and Ghana, where congested grids reward compact footprints. Multi-purpose vans fill commercial people-movement gaps in peri-urban districts absent formal mass-transit systems, reinforcing the body-style mosaic across the Sub Saharan Africa automotive market.

Infrastructure realities sustain the appeal of higher-clearance models: paved-road density outside capitals remains low, and periodic flooding events make underbody robustness a decisive buying filter. Security considerations likewise favor SUV adoption because elevated driver sightlines reduce vulnerability in traffic slowdowns. The Sub Saharan Africa automotive market size for SUV derivatives is projected to grow by 2030, supported by both private ownership and ride-hailing fleet uptake.

Passenger cars preserved a 74.33% share of Sub Saharan Africa automotive market volume in 2024 and are forecast to grow at a 5.65% CAGR as middle-income cohorts expand. Light commercial vehicles (LCVs) benefit from e-commerce acceleration, especially in Nigeria and Kenya, where last-mile delivery providers lease small vans optimized for dense urban routes. Medium and heavy trucks trail overall market growth, tethered to commodity-export cycles in South Africa, Zambia, and Angola. Ride-hailing fleets underpin steady passenger-car demand, absorbing sedan and hatchback stock through structured financing programs that lower upfront cost burdens.

Policy-driven electrification in Ethiopia reshapes the passenger-car mix: 60% of newly registered cars must be EVs, catalyzing dedicated assembly ventures and public-sector procurement. Conversely, commercial-vehicle electrification lags because of payload-range constraints, though pilot programs in Johannesburg test battery-electric vans under urban logistics duty cycles. Sustained momentum within the passenger-car segment remains contingent on currency stability and progressive credit-access reforms across the Sub Saharan Africa automotive market.

The Sub Saharan Africa Automotive Market Report is Segmented by Body Style (Hatchback, Sedan, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Fuel Type (Gasoline, Diesel, and More), Propulsion Technology (Internal Combustion Engine (ICE), Hybrid Electric Vehicle (HEV), and More), Sales Channel, and Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Toyota Motor Corporation

- Volkswagen AG

- Hyundai Motor Company

- Nissan Motor Corporation

- Isuzu Motors Ltd.

- Ford Motor Company

- Groupe Renault

- Honda Motor Corporation

- Suzuki Motor Corporation

- Subaru Corporation

- Stellantis N.V.

- Daimler AG (Mercedes-Benz)

- BYD Co.

- Geely Auto Group

- Changan Auto

- JAC Motors

- BAIC Group

- Tata Motors

- Mahindra & Mahindra

- Innoson Vehicle Manufacturing (Nigeria)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Middle-Class Income and Urbanization

- 4.2.2 Surge of Ride-Hailing Platforms Accelerating Fleet Renewal

- 4.2.3 Government CKD/SKD Assembly Incentives

- 4.2.4 Infrastructure Upgrades Improving Road Connectivity

- 4.2.5 AfCFTA Tariff Reductions Expanding Intra-Regional Trade

- 4.2.6 Growth of Chinese Micro-EV Imports Filling Ultra-Low-Cost Niche

- 4.3 Market Restraints

- 4.3.1 Dominance of Used-Car Imports

- 4.3.2 Limited Consumer Credit Access and High Interest Rates

- 4.3.3 Local-Currency Volatility Inflating Import Costs

- 4.3.4 Fragmented Homologation Standards Across SSA

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Body Style

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 Sport-Utility Vehicle (SUV)

- 5.1.4 Multi-Purpose/Minivan

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.3 By Fuel Type

- 5.3.1 Gasoline

- 5.3.2 Diesel

- 5.3.3 Alternative Fuels (CNG, LPG, Bio-fuel)

- 5.4 By Propulsion Technology

- 5.4.1 Internal Combustion Engine (ICE)

- 5.4.2 Hybrid Electric Vehicle (HEV)

- 5.4.3 Battery Electric Vehicle (BEV)

- 5.4.4 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.5 By Sales Channel

- 5.5.1 OEM-Authorized Dealer

- 5.5.2 Grey Import / Parallel

- 5.6 By Country

- 5.6.1 South Africa

- 5.6.2 Nigeria

- 5.6.3 Kenya

- 5.6.4 Ethiopia

- 5.6.5 Ghana

- 5.6.6 Tanzania

- 5.6.7 Angola

- 5.6.8 Zambia

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Toyota Motor Corporation

- 6.4.2 Volkswagen AG

- 6.4.3 Hyundai Motor Company

- 6.4.4 Nissan Motor Corporation

- 6.4.5 Isuzu Motors Ltd.

- 6.4.6 Ford Motor Company

- 6.4.7 Groupe Renault

- 6.4.8 Honda Motor Corporation

- 6.4.9 Suzuki Motor Corporation

- 6.4.10 Subaru Corporation

- 6.4.11 Stellantis N.V.

- 6.4.12 Daimler AG (Mercedes-Benz)

- 6.4.13 BYD Co.

- 6.4.14 Geely Auto Group

- 6.4.15 Changan Auto

- 6.4.16 JAC Motors

- 6.4.17 BAIC Group

- 6.4.18 Tata Motors

- 6.4.19 Mahindra & Mahindra

- 6.4.20 Innoson Vehicle Manufacturing (Nigeria)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment