PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1905983

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1905983

North America Fuel Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

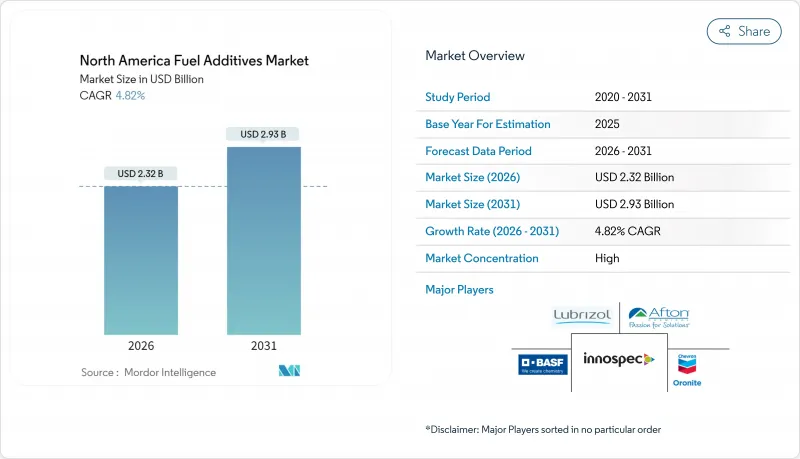

The North America Fuel Additives Market is expected to grow from USD 2.21 billion in 2025 to USD 2.32 billion in 2026 and is forecast to reach USD 2.93 billion by 2031 at 4.82% CAGR over 2026-2031.

Current growth rests on aggressive sulfur-reduction rules, the durability needs of an aging internal-combustion fleet, and the need to keep both gasoline and diesel engines efficient as renewable drop-ins enter mainstream supply. Deposit control chemistries dominate because gasoline direct-injection (GDI) engines foul more readily than legacy port-injection platforms, while octane-boosting antiknock agents record the quickest uptake as refiners strive for higher engine compression ratios without aromatics spikes. Commercial diesel users push demand for lubricity and cetane improvers that offset ultra-low-sulfur diesel (ULSD) shortcomings. Suppliers further benefit from aftermarket channels where margin opportunities remain stronger than at the refinery gate. Even with battery-electric vehicle (BEV) penetration climbing, the North America fuel additives market continues to expand because the liquid-fuel pool still serves legacy passenger vehicles, heavy-duty fleets, marine bunkers, and sustainable aviation fuel applications.

North America Fuel Additives Market Trends and Insights

Stringent Tier-3 and ECA Sulfur Limits

Tier-3 gasoline caps at 10 ppm sulfur and Emission Control Area marine requirements of 0.1% sulfur have permanently reset additive demand. Refiners rely on multifunctional packages that replace lost lubricity, maintain octane, disperse deposits, and guard against corrosion. Compliance costs rise further in California, where the Advanced Clean Cars II framework extends low-sulfur mandates through 2035. Terminal operators simultaneously adopt biocides that prevent microbial contamination during low-sulfur storage seasons. The cumulative effect drives a structural uptick in treat rates across the North America fuel additives market, keeping volumes resilient even when baseline gasoline and diesel throughput plateaus.

Accelerating ULSD and GDI Cleanliness Standards

ULSD carries lower natural lubricity, while GDI engines generate intake-valve deposits at 10X the rate of port systems. This intersection fuels rapid innovation in detergency chemistries such as polyisobutylamine and polyetheramine blends that resist high-temperature bake-on. EPA Tier 3 emission limits obligate automakers to maintain catalyst efficiency, which is compromised when coking rises. Concurrent growth in hydrogenated renewable diesel raises lubricity gaps that traditional petroleum fractions never posed. Together, these vectors expand the functional scope-and revenue opportunity-of detergent, lubricity, and cetane improvers across the North America fuel additives market.

BEV Penetration Reducing Liquid-Fuel Pool

Forecasts point to half of new-light-duty sales being electric by 2030 in densely populated corridors. Each incremental EV permanently displaces gasoline demand and gradually trims the North America fuel additives market addressable volume. Diesel's defensive moat erodes as parcel-delivery and municipal bus fleets test battery platforms, curtailing traditional additive sales to high-throughput commercial accounts. Suppliers respond by pivoting toward aviation, marine, and industrial channels where electrification hurdles remain significant.

Other drivers and restraints analyzed in the detailed report include:

- Rising Aftermarket Demand from Aging Fleet

- Drop-In Renewable Diesel and SAF Compatibility Needs

- High Validation and Treat-Rate Research and Development Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Deposit control packages held 33.02% of the North America fuel additives market share. Multifunctional detergents based on polyetheramines and polyisobutylene succinimides strip valve, injector, and combustion-chamber deposits that proliferate in modern GDI platforms. Higher compression engines spur octane demand, lifting antiknock agent sales at a projected 5.28% CAGR through 2031.

Cold-flow improvers preserve diesel operability below -10 °F in Canadian and Northern U.S. states, while cetane, lubricity, and corrosion inhibitors find fresh relevance in renewable diesel blends that arrive with low aromatics and sulfur. Suppliers increasingly bundle these chemistries into single packages, allowing refiners to reduce treat cost while meeting ASTM, EPA, and Transport Canada specifications. Escalating validation hurdles consolidate bargaining power within a handful of technology owners, yet specialty players still carve out sub-segments such as biodiesel stabilizers and high-flash-point marine additives, ensuring competitive churn inside the North America fuel additives market.

The North America Fuel Additives Report is Segmented by Product Type (Deposit Control, Cetane Improvers, Lubricity Additives, Antioxidants, Anticorrosion, Cold Flow Improvers, Antiknock Agents, and Other Product Types), Application (Diesel, Gasoline, Jet Fuel, and Other Applications), and Geography (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AFTON CHEMICAL

- Baker Hughes Company

- BASF

- Chevron Oronite Company LLC

- Clariant AG

- Croda International Plc

- Dorf Ketal Chemicals

- Evonik Industries AG

- Exxon Mobil Corporation

- Infineum International Limited

- Innospec

- LANXESS AG

- Shell plc

- The Lubrizol Corporation

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Tier-3 and ECA sulfur limits

- 4.2.2 Accelerating ULSD and GDI cleanliness standards

- 4.2.3 Rising aftermarket demand from ageing fleet

- 4.2.4 Drop-in renewable diesel and SAF compatibility needs

- 4.2.5 Off-highway retrofit boom for SCR/DEF

- 4.3 Market Restraints

- 4.3.1 BEV penetration reducing liquid-fuel pool

- 4.3.2 High validation and treat-rate RandD costs

- 4.3.3 Specialty-chemical supply-chain shocks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Deposit Control

- 5.1.2 Cetane Improvers

- 5.1.3 Lubricity Additives

- 5.1.4 Antioxidants

- 5.1.5 Anticorrosion

- 5.1.6 Cold Flow Improvers

- 5.1.7 Antiknock Agents

- 5.1.8 Other Product Types

- 5.2 By Application

- 5.2.1 Diesel

- 5.2.2 Gasoline

- 5.2.3 Jet Fuel

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AFTON CHEMICAL

- 6.4.2 Baker Hughes Company

- 6.4.3 BASF

- 6.4.4 Chevron Oronite Company LLC

- 6.4.5 Clariant AG

- 6.4.6 Croda International Plc

- 6.4.7 Dorf Ketal Chemicals

- 6.4.8 Evonik Industries AG

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 Infineum International Limited

- 6.4.11 Innospec

- 6.4.12 LANXESS AG

- 6.4.13 Shell plc

- 6.4.14 The Lubrizol Corporation

- 6.4.15 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment