PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906966

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906966

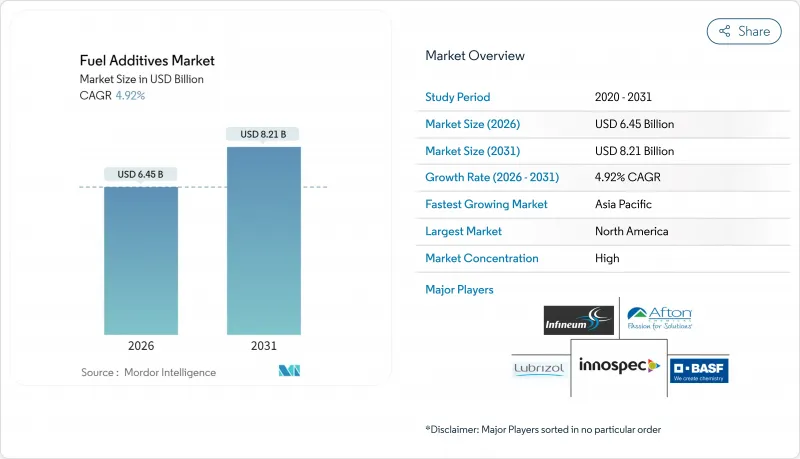

Fuel Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Fuel Additives market is expected to grow from USD 6.15 billion in 2025 to USD 6.45 billion in 2026 and is forecast to reach USD 8.21 billion by 2031 at 4.92% CAGR over 2026-2031.

The outlook balances tightening global emission rules that stimulate additive demand against the long-run decline in fuel consumption tied to battery-electric vehicle adoption. Sustained jet-fuel needs, coupled with emerging-economy rollouts of ultra-low sulfur diesel (ULSD), keep the fuel additives market on an upward trajectory. Aviation recovery, expanding biodiesel mandates, and the refinement of heavy, lower-quality crudes collectively underpin steady product innovation. Competitive intensity has risen as suppliers pivot to multifunctional, biofuel-ready packages while securing raw-material integration to offset cost pressures.

Global Fuel Additives Market Trends and Insights

Enactment of Stringent Environmental Regulations

Global regulatory tightening is reshaping additive consumption as fuel producers align with more complex compliance layers. The U.S. Renewable Fuel Standard embeds additive requirements for ethanol and biodiesel blending, while Euro 7 emission rules in the European Union call for higher detergency to preserve after-treatment efficiency across longer drain intervals. California's Advanced Clean Cars II framework, despite its 2035 internal-combustion phase-out target, lifts near-term demand for premium gasoline additives that curb evaporative and particulate emissions. Maritime sulfur caps under IMO 2020 have spilled into land-based diesel pools, further widening the addressable market for multifunctional packages. Formal test protocols such as ISO 8217 and ASTM D975 channel business toward suppliers that operate accredited laboratories, tightening the qualification bar for new entrants.

Degrading Crude-Oil Quality Raising Deposit Issues

Heavier, higher-contaminant opportunity crudes now fill a larger slice of refinery slates, escalating deposit formation risks throughout storage and combustion cycles. Shale-derived paraffinic crudes elevate wax precipitation, while Canadian oil-sands feedstocks heighten corrosion and oxidation stress during long-haul transport. These dynamics bolster demand for deposit control, antioxidant, and anticorrosion additives that maintain fuel integrity under harsher thermal and chemical loads. In the Middle East, refineries running heavier feed face similar issues as they chase merchandising flexibility. As refiners squeeze economics from lower-grade inputs, additive packages that combine detergency, metal-deactivating, and stabilization functions gain favor.

Surging Adoption of Battery-Electric Vehicles

Electric mobility is redrawing the energy map. China surpassed 45% EV penetration in 2024, and the International Energy Agency sees EVs reaching 60% of global light-duty sales by 2030. As gasoline and diesel consumption peaks, additive volumes linked to road transport face a structural headwind. Heavy-duty fleet electrification compounds the effect, especially for diesel additive vendors. Nevertheless, aviation, marine, and off-road segments remain insulated, prompting suppliers to concentrate research and development and capital around these higher-value niches while exploring additives for alternative fuels such as ammonia and hydrogen carriers.

Other drivers and restraints analyzed in the detailed report include:

- Tight ULSD Specifications in Emerging Economies

- Rising Global Aviation Traffic and Jet-Fuel Demand

- High Research and Development Cost for Multi-Functional Additive Packages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Deposit control additives commanded 28.78% of the fuel additives market share in 2025, cementing their role as the cornerstone of modern fuel quality regimes. They ensure intake-valve and injector cleanliness demanded by EPA Tier 3 and EN 228 gasoline standards, safeguarding combustion efficiency and emission-system longevity. The segment benefits from the proliferation of gasoline direct-injection engines, which are more prone to valve deposits. Equally important, high-pressure diesel injection systems demand detergents to prevent nozzle coking.

Cold flow improvers register a 5.43% CAGR to 2031, the fastest within the product spectrum, as biodiesel blending widens and winter operability becomes mission-critical in Canada, Northern Europe, and Northeast China. As these mandates scale, pour-point depressant technologies that manage biodiesel's higher cloud and pour points gain traction. Cetane improvers follow as commercial fleets upgrade to higher-efficiency engines requiring reliable cold starts and reduced ignition delay. Multifunctional formulations are gaining favor because they reduce treat-rate complexity for refiners and downstream fuel marketers, consolidating performance goals into one SKU.

The Fuel Additives Report is Segmented by Product Type (Deposit Control, Cetane Improvers, Lubricity Additives, Antioxidants, Anticorrosion, Cold Flow Improvers, Antiknock Agents, and Other Product Types), Application (Diesel, Gasoline, Jet Fuel, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value and Volume.

Geography Analysis

North America accounted for 35.55% of the fuel additives market share in 2025. Long-standing EPA rules and mature refining assets foster dependable volume, while extreme winter conditions in Canada stimulate cold flow improver uptake. Gasoline detergent demand remains buoyant under the TOP TIER retail program, which mandates higher deposit-control levels to maintain engine cleanliness.

Asia-Pacific is the fastest-growing region, charting a 5.48% CAGR to 2031. China's enforcement of National VI and India's BS-VI standards accelerates lubricity and cetane additive demand as refineries update hydrodesulfurization units. Rapid urbanization expands commercial vehicle fleets, boosting diesel additive consumption even as passenger EV adoption rises. Southeast Asian economies pursue ULSD and E10 gasoline rollouts, creating multi-product pull across biodiesel stabilizers, antioxidants, and lubricity improvers.

Europe shows steady but lower absolute growth, underpinned by aggressive decarbonization goals that shift the product mix toward biofuel-compatible additives. ReFuelEU Aviation and maritime sulfur caps generate high-margin specialty demand, offsetting declining road-fuel volumes. In the Middle East and Africa, expanding refinery complexes in Saudi Arabia and Nigeria widen regional availability of finished fuels, drawing additive imports to hit export-grade specifications. South America, led by Brazil's ethanol program, sustains robust antioxidant and corrosion-inhibitor demand for high-blend gasoline grades.

- AFTON CHEMICAL

- Baker Hughes Company

- BASF

- Cargill Incorporated

- Chevron Corporation

- Clariant

- Dorf Ketal Chemicals

- Evonik Industries AG

- Exxon Mobil Corporation

- Infineum International Limited

- Innospec

- Lanxess

- The Lubrizol Corporation

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Enactment of stringent environmental regulations

- 4.2.2 Degrading crude-oil quality raising deposit issues

- 4.2.3 Tight ULSD specifications in emerging economies

- 4.2.4 Rising global aviation traffic and jet-fuel demand

- 4.2.5 Biofuel-compatible additive chemistries (E10-E85)

- 4.3 Market Restraints

- 4.3.1 Surging adoption of battery-electric vehicles

- 4.3.2 High research and development cost for multi-functional additive packages

- 4.3.3 Metal-containing additive bans (e.g., MMT limits)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Product Type

- 5.1.1 Deposit Control

- 5.1.2 Cetane Improvers

- 5.1.3 Lubricity Additives

- 5.1.4 Antioxidants

- 5.1.5 Anticorrosion

- 5.1.6 Cold Flow Improvers

- 5.1.7 Antiknock Agents

- 5.1.8 Other Product Types

- 5.2 By Application

- 5.2.1 Diesel

- 5.2.2 Gasoline

- 5.2.3 Jet Fuel

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AFTON CHEMICAL

- 6.4.2 Baker Hughes Company

- 6.4.3 BASF

- 6.4.4 Cargill Incorporated

- 6.4.5 Chevron Corporation

- 6.4.6 Clariant

- 6.4.7 Dorf Ketal Chemicals

- 6.4.8 Evonik Industries AG

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 Infineum International Limited

- 6.4.11 Innospec

- 6.4.12 Lanxess

- 6.4.13 The Lubrizol Corporation

- 6.4.14 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment