PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906004

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906004

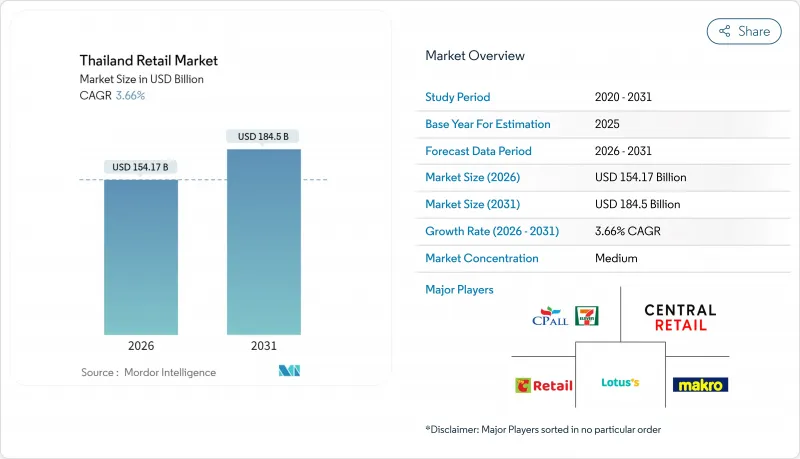

Thailand Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Thailand retail market is expected to grow from USD 148.73 billion in 2025 to USD 154.17 billion in 2026 and is forecast to reach USD 184.5 billion by 2031 at 3.66% CAGR over 2026-2031.

Household deleveraging, evolving payment systems, and sustained tourism inflows form the bedrock of growth, while persistent cost pressures and muted credit expansion temper the outlook. Omnichannel integration accelerates as PromptPay usage tops 52.7 million accounts, steering consumers toward friction-free shopping journeys. Quick-commerce fulfillment networks continue to proliferate, raising the competitive bar for inventory localization and same-hour delivery propositions. Modern trade chains extend footprints into rural provinces, leveraging mobile wallets and data-driven category management to capture rising up-country spending.

Thailand Retail Market Trends and Insights

Surging Quick-Commerce Demand in Bangkok & Tier-2 Cities

Dark stores and micro-fulfillment hubs redefine urban logistics as consumers embrace 30-minute delivery promises. Operators deploy AI-based demand forecasting to trim spoilage and raise pick-accuracy, enabling higher service levels without inflating costs. Parcel-sorting automation at Thailand Post complements private last-mile fleets, ensuring consistent peak-season throughput. Food-focused aggregators consolidate, leaving capitalized players to widen assortment beyond meals into daily essentials. Retailers test "shop-in-app" livestreams to blend impulse discovery with rapid fulfillment, capturing incremental basket value. Regulatory attention centers on traffic congestion and rider-safety mandates, potentially reshaping service geographies over time.

Tourism Rebound Lifting Discretionary Retail Spend

Tourist arrivals rose past 35 million in 2024, restoring footfall across flagship malls and duty-free stores. Average international trip expenditure climbed to THB 50,900 (USD 1,450), with more than half of bookings executed online, signaling heightened digital engagement. Luxury beauty, travel retail exclusives, and local craft items see higher conversion as visitors pursue experiential purchases. Retail landlords allocate incremental space to F&B and themed zones that capture tourist dwell-time. Currency strength of key source markets China, Malaysia, South Korea directly shapes SKU mix and promotional calendars. While geopolitical shocks could disrupt flows, ongoing infrastructure upgrades at Bangkok's airports enhance long-term capacity and retail tenancy demand.

High Household Debt Curbing Big-Ticket Purchases

Debt-to-GDP ratios exceeding 90% constrain credit appetites as lenders tighten scoring models. Auto and consumer-durable loans decelerate, prompting retailers to emphasize entry-level SKUs, refurbishment programs, and subscription models. Promotional calendars pivot toward value packs and zero-interest installments shorter than 12 months. Government debt-relief pilots for vulnerable households alleviate stress but lack scale to spark immediate spending surges. Retailers counter by bundling financial services-micro-insurance, layaway-within loyalty ecosystems, spreading payments without impairing cashflow. The trajectory implies muted volume growth for white goods until mid-2027, when income gains are projected to restore affordability.

Other drivers and restraints analyzed in the detailed report include:

- Modern Trade Expansion into Rural Provinces

- Government "Thailand 4.0" Digital-Payment Incentives

- Rising Minimum Wages Squeezing Retail Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Food, Beverage & Tobacco retained a 55.68% Thailand retail market share in 2025, underpinned by dependable domestic demand and menu innovation that appeals to tourists and locals alike. The segment benefits from resilient agri-supply chains and government food-security initiatives that stabilize farm-gate prices. Modern grocery chains amplify local sourcing to hedge currency swings and shorten replenishment cycles. In contrast, Personal Care & Household Care posts an 11.15% CAGR through 2031 as aging consumers pursue functional skincare, nutraceuticals, and eco-friendly detergents. Cross-border e-commerce introduces niche J-beauty and K-beauty lines, elevating competitive benchmarks on ingredient transparency. Brands emphasize recyclable packaging and halal certification to capture diverse urban cohorts. Electronics and home appliances record softer momentum as deferred upgrades coincide with debt overhang, yet premium smart-home bundles retain a tech-savvy niche.

The Thailand retail market size for Personal Care & Household Care is projected to climb from USD 15.45 billion in 2026 to USD 26.18 billion by 2031, while Food, Beverage & Tobacco expands steadily to USD 104.12 billion, confirming both defensive and aspirational consumption poles. Parallel-import and counterfeit challenges prompt multinationals to deploy serialization and QR-based authenticity checks, educating shoppers on safe-channel purchases. Specialty food exporters leverage origin-tracing platforms to differentiate at modern trade shelves. Regulatory enforcement of intellectual-property laws intensifies at customs points, curbing grey flows and shielding authorized distributors' price architecture. Overall, product diversification and premium-tier development mitigate topline reliance on core staple categories.

The Thailand Retail Market Report is Segmented by Product Type (Food, Beverage, and Tobacco Products; Personal Care and Household Care; Apparel, Footwear, and Many More), Retail Channel (Traditional Mom and Pop Retail, Modern Trade Retail, E-Commerce and Others), Format (Hypermarkets, Supermarkets, Convenience Stores, Department Stores, Specialty Stores, Others). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- CP All PCL (7-Eleven Thailand)

- Central Retail Corporation

- Lotus's (Ek-Chai Distribution System)

- Big C Supercenter PCL

- Siam Makro PCL (Makro/Cash & Carry)

- Shopee (Sea Ltd.)

- Lazada (Alibaba Group)

- JD Central

- HomePro

- The Mall Group

- Minor International (Fashion/F&B)

- Decathlon Thailand

- Power Buy

- Robinson Department Store

- King Power Duty Free

- B2S

- Watsons Thailand

- Boots Thailand

- PTT Oil & Retail Business (OR - Cafe Amazon)

- True Money (Ascend Retail)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging quick-commerce demand in Bangkok & tier-2 cities

- 4.2.2 Tourism rebound lifting discretionary retail spend

- 4.2.3 Modern trade expansion into rural provinces

- 4.2.4 Government 'Thailand 4.0' digital-payment incentives

- 4.2.5 AI-led hyper-personalised retail analytics adoption (under-reported)

- 4.2.6 Cross-border live-commerce from Chinese platforms (under-reported)

- 4.3 Market Restraints

- 4.3.1 High household debt curbing big-ticket purchases

- 4.3.2 Rising minimum wages squeezing retail margins

- 4.3.3 Fragmented cold-chain hurting fresh e-grocery (under-reported)

- 4.3.4 Grey-market imports diluting brand equity (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Food, Beverage, and Tobacco Products

- 5.1.2 Personal Care and Household Care

- 5.1.3 Apparel, Footwear, and Accessories

- 5.1.4 Furniture, Toys, and Hobby

- 5.1.5 Industrial and Automotive

- 5.1.6 Electronic and Household Appliances

- 5.1.7 Other Products

- 5.2 By Retail Channel

- 5.2.1 Traditional Mom and Pop Retail

- 5.2.2 Modern Trade Retail

- 5.2.3 E-Commerce and Others

- 5.3 By Format

- 5.3.1 Hypermarkets

- 5.3.2 Supermarkets

- 5.3.3 Convenience Stores

- 5.3.4 Department Stores

- 5.3.5 Specialty Stores

- 5.3.6 Others (drugstore, cash & carry, wholesaler)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 CP All PCL (7-Eleven Thailand)

- 6.4.2 Central Retail Corporation

- 6.4.3 Lotus's (Ek-Chai Distribution System)

- 6.4.4 Big C Supercenter PCL

- 6.4.5 Siam Makro PCL (Makro/Cash & Carry)

- 6.4.6 Shopee (Sea Ltd.)

- 6.4.7 Lazada (Alibaba Group)

- 6.4.8 JD Central

- 6.4.9 HomePro

- 6.4.10 The Mall Group

- 6.4.11 Minor International (Fashion/F&B)

- 6.4.12 Decathlon Thailand

- 6.4.13 Power Buy

- 6.4.14 Robinson Department Store

- 6.4.15 King Power Duty Free

- 6.4.16 B2S

- 6.4.17 Watsons Thailand

- 6.4.18 Boots Thailand

- 6.4.19 PTT Oil & Retail Business (OR - Cafe Amazon)

- 6.4.20 True Money (Ascend Retail)

7 Market Opportunities & Future Outlook

- 7.1 Provincial dark-store micro-fulfilment networks for 2-hour delivery outside Bangkok

- 7.2 Private-label health & wellness SKUs targeting ageing society in up-country supermarkets