PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906019

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906019

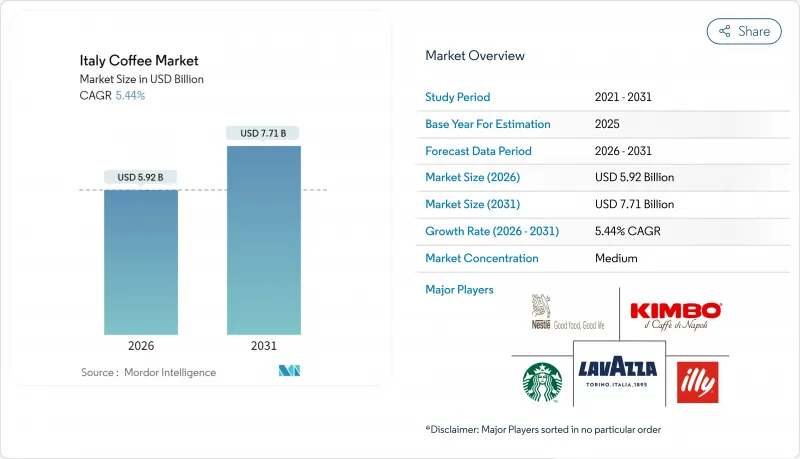

Italy Coffee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Italian coffee market size in 2026 is estimated at USD 5.92 billion, growing from 2025 value of USD 5.61 billion with 2031 projections showing USD 7.71 billion, growing at 5.44% CAGR over 2026-2031.

Coffee consumption remains integral to Italy's cultural heritage and daily lifestyle, maintaining consistent demand across market segments. Ground coffee dominates the market share, supported by the country's strong espresso culture. However, segments including coffee pods, capsules, specialty coffee, and ready-to-drink beverages are experiencing significant growth due to convenience and premium offerings. The market's expansion is supported by increasing consumer interest in sustainable and ethically sourced products. The integration of technology, including smart brewing systems and e-commerce platforms, is enhancing market accessibility and consumer engagement. While market saturation and traditional consumption habits present certain limitations, the combination of cultural significance, premium product development, and changing consumer preferences continues to drive market growth.

Italy Coffee Market Trends and Insights

Strong cultural heritage of coffee

Italy's deep-rooted coffee culture is a primary driver of its coffee market growth. The country's traditional coffee customs, integrated into daily routines and social interactions, maintain a steady demand for premium coffee products. Italy's established espresso culture, cafe customs, and distinct regional preferences shape a market where coffee represents both a beverage and a cultural cornerstone. This cultural foundation supports various coffee formats, from traditional to modern, maintaining consumer loyalty and market expansion. According to the European Coffee Federation (ECF), coffee sales in Europe increased from EUR 2,456 million in 2022 to EUR 2,571 million in 2023, demonstrating growth sustained by strong consumption patterns in key markets like Italy . These figures highlight how Italy's coffee culture influences both domestic consumption and broader European market dynamics, positioning the country as an influential force in the European coffee industry.

Product innovation fuel market development

Product innovation drives the development of the Italy coffee market. While Italian consumers maintain strong ties to traditional coffee culture, they show increasing receptivity to innovative coffee products that combine heritage with modern preferences. New developments in coffee formulations, brewing methods, and flavor combinations expand market appeal beyond traditional offerings. These innovations attract both younger consumers seeking novel experiences and established customers exploring premium and specialty segments, contributing to market expansion. For instance, in February 2023, Starbucks introduced its Oleato olive oil coffee range in Italy. The Oleato line features products including a latte, cold brew, and the Oleato Deconstructed, combining coffee with olive oil to create distinct flavor profiles. This launch demonstrates how international companies adapt their offerings to align with local tastes and cultural elements, supporting market growth and diversification. These innovations enhance market dynamics by addressing evolving consumer preferences while preserving connections to Italian coffee traditions.

Competition from alternative beverages

The Italian beverage market is experiencing a shift as alternative drinks gain popularity, particularly among younger consumers who are open to non-coffee options during traditional coffee drinking times. Premium and functional teas are seeing increased consumption, while energy drinks are gaining market share during afternoon periods typically reserved for espresso. Major Italian cities are witnessing growth in specialty tea shops and bubble tea venues, which serve as social spaces competing with traditional coffee bars. Health-conscious consumers are increasingly choosing matcha, kombucha, and adaptogenic beverages as alternatives to coffee for energy and social occasions. Plant-based milk alternatives are becoming more common in coffee preparation and as standalone beverages. In response, Italian beverage companies are diversifying their product portfolios, with coffee manufacturers adding tea, functional drinks, and wellness products to utilize their existing distribution channels and brand recognition.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability and ethical sourcing

- Convenience and ready-to-drink (RTD) coffees

- Climate change impact on supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ground Coffee dominates the Italian coffee Market with a 34.10% market share in 2025. This leadership position stems from Italy's established coffee culture and traditional brewing methods that emphasize ground coffee use in homes and cafes. Ground coffee remains integral to authentic Italian coffee preparation, with consumers preferring it for its optimal balance of convenience and flavor quality. The format enables users to create fresh brews that match professional cafe standards. Ground coffee's versatility accommodates various brewing methods, supporting daily consumption patterns from morning espressos to afternoon coffee breaks. The segment maintains its strong position through diverse product offerings, including multiple blends, roast levels, and brewing options that serve different consumer preferences.

Coffee Pods and Capsules represent the fastest-growing segment in the Italian Coffee Market, with a CAGR of 6.31% projected through 2031. This growth results from increasing consumer demand for convenience, consistent quality, and wider adoption of single-serve coffee machines in households and offices. Pods and capsules provide efficient brewing solutions while maintaining taste quality, attracting busy consumers and younger demographics who value modern coffee experiences. The segment's expansion continues through product innovations, including the development of cross-compatible capsules and new flavor varieties. In December 2024, Maurizio Distefano Licensing (MDL) demonstrated this trend by launching Baileys-branded coffee capsules and pads through Italian coffee brand Caffe Borbone.

Plain coffee maintains a dominant market position in the Italian coffee Market, representing 78.20% market share in 2025. This significant market presence is attributed to Italian consumers' established preference for traditional, unadulterated coffee that emphasizes the inherent characteristics of premium coffee beans. The market preference for plain coffee demonstrates Italy's deep-rooted coffee heritage, which prioritizes superior bean quality, professional roasting techniques, and conventional brewing methodologies. Plain coffee accommodates diverse consumption patterns, from traditional morning espresso to structured coffee breaks, underscoring its cultural importance and consistent market demand.

Flavored coffee demonstrates substantial market momentum in the Italian coffee Market, exhibiting a projected CAGR of 7.02% through 2031. This market expansion indicates a transformation in consumer preferences, specifically among younger demographic segments and metropolitan consumers pursuing diversified taste experiences. Flavored coffee variants appeal to consumers seeking enhanced aromatic profiles and sweetness characteristics, incorporating specific spice combinations and flavor compounds. The segment's development is facilitated by systematic product innovation and strategic marketing initiatives from coffee manufacturers aiming to establish market presence within specialized segments of the mature coffee industry.

The Italian Coffee Market Report is Segmented by Product Type (Whole Bean, Ground Coffee, Instant Coffee, and More), Flavor (Plain and Flavored), Category (Conventional and Specialty), Bean Type (Arabica, Robusta, and Others), and Distribution Channel (On-Trade and Off-Trade). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

List of Companies Covered in this Report:

- Luigi Lavazza S.p.A.

- Nestle S.A.

- Kimbo S.p.A.

- Starbucks Corporation

- Gruppo Illy S.p.A.

- Tchibo GmbH

- Italmobiliare S.p.A. (Caffe Borbone)

- Caffe Trombetta S.p.A.

- Gruppo Gimoka S.p.A.

- Casa del Caffe Vergnano S.p.A.

- Massimo Zanetti Beverage Group

- JDE Peet's N.V.

- Segafredo Zanetti S.p.A.

- Pellini Caffe S.p.A.

- Hausbrandt Trieste 1892 S.p.A.

- Caffe Motta S.p.A.

- Julius Meinl Italia S.p.A.

- Lugano Caffe

- Volcafe Italia

- Caffe Corsini

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strong cultural heritage of coffee

- 4.2.2 Product innovation fuel market development

- 4.2.3 Sustainability and ethical sourcing

- 4.2.4 Convenience and ready-to-drink (RTD) coffees

- 4.2.5 Rising cafe culture and social coffee consumption

- 4.2.6 Influence of coffee chains and retail expansion

- 4.3 Market Restraints

- 4.3.1 Competition from alternative beverages

- 4.3.2 Climate change impact on supply

- 4.3.3 Price volatility and supply chain disruptions

- 4.3.4 High operational and raw material costs

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Whole Bean

- 5.1.2 Ground Coffee

- 5.1.3 Instant Coffee

- 5.1.4 Coffee Pods and Capsules

- 5.1.5 Ready-to-Drink (RTD) Coffee

- 5.2 By Flavor

- 5.2.1 Plain

- 5.2.2 Flavored

- 5.3 By Category

- 5.3.1 Conventional

- 5.3.2 Speciality (Organic/Single-Origin)

- 5.4 By Bean Type

- 5.4.1 Arabica

- 5.4.2 Robusta

- 5.4.3 Others

- 5.5 By Distribution Channel

- 5.5.1 On-trade

- 5.5.2 Off-trade

- 5.5.2.1 Supermarkets/Hypermarkets

- 5.5.2.2 Convenience/ Grocery Stores

- 5.5.2.3 Online Retail Stores

- 5.5.2.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Luigi Lavazza S.p.A.

- 6.4.2 Nestle S.A.

- 6.4.3 Kimbo S.p.A.

- 6.4.4 Starbucks Corporation

- 6.4.5 Gruppo Illy S.p.A.

- 6.4.6 Tchibo GmbH

- 6.4.7 Italmobiliare S.p.A. (Caffe Borbone)

- 6.4.8 Caffe Trombetta S.p.A.

- 6.4.9 Gruppo Gimoka S.p.A.

- 6.4.10 Casa del Caffe Vergnano S.p.A.

- 6.4.11 Massimo Zanetti Beverage Group

- 6.4.12 JDE Peet's N.V.

- 6.4.13 Segafredo Zanetti S.p.A.

- 6.4.14 Pellini Caffe S.p.A.

- 6.4.15 Hausbrandt Trieste 1892 S.p.A.

- 6.4.16 Caffe Motta S.p.A.

- 6.4.17 Julius Meinl Italia S.p.A.

- 6.4.18 Lugano Caffe

- 6.4.19 Volcafe Italia

- 6.4.20 Caffe Corsini

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK