PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907239

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907239

Middle East Africa Coffee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

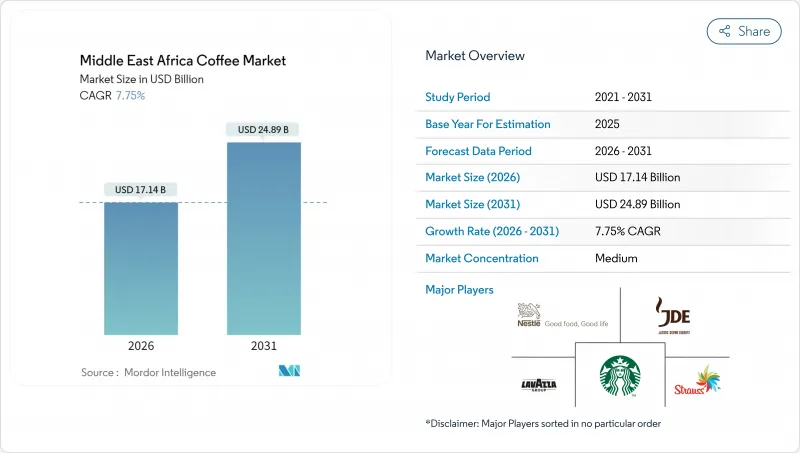

The coffee market in the Middle East and Africa was valued at USD 15.91 billion in 2025 and estimated to grow from USD 17.14 billion in 2026 to reach USD 24.89 billion by 2031, at a CAGR of 7.75% during the forecast period (2026-2031).

This growth is driven by factors such as increasing urbanization, higher disposable incomes, and the growing trend of visiting cafes as part of daily social activities. Global coffee roasters are focusing on localization by launching Arabic-language marketing campaigns and introducing Ramadan-specific flavors to cater to regional preferences. At the same time, local players are strengthening their supply chains by securing green coffee beans from key producers like Ethiopia and Kenya. Additionally, Gulf governments are investing in logistics hubs to reduce delivery times for fresh-roasted coffee, which supports the demand for premium products in high-income areas. The competitive landscape is becoming more intense as franchise agreements expand and specialty cafes attract mall visitors who previously frequented international fast-food chains.

Middle East Africa Coffee Market Trends and Insights

Rapid Urbanization and Lifestyle Shifts

In Saudi Arabia and the United Arab Emirates, urban populations have surpassed 85%, leading to the emergence of densely packed clusters of young, digitally-savvy consumers. For these consumers, coffee has evolved from a mere beverage to a symbol of social currency. This shift is evident in the surge of specialty cafes sprouting up in Riyadh's King Abdullah Financial District and Dubai's Design District. World Bank data reveals that 43% of Egypt's populace resides in urban locales, hinting at a burgeoning appetite for affordable instant and ready-to-drink coffee options tailored for the on-the-go commuter. Similarly, in Nigeria's Lagos and Abuja, trends mirror those of their Middle Eastern counterparts. Local roasters, such as Bunna Bet Ethiopia, are making inroads, catering to both expatriate communities and the aspirational middle class. As urbanization condenses meal times, grab-and-go coffee has begun to replace traditional tea breaks. This shift has paved the way for Nestle's September 2024 debut of Nescafe Ready-to-Drink in Saudi Arabia, UAE, Egypt, and Iraq, all under the catchy "Bikeifi" campaign. With rising incomes, widespread smartphone use, and the omnipresence of delivery apps, it's clear that urbanization will continue to drive volume growth, even if per-capita consumption levels off in the more established Gulf markets.

Expansion of Cafe Culture and Specialty Coffee Shops

Third-wave coffee culture has grown beyond Western cities, with Dubai, Riyadh, and Istanbul now hosting international barista championships and single-origin coffee tasting events that attract regional buyers and roasters. In 2024, Black Sheep Coffee announced plans to open 250 stores across the Middle East and Africa. These stores will be located in busy malls and business districts, offering premium espresso drinks and co-working spaces. Costa Coffee has partnered with Saudi Arabia's Jazean Group to open 100 stores. This partnership uses Jazean's expertise in real estate and cultural knowledge to handle zoning laws and labor-nationalization requirements effectively. Ethiopia's specialty coffee industry is shifting from exporting commodities to building branded retail. Nordic Approach's project in Yirgacheffe connects small farmers directly with European roasters, bypassing the Ethiopian Commodity Exchange and ensuring farmers earn higher premiums that previously went to middlemen. The trend of cafes serving as workspaces, driven by remote work policies, is increasing customer visit durations and repeat visits. This change supports higher rents and attracts institutional investors, showing strong confidence in the sector's growth potential.

Health Concerns Over Caffeine and Sugar

Public health campaigns in the Middle East are driving changes in sugar-sweetened beverages. The World Health Organization's Eastern Mediterranean office reports that 4 out of 8 countries in the region, including Saudi Arabia, have introduced taxes on these beverages. Saudi Arabia's tax reduced consumption by 19%. To comply with regulations and attract health-conscious consumers, brands are reformulating products. For example, Nestle's Nescafe Ready-to-Drink line, launched in September 2024, now includes reduced-sugar options. Caffeine content is also under scrutiny, especially for pregnant women and adolescents, leading retailers in the UAE and Kuwait to add advisory labels on high-caffeine products. Functional beverages like matcha lattes and turmeric teas are gaining popularity, replacing coffee on premium grocery shelves as consumers seek wellness benefits. Decaffeinated and half-caff options are also growing, with decaf now accounting for 5% to 8% of specialty coffee sales in Gulf markets, up from negligible levels three years ago. Stricter labeling rules and public health messaging are expected to push coffee brands to invest more in reformulation and consumer education to maintain market share.

Other drivers and restraints analyzed in the detailed report include:

- Premiumisation and Single-Origin Positioning

- Growth in Coffee House Stores Fueling Market Demand

- Detrimental Impact of Coffee Pods and Capsules on the Environment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, Whole Bean coffee held 42.82% of the market, driven by Turkey's traditional cezve brewing and the UAE's demand for premium single-origin beans. Specialty roasters like RAW Coffee Company and Ludlow Coffee Group cater to UAE consumers willing to pay USD 20 to USD 40 per kilogram for traceable Ethiopian and Kenyan beans. Lavazza's launch of the Tibali brewing system in 2024, designed for whole-bean extraction, highlights its appeal to affluent consumers valuing flavor complexity. Turkey's annual per-capita coffee consumption, currently 1 to 1.2 kilograms, is expected to double to 2 kilograms by 2030, fueled by younger consumers exploring espresso-based drinks. While urbanization and time constraints may shift preferences toward pre-ground and instant coffee, Whole Bean's association with authenticity ensures a loyal customer base.

Ready-to-Drink coffee is projected to grow at a CAGR of 8.02% through 2031, the fastest among product types, as millennials in Saudi Arabia, Egypt, and the UAE embrace convenient, on-the-go formats. Ground Coffee, Instant Coffee, and Coffee Pods and Capsules occupy a middle ground. Instant Coffee benefits from affordability and long shelf life in price-sensitive markets like Egypt and Nigeria, while Coffee Pods and Capsules face challenges from environmental concerns and limited machine penetration outside Gulf Cooperation Council states. Nescafe's May 2024 launch of Espresso Concentrate, a liquid format for foodservice, addresses labor shortages in cafes and restaurants. RTD coffee's growth depends on expanding cold-chain infrastructure in North and Sub-Saharan Africa and managing sugar-tax regulations without compromising taste or margins.

In 2025, conventional coffee accounted for 78.74% of the market, driven by the popularity of mass-market instant and ground coffee formats. These products cater to price-sensitive households in countries like Egypt, Nigeria, Morocco, and rural Turkey. Brands such as Nescafe, Jacobs, and local competitors utilize economies of scale to offer 100-gram jars priced affordably between USD 2 and USD 3. This pricing strategy positions coffee as an accessible daily necessity rather than a premium product. The segment's stronghold is further supported by institutional demand from hotels, restaurants, and offices, where cost efficiency and consistency take precedence over factors like origin or quality scores. However, the growth of this segment is slowing as urban consumers increasingly shift to specialty coffee options, and younger generations move away from the instant-coffee preferences of older demographics.

Specialty coffee is projected to grow at a robust 9.05% CAGR through 2031, making it the fastest-growing category. This growth is fueled by the expansion of third-wave coffee roasters in cities such as Riyadh, Dubai, Istanbul, and Johannesburg. These roasters focus on direct-trade Ethiopian and Kenyan coffee, which commands premiums of 200% to 400% over standard commodity coffee. The retail sector is also adapting to this trend, with UAE hypermarkets dedicating entire aisles to single-origin coffee products. Additionally, Saudi Arabia's DMCC Coffee Centre expanded its grading and storage facilities in 2024, aiming to establish Dubai as a key re-export hub for African specialty coffee. The future growth of this category will depend on the ability of roasters to implement scalable traceability systems that meet consumer expectations and on the resilience of disposable incomes in Gulf markets amid fluctuating oil prices.

The Middle East Africa Coffee Market Report is Segmented by Product Type (Whole Bean, Ground Coffee, Instant Coffee, and More), Category (Conventional Coffee, Specialty), Coffee Species (Arabica, Robusta, Liberica, Others), Distribution Channel (On-Trade, Off-Trade), and Geography (UAE, South Africa, Saudi Arabia, Nigeria, Egypt, Morocco, Turkey, Rest of MEA). Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nestle SA

- JDE Peet's N.V.

- Starbucks Corporation

- Luigi Lavazza S.p.A.

- Strauss Group Ltd

- Tchibo GmbH

- Gruppo Illy S.p.A.

- Inspire Brands, Inc.

- Caffe Nero Group Ltd

- Caffitaly System S.p.A.

- Ludlow Coffee Group

- RAW Coffee Company

- Al Mokha Yemen Coffee

- Oromia Coffee Farmers Cooperative Union

- Gold Crown Beverages (K) Ltd

- Tanzania Instant Coffee Co.

- Bunna Bet Ethiopia

- Kahawa 1893, Inc.

- Almarai Company

- Merefin Coffee

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Deep cultural and social role of coffee

- 4.2.2 Rapid urbanization and lifestyle shifts

- 4.2.3 Expansion of cafe culture and specialty coffee shops

- 4.2.4 Premiumisation and single-origin positioning

- 4.2.5 Growth in the coffee house stores fueling market demand

- 4.2.6 Innovativation in coffee brewing methods

- 4.3 Market Restraints

- 4.3.1 Substitute beverages and functional drinks

- 4.3.2 Supply-chain/logistics bottlenecks

- 4.3.3 Health concerns over caffeine and sugar

- 4.3.4 Detrimental impact of coffee pods and capsules on the environment

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Whole Bean

- 5.1.2 Ground Coffee

- 5.1.3 Instant Coffee

- 5.1.4 Coffee Pods and Capsules

- 5.1.5 RTD Coffee

- 5.2 By Category

- 5.2.1 Conventional Coffee

- 5.2.2 Specialty

- 5.3 By Coffee Species

- 5.3.1 Arabica

- 5.3.2 Robusta

- 5.3.3 Liberica

- 5.3.4 Others

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience/ Grocery Stores

- 5.4.2.3 Specialty Stores

- 5.4.2.4 Online Retail Stores

- 5.4.2.5 Other Off-trade Channels

- 5.5 By Country

- 5.5.1 United Arab Emirates

- 5.5.2 South Africa

- 5.5.3 Saudi Arabia

- 5.5.4 Nigeria

- 5.5.5 Egypt

- 5.5.6 Morocco

- 5.5.7 Turkey

- 5.5.8 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nestle SA

- 6.4.2 JDE Peet's N.V.

- 6.4.3 Starbucks Corporation

- 6.4.4 Luigi Lavazza S.p.A.

- 6.4.5 Strauss Group Ltd

- 6.4.6 Tchibo GmbH

- 6.4.7 Gruppo Illy S.p.A.

- 6.4.8 Inspire Brands, Inc.

- 6.4.9 Caffe Nero Group Ltd

- 6.4.10 Caffitaly System S.p.A.

- 6.4.11 Ludlow Coffee Group

- 6.4.12 RAW Coffee Company

- 6.4.13 Al Mokha Yemen Coffee

- 6.4.14 Oromia Coffee Farmers Cooperative Union

- 6.4.15 Gold Crown Beverages (K) Ltd

- 6.4.16 Tanzania Instant Coffee Co.

- 6.4.17 Bunna Bet Ethiopia

- 6.4.18 Kahawa 1893, Inc.

- 6.4.19 Almarai Company

- 6.4.20 Merefin Coffee

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK