PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906029

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906029

Europe Activated Carbon - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

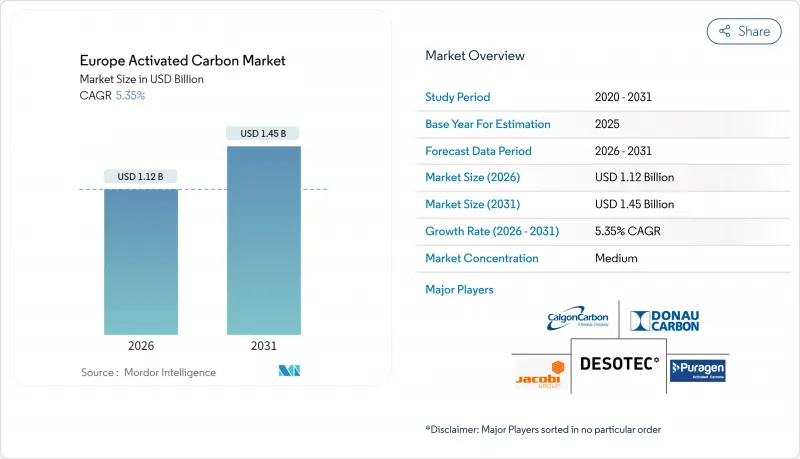

The Europe Activated Carbon Market is expected to grow from USD 1.06 billion in 2025 to USD 1.12 billion in 2026 and is forecast to reach USD 1.45 billion by 2031 at 5.35% CAGR over 2026-2031.

This growth rests on converging environmental regulations, expanding municipal water quality mandates, and tightening industrial emission limits that collectively reinforce demand for rapid-deployment sorbent technologies across the region. Strong replacement cycles in water utilities, a looming PFAS compliance deadline in 2026, and the enlargement of the Industrial Emissions Directive 2.0 are pushing end users to lock in long-term supply contracts, securing predictable pricing and reactivation services. The European activated carbon market is also adapting to feedstock volatility by blending imported coconut shell char with regional hardwood or lignite sources, while simultaneously investing in circular reactivation capacity that cuts disposal fees and lowers scope-3 emissions for customers

Europe Activated Carbon Market Trends and Insights

Tightening EU Industrial Emissions Limits

Revisions to the Industrial Emissions Directive broaden compliance coverage from large combustion plants to mid-scale boilers, smelting and foundries, compelling thousands of facilities previously below threshold to meet mercury and dust caps. Emission ceilings now stand at 1-4 µg/m3 for existing stacks and 1-2 µg/m3 for new builds, and the official BAT reference document explicitly names activated carbon injection as the primary path to meet the mercury target. Plant operators gravitate toward powdered formulations because duct-side injection systems can be engineered, ordered, and commissioned within an 18-month window, whereas fabric filter retrofits or wet scrubbers often exceed 50 months. EU Cohesion Funds reserve EUR 147 billion for clean-air objectives through 2027, shaving capital hurdles for smaller emitters. Consequently, the European activated carbon market registers rising forward orders for high-iodine PAC grades tailored to sulfur-rich flue gas. Equipment OEMs also report a surge in service contracts bundling carbon supply, silo rental, and spent carbon haul-back, reflecting customers' preference for turnkey compliance over component procurement.

Surging Demand from Municipal Water Utilities

Utilities in Germany, France, the Netherlands, and Belgium confront stricter micropollutant removal thresholds, leading to more frequent GAC change-outs and larger bids that roll media supply, vessel refurbishments, and reactivation into eight-year service lots. Germany alone consumes activated carbon worth EUR 130 million annually for municipal water polishing, equating to roughly 55,000 tons of virgin and reactivated material per year. Trace-substance rules being transposed under the revised Urban Wastewater Directive require 80-93% removal efficiency, levels consistently achieved by low-ash coconut shell or lignite-based GAC in tandem with biologically active filters. Procurement records show utilities favor dual-bed filter designs that retain hydraulic head yet extend media life by 18-24 months.

Price Volatility of Coconut Shell and Coal Feedstock

Coconut growing regions in Southeast Asia witnessed drought-driven shell shortages, sending CIF Europe prices up 38% between Q1 2024 and Q3 2025. Simultaneously, geopolitical tension in Eastern Europe constrained petcoke alternatives, forcing several small European kilns to idle capacity for maintenance during peak tender season. Large multi-feedstock players mitigated risk through long-term offtake agreements with Philippine copra mills and Colombian coal exporters, but price whiplash still squeezes profit margins for distributors lacking index-linked contracts. Utilities and food companies increasingly request price escalation clauses capped at 5% per annum, transferring part of the volatility to suppliers and intensifying the working-capital load across the Europe activated carbon market. Investment in European hardwood char projects provides some buffer, yet limited scale means bio-feedstock cannot fully displace imported coconut shell in high-purity applications.

Other drivers and restraints analyzed in the detailed report include:

- Mercury Emissions Cap in Coal and Biomass Co-firing

- Growth of Beverage Can-Line Filtration Capacity

- Availability of Emerging Biochar Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Powdered Activated Carbons jointly captured 47.63% Europe activated carbon market share in 2025, reflecting entrenched use in flue-gas injection systems across lignite and biomass boilers, and it is projected to grow at a 5.63% CAGR as more mid-scale stacks fall under the Industrial Emissions Directive. PAC's sub-45 µm particle size coupled with halogen impregnation elevates mercury uptake capacity to 1.8-2.4 mg Hg/g carbon, outperforming baseline coal-derived powders.

Granular Activated Carbons account for most water purification spending, driven by PFAS deadlines. Extruded carbons remain indispensable in solvent recovery and pharmaceutical air purification because their cylindrical geometry lowers pressure drop and resists attrition in high-velocity beds. Looking forward, PAC suppliers are experimenting with coconut-shell precursors that combine low ash content with micropore dominance, targeting both mercury and dioxin capture to stay relevant once coal plants retire. These innovations ensure the Europe activated carbon market maintains continuous product renewal rather than slipping into commoditization.

The Europe Activated Carbon Report is Segmented by Type (Powdered Activated Carbons, Granular Activated Carbons, and Extruded or Pelletized Activated Carbons), Application (Gas Purification, Water Purification, Metal Extraction, Medicine, and Others), and Geography (Germany, United Kingdom, France, Italy, Spain, and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AdFiS products GmbH

- Albemarle Corporation

- Calgon Carbon Corporation (Kuraray)

- Carbon Activated Corporation

- CarboTech Group

- Desotec

- Donau Carbon GmbH

- Haycarb PLC

- Ingevity

- JACOBI CARBONS GROUP

- KUREHA CORPORATION

- Norit

- Puragen

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tightening EU industrial-emissions limits

- 4.2.2 Surging demand from municipal water utilities

- 4.2.3 Mercury-emissions cap in coal and biomass co-firing

- 4.2.4 Growth of beverage can-line filtration capacity

- 4.2.5 Rising PFAS removal mandates in groundwater

- 4.3 Market Restraints

- 4.3.1 Price volatility of coconut-shell and coal feedstock

- 4.3.2 Availability of emerging biochar substitutes

- 4.3.3 Carbon-footprint penalties on coal-based grades

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Rivalry

- 4.6 Supply Scenario

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Powdered Activated Carbons (PAC)

- 5.1.2 Granular Activated Carbons (GAC)

- 5.1.3 Extruded or Pelletized Activated Carbons

- 5.2 By Application

- 5.2.1 Gas Purification

- 5.2.2 Water Purification

- 5.2.3 Metal Extraction

- 5.2.4 Medicine

- 5.2.5 Others

- 5.3 By Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AdFiS products GmbH

- 6.4.2 Albemarle Corporation

- 6.4.3 Calgon Carbon Corporation (Kuraray)

- 6.4.4 Carbon Activated Corporation

- 6.4.5 CarboTech Group

- 6.4.6 Desotec

- 6.4.7 Donau Carbon GmbH

- 6.4.8 Haycarb PLC

- 6.4.9 Ingevity

- 6.4.10 JACOBI CARBONS GROUP

- 6.4.11 KUREHA CORPORATION

- 6.4.12 Norit

- 6.4.13 Puragen

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment