PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906039

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906039

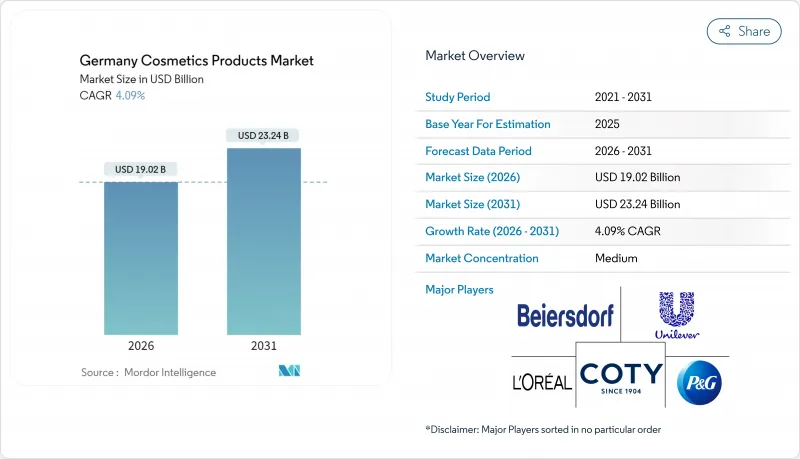

Germany Cosmetics Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Germany cosmetics products market size in 2026 is estimated at USD 19.02 billion, growing from 2025 value of USD 18.27 billion with 2031 projections showing USD 23.24 billion, growing at 4.09% CAGR over 2026-2031.

There's a noticeable tilt towards premium formulations, a digital-first approach to distribution, and a demand for ingredient transparency. Local players are adeptly navigating tighter EU chemical restrictions. As consumers become more health-conscious, there's a heightened interest in probiotic and microbiome-friendly products, especially those that bolster skin hydration and barrier function. Premium brands are leveraging clinically validated ingredients, refillable packaging, and endorsements from dermatologists. In contrast, mass brands are focusing on depth through private labels and competitive pricing to maintain their volume. Notable growth areas include lip and nail makeup, natural and organic products, and AI-driven personalization. However, challenges like supply-chain volatility and impending bans on PFAS and microplastics are driving up compliance costs. To counteract the rise of private labels, brands are increasingly adopting strategies centered around omnichannel ecosystems, epigenetic skin diagnostics, and consolidating in the prestige dermocosmetics space.

Germany Cosmetics Products Market Trends and Insights

Social media influence boosting the market

Beauty brands are increasingly leveraging platform-native content to streamline product discovery processes and elevate niche brands that lack a presence in traditional retail channels. According to Meta, the focus of influencer partnerships is shifting towards micro-tier creators, who have follower counts ranging from 10,000 to 50,000. These micro-influencers deliver a significantly higher engagement rate of 6.7%, compared to the 1.9% achieved by celebrity endorsements. This makes them a highly cost-effective option for premium brands to promote their products. This evolving trend benefits agile market entrants capable of rapidly adapting their product formulations based on real-time consumer feedback, thereby challenging established players to accelerate their product launch timelines. Additionally, the growing number of internet users is driving increased social media engagement. For instance, in 2024, an impressive 94% of Germany's population is reported to be internet users, according to data from the World Bank.

Clean and organic beauty demand among millennials and gen Z

Millennials and Gen Z are fueling the growth of Germany's cosmetics market, with a pronounced demand for clean and organic beauty products. These younger demographics prioritize cosmetics made from natural, non-toxic, and sustainably sourced ingredients, underscoring their commitment to environmental and health issues. They're not just conscious consumers; they're also willing to pay a premium for cosmetics that are cruelty-free, eco-friendly, and ethically produced, aligning with their values of wellness and sustainability. In 2024, data from Statistisches Bundesamt revealed that 38.13 million Germans aged 21-39 were driving this trend . This demographic is also at the forefront of market innovation, urging companies to roll out personalized and multifunctional organic skincare solutions tailored to specific concerns, be it sensitive skin or anti-aging. Furthermore, German consumers under 35 are particularly discerning, willing to pay extra for products devoid of parabens, sulfates, and synthetic fragrances, especially when backed by third-party certifications like NATRUE or Ecocert. In a move underscoring the industry's shift towards transparency, Beiersdorf's Eucerin and L'Oreal's Garnier both introduced EcoBeautyScore labels in July 2025. These labels, offering A-to-E environmental ratings akin to France's Nutri-Score for food, set a new standard in the market.

EU microplastics and PFAS ingredient bans

In 2024, the European Chemicals Agency introduced restrictions on microplastics. Rinse-off products containing polyethylene and polypropylene beads will be prohibited by October 2027, with leave-on cosmetics facing a ban by 2029. Concurrently, the EU is addressing per- and polyfluoroalkyl substances (PFAS) in items such as waterproof mascaras and long-wear foundations, with implementation set for 2027. Reformulating these products entails significant costs: replacing PFAS with bio-derived film-formers requires 18-24 months of stability testing and regulatory updates, costing major brands approximately EUR 40 million. Henkel disclosed in its 2024 report that it allocated EUR 22 million to reformulate Fa deodorants and Schauma shampoos ahead of the microplastics deadline. Smaller brands, without in-house toxicology teams, face greater compliance challenges, potentially leading to exits or acquisitions. Additionally, the bans reduce product differentiation; without PFAS, waterproof mascaras may experience a 30-40% decline in wear-time, eroding the distinctiveness of a premium category.

Other drivers and restraints analyzed in the detailed report include:

- Technological advancements in product formulations

- Premiumisation of German beauty routines

- Consumer concerns about chemical ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lip and nail makeup products will register the fastest expansion at 4.66% CAGR from 2026 to 2031, outpacing facial cosmetics despite the latter's commanding 44.40% share in 2025. The increasing demand for lip and nail products is primarily attributed to Gen Z consumers, who favor bold and trend-driven color cosmetics. These products typically have a rapid turnover cycle of 6-8 weeks, fueled by social media virality that accelerates product lifecycles. This dynamic encourages impulse purchases, particularly in the lip and nail categories. On the other hand, facial cosmetics, supported by products like anti-aging serums and SPF moisturizers, continue to benefit from favorable demographic trends, ensuring steady growth.

Eye cosmetics occupy an intermediate position in the market. While sales of traditional products like mascara and eyeliner have stabilized, there is a growing consumer preference for semi-permanent solutions such as lash extensions and microblading. These alternatives reduce the need for daily makeup application, signaling a shift in consumer behavior. In the facial cosmetics segment, Beiersdorf's Q10 Dual Action Serum exemplifies the industry's move toward multifunctional formulations. This product, which combines anti-glycation peptides with hyaluronic acid, demonstrates the ability to command premium price points ranging from EUR 30 to EUR 50. However, the lip and nail segment faces potential challenges due to the European Union's PFAS ban. This regulation is expected to disproportionately impact long-wear lip formulations, potentially slowing the segment's growth trajectory after 2027. The adoption of bio-based film-formers that can deliver comparable performance will be critical to mitigating this impact and sustaining growth in the segment.

Germany's premium cosmetics segment is projected to grow at a CAGR of approximately 5.07% through 2031, narrowing the revenue gap with mass-market offerings. In 2025, mass-market products represented about 61.70% of the total cosmetics revenue. This trend towards premiumization indicates a shift in consumer focus from quantity to quality. There's a rising appetite for high-performance, technologically advanced, and experience-centric products. Key drivers of this growth include increasing disposable incomes, particularly in metropolitan and affluent areas, enabling consumers to spend more on premium beauty items. Millennials and Gen Z, who place a high value on self-care and wellness, are at the forefront of this shift, actively seeking products with innovative formulations, personalized touches, and enhanced sensory experiences.

While mass-market products continue to dominate, bolstered by private-label penetration and widespread availability in drugstores, the premium segment's growth is notably concentrated in metropolitan hubs like Berlin, Munich, and Hamburg, where household incomes are higher. In contrast, mass products hold sway in smaller cities and rural areas. Although the divide between mass and premium segments is likely to endure, there's a notable trend towards hybrid models, blending premium ingredients with mass-market packaging.

The Germany Cosmetics Products Market Report is Segmented by Product Type (Facial Cosmetics, Eye Cosmetics, Lip and Nail Make-Up Products), Category (Premium Products, Mass Products), Ingredient Type (Natural and Organic, Conventional/Synthetic), and Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Online Retail Stores, Other Channels). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Beiersdorf AG

- L'Oreal Deutschland GmbH

- Henkel AG and Co. KGaA

- Procter and Gamble Service GmbH

- Unilever Deutschland GmbH

- Kao Corporation

- Coty Inc.

- Estee Lauder Companies GmbH

- Kenvue

- Colgate-Palmolive GmbH

- Shiseido Germany GmbH

- LVMH Perfumes and Cosmetics (Germany)

- Natura and Co Deutschland

- Revlon Consumer Products GmbH

- Glossier Inc. (EU Hub)

- Dr. August Wolff GmbH (Alpecin)

- Kneipp GmbH

- WELEDA AG

- Douglas

- Artdeco Cosmetic GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Social media influence to boost the market

- 4.2.2 Clean/organic beauty demand among Millennials and Gen Z

- 4.2.3 Technological advancements in product formulations

- 4.2.4 Premiumisation of German beauty routines

- 4.2.5 AI-powered personalization boosting demand

- 4.2.6 Increasing disposable income drives market expansion

- 4.3 Market Restraints

- 4.3.1 EU micro-plastics and PFAS ingredient bans

- 4.3.2 Consumer concerns about chemical ingredients

- 4.3.3 Rising concerns over counterfeit products in the market

- 4.3.4 Ingredient and packaging supply-chain volatility

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Facial Cosmetics

- 5.1.2 Eye Cosmetics

- 5.1.3 Lip and Nail Make-up Products

- 5.2 By Category

- 5.2.1 Premium Products

- 5.2.2 Mass Products

- 5.3 By Ingredient Type

- 5.3.1 Natural and Organic

- 5.3.2 Conventional/Synthetic

- 5.4 By Distribution Channel

- 5.4.1 Specialty Stores

- 5.4.2 Supermarkets/Hypermarkets

- 5.4.3 Online Retail Stores

- 5.4.4 Other Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Beiersdorf AG

- 6.4.2 L'Oreal Deutschland GmbH

- 6.4.3 Henkel AG and Co. KGaA

- 6.4.4 Procter and Gamble Service GmbH

- 6.4.5 Unilever Deutschland GmbH

- 6.4.6 Kao Corporation

- 6.4.7 Coty Inc.

- 6.4.8 Estee Lauder Companies GmbH

- 6.4.9 Kenvue

- 6.4.10 Colgate-Palmolive GmbH

- 6.4.11 Shiseido Germany GmbH

- 6.4.12 LVMH Perfumes and Cosmetics (Germany)

- 6.4.13 Natura and Co Deutschland

- 6.4.14 Revlon Consumer Products GmbH

- 6.4.15 Glossier Inc. (EU Hub)

- 6.4.16 Dr. August Wolff GmbH (Alpecin)

- 6.4.17 Kneipp GmbH

- 6.4.18 WELEDA AG

- 6.4.19 Douglas

- 6.4.20 Artdeco Cosmetic GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK