PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906042

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906042

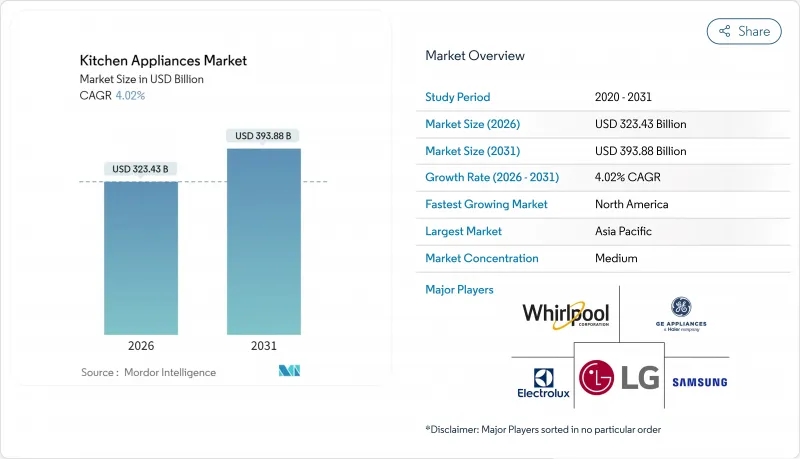

Kitchen Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Kitchen Appliances market size in 2026 is estimated at USD 323.43 billion, growing from 2025 value of USD 310.93 billion with 2031 projections showing USD 393.88 billion, growing at 4.02% CAGR over 2026-2031.

The measured pace signals a sector that now grows more through replacement cycles than new household formation, yet product innovation keeps demand steady. Regulations that tighten energy-use thresholds, especially in the United States and European Union, stimulate early replacements as consumers seek compliant models. Urbanization, rising single-person households, and an appetite for compact multifunctional designs keep unit volumes healthy in space-constrained cities. At the same time, embedded carbon labels and smart-home integration allow manufacturers to command premium pricing, even as they face cost pressure from supply-chain uncertainty and rising competition. Together, these forces shape a resilient, innovation-driven kitchen appliances market.

Global Kitchen Appliances Market Trends and Insights

Rising Household Expenditure on Kitchen Renovations

Kitchen renovation budgets climbed to a median USD 60,000 in 2024, up 9% year-on-year, as homeowners view remodels as long-term value rather than discretionary spend. Based on a survey of over 1,600 respondents, home remodeling and design platform Houzz found that homeowners in 2025 are investing in large, luxury kitchen spaces. Larger budgets favor built-in suites that integrate cooktops, refrigeration, and dishwashers behind custom panels. Because 53% of renovating households now change kitchen layout, demand for modular, space-efficient appliances grows in tandem. Professional contractors influence roughly 86% of renovation purchases, shifting decision-making toward holistic packages over individual units. The trend endures while housing supply stays tight, channeling capital that would otherwise fund home purchases into replacement of legacy appliances.

Growing Demand for Smart and Connected Appliances

Smart connectivity has moved from novelty to baseline in the kitchen appliances market. Samsung's 2025 Bespoke AI line detects more than 30 food items to automate storage decisions and lower power draw using AI Energy Mode. GE Appliances' SmartHQ platform connects ovens, refrigerators, and small appliances, letting users launch guided recipes or schedule maintenance remotely . Yet consumer adoption remains tempered by privacy worries, prompting the United States Federal Communications Commission to introduce the Cyber Trust Mark in 2025 for connected devices. Brands that marry security by design with intuitive interfaces are positioned to command durable premiums.

Intense Price Competition Compressing Manufacturer Margins

Tariff uncertainty and aggressive promotions pressure average selling prices worldwide. Ranges and refrigerators imported into the United States could see 8-25% duty hikes in 2025, but brands plan large rebates to blunt sticker shock. Chinese exporters shipped 4.48 billion units in 2024, up 20.8%, amplifying the low-cost supply that squeezes incumbent mid-range portfolios. Retailers deepen private-label penetration, forcing national labels to trade volume for profit or shift upscale.

Other drivers and restraints analyzed in the detailed report include:

- Energy-Efficiency Regulations Boosting Replacement Sales

- Rapid Urbanization and Growth in Residential Construction

- Supply-Chain Disruptions and Component Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The refrigeration category held 32.55% of the kitchen appliances market in 2025 thanks to its essential status and high replacement cost. Ovens, however, are forecast to rise at a 4.72% CAGR to 2031, outpacing other major categories. Smart oven models now combine convection, microwave, and air-fry modes in a single cavity, raising average selling prices. Voice-controlled temperature adjustment features help address cooking accuracy and reduce energy waste.Refrigerators evolve through modular panel systems and internal cameras that monitor spoilage. Meanwhile, dishwashers gain steam-finish cycles and adjustable racks that improve accessibility for users with limited reach. Cooktops lean into induction for speed and precision, while range hoods integrate air-quality sensors that trigger automatically. Small kitchen gadgets also grow quickly as consumers seek countertop convenience. Together, these product innovations sustain revenue even as mature households only replace rather than add units.

The Kitchen Appliances Market is Segmented by Product (Large Kitchen Appliances and Small Kitchen Appliances), by End User (Residential and Commercial), by Distribution Channel (B2C/Retail and B2B (directly From the Manufacturers)), and by Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 31.70% of global revenue in 2025, driven by high penetration and a culture of frequent replacement. Utility rebates accelerate demand for ENERGY STAR-rated units, while smart-home ecosystems lift premium segments. Tariff volatility may lift import costs, yet manufacturers often absorb duty spikes through production shifts. Competitive rivalry compressed Whirlpool's U.S. margins in late 2024, prompting cost-cutting and brand mix adjustments at Whirlpool.

Asia-Pacific is on track for a 5.42% CAGR, the fastest among major regions, as rising middle-class incomes convert first-time buyers into upgraders. India's consumer-durables sales have gained momentum with easier credit and rapid urban housing delivery. China remains the manufacturing engine; exports climbed 20.8% in 2024, reinforcing cost leadership and allowing regional brands to penetrate Latin America and Africa . Southeast Asian markets, notably Indonesia, offer tailwinds from demographic youth and modern retail expansion.Europe shows balanced growth but tighter sustainability rules. The upcoming right-to-repair directive forces appliance makers to stock parts for at least seven years, reshaping service supply chains. Whirlpool's partnership with Arcelik to create Beko Europe rebalances its footprint and concentrates R&D on energy-efficient platforms. Consumer demand skews toward induction cooktops and heat-pump dryers as households aim to lower energy bills amid rising utility rates.

- Electrolux AB

- Whirlpool Corporation

- Haier Group Corp. (incl. GE Appliances)

- LG Electronics

- Samsung Electronics

- BSH Hausgerate GmbH

- Midea Group

- Panasonic Corporation

- Groupe SEB

- Miele & Cie. KG

- Smeg S.p.A.

- Breville Group

- SharkNinja Operating LLC

- Arcelik A.S. (incl. Beko)

- Gorenje (Hisense)

- Sub-Zero Group Inc.

- Viking Range LLC

- TTK Prestige Ltd.

- Kenwood Limited

- De'Longhi Appliances S.r.l.*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Household Expenditure On Kitchen Renovations

- 4.2.2 Growing Demand For Smart And Connected Appliances

- 4.2.3 Energy Efficiency Regulations Boosting Replacement Sales

- 4.2.4 Rapid Urbanization And Growth In Residential Construction

- 4.2.5 Surge In Single-Person Households Driving Compact Appliance Sales

- 4.2.6 Embedded Carbon Labeling Influencing Premium Appliance Adoption

- 4.3 Market Restraints

- 4.3.1 Intense Price Competition Compressing Manufacturer Margins

- 4.3.2 Supply Chain Disruptions And Component Shortages

- 4.3.3 Rising Cybersecurity Concerns In Smart Appliances Ecosystem

- 4.3.4 Increasing Scrutiny On Right-To-Repair Regulations Reducing Replacement Demand

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Large Kitchen Appliances

- 5.1.1.1 Refrigerators & Freezers

- 5.1.1.2 Dishwashers

- 5.1.1.3 Range Hoods

- 5.1.1.4 Cooktops

- 5.1.1.5 Ovens

- 5.1.1.6 Other Large Kitchen Appliances

- 5.1.2 Small Kitchen Appliances

- 5.1.2.1 Food Processors

- 5.1.2.2 Juicers and Blenders

- 5.1.2.3 Grills and Roasters

- 5.1.2.4 Air Fryers

- 5.1.2.5 Coffee Makers

- 5.1.2.6 Electric Cookers

- 5.1.2.7 Toasters

- 5.1.2.8 Electric Kettles

- 5.1.2.9 Countertop Ovens

- 5.1.2.10 Other Small Kitchen Appliances (bread makers, waffle makers, egg cookers, etc.)

- 5.1.1 Large Kitchen Appliances

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 B2C/Retail

- 5.3.1.1 Multi-brand Stores

- 5.3.1.2 Exclusive Brand Outlets

- 5.3.1.3 Online

- 5.3.1.4 Other Distribution Channels

- 5.3.2 B2B (directly from the manufacturers)

- 5.3.1 B2C/Retail

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 Canada

- 5.4.1.2 United States

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East And Africa

- 5.4.5.1 United Arab of Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East And Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Electrolux AB

- 6.4.2 Whirlpool Corporation

- 6.4.3 Haier Group Corp. (incl. GE Appliances)

- 6.4.4 LG Electronics

- 6.4.5 Samsung Electronics

- 6.4.6 BSH Hausgerate GmbH

- 6.4.7 Midea Group

- 6.4.8 Panasonic Corporation

- 6.4.9 Groupe SEB

- 6.4.10 Miele & Cie. KG

- 6.4.11 Smeg S.p.A.

- 6.4.12 Breville Group

- 6.4.13 SharkNinja Operating LLC

- 6.4.14 Arcelik A.S. (incl. Beko)

- 6.4.15 Gorenje (Hisense)

- 6.4.16 Sub-Zero Group Inc.

- 6.4.17 Viking Range LLC

- 6.4.18 TTK Prestige Ltd.

- 6.4.19 Kenwood Limited

- 6.4.20 De'Longhi Appliances S.r.l.*

7 Market Opportunities & Future Outlook

- 7.1 Demand for Smart and Connected Kitchen Appliances

- 7.2 Built-in Kitchen Appliances Becoming Mainstream