PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906051

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906051

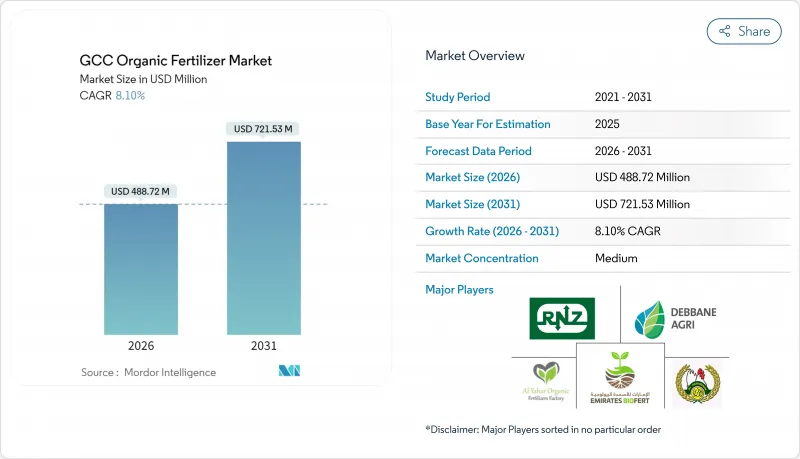

GCC Organic Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The GCC organic fertilizer market was valued at USD 452.1 million in 2025 and estimated to grow from USD 488.72 million in 2026 to reach USD 721.53 million by 2031, at a CAGR of 8.10% during the forecast period (2026-2031).

National food security initiatives, water conservation regulations, and carbon credit programs are driving the adoption of sustainable agricultural inputs. In 2024, Saudi Arabia's Green Initiative allocated USD 186 billion across 77 programs to promote soil-enhancing products. The United Arab Emirates implemented Cabinet Resolution No. 67 of 2024, which provides financial incentives for organic waste conversion through carbon credits. Qatar's focus on precision agriculture and Oman's development of blue and green ammonia production expand local raw material availability and reduce supply chain risks. Regional retailers and hospitality companies now require certified organic produce, encouraging farmers to adopt bio-fertilizer technologies that improve nutrient efficiency and water conservation. The acquisition of fertilizer assets by petrochemical companies indicates an industry shift toward integrated, environmentally sustainable production systems.

GCC Organic Fertilizer Market Trends and Insights

Government Organic-Farming Subsidy Programs

Government subsidies reduce input costs and help farmers transition to sustainable practices. Saudi Arabia's National Agricultural Development Company (NADEC) indicates that fertilizer costs directly influence consumer food prices, making public support essential. In 2024, the Emirates Development Bank allocated AED 945 million (USD 257 million) for precision irrigation and organic input initiatives. Qatar's land-expansion program aims to increase cultivated area to 1,044 square kilometers, providing consistent demand for organic residues and bio-fertilizers. These initiatives help small-scale farmers adopt sustainable practices while ensuring stable demand for organic fertilizer producers. Beyond direct financial support, government demonstration projects help validate organic farming methods and increase farmer confidence in crop yields.

Growing Consumer Demand for Chemical-Free Produce

Retail chains and food processors incorporate organic certification requirements into their procurement policies, requiring farms to use verified inputs. The United Arab Emirates National Food Strategy 2051 sustainable-finance survey identifies sustainable agriculture as a key investment area. High-end retail and hospitality segments require organic certification for produce procurement, driving growers to use certified organic inputs such as bio-fertilizers and organic residues. This shift accelerates as younger consumers emphasize health and sustainability, reinforced by government awareness programs and educational initiatives in GCC countries.

Shorter Shelf Life of Liquid Bio-Fertilizers

The extreme climate conditions in the GCC region significantly affect liquid bio-fertilizer viability, creating storage and distribution challenges that restrict market penetration. Research on Trichoderma formulation stability shows that temperatures above 40°C, which are common in the region, reduce microbial viability by up to 60% within 30 days of production. The need for temperature-controlled storage infrastructure increases distribution costs by 25-35% compared to conventional fertilizers. This challenge becomes more severe during summer months when ambient temperatures exceed 50°C, making outdoor storage unfeasible for liquid formulations.

Other drivers and restraints analyzed in the detailed report include:

- Rising Soil-Health Awareness Among Growers

- Carbon-Credit Monetization Pilots for Organic Residue Management

- Inadequate GCC-Wide Organic-Label Harmonization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Organic residues accounted for 51.60% of the GCC organic fertilizer market share in 2025, leveraging abundant date palm waste and livestock manure resources. The segment primarily serves large afforestation and field-crop projects where volume requirements exceed precision application needs. The price competitiveness of organic residues in large-acreage applications ensures their continued market dominance throughout the forecast period.

Bio-fertilizers demonstrate robust growth with an 10.75% CAGR, supported by government-funded microbial research and precision agriculture adoption. Companies are developing date palm biochar as a premium soil conditioner, while halal-certified farmyard manure maintains cost advantages. The market for bio-fertilizers is expanding as shelf-stable formulations become commercially viable. Green manure and crop residues gain adoption as cover cropping practices increase under government sustainability initiatives. The growing cross-border trade in specialized organic inputs is evidenced by vermicompost exports from India to the United Arab Emirates markets. Other organic residues, such as bone meal and fish meal, require halal certification compliance, creating market opportunities for certified producers.

The GCC Organic Fertilizer Market Report is Segmented by Product Group (Organic Residues and Bio-Fertilizer), by Form (Solid and Liquid), by Application (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Commercial Crops, and Turf and Ornamentals), and by Geography (Saudi Arabia, United Arab Emirates, Qatar, Oman, Bahrain, and Kuwait). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- RNZ Agrotech Industries Ltd. (RNZ Group)

- Emirates Bio Fertilizer Factory (EBFF)

- Al-Akhawain (Al-Akhawain Holding)

- Al Yahar Organic Fertilizers Factory

- uTerra Middle East Agro Industries LLC.(UniPax Investment Group)

- Debbane Agri (Debbane Saikali Group)

- Desert Oasis Fertilizers Packaging LLC (Desert Group)

- Union Chemicals Co. LLC

- Sikri Farms Innovation Private Limited

- Tadweer Food Recycling Company

- Dhofar Organics LLC

- Oman Agri-Fertilizer Co. LLC

- Dafe Afate Alborz Behsam Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Organic-Farming Subsidy Programs

- 4.2.2 Growing Consumer Demand for Chemical-Free Produce

- 4.2.3 Rising Soil-Health Awareness Among Growers

- 4.2.4 GCC Water-Scarcity Regulations Favoring Organic Inputs

- 4.2.5 Carbon-Credit Monetization Pilots for Organic Residue Management

- 4.2.6 Surge in Halal-Certified Organic Livestock Manure Availability

- 4.3 Market Restraints

- 4.3.1 Shorter Shelf Life of Liquid Bio-Fertilizers

- 4.3.2 Inadequate GCC-Wide Organic-Label Harmonization

- 4.3.3 Dependency on Imported Microbial Strains

- 4.3.4 Grower Skepticism Over Batch-to-Batch Nutrient Variability

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Group

- 5.1.1 Organic Residues

- 5.1.1.1 Farmyard Manure

- 5.1.1.2 Crop Residues

- 5.1.1.3 Green Manure

- 5.1.1.4 Other Organic Residues (Bone Meal, Fish Meal, and More)

- 5.1.2 Bio-Fertilizers

- 5.1.2.1 Rhizobium

- 5.1.2.2 Azotobacter

- 5.1.2.3 Azospirillum

- 5.1.2.4 Mycorrhizae

- 5.1.2.5 Other Bio-fertilizers (Phosphate-Solubilizing Microorganisms, Blue-Green Algae (BGA), and More)

- 5.1.1 Organic Residues

- 5.2 By Form

- 5.2.1 Solid

- 5.2.2 Liquid

- 5.3 By Application

- 5.3.1 Grains and Cereals

- 5.3.2 Pulses and Oilseeds

- 5.3.3 Fruits and Vegetables

- 5.3.4 Commercial Crops

- 5.3.5 Turf and Ornamentals

- 5.4 By Geography

- 5.4.1 Saudi Arabia

- 5.4.2 United Arab Emirates

- 5.4.3 Qatar

- 5.4.4 Oman

- 5.4.5 Bahrain

- 5.4.6 Kuwait

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Overview, Market Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 RNZ Agrotech Industries Ltd. (RNZ Group)

- 6.4.2 Emirates Bio Fertilizer Factory (EBFF)

- 6.4.3 Al-Akhawain (Al-Akhawain Holding)

- 6.4.4 Al Yahar Organic Fertilizers Factory

- 6.4.5 uTerra Middle East Agro Industries LLC.(UniPax Investment Group)

- 6.4.6 Debbane Agri (Debbane Saikali Group)

- 6.4.7 Desert Oasis Fertilizers Packaging LLC (Desert Group)

- 6.4.8 Union Chemicals Co. LLC

- 6.4.9 Sikri Farms Innovation Private Limited

- 6.4.10 Tadweer Food Recycling Company

- 6.4.11 Dhofar Organics LLC

- 6.4.12 Oman Agri-Fertilizer Co. LLC

- 6.4.13 Dafe Afate Alborz Behsam Company

7 Market Opportunities and Future Outlook