PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906065

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906065

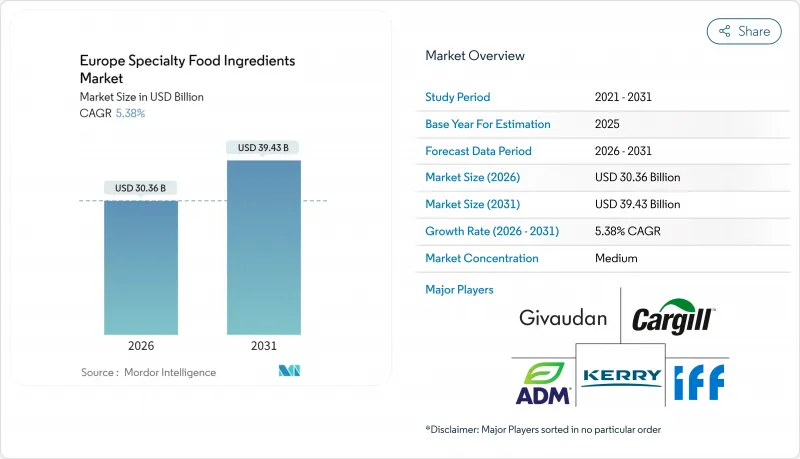

Europe Specialty Food Ingredients - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

European specialty food ingredients market size in 2026 is estimated at USD 30.36 billion, growing from 2025 value of USD 28.81 billion with 2031 projections showing USD 39.43 billion, growing at 5.38% CAGR over 2026-2031.

Growth stems from a decisive shift away from commodity inputs toward tailored solutions that support sugar reduction, shelf-life extension, and fortification. Demand accelerates as manufacturers balance stringent European safety rules with consumer expectations for cleaner labels and transparent sourcing, pushing suppliers to validate efficacy through sound science while scaling novel fermentation platforms. Competitive intensity remains balanced: multinationals supply security of scale, whereas smaller innovators commercialize advanced extracts, cultures, and enzymes that give finished-product owners formulation agility.

Europe Specialty Food Ingredients Market Trends and Insights

Rising Demand for Functional and Health-Focused Foods

Driven by heightened health consciousness, consumers are increasingly seeking ingredients that offer tangible wellness benefits, extending beyond mere nutrition. The European nutraceutical market, valued at USD 83 billion in 2025, is set to surge to USD 111.83 billion by 2030, with functional foods emerging as the fastest-growing segment. This evolution underscores a post-pandemic shift in consumer behavior, emphasizing choices that bolster immune support, digestive health, and mental well-being. In response, manufacturers are infusing products with bioactive compounds, probiotics, and adaptogenic ingredients, elevating them to functional solutions. This trend is especially advantageous for specialty ingredient suppliers who can showcase clinical efficacy and navigate the regulatory landscape across Europe's varied markets. While EFSA's rigorous health claim standards pose challenges, they inadvertently fortify the market stance of validated functional ingredients, erecting hurdles for competitors without solid scientific backing.

Increasing Innovation in Clean-Label and Natural Ingredients

As consumers increasingly scrutinize product formulations, the clean-label movement is reshaping ingredient selection criteria. Natural food additives are now commanding premium prices. This surge in demand is largely driven by regulatory pressures and a growing consumer aversion to synthetic additives. In response, manufacturers are pivoting towards plant-based alternatives. The spotlight of innovation is on natural preservatives, colors, and flavor enhancers, which not only uphold product quality but also cater to the demand for transparency. Companies such as Syensqo are riding this wave, introducing products like Riza. This rosemary-derived antioxidant range not only dispenses with artificial preservatives but also safeguards omega-3 fatty acids. However, the industry grapples with the challenge of achieving cost parity with synthetic counterparts, all while ensuring consistent functional performance across a myriad of applications.

High Cost of Compliance with Evolving EU Food Safety and Labeling Regulations

As European authorities tighten safety evaluations and labeling mandates, compliance costs for businesses are surging. Starting in 2024, the Corporate Sustainability Reporting Directive (CSRD) will require large companies to undertake detailed ESG reporting. This not only adds to their administrative workload but also demands significant investments in data management systems and third-party validations. Highlighting the ongoing regulatory shifts, Spain has recently updated its food hygiene regulations, compelling companies to revise their processes and documentation, as noted by Food Compliance International. Smaller suppliers of specialty ingredients are feeling the brunt of these compliance costs, a situation that could tilt the market dynamics in favor of larger players equipped with dedicated regulatory teams. With the European Union Deforestation Regulation (EUDR) set to be enforced in December 2024, managing supply chains for ingredients like palm oil, cocoa, and soy is becoming increasingly challenging. The regulation's demand for rigorous traceability systems poses a significant hurdle, especially for smaller suppliers trying to implement them without breaking the bank.

Other drivers and restraints analyzed in the detailed report include:

- Strict European Regulations Encourage Uptake of Advanced, Approved Specialty Ingredients

- Surge in Plant-Based and Alternative Protein Products

- Volatile Pricing of Natural Raw Materials

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Alternative sweeteners secured 21.24% of Europe's specialty food ingredients market share in 2025, thanks to Union-wide sugar-reduction pledges and consumer pursuit of lower glycemic loads. Reb-M stevia, allulose, and erythritol rank among the fastest-adopted molecules, while aspartame sustains volume in zero-calorie carbonates despite heightened media scrutiny. Europe's specialty food ingredients market size for sweeteners is projected to rise steadily as beverage and bakery brands race to comply with voluntary 10% added-sugar cut-offs by 2025. Yet supply-chain risks persist; stevia leaf yields depend on reliable Paraguayan and Chinese harvests, prompting investment in fermented Reb-M routes that reduce agricultural exposure.

Preservatives, although only mid-single-digit in value today, post the quickest forecast growth at 6.28% CAGR. Success hinges on natural antimicrobials such as cultured dextrose, natamycin, and herb extracts that promise extended shelf life without synthetic "E-numbers." Fermentation-derived bacteriocins like nisin gain traction for ready meals, charcuterie, and plant-based sausages. Market veterans leverage application labs across Germany and Spain to co-develop prototypes that prove microbial stability in real-world logistics. Ongoing titanium-dioxide withdrawal shifts attention toward multifunctional ingredients that combine opacity, color stabilization and pathogen inhibition in a single label-friendly line item.

The Europe Specialty Food Ingredients Market Report is Segmented by Product Type (Functional Ingredients, Starches, Sweeteners, Flavors, Preservatives, Emulsifiers, Colors, Enzymes, Cultures, Oils, Yeasts), Application (Beverages, Bakery, Dairy, Confectionery, Snacks, Others), and Geography (Spain, United Kingdom, France, Germany, Russia, Italy, Rest of Europe). Forecasts in Value (USD) and Volume (Tons).

List of Companies Covered in this Report:

- Cargill Inc.

- Archer Daniels Midland Company (ADM)

- Kerry Group

- International Flavors & Fragrances (IFF)

- Givaudan SA

- Tate & Lyle Plc

- DSM-Firmenich

- Ingredion Inc.

- Sensient Technologies

- Advanced Enzyme Technologies

- BASF SE

- Sudzucker Group

- Novozymes A/S

- Roquette Freres

- Corbion NV

- Lonza Group

- AAK AB

- Lesaffre International

- Lallemand Inc.

- Bunge Loders Croklaan

- Puratos Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for functional and health-focused foods

- 4.2.2 Increasing innovation in clean-label and natural ingredients

- 4.2.3 Surge in plant-based and alternative protein products

- 4.2.4 Strict European regulations encourage uptake of advanced, approved specialty ingredients

- 4.2.5 Expanding markets for free-from, allergen-free, and gluten-free foods

- 4.2.6 Manufacturer investments in sustainable sourcing and traceability,

- 4.3 Market Restraints

- 4.3.1 High cost of compliance with evolving EU food safety and labeling regulations

- 4.3.2 Volatile pricing of natural raw materials

- 4.3.3 Challenges in scaling up new ingredient production

- 4.3.4 Fermentation capacity bottlenecks in Europe

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECAST (in Value and Volume)

- 5.1 Product Type

- 5.1.1 Functional Food Ingredient

- 5.1.1.1 Vitamins and Mineral

- 5.1.1.2 Amino Acids

- 5.1.1.3 Omega-3 Ingreidents

- 5.1.1.4 Probiotic Ingredients

- 5.1.2 Specialty Starch and Texturants

- 5.1.3 Alternative Sweeteners

- 5.1.4 Flavors

- 5.1.5 Acidulants

- 5.1.6 Preservatives

- 5.1.7 Emulsifiers

- 5.1.8 Colors

- 5.1.9 Enzymes

- 5.1.10 Cultures

- 5.1.11 Specialty Oils

- 5.1.12 Yeasts

- 5.1.1 Functional Food Ingredient

- 5.2 Application

- 5.2.1 Beverages

- 5.2.2 Sauces, Dressings and Condiments

- 5.2.3 Bakery

- 5.2.4 Dairy

- 5.2.5 Confectionery

- 5.2.6 Dried Processed Foods

- 5.2.7 Frozen/Chilled Processed Foods

- 5.2.8 Sweet and Savory Snacks

- 5.2.9 Other Applications

- 5.3 Region

- 5.3.1 Spain

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Germany

- 5.3.5 Russia

- 5.3.6 Italy

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Cargill Inc.

- 6.4.2 Archer Daniels Midland Company (ADM)

- 6.4.3 Kerry Group

- 6.4.4 International Flavors & Fragrances (IFF)

- 6.4.5 Givaudan SA

- 6.4.6 Tate & Lyle Plc

- 6.4.7 DSM-Firmenich

- 6.4.8 Ingredion Inc.

- 6.4.9 Sensient Technologies

- 6.4.10 Advanced Enzyme Technologies

- 6.4.11 BASF SE

- 6.4.12 Sudzucker Group

- 6.4.13 Novozymes A/S

- 6.4.14 Roquette Freres

- 6.4.15 Corbion NV

- 6.4.16 Lonza Group

- 6.4.17 AAK AB

- 6.4.18 Lesaffre International

- 6.4.19 Lallemand Inc.

- 6.4.20 Bunge Loders Croklaan

- 6.4.21 Puratos Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK