PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907222

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907222

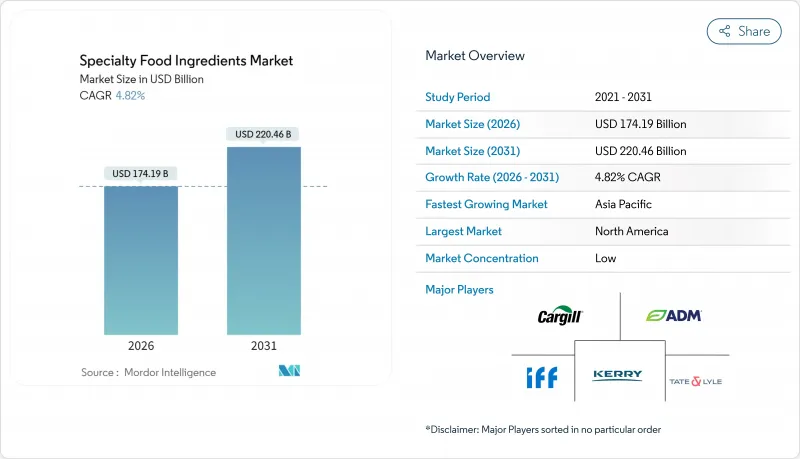

Specialty Food Ingredients - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The specialty food ingredients market is expected to grow from USD 166.17 billion in 2025 to USD 174.19 billion in 2026 and is forecast to reach USD 220.46 billion by 2031 at 4.82% CAGR over 2026-2031.

The market is growing due to rising health-conscious eating, clean-label preferences, and advancements in precision fermentation, enabling animal-free proteins and bioactive compounds with reduced environmental impact. Consumers demand natural, minimally processed ingredients, transparent labeling, and functional foods with less sugar and better nutrition. The U.S. FDA's plan to phase out synthetic dyes by 2026 has accelerated the use of natural colorants from fruits, vegetables, and botanicals. Enzyme engineering advancements support gluten-free, dairy-free, and protein-rich product formulations. Growth is further driven by increasing disposable incomes in emerging economies, especially in Asia-Pacific, with rising demand for probiotics, dietary supplements, and functional food ingredients.

Global Specialty Food Ingredients Market Trends and Insights

Growth of Plant-Based Food Sector

The growing plant-based food market demands specialty ingredients that replicate animal-based functionalities while meeting clean-label standards. The 2024 Food and Health Survey by the International Food Information Council (IFIC) found 5% of Americans follow a flexitarian diet, with many seeking plant-based alternatives . Beyond protein isolates, the market requires emulsifiers, texturizers, and flavor enhancers to mimic animal products' sensory attributes. Companies like Paleo use precision fermentation to produce GMO-free animal heme proteins, enabling plant-based meat producers to achieve authentic flavors and maintain premium pricing. Hydrocolloid and protein ingredient suppliers benefit as their products provide essential mouthfeel and binding properties. Supply chain issues with locust bean gum and carrageenan have led to alternatives like xanthan and gellan gums, offering similar functionality and better availability. Developing new ingredients involves rigorous testing, regulatory compliance, and optimization, requiring long-term R&D partnerships between ingredient suppliers and food manufacturers.

Rise in Demand for Processed/Packaged Food

Urbanization and changing lifestyles drive consistent demand for processed food ingredients focused on preservation, texturization, and nutrition. In 2024, the European Commission updated regulations on additives like sorbic acid and potassium sorbate, ensuring safety while supporting increased usage . These updates help manufacturers improve shelf life and quality, vital for exports. Enzyme manufacturers benefit as food processors adopt biotechnology for texture and nutrient enhancements. Ingredion's USD 100 million Indianapolis facility expansion in March 2025 highlights the industry's growth potential, supported by strong performance in its Texture and Healthful Solutions division despite inflation. The processed food sector's diverse ingredient needs create significant revenue opportunities for specialty ingredient manufacturers.

High Cost Associated with Specialty Ingredients

Rising raw material costs and complex manufacturing processes are intensifying pricing pressures in the specialty ingredients market, particularly for small-scale producers lacking economies of scale. These producers face challenges in maintaining profit margins while managing higher costs and meeting quality standards. Companies like The Flava People are addressing ingredient cost inflation by renegotiating supplier contracts, adopting collective purchasing, and exploring alternative sourcing. In the hydrocolloids segment, supply constraints for locust bean gum and carrageenan are driving price increases, prompting manufacturers to shift to alternatives like xanthan gum and modified starches. The market is segmented between premium applications that can absorb higher costs and mass-market products requiring cost-effective substitutes, creating opportunities but challenging manufacturers to balance quality and cost.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization of Food Products

- Shift Toward Low-Glycemic and Diabetic-Friendly Products

- Supply Chain Challenges for Niche Ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Functional food ingredients accounted for 16.98% of the specialty food ingredients market share in 2025. This segment's growth is driven by rising consumer demand for health-promoting components such as vitamins, minerals, amino acids, omega-3s, and probiotics. The ability to make scientifically substantiated health claims enables manufacturers to position products at premium price points. Specialty fats and oils emerge as one of the fastest-growing segments, projected to register a 7.24% CAGR, propelled by demand for customized lipid profiles, plant-based alternatives, and tailored nutritional formulations. Meanwhile, segments such as natural sweeteners and specialty starches continue to gain ground due to sugar-reduction mandates and clean-label preferences.

Biotechnology continues to reshape the specialty food ingredients market, enabling enhanced functionality and greater sustainability. Onego Bio's Bioalbumen, a precision-fermented egg-white protein, exemplifies this trend by offering equivalent foaming and binding properties to conventional egg whites while eliminating exposure to avian flu-related supply chain risks. Enzymatic processing methods for flavor extraction and the shift toward cellulose-based natural colorants are further driven by regulatory shifts away from synthetic additives. These innovations ensure regulatory compliance while improving product performance, contributing to the overall expansion of the specialty ingredients space

The Specialty Food Ingredients Market Report is Segmented by Product Type (Functional Food Ingredient, Sweetener, Food Flavors and Enhancers, Acidulants, and More), Application (Bakery Products, Beverages, Confectionery, Fats and Oils, and More), and Geography (North America. Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 31.05% of global sales in 2025, driven by supportive regulations, established R&D infrastructure, and consumers' willingness to pay more for functional benefits. The FDA's GRAS pathway facilitates market entry for novel bioengineered ingredients despite ongoing regulatory review. The region's production capabilities benefit from precision-fermentation facilities and co-manufacturing centers, while consumers prefer "100% natural" labels, driving clean-label ingredient demand.

Europe influences global standards through the European Food Safety Authority's (EFSA) 2025 novel-food guidance, which implements stricter data requirements while introducing pre-submission reviews to reduce approval times . Industry initiatives, including Cargill's target to decrease supply-chain greenhouse gas emissions by 30% by 2030, reflect a growing interest in circular-economy ingredients from upcycled materials. Recent approvals of glucosyl hesperidin and tiger-nuts oil demonstrate regulatory support for scientifically validated innovations.

Asia-Pacific projects a 5.96% CAGR through 2031, driven by increasing disposable incomes, urbanization, and growing demand for functional products. China's expanded "Three New Foods" catalogue includes 98 new ingredients and 215 additives, providing clear guidelines for international suppliers. Regional biotechnology investments, such as VTT's CellularFood platform, support domestic production of alternative proteins and specialty bioactives. Traditional acceptance of botanical ingredients enables broader adoption of adaptogens and functional mushrooms in mainstream food products, expanding the specialty ingredients market.

- Archer Daniels Midland Company

- Cargill, Incorporated

- Kerry Group plc

- DSM-Firmenich AG

- International Flavors & Fragrances Inc.

- Tate & Lyle PLC

- Ingredion Incorporated

- Givaudan SA

- Associated British Foods plc

- Sensient Technologies Corporation

- Symrise AG

- Novozymes A/S

- AAK AB

- Corbion N.V.

- Lonza Group AG

- Glanbia plc

- Roquette Freres S.A.

- Sudzucker AG

- Celanese Corporation

- Tereos Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of Plant-Based Food Sector

- 4.2.2 Rise in Demand for Processed/Packaged Food

- 4.2.3 Premiumization of Food Products

- 4.2.4 Shift Towards Low-Glycemic and Diabetic-Friendly Products

- 4.2.5 Technological Advancement in Fermentation and Enzyme Production

- 4.2.6 Rise in Demand for Functional Foods

- 4.3 Market Restraints

- 4.3.1 High Cost Associated with Speciality Ingredients

- 4.3.2 Supply Chain Challenges for Niche Ingredients

- 4.3.3 Significant Investment Required for Certification and Testing

- 4.3.4 Consumer Resistance to Novel Ingredients

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Functional Food Ingredient

- 5.1.1.1 Vitamins

- 5.1.1.2 Minerals

- 5.1.1.3 Amino Acids

- 5.1.1.4 Omega-3 Ingredients

- 5.1.1.5 Probiotic Cultures

- 5.1.1.6 Other Functional Food Ingredients

- 5.1.2 Speciality Starch and Texturants

- 5.1.3 Sweetener

- 5.1.4 Food Flavors and Enhancers

- 5.1.5 Acidulants

- 5.1.6 Preservatives

- 5.1.7 Emulsifiers

- 5.1.8 Colorants

- 5.1.9 Enzymes

- 5.1.10 Proteins

- 5.1.11 Speciality Fats and Oils

- 5.1.12 Food Hydrocolloids and Polysaccharides

- 5.1.13 Anti-Caking Agents

- 5.1.14 Other Product Types

- 5.1.1 Functional Food Ingredient

- 5.2 By Application

- 5.2.1 Bakery Products

- 5.2.2 Beverages

- 5.2.3 Meat, Poultry, and Seafood

- 5.2.4 Dairy Products

- 5.2.5 Confectionery

- 5.2.6 Fats and Oils

- 5.2.7 Dressings/Condiments/Sauces/Marinade

- 5.2.8 Pasta, Soup and Noodles

- 5.2.9 Prepared Food

- 5.2.10 Plant-based Food and Beverage

- 5.2.11 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Italy

- 5.3.2.4 France

- 5.3.2.5 Netherlands

- 5.3.2.6 Poland

- 5.3.2.7 Belgium

- 5.3.2.8 Sweden

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Indonesia

- 5.3.3.6 South Korea

- 5.3.3.7 Thailand

- 5.3.3.8 Singapore

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Chile

- 5.3.4.5 Peru

- 5.3.4.6 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 Morocco

- 5.3.5.7 Turkey

- 5.3.5.8 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Archer Daniels Midland Company

- 6.4.2 Cargill, Incorporated

- 6.4.3 Kerry Group plc

- 6.4.4 DSM-Firmenich AG

- 6.4.5 International Flavors & Fragrances Inc.

- 6.4.6 Tate & Lyle PLC

- 6.4.7 Ingredion Incorporated

- 6.4.8 Givaudan SA

- 6.4.9 Associated British Foods plc

- 6.4.10 Sensient Technologies Corporation

- 6.4.11 Symrise AG

- 6.4.12 Novozymes A/S

- 6.4.13 AAK AB

- 6.4.14 Corbion N.V.

- 6.4.15 Lonza Group AG

- 6.4.16 Glanbia plc

- 6.4.17 Roquette Freres S.A.

- 6.4.18 Sudzucker AG

- 6.4.19 Celanese Corporation

- 6.4.20 Tereos Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK