PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906077

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906077

Release Agents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

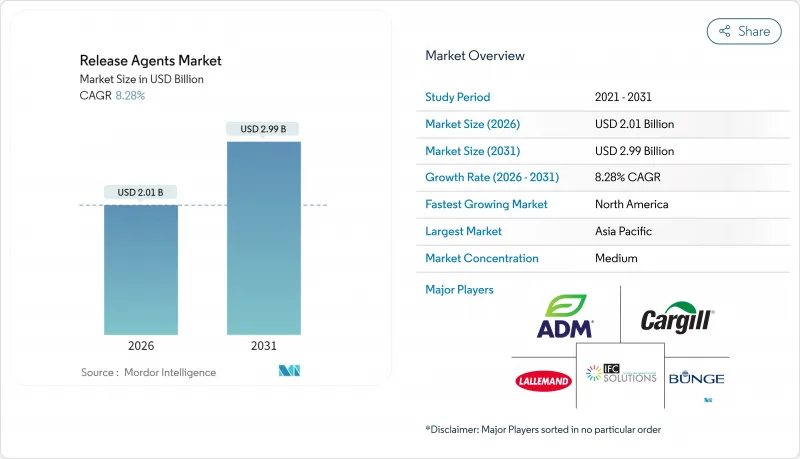

The release agents market was valued at USD 1.86 billion in 2025 and estimated to grow from USD 2.01 billion in 2026 to reach USD 2.99 billion by 2031, at a CAGR of 8.28% during the forecast period (2026-2031).

This growth reflects manufacturers' efforts to balance strict food-contact regulations with automated production requirements. The increased use of NSF-H1 and EU 1935/2004-compliant formulations, combined with the implementation of low-VOC water-based spray systems, highlights the importance of advanced release agents in bakeries, meat processing plants, confectionery production lines, and frozen-dessert facilities. The market expansion is supported by infrastructure investments in emerging economies, particularly in Asia-Pacific region, where the growth of dairy, meat, and convenience food operations exceeds local expertise in specialized release technologies. Companies are focusing on PFAS-free formulations, biodegradable wax esters, and plant-based oils to meet sustainability goals and consumer transparency demands while maintaining effective anti-stick properties. Additionally, fluctuating commodity prices and regional migration testing requirements are driving supplier consolidation, emphasizing the importance of regulatory compliance and reliable global supply chains.

Global Release Agents Market Trends and Insights

Expanding food processing industry

The global food processing industry's expansion drives the release agents market growth through increased production of bakery, confectionery, dairy, and processed meat products. Release agents are essential for maintaining product quality, minimizing waste, and ensuring production line efficiency in high-volume processing operations. The United Kingdom's bread and bakery manufacturing sector exemplifies this trend, representing the food industry's largest subsector by number of companies. The Office for National Statistics (UK) reports approximately 2,910 enterprises operating in this subsector, demonstrating substantial bakery-related demand for release agents. This pattern extends across Europe, North America, and Asia-Pacific, where industrial food manufacturing growth sustains the demand for release technologies. The combination of industry growth and increasing consumer demand for packaged and ready-to-eat foods drives the adoption of advanced release agent formulations. Manufacturers are developing solutions that align with automated production systems, clean-label requirements, and sustainability standards required by global processors.

Preference for non-hydrogenated vegetable oils

The global release agents market is transforming due to the increasing adoption of non-hydrogenated vegetable oils, influenced by growing consumer health consciousness and regulatory requirements. While hydrogenated oils were previously common in release agent formulations due to their stability and functionality, research linking trans fats to health issues such as cardiovascular disease, obesity, and metabolic disorders has led to global regulatory restrictions and product reformulations. Health Canada's endorsement of vegetable diacylglycerol oil as an alternative to partially hydrogenated oils (PHOs) demonstrates regulatory support for new lipid technologies. This approval may increase the adoption of alternative solutions across the industry. Food manufacturers in the bakery, confectionery, and processed meat industries are now implementing non-hydrogenated oils, including canola, sunflower, soybean, and rapeseed oils, in their release agent products. These alternatives provide essential functional properties such as reliable release performance and longer shelf life while supporting clean-label initiatives without the health concerns linked to trans fats.

Raw-material price volatility

Commodity price fluctuations create margin pressure, forcing strategic decisions between formulation complexity and cost competitiveness. Food processing ingredient costs increased by 23.6% between 2020-2024, according to Bureau of Labor Statistics data. The inflationary environment significantly affects specialty release agents that require premium raw materials, as price sensitivity restricts their market penetration in cost-conscious applications. Supply chain disruptions intensify volatility effects, creating procurement challenges for release agent manufacturers who depend on specific raw material grades or sources. The volatility impacts direct material costs, transportation, and energy inputs, creating compound margin pressure that particularly affects smaller suppliers without hedging capabilities. Forward contracting strategies provide competitive advantages by enabling price stability and supporting long-term customer relationships, while smaller competitors experience periodic margin compression during commodity price spikes.

Other drivers and restraints analyzed in the detailed report include:

- Food safety push for NSF-H1 and EU 1935/2004-compliant release agents

- Technological advancements in release agent formulations

- Stringent regulatory standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, emulsifiers command a 38.05% share of the market, underscoring their pivotal role in bridging the gap between hydrophobic release agents and water-based food systems. Their widespread use in food processing, particularly with formulations like mono- and diglycerides, polyglycerol esters, and lecithin, ensures consistent results across diverse manufacturing conditions. These emulsifiers are critical in maintaining product stability, improving texture, and enhancing the overall quality of processed foods, making them indispensable in the industry. Additionally, their ability to adapt to various processing environments and withstand different manufacturing conditions further solidifies their dominance in the market.

Wax and wax esters are the composition segment to watch, boasting an impressive 8.84% CAGR through 2031. This surge is largely fueled by innovations in biodegradable formulations and PFAS-free alternatives, striking a balance between environmental compliance and performance. The growing emphasis on sustainability and the need for eco-friendly solutions have further accelerated the adoption of these compositions. Meanwhile, vegetable oils enjoy sustained demand, bolstered by regulatory endorsements for non-hydrogenated options, which align with the increasing consumer preference for healthier and more natural ingredients. Antioxidants play a crucial role, enhancing shelf life and curbing rancidity in lipid-based release systems, thereby ensuring product integrity and extending usability in various applications. Furthermore, the integration of antioxidants into these systems not only improves product longevity but also supports the development of high-quality, stable formulations that meet evolving consumer and industry standards.

The Release Agents Market Report Segments the Industry by Composition (Emulsifiers, Antioxidants, Vegetable Oils, Wax and Wax Esters, Others), by Form (Liquid, Solid), by Application (Bakery and Confectionery, Meat and Meat Products, More), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America commands a 34.10% share of the market, bolstered by its sophisticated food processing infrastructure and stringent regulations that demand top-tier release agent formulations. Years of advancement in industrial food processing have equipped the region with robust supply chains and deep technical expertise, ensuring the consistent application of release agent performance standards. The region's regulatory environment, which emphasizes food safety and quality, further drives the adoption of advanced release agents, making North America a dominant player in the market. Meanwhile, the Asia-Pacific region is on a growth trajectory, boasting a 9.10% CAGR through 2031. This surge is largely due to heightened industrialization in food processing and shifting regulatory standards, both of which amplify the demand for specialized release agents. The region's expanding middle-class population and increasing consumer demand for processed and packaged foods also contribute to the growing need for efficient release agent solutions.

Europe, with its significant market presence, is guided by EU Regulation 1935/2004. This regulation delineates specific requirements for food contact materials, influencing the selection of release agents. Europe's dedication to environmental stewardship has spurred the rise of biodegradable and plant-based release agents. Coupled with a robust regulatory framework and a sustainability focus, Europe stands out as a pivotal market, driving continuous innovation in release agent formulations. Additionally, the region's strong emphasis on research and development fosters the creation of advanced solutions that align with both regulatory and consumer demands, further solidifying its position in the global market.

As food processing industrialization gains momentum, South America and the Middle East, and Africa emerge as promising markets. Yet, the pace of market development is uneven, shaped by the nuances of regulatory frameworks and the maturity of processing infrastructure. While there's a noticeable uptick in the adoption of release agents for food processing in these regions, the speed of this growth is heavily influenced by each country's industrial maturity and regulatory landscape. In South America, the growing focus on modernizing food processing facilities and improving food safety standards is driving demand. Similarly, in the Middle East and Africa, increasing investments in food processing industries and the gradual establishment of regulatory frameworks are creating opportunities for market expansion.

- Archer Daniels Midland (ADM)

- Cargill Inc.

- AAK AB

- Palsgaard A/S

- Dow Inc.

- IFC Solutions

- Lallemand Inc.

- Bunge Ltd.

- Masterol Foods Pty Ltd.

- Mallet & Company

- The Bakels Group

- Bundy Baking Solutions

- Avatar Corporation

- Chem-Trend (Lubrizol)

- Kerry Group plc

- PPG Silicones

- Henkel AG

- JAX Inc.

- ROCOL (ITW)

- Vegalene(R) / PLZ Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and market definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding food processing industry

- 4.2.2 Preference for non-hydrogenated vegetable oils

- 4.2.3 Food safety push for NSF-H1 and EU 1935/2004-compliant release agents

- 4.2.4 Technological advancements in release agent formulations

- 4.2.5 Cost-effective plant-based formulations are gaining regulatory tailwinds

- 4.2.6 Water-based spray technologies cutting solvent VOCs in industrial bakeries

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility

- 4.3.2 Low end-user awareness in emerging meat-processing clusters

- 4.3.3 Stringent Regulatory Standards

- 4.3.4 Allergen and "free-from" limitations

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porters Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry Source

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Composition

- 5.1.1 Emulsifiers

- 5.1.2 Antioxidants

- 5.1.3 Vegetable Oils

- 5.1.4 Wax and Wax Esters

- 5.1.5 Others

- 5.2 By Form

- 5.2.1 Liquid

- 5.2.2 Solid

- 5.3 By Application

- 5.3.1 Bakery and Confectionery

- 5.3.2 Meat and Meat Products

- 5.3.3 Dairy and Frozen Desserts

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Market Positioning Analysis

- 6.3 Company Profiles

- 6.3.1 Archer Daniels Midland (ADM)

- 6.3.2 Cargill Inc.

- 6.3.3 AAK AB

- 6.3.4 Palsgaard A/S

- 6.3.5 Dow Inc.

- 6.3.6 IFC Solutions

- 6.3.7 Lallemand Inc.

- 6.3.8 Bunge Ltd.

- 6.3.9 Masterol Foods Pty Ltd.

- 6.3.10 Mallet & Company

- 6.3.11 The Bakels Group

- 6.3.12 Bundy Baking Solutions

- 6.3.13 Avatar Corporation

- 6.3.14 Chem-Trend (Lubrizol)

- 6.3.15 Kerry Group plc

- 6.3.16 PPG Silicones

- 6.3.17 Henkel AG

- 6.3.18 JAX Inc.

- 6.3.19 ROCOL (ITW)

- 6.3.20 Vegalene(R) / PLZ Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK