PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906080

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906080

Jeans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

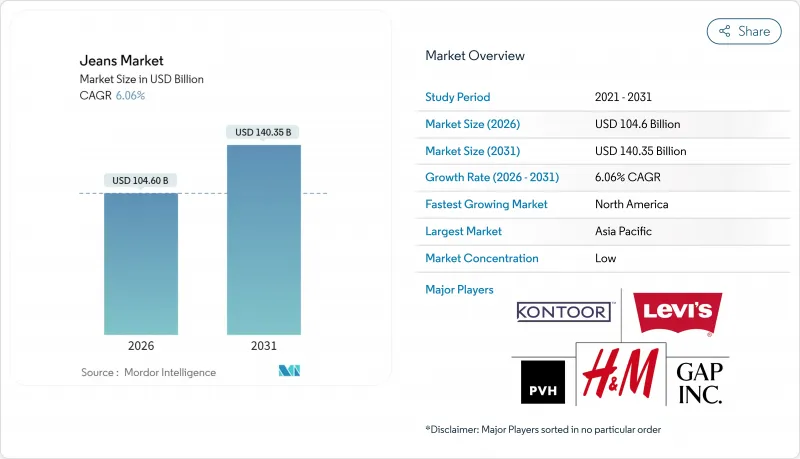

The global jeans market was valued at USD 98.63 billion in 2025 and estimated to grow from USD 104.6 billion in 2026 to reach USD 140.35 billion by 2031, at a CAGR of 6.06% during the forecast period (2026-2031).

As premium denim and innovative fabrics gain traction, coupled with direct-to-consumer (DTC) strategies, consumers enjoy a broader selection. This not only bolsters brand margins but also extends product life cycles. In 2024, Levi Strauss & Co., the American giant synonymous with its Levi's denim brand, reported net sales of approximately USD 6.35 billion, a rise from USD 6.17 billion in 2023. Denim's enduring cultural significance cements its place in casual wardrobes. Yet, with sustainability in focus, brands are increasingly turning to low-impact dyeing, recycled fibers, and take-back initiatives. The rise of digital commerce is undeniable, with virtual fit tools playing a pivotal role in reducing return rates and expanding market reach. In response to a hefty 120% U.S. tariff on Chinese jeans, manufacturers are diversifying their supply chains, shifting production to Mexico, Turkey, and Egypt, and ramping up investments in automation for nimble inventory management.

Global Jeans Market Trends and Insights

Fashion Trends and Consumer Preferences

As consumer preferences evolve, denim pieces are increasingly favored for their versatility, effortlessly transitioning from casual to semi-formal settings. This shift is propelling the denim market's expansion, moving beyond its traditional workwear roots. In the wake of the pandemic, workplaces have embraced an "elevated casual" dress code, fueling a demand for premium denim that strikes a balance between comfort and professionalism. Generational preferences in denim consumption reveal stark contrasts: Gen Z places a premium on fit innovation and sustainability, often sidelining brand legacy, whereas millennials seek a harmonious blend of quality and value. The color palette of denim has expanded, moving beyond the classic indigo to embrace earthy tones and technical washes, resonating with the style-savvy. The rapid pace of trend cycles, amplified by social media, has pushed brands to shorten their design-to-market timelines from 18 months to a swift 6-8 months, ensuring they don't miss out on viral fashion moments. These dynamics underscore the surging global demand for denim and jeans, a demand increasingly met by rising imports. Highlighting this trend, data from UN Comtrade reveals Vietnam's dominance as the world's top denim importer, with a staggering import value exceeding USD 320 million.

Increasing Preference for Premium and Branded Denim

Even in tough economic times, consumers are willing to invest in premium denim, valuing its longevity and the status it conveys. The USD 200-400 price segment is thriving, as buyers justify the splurge with cost-per-wear logic and sustainability narratives. Heritage brands, with their emphasis on craftsmanship and storytelling, use limited edition releases to validate their premium pricing. In contrast, newer brands are carving their niche with innovative materials and ethical production. By selling directly to consumers, premium brands not only boost their margins but also offer a personalized shopping experience that's hard to find in traditional retail. Collaborations with luxury fashion houses have transformed denim from a mere utility to a coveted fashion statement, broadening its market appeal. Cotton-based denim, celebrated for its timelessness and versatility from casual outings to semi-formal events, is witnessing a surge in global demand. This is driven by a growing appetite for durable, comfortable, and sustainable clothing. Data from UN Comtrade highlights this trend: in 2023, Mexico exported nearly USD 56 million worth of denim fabric, predominantly cotton (at least 85% cotton content), to the U.S. Nicaragua trailed with imports valued at USD 8.7 million.

Intense Competition from Alternative Apparel

As consumers shift towards comfort and versatility in their post-pandemic lifestyles, athletic wear's rise in casual fashion is encroaching on denim's market share. Athleisure brands are harnessing technical fabrics and performance features, outpacing traditional denim, especially in areas like moisture management and stretch recovery. With the normalization of the "work from home" culture, there's been a marked reduction in occasions for structured denim, leading to a pronounced shift in preference towards joggers and leggings. Fast fashion retailers, by offering denim alternatives at competitive price points, are accelerating trend cycles, putting established brands under pressure to innovate and provide value. As fashion trends lean towards minimalist wardrobes, there's a growing preference for multi-functional garments, sidelining category-specific pieces like jeans.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Fabric and Finishes

- Sustainability and Eco-Friendly Innovations

- High Production Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, the regular fit segment leads the market with a 22.05% share, underscoring a consumer preference for versatile silhouettes that cater to various body types and style inclinations. Meanwhile, slim fit variants are on the rise, boasting a 7.55% CAGR through 2031, fueled by younger consumers drawn to modern aesthetics and refined tailoring. As fashion trends pivot towards relaxed silhouettes, skinny fit options see a downturn. Conversely, bootcut and flared styles make a comeback, appealing to trendsetters with a penchant for Y2K-inspired looks. The "others" category highlights emerging fits like tapered, straight-leg, and wide-leg variants, reflecting the industry's response to shifting style preferences and the body positivity movement.

Brands leverage advanced manufacturing techniques to broaden size ranges and fit variations, all without a proportional spike in inventory, bolstering their market segmentation strategies. By integrating fit technologies such as 3D body scanning and virtual try-ons, brands not only enhance customer satisfaction across diverse body types but also curtail return rates. The fusion of comfort and style has birthed hybrid fits, merging relaxed waistlines with tapered legs, catering to consumers who prioritize both fashion and functionality. While regulatory compliance for fit variations is largely minimal, industry associations are pushing for sizing standardization to mitigate consumer confusion and reduce return rates.

In 2025, men's denim holds a 45.05% share of the market, a testament to its historical development and robust per-capita consumption globally. Women's denim, however, is on a rapid ascent, boasting an 7.92% CAGR through 2031. This surge is fueled by fashion innovations, a premium market stance, and a broadened application of occasion-wear, moving beyond just casual settings. Meanwhile, children's denim, though stable, grows at a more measured pace, shaped by swift market dynamics and parents' awareness of their kids' rapid growth.

Women's denim thrives on the fast-paced fashion cycle, with seasonal collections prompting more frequent purchases. In contrast, men's denim sales are largely driven by replacements. Premium women's denim, with its trendy fits and sustainable materials, often backed by celebrity endorsements, commands higher price points and wider margins. The rise of gender-neutral designs is resonating with younger consumers, opening doors to markets that defy traditional segmentation. Growth in the children's denim segment is closely tied to birth rates and disposable income, with eco-conscious parents increasingly favoring organic cotton and sustainable production methods.

The Jeans Market is Segmented by Type/Fit (Regular Fit, Slim Fit, Skinny Fit, Bootcut, Flared, and More), by End User (Men, Women, and Children), by Category (Mass and Premium), by Distribution Channel (Supermarkets / Hypermarkets, Specialist Stores, Online Retail Stores, and More), and by Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America captured 32.35% of global revenue, driven by mature consumption and aggressive direct-to-consumer (DTC) strategies from established brands. Factors like high disposable incomes, prevalent casual dress codes, and an early embrace of personalization technology bolster the regional jeans market. In response to rising sustainability concerns, brands are initiating take-back events and highlighting recycled cotton blends on their hangtags. However, tariff disputes with China are inflating landed costs, prompting a shift in sourcing towards Mexico, Guatemala, and the Caribbean.

Asia-Pacific emerges as the dominant growth engine, targeting a 7.45% CAGR through 2031. Urbanization in China, India, and Indonesia is broadening the middle-class demographic, increasingly attracted to Western fashion. Platforms like Tmall in China and Myntra in India are enhancing last-mile delivery, boosting market penetration in tier-2 cities. Government initiatives bolster textile growth: India's Production-Linked Incentive scheme offers modernization subsidies, while Vietnam enjoys duty-free access to the EU. Rising wages in coastal China are pushing factory clusters either inland or overseas, creating intricate supply networks across Asia.

Europe, while anchoring a premium stance in the jeans market, grapples with stringent regulations promoting eco-innovation. The EU's Extended Producer Responsibility mandates designs that facilitate disassembly, leading to the creation of modular jeans with detachable components. Heightened consumer awareness is elevating the importance of B-Corp and Fairtrade certifications. In a bid to meet circularity goals, brands are testing rental and resale initiatives. Yet, challenges arise from currency volatility and fluctuating energy prices, pushing Italian and Spanish brands towards greater automation.

South America, along with the Middle East and Africa, holds potential for the long haul, buoyed by youthful demographics and burgeoning e-commerce. Yet, political instability and currency fluctuations hinder swift expansion. To navigate these challenges, brands are piloting micro-fulfillment centers in Brazil and setting up omnichannel kiosks in Saudi malls, aiming to enhance local service and mitigate import duties.

- Levi Strauss & Co.

- Kontoor Brands Inc. (Wrangler, Lee)

- PVH Corp.

- Gap Inc.

- Hennes & Mauritz AB

- Inditex (Zara)

- Diesel S.p.A.

- American Eagle Outfitters

- Fast Retailing Co. (Uniqlo)

- G-Star RAW

- AG Adriano Goldschmied

- Mavi Jeans

- Nudie Jeans

- OTB Group (Replay)

- Iconix Brand Group

- Marks & Spencer Group plc

- TowerBrook Capital Partners (True Religion)

- Big John Co.

- Pepe Jeans London

- VF Corp. (Timberland, The North Face)**denim accessories**

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Fashion Trends and Consumer Preferences

- 4.2.2 Increasing Preference for Premium and Branded Denim

- 4.2.3 Technological Advancements in Fabric and Finishes

- 4.2.4 Sustainability and Eco-Friendly Innovations

- 4.2.5 Customization and Personalization

- 4.2.6 Celebrity and Influencer Collaborations

- 4.3 Market Restraints

- 4.3.1 Intense Competition from Alternative Apparel

- 4.3.2 Counterfeit and Low-Quality Products

- 4.3.3 High Production Costs

- 4.3.4 Tariff and Trade Policy Uncertainties

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Type/Fit

- 5.1.1 Regular Fit

- 5.1.2 Slim Fit

- 5.1.3 Skinny Fit

- 5.1.4 Bootcut

- 5.1.5 Flared

- 5.1.6 Others

- 5.2 By End User

- 5.2.1 Men

- 5.2.2 Women

- 5.2.3 Children

- 5.3 By Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets / Hypermarkets

- 5.4.2 Specialist Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Sweden

- 5.5.3.8 Belgium

- 5.5.3.9 Poland

- 5.5.3.10 Netherlands

- 5.5.3.11 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Thailand

- 5.5.4.5 Singapore

- 5.5.4.6 Indonesia

- 5.5.4.7 South Korea

- 5.5.4.8 Australia

- 5.5.4.9 New Zealand

- 5.5.4.10 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Saudi Arabia

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Levi Strauss & Co.

- 6.4.2 Kontoor Brands Inc. (Wrangler, Lee)

- 6.4.3 PVH Corp.

- 6.4.4 Gap Inc.

- 6.4.5 Hennes & Mauritz AB

- 6.4.6 Inditex (Zara)

- 6.4.7 Diesel S.p.A.

- 6.4.8 American Eagle Outfitters

- 6.4.9 Fast Retailing Co. (Uniqlo)

- 6.4.10 G-Star RAW

- 6.4.11 AG Adriano Goldschmied

- 6.4.12 Mavi Jeans

- 6.4.13 Nudie Jeans

- 6.4.14 OTB Group (Replay)

- 6.4.15 Iconix Brand Group

- 6.4.16 Marks & Spencer Group plc

- 6.4.17 TowerBrook Capital Partners (True Religion)

- 6.4.18 Big John Co.

- 6.4.19 Pepe Jeans London

- 6.4.20 VF Corp. (Timberland, The North Face)**denim accessories**

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK