PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910852

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910852

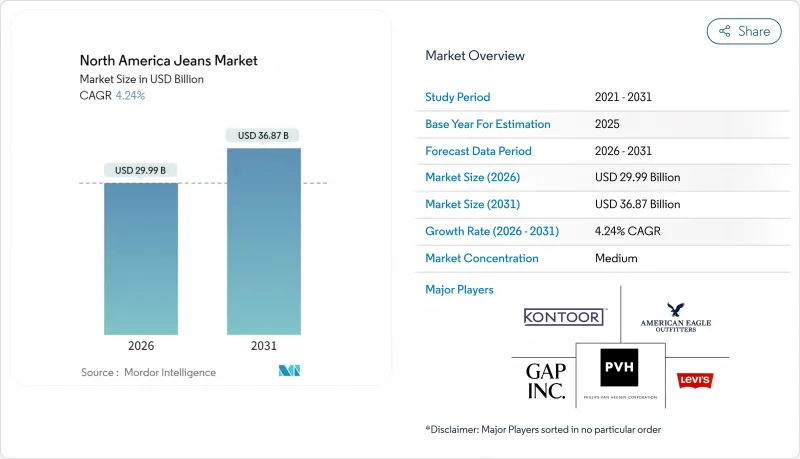

North America Jeans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North American jeans market size in 2026 is estimated at USD 29.99 billion, growing from 2025 value of USD 28.77 billion with 2031 projections showing USD 36.87 billion, growing at 4.24% CAGR over 2026-2031.

Once limited to casual wear, denim has evolved, now intertwining with sustainability, digital innovation, and changing work-leisure dress codes. The market's stability stems from fundamental shifts in workplace dress codes, where 61% of workers report their workplace dress code has changed since the pandemic, with 22% becoming more casual. This evolution has fostered consistent demand across various price tiers. As consumers increasingly value circular manufacturing, low-impact dyes, and biodegradable stretch fibers, the trend of premiumization gains traction. Yet, even with this shift, mass-market volumes continue to dominate omnichannel retail spaces. Highlighting the digital realm's significance, online retail commands a 37.58% market share. Furthermore, AI-driven fit guidance not only reduces return rates but also broadens the customer base. While competitive intensity remains moderate, heritage labels, despite their scale, find themselves sharing the spotlight with data-savvy newcomers who adeptly adjust assortments in near-real time. In North America, particularly in states like California and Massachusetts, regulatory emphasis on textile waste and recycled content is prompting swift investments in closed-loop systems and localized production. These moves present both challenges and unique differentiation opportunities for the jeans market.

North America Jeans Market Trends and Insights

Fashion-forward fabric innovations drive premium positioning

Across North America's jeans market, denim mills and brands are adopting innovative techniques. They're using bio-based stretch yarns, blending in pineapple fibers, and employing low-liquor indigo methods. These methods not only cut water usage by up to 44% but also maintain fabric performance. Such advancements allow for premium pricing, yet they broaden the consumer base by offering breathable fabrics that are versatile enough for warmer climates. Heritage brands are taking it a step further, highlighting their carbon savings on product hangtags, appealing directly to eco-conscious shoppers. The Lycra Company's EcoMade platform showcases a significant industry shift: renewable inputs are now harmoniously blending with recyclability, addressing the elastane end-of-life dilemma. These innovative textiles, now part of mainstream collections, are proving beneficial for retailers. They lower the total cost of ownership for compliant inventory, driving volume growth in North America's jeans sector.

Circular resale platforms accelerate market evolution

Every year, 17 million pairs of jeans are processed through secondhand infrastructure, generating value loops that enhance profit margins and extend product lifespans. These infrastructures play a critical role in promoting sustainability by reducing waste and encouraging the reuse of apparel. Brands, through ThredUp-powered trade-in programs, can reclaim items from idle closets, offer credits, and resell authenticated jeans priced between USD 35 and 50. This strategy resonates with consumers, 59% indicate a willingness to shop resale if tariffs push up apparel prices. This sentiment bolsters a circular adoption trend, benefiting the larger North American jeans market by fostering a more sustainable and cost-effective approach to fashion. For established players, the resale market serves as a buffer against raw material price fluctuations, allowing them to capture value that might otherwise be lost to informal peer-to-peer transactions. Additionally, it provides an opportunity to strengthen brand loyalty by aligning with consumer preferences for eco-friendly and affordable options.

Cotton-price volatility from climate shocks

In early 2024, ICE futures saw 15-cent fluctuations, making hedging more challenging and increasing working-capital demands for denim mills. These price swings have added complexity to financial planning and risk management for mills, as they struggle to maintain profitability amidst volatile market conditions. Retailers are now shortening their reorder cycles, transferring cost risks upstream, while mills are managing larger inventory buffers to meet fluctuating demand. New traceability laws are restricting flexibility in fiber origins, intensifying the pricing challenges in the North American jeans market by limiting sourcing options and increasing compliance costs. Although synthetic alternatives are available, consumers' preference for the natural feel keeps the industry tethered to cotton, making them vulnerable to price surges driven by climate factors, such as unpredictable weather patterns and crop yield variations.

Other drivers and restraints analyzed in the detailed report include:

- Limited-edition celebrity/brand collaborations

- AI-driven personalization transforms shopping

- Water usage and ESG compliance costs escalate

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, regular fit jeans captured 23.86% of the North American market, bolstered by their traditional, roomy design favored by older consumers prioritizing comfort. This sustained demand not only aids brands in managing inventory but also underscores the enduring appeal of family and casual wear. Regular fits anchor seasonal promotions and retailer partnerships, ensuring market stability amidst shifting trends. Innovations like Adaptive Lycra enhance flexibility, accommodating multiple sizes and reducing markdown risks. The revival of retro styles, such as bootcut and carpenter fits, bolsters regular sales, appealing to diverse generational tastes without sidelining slim fits. Brands employ modular manufacturing, swiftly adjusting patterns to curtail obsolete stock, thereby safeguarding profitability in a volatile fashion arena.

Meanwhile, slim silhouettes are poised to emerge as the fastest-growing segment, projected to ascend at a 7.08% CAGR through 2031. This surge is fueled by younger urban consumers drawn to the engineered stretch and tapered design. Minimalist labels, venturing into raw selvedge and linen-denim blends, unlock premium revenue streams. These blends not only offer a lighter feel for humid conditions but also command higher price tags, a premium validated by heat-mapping studies indicating cooler body temperatures. The "French tuck" office trend, popularized by influencers, has amplified the demand for seasonless capsule wardrobes. Enhanced by functional storytelling and a digital-first marketing approach, slim jeans have seen a swift uptick in adoption. Their allure is further bolstered by innovations across categories and a resilience to trends, positioning slim fits as pivotal to North America's market expansion.

In 2025, women accounted for a dominant 56.62% of North America's jeans market revenue, spearheading design innovations and shaping marketing strategies. Brands are prioritizing sophisticated fit solutions, emphasizing detailed rises, sculpting yokes, and offering inclusive size ranges to broaden their appeal. Construction enhancements, like seamless waistbands, address persistent fit issues such as gaping, fostering buyer loyalty. Collaborations with celebrities, exemplified by Emma Chamberlain's patchwork 501(R) capsule collection, blend nostalgia with contemporary fashion, drawing in shoppers from diverse generations. Women are quick to adopt trends, aided by digital try-on filters that allow personalized visualization of embroidery and cuff lengths, bolstering loyalty and conversion rates. Furthermore, the incorporation of QR codes linked to digital product passports enhances transparency an aspect women value by connecting care instructions and recyclability features to their purchase journey. This cycle of value, transparency, and trend relevance not only boosts the overall jeans market size but also sees sustainability cues driving premium pricing and frequent purchases throughout the year.

The children's segment is witnessing the fastest growth, with a projected CAGR of 6.24% through 2031. This surge is fueled by health-conscious parents prioritizing durability and chemical-safe dyes for their kids. Retailers are enhancing perceived value by bundling jeans with growth-fit features like extendable hems and adjustable waistbands, leading to shorter repurchase cycles. Marketing strategies focus on educating buyers about sustainable production and hypoallergenic textile blends. With schools and play institutions embracing jeans, baseline demand sees an uptick. Omnichannel strategies further facilitate parents in renewing these wardrobe staples. Digital features tailored for children, comprehensive sizing grids, and curated quick-pick bundles simplify decision-making for busy families. As children's fashion increasingly mirrors adult denim innovations, the market momentum for jeans in North America remains robust.

The North America Jeans Market Report is Segmented by Type/Fit (Regular Fit, Slim Fit, Skinny Fit, Bootcut, Flared, Others), End User (Men, Women, Children/Kids), Category (Mass, Premium), Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, and More), and Geography (United States, Canada, Mexico, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Levi Strauss & Co.

- Kontoor Brands Inc. (Wrangler, Lee)

- PVH Corp. (Calvin Klein, Tommy Hilfiger)

- Gap Inc.

- American Eagle Outfitters Inc.

- OTB Group (Diesel)

- TowerBrook - True Religion Brand Jeans

- Superdry PLC

- H & M Hennes & Mauritz AB

- Ralph Lauren Corporation

- VF Corporation (7 For All Mankind)

- Guess, Inc.

- J.Crew Group

- Lucky Brand Dungarees

- AG Adriano Goldschmied

- Fast Retailing Co., Ltd. (Uniqlo)

- Madewell Inc.

- Everlane

- Silver Jeans Co.

- Bonobos

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Fashion-forward fabric innovations (stretch, bio-based blends)

- 4.2.2 Rise of circular resale and rental denim platforms

- 4.2.3 Limited-edition celebrity/brand collaborations

- 4.2.4 AI-driven fit-personalization and virtual try-on

- 4.2.5 Work-leisure dress codes expanding denim occasions

- 4.2.6 Regulatory push for recycled cotton and clean dyes

- 4.3 Market Restraints

- 4.3.1 Cotton-price volatility from climate shocks

- 4.3.2 Water-usage and ESG compliance cost escalation

- 4.3.3 Substitution by athleisure bottoms

- 4.3.4 Tariff and trade-tension exposure on imported denim

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type/Fit

- 5.1.1 Regular Fit

- 5.1.2 Slim Fit

- 5.1.3 Skinny Fit

- 5.1.4 Boocut

- 5.1.5 Flared

- 5.1.6 Others

- 5.2 By End User

- 5.2.1 Men

- 5.2.2 Women

- 5.2.3 Children/Kids

- 5.3 By Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 Distribution Channel

- 5.4.1 Specialty Stores

- 5.4.2 Supermarkets/Hypermarkets

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Levi Strauss & Co.

- 6.4.2 Kontoor Brands Inc. (Wrangler, Lee)

- 6.4.3 PVH Corp. (Calvin Klein, Tommy Hilfiger)

- 6.4.4 Gap Inc.

- 6.4.5 American Eagle Outfitters Inc.

- 6.4.6 OTB Group (Diesel)

- 6.4.7 TowerBrook - True Religion Brand Jeans

- 6.4.8 Superdry PLC

- 6.4.9 H & M Hennes & Mauritz AB

- 6.4.10 Ralph Lauren Corporation

- 6.4.11 VF Corporation (7 For All Mankind)

- 6.4.12 Guess, Inc.

- 6.4.13 J.Crew Group

- 6.4.14 Lucky Brand Dungarees

- 6.4.15 AG Adriano Goldschmied

- 6.4.16 Fast Retailing Co., Ltd. (Uniqlo)

- 6.4.17 Madewell Inc.

- 6.4.18 Everlane

- 6.4.19 Silver Jeans Co.

- 6.4.20 Bonobos

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK